Crypto Investing Strategies: A Comprehensive Guide for Aussie Beginners

2023-10-18 08:48:46Navigating the dynamic world of cryptocurrency can be a daunting endeavor for beginners in Australia. With a plethora of coins to choose from, volatile market conditions, and a unique set of investment principles, the crypto arena is a far cry from traditional investing landscapes. Our guide is designed to demystify the complexities of this rapidly evolving financial frontier. Whether you're dipping your toes into the crypto waters for the first time or looking to refine your investment approach, this guide offers essential insights to empower you on your cryptocurrency journey. Dive in and discover the strategic tools and knowledge required to make informed decisions and optimize your crypto portfolio.

Investment Strategies: Where to Start?

In today's rapidly evolving financial landscape, investment opportunities come in a myriad of shapes and sizes. One of the most groundbreaking and captivating sectors that has recently gained significant traction is cryptocurrency. This decentralized form of currency, built on blockchain technology, has not only transformed the way we view money, but has also created a new realm of investment opportunities. As with any investment, understanding its basics and benefits is crucial to making informed decisions. So, whether you're an experienced investor looking to diversify your portfolio or a newbie in Australia eager to dive into the crypto world, it's essential to familiarize yourself with the strategies to get started.

Understanding the Basics: Crypto Investing for Beginners in Australia

Embarking on a journey into the world of cryptocurrency might seem scary, but by breaking down the basics, it becomes more approachable. At its core, cryptocurrency is a digital or virtual form of money, relying on cryptography for security, making it resistant to counterfeit. Bitcoin, the first and most well-known cryptocurrency, paved the way for an array of other digital currencies. Investing in crypto often involves purchasing coins or tokens, storing them in a digital wallet, and then deciding to hold or trade based on market dynamics. Beginners should acquaint themselves with terms like "blockchain," the underlying technology behind most cryptocurrencies, "ICO" (Initial Coin Offering), a fundraising method for new projects, and "exchange," platforms where buying and selling of cryptos take place. If you want to know more about ICO, you can refer to our guide here.

Exploring the Benefits of Investing in Cryptocurrency

Cryptocurrency, often touted as the money of the future, has made significant strides since its inception over a decade ago. As more individuals and institutions embrace this new form of currency, it's evident that its impact on the global financial landscape is far from fleeting. The transformative nature of cryptocurrency lies not only in its digital form but also in the distinct advantages it offers over traditional investment avenues. The allure of cryptocurrency extends beyond its innovative technology. Delving deeper, one uncovers a myriad of benefits that make this digital asset a compelling choice for both newcomers and experienced investors in Australia. Here are some benefits to consider:

・Decentralization: Unlike traditional currencies, crypto operates independently of central banks, offering greater freedom from governmental controls and interventions.

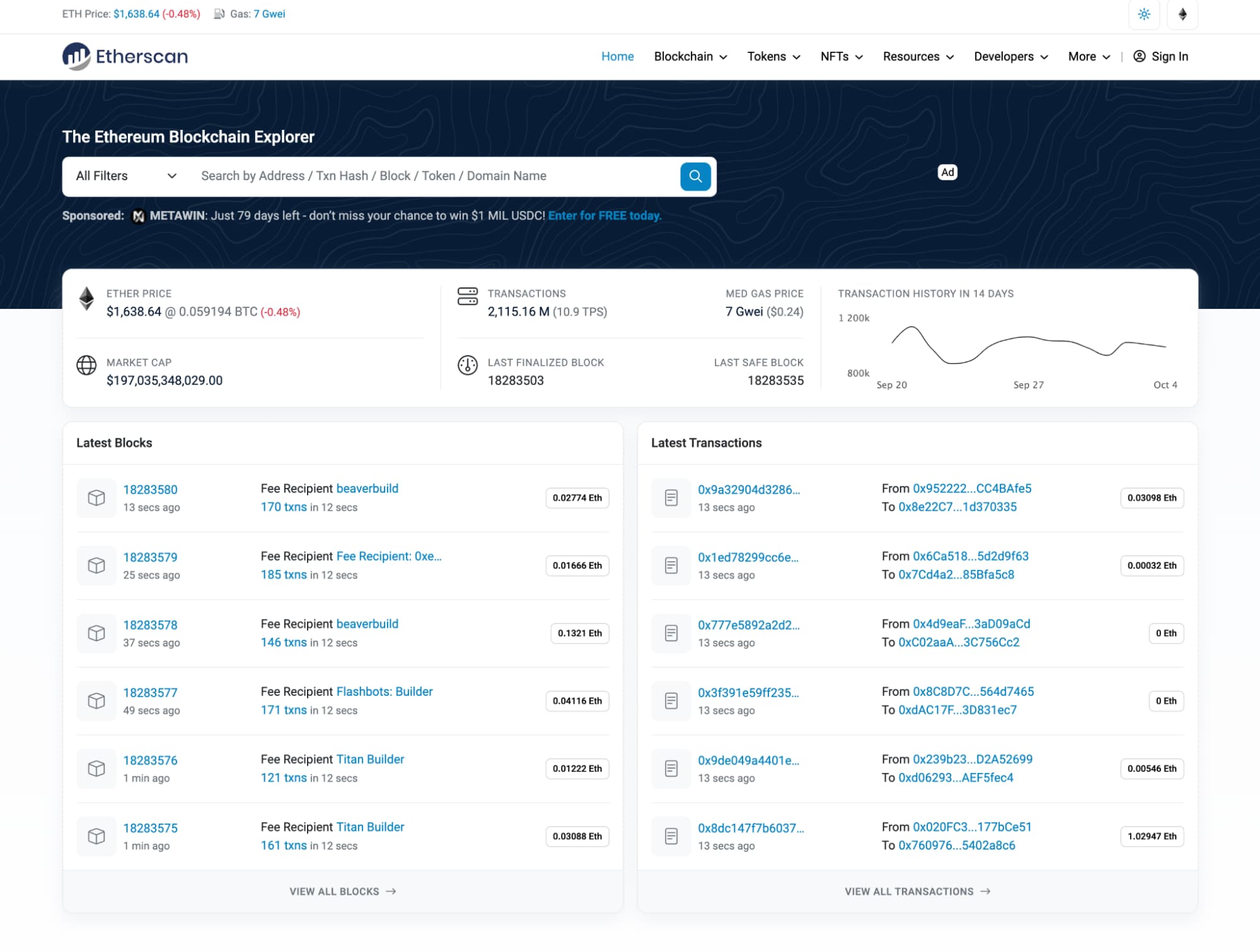

・Transparency: With blockchain's public ledger, all transactions are visible, providing unparalleled transparency in the financial world. With each transaction, traders can view details on the blockchain explorer. Each transaction is transparent and trackable.

Blockchain explorer to track each transaction. Source: Etherscan

・Potential for High Returns: While volatile, many Australian early crypto investors have seen remarkable returns on their investments, particularly during bullish market phases.

・Diversification: Crypto provides a fresh and new means to diversify one's investment portfolio beyond traditional assets.

・Global Transactions: Facilitating swift, borderless transactions, crypto can simplify international trades and investments.

The Growth Potential of Crypto Assets in 2024

The year 2024 stands as a pivotal moment for the crypto domain. With increased institutional adoption, favorable regulatory stances in many regions, and technological advancements, cryptocurrencies are poised for potential growth. Factors like the rise of decentralized finance (DeFi) platforms, the proliferation of non-fungible tokens (NFTs), and the integration of blockchain in various industries underscore the expansive use cases of crypto. The technology trending significantly in 2023 is Worldcoin, which seeks to revolutionize the identity verification process in the crypto industry. Worldcoin is a digital identification platform designed to offer every individual a convenient method to confirm they are genuine humans rather than bots or AI algorithms. The enterprise behind Worldcoin, "Tools for Humanity", was co-founded by Altman, who is more famously recognized for developing ChatGPT. Furthermore, as more people worldwide gain access to digital financial systems, the demand for cryptocurrencies could surge, potentially driving up value and providing lucrative opportunities for astute investors. However, as with any investment, it's essential to conduct thorough research and understand the inherent risks before committing capital.

Exploring Different Investment Strategies in the Crypto Market

The cryptocurrency market, with its hallmark volatility and transformative potential, has emerged as a compelling arena for Aussie investors seeking diversification and growth. As digital assets continue to mature and establish their place in the financial ecosystem, adopting the right investment strategy becomes paramount to navigate the intricate complexities of this space. Whether you're a newbie taking your first steps or an adept investor searching for refinement, understanding various crypto investment strategies can be the key to realizing your financial goals. Let's dig deeper into some of the most effective strategies to enhance your crypto investment journey.

Momentum Investing: Riding the Wave of Crypto Market Trends

Investing in the crypto realm is akin to surfing. It involves catching the trend waves at the right moment. Aussie investors who employ this strategy focus on assets that have shown a strong recent performance, hoping that their momentum will continue. By capitalizing on short-term price movements driven by news, community events, or market sentiments, momentum investors aim to seize potential profits before a trend reversal. However, just as waves can suddenly crash, so can crypto trends; hence, agility and close monitoring are indispensable for this strategy.

Value Investing: Identifying Fundamentally Strong Crypto Projects

Drawing inspiration from traditional stock markets, value investing in the crypto sector revolves around identifying undervalued digital assets with strong fundamentals. These investors in Australia conduct thorough research, scrutinizing whitepapers, team credentials, use cases, and tech infrastructure of a project, betting on its intrinsic value rather than short-term price fluctuations. By discovering assets that the market has overlooked or misunderstood, value investors aim for substantial long-term gains when the broader market eventually recognizes the project's true worth.

Long-Term vs. Short-Term Investment Strategies

The horizon of your investment often dictates the approach and risk tolerance. Long-term strategies, often spanning years, are generally characterized by a belief in the overall growth of the crypto market or in specific projects. These investors weather short-term volatility, believing in eventual higher returns. On the contrary, short-term investors, sometimes referred to as 'day traders', capitalize on hourly or daily price movements. While short-term trading can yield significant gains, it demands constant attention, rigorous analysis, and a steelier nerve to navigate frequent market fluctuations.

Buy and Hold Strategy for Crypto Investment

The 'Buy and Hold' strategy, also known colloquially as 'HODLing' in the crypto community, is a testament to patience and conviction. Australian investors adopting this approach believe in the long-term potential of their holdings, irrespective of interim market volatilities. By minimizing the temptation to sell during dips or buy during peaks, HODLers aim to benefit from the overarching upward trajectory of the crypto market over extended periods.

Dollar-Cost Averaging: Investing Regularly Regardless of Market Conditions

Dollar-Cost Averaging (DCA) is a disciplined investment approach where an investor allocates a fixed amount of money to buy crypto assets at regular intervals, irrespective of their price. This method reduces the impact of volatility and negates the need to time the market. Over time, DCA can potentially lower the average cost per coin/token as the investor buys more units when prices are low and fewer units when prices are high. DCA strategy is a widely embraced strategy for cryptocurrency investments. Instead of making a lump sum investment, you spread out your investment by consistently buying a set amount of crypto over a specified duration.

For instance, consider depositing $10 into Bitcoin monthly for a year rather than a one-time $120 investment. Both newbies and experienced crypto enthusiasts trust this method. By adopting the DCA approach, you can mitigate investment risks. However, the key is to stay consistent with your contributions, regardless of market fluctuations. Committing to this strategy might feel challenging, especially during turbulent market times or if you're naturally hesitant about long-term commitments. Investing in a market that's seemingly stagnant or declining can be daunting. But remember, even if the market faces a downturn, there will be a time when it rebounds. Persistence with this strategy can be rewarding in the long haul.

Moreover, an intriguing AI quant method known as grid trading on FameEX stands out. The FameEX Grid Trading system automates the purchase and sale of digital assets at opportune moments, functioning round-the-clock without manual oversight. This avant-garde AI-driven trading bot offers traders an enhanced degree of time flexibility and enforces disciplined, systematized trading practices. Fundamentally, grid trading adheres to the principle of "Buying Low and Selling High." By anticipating a crypto asset's price range movements, the strategy capitalizes on slight variations in its value. Notably, this AI-empowered quantitative approach shines in lateral trading environments characterized by minimal price shifts, aiding traders in maintaining composure and steering clear of rash choices influenced by FOMO.

FameEX Grid Trading strategy

Income-Generating Strategies in the Crypto Space

Beyond traditional buying and selling, the crypto market offers avenues for passive income. Staking, where investors lock up a certain amount of their crypto to support network operations like transaction validation, rewards them with additional tokens. Another avenue is liquidity mining or yield farming, where users provide liquidity to decentralized exchanges and earn interest or tokens in return. With decentralized finance (DeFi) platforms proliferating, opportunities to earn passive income in the crypto space are continuously expanding, providing investors in Australia with diversified means to grow their portfolios.

Investing in Cryptocurrencies: Building a Diverse Portfolio

Just as explorers once sought uncharted territories, today's investors delve into the vast digital space of cryptos, aiming to discover the next Bitcoin or Ethereum. However, as with any form of investment, the volatile nature of cryptocurrencies means that risk is an ever-present companion. To mitigate these risks and maximize potential returns, it's crucial for aussie investors to consider building a diverse crypto portfolio. By understanding the nuances of different cryptocurrencies and the importance of diversification, you stand a better chance at weathering market storms and realizing long-term gains.

The Importance of Portfolio Diversification in Crypto Investing

Diversification, in its simplest form, is the act of spreading one's investments across various assets to reduce the exposure to any single risk. In the traditional stock market, this might mean holding shares in companies from different industries or regions. In the cryptocurrency market, diversification takes on a slightly different but equally vital role. Given the infancy and volatility of the crypto market, prices can swing dramatically based on news, regulatory changes, or technological advancements. By diversifying your crypto holdings, you're not only spreading risk but also maximizing the chances of holding a token that might outperform others. A diverse portfolio can help absorb the shock of any one crypto asset plummeting, ensuring that your entire investment doesn't sink with it.

Types of Cryptocurrencies to Consider for Your Portfolio

Embarking on a journey into the vast universe of cryptocurrencies can be daunting, given the multitude of options available. Every cryptocurrency comes with its own vision, technology, and potential for return on investment. However, not all cryptocurrencies serve the same purpose or have the same potential for growth. In curating a well-rounded portfolio, it's essential to recognize the varied landscape of digital assets and their unique offerings. From the pioneering giants like Bitcoin to niche tokens in emerging sectors, understanding the various types of cryptocurrencies can empower investors to make informed decisions. Here are some pivotal categories to consider:

- Bitcoin (BTC): Often referred to as 'digital gold', Bitcoin is the original cryptocurrency and remains the most recognized and valuable. It serves as a store of value and is a must-have in most crypto portfolios.

- Ethereum (ETH): As the foundation for many decentralized applications and smart contracts, Ethereum has secured its place as a leading utility coin.

- Stablecoins: Tied to traditional fiat currencies like the USD, stablecoins such as USDC or Tether (USDT) provide a hedge against crypto market volatility.

- DeFi Tokens: With the rise of decentralized finance, tokens like Uniswap (UNI) or Chainlink (LINK) offer investors in Australia exposure to this innovative financial sector. If you want to learn more about the DeFi tokens, you can refer to our comprehensive guide here.

- NFT Tokens: As the world of digital art and collectibles grows, tokens related to non-fungible tokens (NFTs) can be a fascinating addition. Examples include Enjin (ENJ) or Flow.

When building a diverse cryptocurrency portfolio, it's crucial to research each type, understand its purpose, and evaluate its potential in the ever-evolving crypto landscape. Balancing your investments between established coins and emerging projects can help achieve a blend of stability and potential high returns.

Risks and Challenges in Crypto Investing: How to Mitigate Them?

In the fast-paced world of cryptocurrency, investors in Australia are drawn to the promise of substantial returns. However, the journey is laden with risks and challenges that can easily turn profit dreams into financial nightmares. With the volatile nature of crypto prices, regulatory grey areas, and a plethora of investment choices, it's essential to approach the crypto realm with knowledge and caution. By understanding the nuances of these challenges, and by employing strategic measures, one can optimize their chances of success. This article delves deep into these risks, offering insights into navigating the tumultuous waters of crypto investing.

Assessing Market Volatility: How to Navigate the Crypto Market

Market volatility in the crypto sector is notorious. Rapid price swings can be triggered by anything from regulatory news to technological advancements or macroeconomic factors. To navigate this volatility:

・Stay Informed: Regularly monitor industry news and developments. By staying updated, you can anticipate market-moving events and adjust your strategy accordingly.

・Diversify Investments: Avoid putting all your funds into one cryptocurrency. Diversification across various coins can help spread and mitigate risk.

・Utilize Stop-Loss Orders: These orders allow you to set a predetermined price to sell a cryptocurrency, ensuring you don't hold onto a plummeting asset for too long.

・Avoid Emotional Trading: Making decisions based on emotions can lead to impulsive buying or selling. Always rely on data, research, and strategy.

Avoiding Common Mistakes Made by Crypto Investors

Many crypto investors in Australia learn through trial and error, but understanding common pitfalls can save both time and money:

・Overconfidence: Just because you've had some wins doesn't mean you're immune to losses. Always approach investing with humility and a willingness to learn.

・FOMO (Fear of Missing Out): Buying a coin simply because it's surging can often lead to buying at a peak and facing losses when the hype subsides.

・Lack of Research: Always do your due diligence before investing in any crypto asset. Understand the coin's purpose, technology, and market position.

・Ignoring Security: Always use trusted wallets, enable two-factor authentication, and be wary of phishing attempts. At FameEX, we offer 8 different security settings for users to protect their funds. For detailed security reminders on your crypto wallet, please refer to our guide here.

Dealing With Regulatory Uncertainties in the Crypto Industry

The crypto industry is still relatively young, and many governments are grappling with how to regulate it:

・Stay Updated on Regulatory News: Regularly monitor announcements from financial regulators in your country.

・Consider Geo-diversification: Some countries are more crypto-friendly than others. Having a global perspective can open up opportunities and provide safety nets.

・Engage with a Financial Advisor: Professionals can offer insights into the implications of current and potential future regulations on your investments.

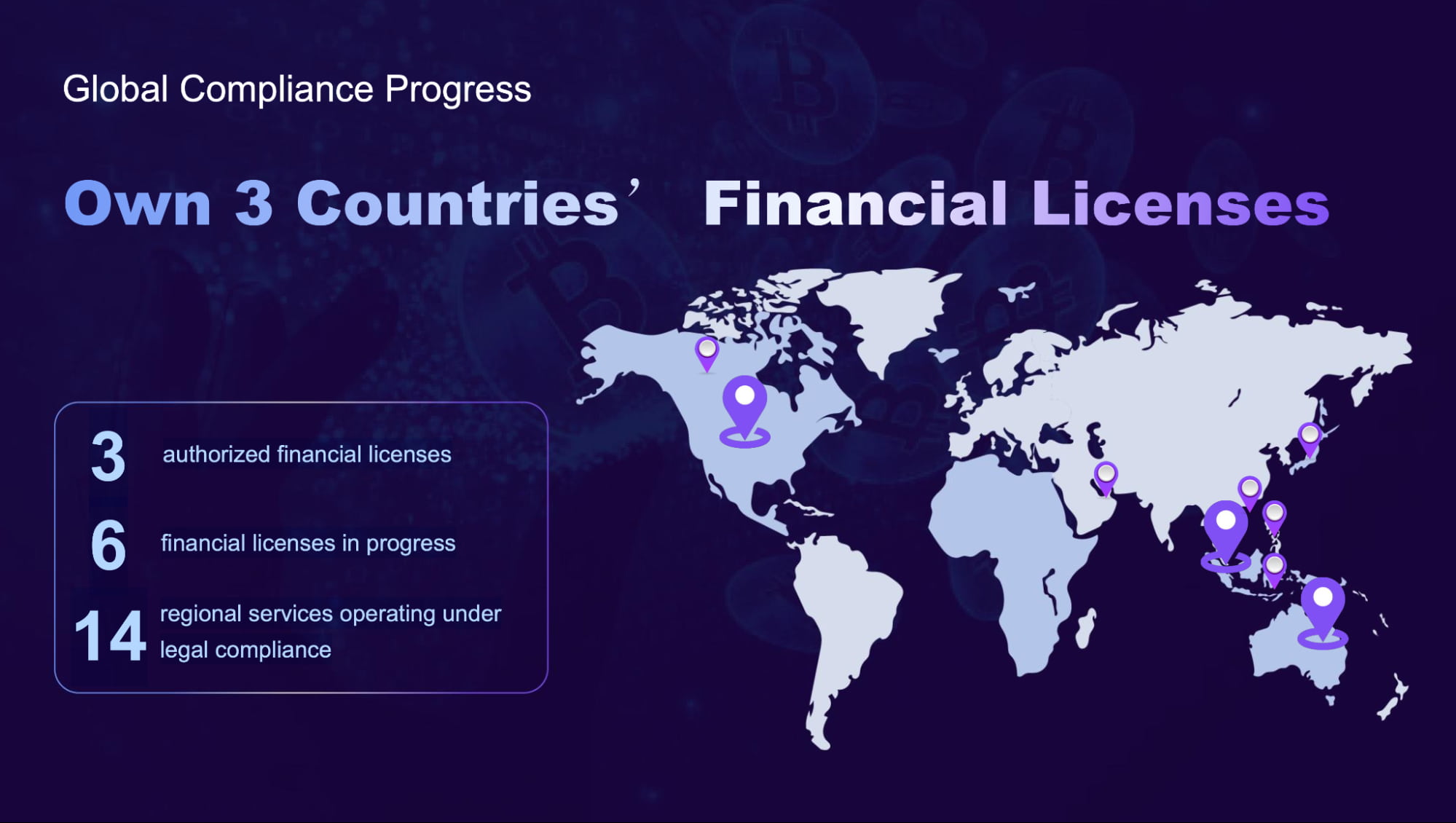

It's essential to understand the regulatory rules and guidelines in your country and to research any projects or exchanges you're considering for investment. At FameEX, we always follow the global compliance progress, holding licenses from three different countries. We have 3 authorized financial licenses, with an additional 6 financial licenses currently in progress, and we operate 14 regional services in full legal compliance.

Long-Term vs Short-Term: Choosing Your Investment Horizon

In the vast and evolving world of cryptocurrency, one of the most pivotal decisions an Aussie investor needs to make is selecting an appropriate investment horizon. This decision plays a crucial role in shaping your approach to the market and ultimately determines the strategies and tools you will employ. Simply put, your investment horizon is the timeframe you plan to hold a specific asset before selling it. When it comes to cryptocurrency, there are primarily two broad categories of investment horizons to consider:

・Long-Term (Hodling): A long-term strategy, colloquially known as 'HODLing,' is anchored in the philosophy of purchasing and retaining a cryptocurrency for extended durations, which could range from a few years to even decades. This method rests on the conviction that, in spite of the periodic volatilities and market downturns, the intrinsic value of the cryptocurrency will appreciate over the long run. Investors who adopt this strategy often have a bullish outlook on the future of the digital asset and are less perturbed by interim market setbacks.

・Short-Term (Trading): Contrasting the hodling approach is short-term trading, which is an active strategy that seeks to capitalize on fleeting market trends. Investors who opt for this approach buy and offload cryptocurrencies within relatively short intervals, which can range from mere minutes to a couple of months. The primary objective here is to garner profits from transient price shifts. Engaging in short-term trading demands a more nuanced comprehension of market mechanics, real-time data analysis, and potentially a significant time commitment to keep abreast of market movements and make timely adjustments to one's positions.

Investing into the realm of crypto investing carries with it both potential rewards and inherent risks. Therefore, regardless of the chosen strategy, it is of utmost importance to be well-equipped with knowledge, maintain vigilance, and stay attuned to the intricacies and developments of this dynamic market.

Conclusion

In this dynamic world of cryptocurrencies, understanding the foundation of investment strategies is vital for any beginner. From grasping the basics and acknowledging the numerous benefits, to recognizing the immense growth potential of crypto assets in 2024, this guide has aimed to equip beginners with a clear roadmap. While momentum and value investing offer tailored approaches based on market trends and fundamental analysis respectively, choosing between long-term and short-term horizons remains a personal decision based on one's financial goals. The buy-and-hold approach and dollar-cost averaging present disciplined strategies that cater to both passive and active Australian investors, and there are several methods available for those seeking to generate income from their investments. Emphasizing a diverse portfolio, this guide sheds light on the significance of diversification in mitigating risks and optimizing returns. However, just as crucial is the understanding of the inherent challenges in the crypto market, including market volatility, common pitfalls, and regulatory uncertainties. In conclusion, while the crypto landscape is fraught with both opportunities and challenges, a well-informed and strategic approach can potentially lead to significant rewards. As you embark on your crypto investment journey, remember to continually educate yourself, stay updated with the latest trends, and most importantly, invest with prudence and caution.

FAQ About Crypto Investing Strategies for Beginners

Q: Are Cryptocurrency Investing Strategies Suitable for Beginner Investors in Australia?

A: Absolutely, beginner investors can benefit from cryptocurrency investing strategies. Like any form of investment, having a well-thought-out strategy can help mitigate risks and increase the chances of success. It's crucial, however, for beginners to ensure that the strategy they choose aligns with their financial goals, risk tolerance, and investment horizon. Also, seeking education and perhaps guidance from financial experts can be beneficial in understanding the complexities of the crypto market.

Q: How Much Should I Invest in Crypto as a Beginner?

A: The amount you should invest in crypto as a beginner largely depends on your financial situation and risk tolerance. As a general rule, only invest what you can afford to lose. The cryptocurrency market is known for its high volatility, which means prices can swing dramatically in a short period. For those new to investing, starting with a small amount can be a good way to get a feel for the market without risking significant capital.

Q: What Is the Best Strategy to Invest in Crypto?

A: There isn't a one-size-fits-all "best" strategy for crypto investing, as it largely depends on individual goals and risk tolerance. However, some common strategies include:

- Dollar-Cost Averaging (DCA): Investing a fixed amount at regular intervals regardless of the asset's price. This helps in reducing the impact of market volatility over time.

- Holding (HODLing): Buying and holding onto a cryptocurrency for the long-term, regardless of short-term price fluctuations.

- Diversification: Spreading investments across multiple cryptocurrencies to reduce the risk associated with any single asset's poor performance.

Regardless of the strategy you choose, it's essential to stay informed about market trends, conduct thorough research on specific cryptocurrencies, and review your investment approach periodically.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.