Crypto Futures Risk Management: A Comprehensive Guide for Aussie Beginners

2024-06-25 12:57:50Are you a beginner in the world of crypto futures trading? Are you looking for ways to manage risks and avoid potential losses? Look no further as we present to you a comprehensive guide on mastering crypto futures risk management. As the popularity of cryptocurrency continues to soar, it is important to understand that with high rewards comes high risk. This guide covers everything from the basics of technical analysis and market psychology to advanced strategies for profiting in both bull and bear markets. With real-world examples, you will learn the must-know terminology and tools to make informed trading decisions confidently. So buckle up and get ready to dive into the world of crypto futures risk management.

Introduction to Crypto Futures Risk Management

If you are new to the world of cryptocurrency trading, it can be overwhelming navigating the unpredictable market and volatility. However, with the right knowledge and skills, you can manage the risks and become a successful trader in Australia. A key component to successful trading is risk management. Emotions can cloud a trader's thoughts if they are not managed properly, so it's important to develop a trading plan and a solid risk management approach.

Why the Need for Risk Management in Futures Trading?

As a beginner in futures trading, it can be easy to get caught up in the excitement of the potential earnings. Unfortunately, this excitement is often coupled with high risk, particularly in the volatile world of cryptocurrency futures trading. Because of this, implementing a proper risk management strategy is essential. The need for risk management in futures trading is crucial to protect yourself against potential losses, which can even exceed your initial investment. Proper risk management includes developing a sound trading plan, sticking to your strategy even when faced with losses, setting stop-loss and take-profit levels, and managing your money by limiting your position sizes and overtrading. With a solid risk management approach, you can mitigate potential losses and improve your chances of long-term profitability in crypto futures trading.

Leverage and Margin in Crypto Futures Trading: What Aussie Novices Need to Know

With the ever-evolving cryptocurrency landscape, traders seek ways to optimize their profits. Utilizing leverage and margin in futures trading has gained popularity. However, it is vital to fully grasp the high-risk factors involved. In the following explanation, we dissect the key aspects of leverage and margin, empowering both experienced and novice traders in Australia to harness their potential effectively.

The Role of Leverage and Margin in Risk Management

When it comes to crypto futures trading, leverage and margin play a crucial role in managing risks and maximizing profits. Leverage allows Aussie traders to borrow funds to increase their buying power and potential gains, while margin represents the percentage of their own funds that they must contribute to the trade. Both leverage and margin can significantly amplify returns but they also come with the risk of magnifying losses. That's why it's essential for beginners to understand how to manage leverage and margin properly in order to minimize risks. This includes setting stop-losses, diversifying portfolios, and avoiding excessive leverage ratios. It's also important to choose a reputable and regulated exchange that offers transparent margin requirements and risk management tools. By mastering leverage and margin, traders can take advantage of the opportunities offered by crypto futures trading while protecting their investments from potential losses.

Risks Associated With High Leverage and Margin Trading

When it comes to trading crypto futures, leverage and margin can be powerful tools that can amplify your gains. But, they also come with substantial risks that can cause significant losses. High leverage is a double-edged sword that can increase profits or magnify losses exponentially. Hence, it is necessary to use leverage judiciously, keeping an eye on the volatility of the underlying asset. Margin trading exposes Australian traders to counterparty risk, exchanges bankruptcy, and system failures. Moreover, sudden market moves can trigger margin calls, and neglecting them can lead to liquidation of positions. Therefore, it is crucial to understand how much margin is required, the types of margin systems, and the potential risks associated with margin-dominant trading strategies. In conclusion, proper knowledge, risk management techniques, and frequent monitoring of trades and positions are necessary to navigate the complexities of high leverage and margin trading in crypto futures.

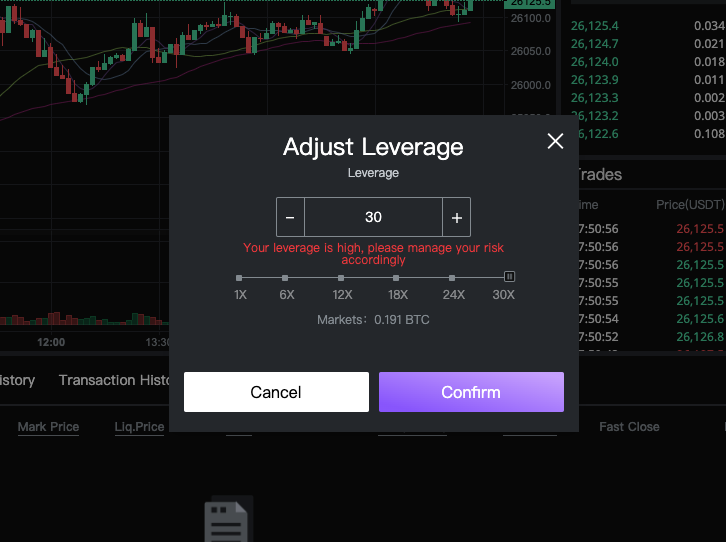

FameEX now with a maximum leverage of 30X to safeguard users' funds.

Top Risk Management Strategies for Trading Crypto Futures

In the fast-paced world of crypto futures trading, understanding and employing top risk management strategies can spell the difference between profitability and steep losses. Learn more about these proven strategies and how they can help you navigate the volatile crypto market.

Using Stop-Loss & Take-Profit Levels

When trading crypto futures, it's important to use stop-loss and take-profit levels to mitigate risk. Stop-loss levels are a set of predetermined levels that automatically cancel trades that are losing money, while take-profit levels terminate profitable trades before the trend shifts. These strategies are particularly useful during abrupt market movements, especially if the Aussie trader isn't physically present in front of their computer. However, it's important not to rely solely on these tactics and to use them with caution. Additionally, traders should ensure their trades don't close too soon or too late, as this could result in missed opportunities or losses. Money management is also crucial, limiting the amount of money invested in each trade to avoid overexposure to one position. By taking the time to understand stop-loss and take-profit levels, traders in Australia can effectively manage risk and increase their chances of success in the crypto futures market.

Stick to the Trading Strategy & Avoid Emotional Trading

When engaging in cryptocurrency futures trading, it's crucial to stick to your trading plan and avoid making impulsive decisions driven by emotions. The fear of missing out (FOMO) or the fear of losing out (FOLO) can lead Australian traders to make irrational decisions that result in losses. Emotions can clog a trader's thoughts if they aren't managed properly, so it's important to maintain professional and emotional control. Develop a solid risk management approach that includes setting entry and exit points, implementing stop-loss orders, and sticking to profit targets. Utilize technical analysis and other forms of analysis to make informed trading decisions. Remember that losses are part of the trading journey, and it's essential to maintain a long-term perspective. Stay vigilant and proactive by constantly monitoring the cryptocurrency market and staying updated with the latest news and market sentiments. By following a disciplined approach to trading and avoiding emotional trading, traders can increase their chances of success in this risky but profitable market.

Position Sizing

When it comes to trading crypto futures, proper position sizing is of the utmost importance. Money management techniques that limit the amount of money invested in a single trade to 5% of the account value can help mitigate risks associated with volatile cryptocurrencies. For example, if you have $10,000 in USDT, you should risk only between USDT100 and USDT200 for each trade. This strategy ensures that your entire account is not overexposed to one position. It's also essential to balance the number of positions with available margin, as overtrading can result in big profits but can also lead to massive losses. By following these risk management techniques, you can help secure your trading consistency and prevent blowout losses that can occur in the unpredictable world of crypto futures trading. Remember, taking your time to understand the market and implementing sound trading strategies can make a big difference in your long-term success as a crypto trader.

Hedging

When it comes to trading crypto futures, hedging is an important strategy for risk management. This involves investing in positions that offset any potential losses in your primary position. For example, if you have a long position on Bitcoin, you might take a short position on to hedge against any potential market downturns. Hedging can help limit your losses and ensure that you don't lose all your capital in a volatile market. However, it's important to remember that hedging does come with its own risks and additional costs, such as transaction fees and maintaining multiple positions. It's important to weigh the potential benefits and drawbacks of hedging before implementing this strategy in your trading plan. Overall, hedging can be a valuable tool for managing risk in crypto futures trading but should be used with caution and an understanding of the market.

Implementing Risk Management Strategies: Tips and Tricks

Effective risk management strategies are essential for successful crypto futures trading. To help you optimize your trading outcomes and safeguard your trades, we've compiled valuable tips and tricks in this section. By applying these proven risk management strategies, you can protect your investments, minimize potential losses, and increase your chances of achieving long-term success in the dynamic world of crypto futures trading.

Setting Stop-Loss Orders Effectively

When it comes to cryptocurrency trading, setting stop-loss orders is crucial to effective risk management. A stop-loss order is an instruction to sell a cryptocurrency asset when it reaches a certain price, preventing further losses beyond a predefined level. Setting stop-loss orders effectively involves understanding the market conditions and setting the order at an appropriate level to avoid triggering too soon or too late. It's important to determine the level of risk you're willing to take and set the stop-loss order accordingly. This requires a solid understanding of the market and the cryptocurrency you're trading. It's also important to regularly review and adjust your stop-loss orders in response to changing market conditions, as setting them too tight or too loose can result in missed opportunities or significant losses. By setting stop-loss orders effectively, you can reduce the impact of volatility on your trades and minimize potential losses, ultimately increasing your chances of success in the cryptocurrency market.

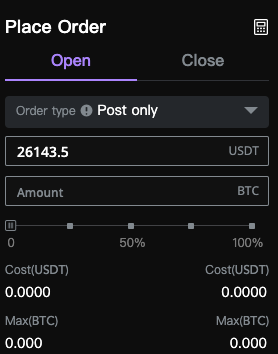

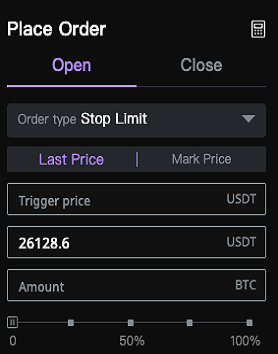

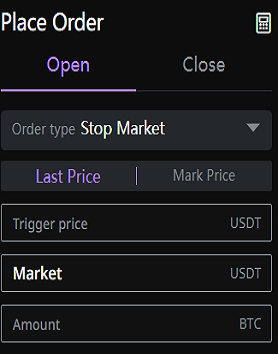

Users can set up post-only, stop-limit, and stop-market orders on FameEX.

Determining the Appropriate Position Size

When it comes to trading, determining the appropriate position size is crucial for managing risk. The position size is the amount of capital you will risk on the trade. To determine the appropriate size, you should consider your risk tolerance, account size, and the volatility of the asset you are trading. You don't want to risk too much, as a loss can quickly wipe out your entire account. On the other hand, risking too little can lead to missed opportunities and lower profits. Experts recommend that beginner traders risk no more than 1% of their account on a single trade. As you gain more experience, you can then adjust your position size accordingly. By calculating the appropriate position size, you can protect your capital while also maximizing your potential profits. Remember, managing risk is key to long-term success in trading.

Building a Diversified Crypto Futures Portfolio

When building a successful crypto futures portfolio, diversification is key. This means investing in a variety of cryptocurrencies across different market sectors. By diversifying your holdings, you can mitigate the impact of volatility and reduce the potential for significant losses. Additionally, it's important to consider your risk tolerance and financial goals when selecting investments. A well-defined trading plan including entry and exit points, stop-loss orders, and profit targets is also crucial. Remember to conduct thorough research before making any investment decisions. Keep up with industry news, stay informed about the latest developments, and analyze market sentiment. Finally, it's important to constantly monitor the market and adapt your strategies accordingly. By building a diversified portfolio and implementing proper risk management strategies, you can position yourself for success in the ever-changing crypto futures market.

Utilizing Hedging Strategies in Crypto Futures Trading

Crypto futures trading can be an exciting and profitable venture, but it also carries a high level of risk due to the volatility of the cryptocurrency market. To mitigate these risks, traders can utilize various hedging strategies. Portfolio diversification is one such strategy where Aussie traders invest in various unrelated or non-correlated assets. Additionally, hedge mode trading involves taking both long and short positions on a contract, significantly reducing the risk of liquidation. Meanwhile, short hedge and long hedge are two fundamental hedging strategies for crypto futures contracts. A short hedge involves a short position in futures contracts, mitigating the risk of a declining asset price in the future. In comparison, a long hedge involves a long position in futures contracts, protecting Aussie traders from a rising asset price in the future. By implementing these hedging strategies, traders can manage market volatility and protect their profits.

Case Studies: Learning from Successes and Failures in Crypto Futures Risk Management

As the popularity of cryptocurrencies continues to rise, many businesses are considering integrating them into their operations. However, the volatile nature of these digital assets presents significant risk management challenges. Learning from both successes and failures in crypto futures risk management can help companies make informed decisions about their involvement with cryptocurrencies.

Real-Life Examples of Risk Management in Action

One case study involves the CEO of a successful online education platform considering whether to adopt Bitcoin for payments and investments. While the CEO was a huge proponent of Bitcoin and saw it as a way to hedge against dollar inflation, the CFO had fiduciary responsibility to protect the company's capital and ensure its future development. This case illustrates the need for careful consideration of the potential benefits and risks of integrating cryptocurrencies into a business.

Another case study is the collapse of several cryptocurrencies and crypto firms in 2022, causing trillions of dollars in losses. This highlights the risks associated with investing in highly volatile digital assets that lack regulation.

On the other hand, the rise of central bank digital currencies (CBDCs) in 114 countries suggests that cryptocurrencies have the potential to change the global financial system. Companies can learn from the successful development and implementation of CBDCs to inform their own involvement with cryptocurrencies.

Overall, understanding both the successes and failures in crypto futures risk management can help companies make informed decisions about their involvement with cryptocurrencies.

Common Pitfalls to Avoid in Crypto Futures Risk Management

1. Overlooking Convexity: One of the most common mistakes made in crypto futures trading is not properly understanding convexity. This is the relationship between a change in the price of an asset and a change in the price of a future contract. It's important to note that borrowed funds amplifies gains, but also risks significant losses if the price of the underlying asset falls. Traders in Australia need to ensure they're fully aware of how leverage and collateral requirements work and that they have a solid understanding of the risks involved with using borrowed funds.

2. Insufficient Fund Management: When trading crypto futures, traders may need to transfer funds from their spot trading wallet to their futures trading wallet. Often, Australian traders have the option to use their margin for multiple positions or keep it isolated. Proper fund management is critical in futures trading to avoid unnecessary liquidation. Traders should be careful when using margins and keep an eye on the minimum balance required by their trading platform to avoid margin calls.

3. Pricing and Trading Structures: Crypto futures contracts vary on different trading platforms, with quotes shown in various currencies. Traders should be aware of the pricing structure and trading procedures on their chosen platform. Not being fully aware of the trading parameters can result in additional risks and distortions when analyzing or trading a futures contract.

By focusing on these key areas—convexity, fund management, and trading structures—traders can mitigate risks and improve their chances of success in crypto futures trading.

Conclusion

Leverage and margin, the dynamic duo of crypto futures trading, hold immense potential for traders like you to maximize profits. However, they also come with significant risks that must be understood and managed. This educational and engaging guide unravels the complexities of leverage and margin in an easy-to-understand manner, providing you with the knowledge and insights to wield these powerful tools with finesse. By implementing proper risk management techniques, such as setting stop-loss orders, diversifying portfolios, and carefully choosing leverage ratios, you can harness the potential of leverage and margin while safeguarding your investments from potential losses. So, seize the opportunity to master these risk management techniques and unleash the full potential of your crypto futures trading endeavors.

FAQ About Crypto Futures Risk Management

Q: What Are the Main Risks in Crypto Futures Trading?

Crypto futures trading carries several risks that traders need to consider. The cryptocurrency market is notorious for its high volatility, which can result in sudden price fluctuations leading to potential gains or losses for traders. In addition, market manipulation is a concern as the lack of regulatory oversight makes it possible for certain groups to artificially inflate or deflate prices. Traders must also be conscious of leveraging and margins when trading crypto futures. While leverage can amplify profits, it can also magnify losses, making careful attention to position management and responsible borrowing essential. Stay vigilant and well-informed to mitigate potential risks and maximize your chances for success in crypto futures trading.

Q: What Are Some Good Hedging Strategies for Crypto Futures Trading?

Diversification, options contracts, and inverse positions are effective hedging strategies for crypto futures trading. Diversify your investments across various cryptocurrencies and assets to reduce risk. Utilize options contracts to protect against price movements or profit from potential market shifts. Employ inverse positions or inverse ETFs to benefit from price declines. These strategies help mitigate risk in the volatile crypto futures market. However, ensure a thorough understanding of these strategies and associated risks before implementation. Consulting with a financial advisor or experienced trader can provide valuable guidance.

Q: What Are the Most Common Mistakes Beginners Make in Crypto Futures Risk Management?

Common mistakes beginners make in crypto futures risk management include neglecting risk management altogether, not setting stop-loss orders, trading based on emotions rather than a plan, and overexposing themselves to high leverage. Neglecting risk management exposes beginners to significant losses. Failure to set stop-loss orders can result in substantial drawdowns. Emotion-driven trading often leads to impulsive and irrational decisions. Overusing leverage increases risk and potential losses. To avoid these mistakes, beginners should prioritize risk management, set clear trading rules, implement stop-loss orders, trade based on analysis rather than emotions, and use leverage judiciously.

This is not investment advice. Please conduct your own research when investing in any project.