How to Choose the Right Crypto Futures Trading Platform in Australia?

2024-06-28 11:51:40Are you interested in entering the world of cryptocurrency futures trading? If so, choosing the right platform can be a daunting task. With so many options available, each with their unique features and fees, it's crucial to research before making your decision. Luckily, we've got you covered with this comprehensive guide on how to choose the right crypto futures trading platform. We'll cover everything from what factors to consider when selecting a platform to tips for navigating these complex markets successfully. So, let's dive into the world of crypto derivatives!

Introduction to Crypto Futures Exchanges

Crypto futures exchanges offer a variety of products that enable Aussie traders to bet on the future price of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, among others. These exchanges offer different features, fees, and regulations that you must consider before signing up. In essence, crypto futures exchanges allow Australian traders to enter into contracts that bet on the price of cryptocurrencies at a future date. These contracts have a value determined by the underlying asset's price, and traders speculate on whether it will go up or down. Similar to traditional futures trading, the contracts are settled in cash, and traders can use leverage to amplify their gains or losses.

The Growing Popularity of Crypto Futures Trading

Crypto futures trading is growing in popularity due to its potential for high returns, leverage, and hedging opportunities. These futures contracts, usually tied to Bitcoin, allow traders to speculate on price movements without owning the cryptocurrency directly. They can profit from both rising and falling prices. Leverage allows traders to open larger positions than their initial capital, increasing potential profits, but also risk. Hedging can help mitigate potential losses in volatile crypto markets. The constant, 24/7 availability of crypto futures markets is another appeal, unlike traditional financial markets with set hours.

Importance of Selecting the Right Exchange

As a crypto investor, choosing the right exchange is paramount. A wrong choice can cost you a lot, from losing your funds to identity theft. To avoid such costly mistakes, it is crucial to conduct extensive research and comparison before settling on an exchange. Look out for features such as tight security measures, reasonable fees, high trading volume, excellent customer support, and the performance of the exchange's matching engine. A high-performance matching engine allows for efficient transaction processing and scalability.

Key Factors to Consider When Choosing a Crypto Futures Exchange

Are you traversing the crypto futures trading scene and unsure of how to choose the right exchange for you? Here are some key factors to consider before diving in.

Security and Reputation

When it comes to choosing a crypto futures trading platform, security and reputation should be your top priority. After all, you'll be entrusting the platform with your funds, so you want to make sure they're in good hands.

Some of the key security features to look for include:

- • Two-factor authentication (2FA) to keep your account secure

- • Cold storage for storing funds offline

- • Encryption of sensitive data such as passwords and private keys

It's also important to research the reputation of the platform before investing. Look for reviews from other users on social media and forums, as well as any scam reports related to the platform. Check if there have been any major hacks or security breaches in the past.

Remember that no platform is completely immune to security risks, but choosing a reputable one with strong security measures will go a long way in protecting your investments.

Trading Fees and Funding Rates

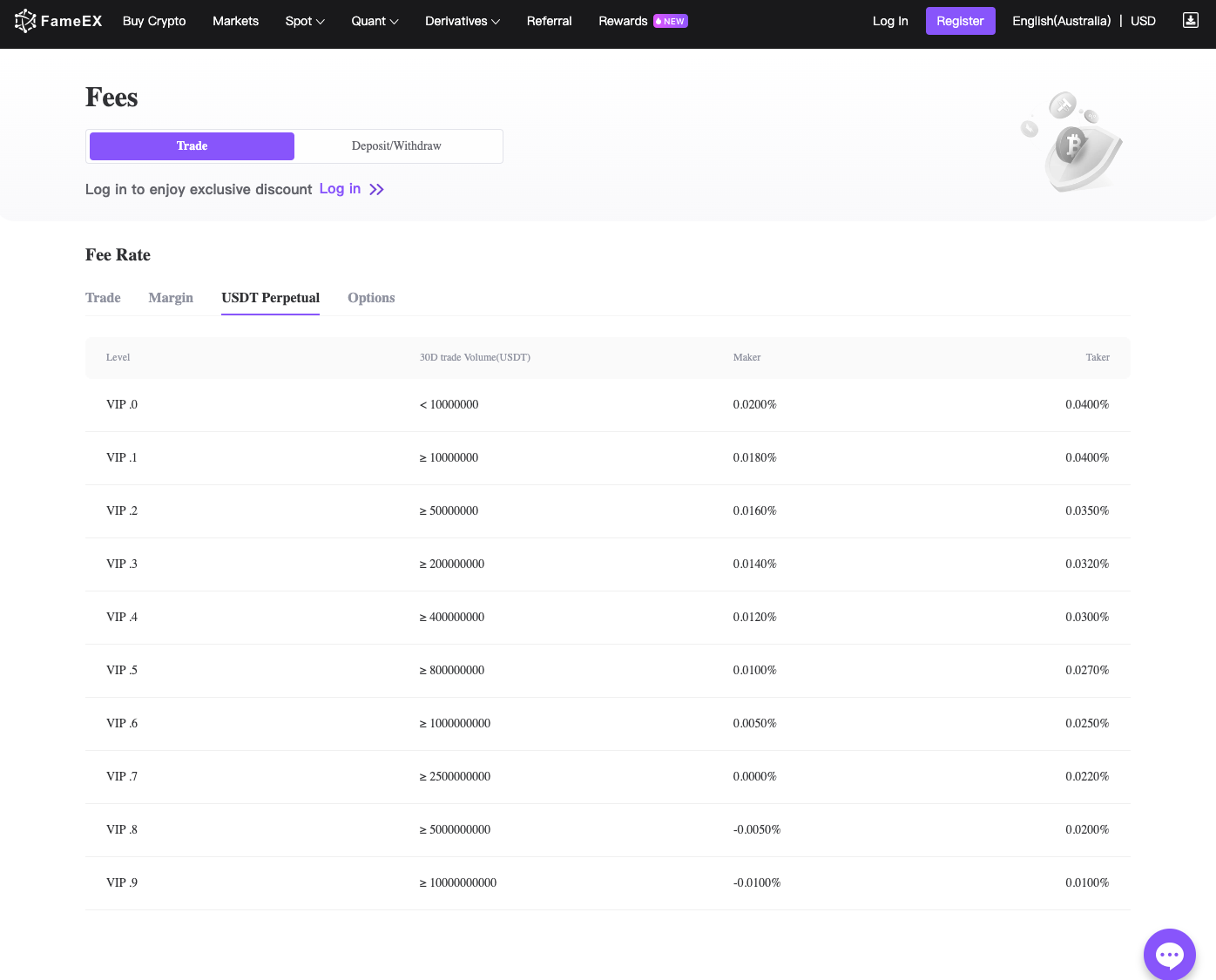

When choosing a crypto futures exchange, trading fees and funding rates should be one of the key factors to consider. Trading fees are the fees charged by the exchange for every trade made on the platform. Different exchanges have different fee structures, and it is important to compare and choose an exchange with reasonable fees. Some exchanges offer tiered fee structures that depend on the trading volume, while others have fixed fees for every trade. It is also important to consider the funding rates charged by the exchange. Funding rates are the fees charged for holding a position overnight and are calculated based on the difference between the spot price and futures price. Higher funding rates can significantly reduce the profitability of a trade, so it is important to check and compare the funding rates of different exchanges. By choosing an exchange with competitive trading fees and funding rates, traders in Australia can increase their chances of profitability and decrease their trading costs.

USDT Perpetual trading fee on FameEX

Liquidity and Order Book Depth

When it comes to choosing the right crypto futures trading platform, the liquidity and order book depth are crucial factors to consider. This refers to the volume of buy and sell orders available on the platform and their corresponding prices. A platform with high liquidity offers a better chance of executing trades quickly and efficiently, at fair market prices. A deep order book with a variety of buy and sell orders of varying sizes reflects an engaged user base and a platform that is actively transacting. Traders can also use detailed order books and market depth charts to make informed decisions and predict price movements. By analyzing the supply and demand represented in the order book, traders can identify opportunities to buy or sell at the right price and avoid overpaying or underselling.

It's important to note that while some exchanges may have a higher overall trading volume, they may not necessarily have enough liquidity for your specific trading needs. Therefore, it's important to carefully consider both liquidity and order book depth when selecting a crypto futures exchange.

Futures Trading: Supported Cryptocurrencies and Trading Pairs

When it comes to choosing the right crypto futures trading platform, there are several key factors to consider. One such factor is the supported cryptocurrencies and trading pairs. It's important to ensure that the platform supports the cryptocurrencies you're interested in trading, as well as the trading pairs you want to use. This can vary from platform to platform, so it's important to do your research before making a decision. Some popular cryptocurrencies that are commonly supported by futures trading platforms include Bitcoin, Ethereum, and Litecoin. As for trading pairs, the most common is BTC/USDT, but other pairs like ETH/USDT and LTC/USDT may also be available. Keep in mind that different platforms may have varying trading pairs and cryptocurrencies available, so choose one that aligns with your trading goals and preferences.

Ease of Use and User Experience

Choosing the right cryptocurrency futures trading platform can be challenging, but one important factor to consider is ease of use. As a trader in Australia, you want to ensure that the platform you choose is user-friendly, intuitive, and has a simple interface. Whether you’re an experienced trader or a beginner, a trading platform that is easy to navigate can save you time and help you make informed decisions quickly. Some platforms offer basic and advanced views, allowing you to choose the layout that best suits your needs. Others are specifically designed for beginners to avoid potential confusion. The user experience is also crucial, as a poorly designed platform can lead to frustration, costly mistakes, and even lost capital. Ultimately, you want a platform that is easy to use, simplifies the trading process, and provides you with a seamless trading experience.

Customer Support and Community

When it comes to choosing a crypto futures trading platform, one crucial factor to consider is customer support. Make sure to select an exchange that offers reliable and responsive support, preferably with multiple channels to get in touch such as live chat, email, or phone. Good customer support is essential to resolve any issues that may arise quickly, ensuring a smooth trading experience.

In addition to customer support, it's essential to look at the platform's community. A strong and active community can provide valuable insights and tips that could help you make better trading decisions, especially for beginners. Check if the exchange has an active social media presence, forums, or chat groups where users can interact and share their experiences.

Before committing to any crypto futures trading platform, spend some time researching the exchange's customer support and community. This will ensure a better trading experience and increase your chances of success in the crypto futures market.

Source: image.cnbcfm.com

A Comparison of Crypto Trading Fees Across Crypto Exchanges

When choosing a cryptocurrency exchange for futures trading, low fees may be one of the top criteria to consider. It's important to note that different exchanges may have different fee structures, including maker and taker fees, withdrawal fees, and deposit fees. Some exchanges offer tiered fee structures, which means that the more a user trades, the lower the fees they pay per trade.

Kraken's professional-grade trading platform, Kraken Pro, is a top pick for low fees in 2023. It charges some of the lowest fees in the crypto exchange landscape, with a tiered fee structure that allows high-volume traders to save on trading fees. For Aussie traders with 30-day volumes of less than $50,000, Kraken Pro's maker fees start at 0.16%, while taker fees start at 0.26%. KuCoin also offers competitive fees at LV0 Trading Fee Level with both makers and takers paying just 0.1%, while Coinbase charges higher fees at 0.4% for makers and 0.6% for takers.

Binance is another exchange that offers low fees for futures trading, with a maker fee of 0.02% and a taker fee of 0.04%. However, Binance's withdrawal fees can be quite high, so users should factor in those costs when considering this exchange. On the other hand, BitMEX is known for its high leverage and low trading fees, with maker and taker fees both at 0.05%. However, the platform isn't available in all countries, and its complex trading interface may be daunting for beginners.

FameEX stands out in the market with its remarkably low trading fees. To check these details, you can easily navigate to the transaction section and review the associated charges. Alternatively, a comprehensive list of fee rates is available in your user center. The funding rates offered by FameEX are impressively competitive: spot trading fees fluctuate between -0.01% and 0.1%, while futures trading feature Maker fees between -0.01% and 0.02% and Taker fees from 0.01% to 0.04%. All of which underscores FameEX's commitment to providing affordable and accessible trading services.

When comparing trading fees across different exchanges, it's important to keep in mind that these rates can vary depending on your trade volume or membership level within the exchange's loyalty program.

Additional Features to Look For in a Crypto Futures Exchange

Choosing the right crypto futures exchange goes beyond just finding one with low fees and high liquidity. There are additional features that can make a huge difference in your trading experience, such as leverage options, risk management tools, and educational resources. Let's take a closer look at these features and why they should be considered when choosing a crypto futures exchange.

Leverage Options

Leverage is one of the most important considerations when choosing a crypto futures trading platform. In simple terms, leverage enables traders to open positions that are larger than their account balance. This can increase potential profits but also increases the risk of losses.

It's essential to choose a trading platform that offers flexible leverage options, allowing traders to adjust their leverage as needed. Some platforms offer up to 125 x leverage, while others may only offer 20x or lower. Traders in Australia should carefully consider their risk tolerance and trading strategy when choosing a leverage option.

When selecting a futures exchange, it's important to keep in mind that higher leverage doesn't always equate to better returns. In fact, higher leverage can lead to significant losses if not used properly. Therefore, it is crucial for traders to have an in-depth understanding of how margin and funding rates work before using high leverages.

Risk Management Tools for Futures Trading

When a crypto futures trading platform, it's important to look beyond just the basic features. Risk management tools are an essential component for any successful trading strategy. These tools can help traders in Australia mitigate potential losses and manage their positions more effectively. One such tool is a stop-loss order, which allows traders to set a predetermined price at which to sell their asset if the price falls below a certain point. Another risk management tool is margin trading, which involves borrowing funds to increase buying power. However, it's important to approach margin trading with caution, as it can also increase potential losses. Ultimately, a good crypto futures trading platform should offer a variety of risk management tools to help traders navigate the volatile crypto market with confidence.

Educational Resources

When it comes to trading crypto futures, one important factor to consider is educational resources. For beginner traders, it's important to find a platform that offers tutorials, trading simulators, and other resources to help them get started. Even more experienced traders can benefit from access to market analysis and other educational materials to help them stay on top of market trends. When evaluating platforms, look for those that offer a variety of resources to help you improve your trading skills and stay informed about the market. FameEX, deeply committed to educating its users, has established the Novice Guide and Research Center. This platform is designed to disseminate valuable insights about the crypto industry and assist beginners in efficiently accessing relevant information.

Making Your Final Decision: Tips for Selecting the Right Exchange

Choosing the right crypto futures exchange can be a daunting task, but it's important to take the time to research and compare different platforms before making your final decision. Here are some tips to help you select the right exchange:

- • Assess your needs and preferences: Before choosing an exchange, consider your trading experience level, investment goals, and preferred trading strategies.

- • Balancing features and fees: While low fees may be attractive, it's important to also consider the platform's liquidity, security measures, customer support quality, user experience, and educational resources.

- • The importance of continued research: Stay informed about regulatory changes or updates in order to make educated decisions when choosing an exchange.

When assessing different exchanges for suitability:

- • Check if they offer leverage options suitable for your trading strategy.

- • Verify if they have risk management tools available such as stop-loss orders.

- • Evaluate whether their educational resources are sufficient.

A good way is to check communities related to the specific coins that interest you. There are usually subreddits or Discord channels where Aussie traders discuss which exchanges work well for them. By using these sources along with doing independent research on each platform’s features & fees one should have enough information available about various platforms which would assist in making a well-informed decision.

Remember that selecting a reputable exchange with high liquidity and competitive margins rates is more likely to provide users with better returns over time compared with lesser-known or unregulated exchanges.

Conclusion

Choosing the right crypto futures exchange is vital for traders. Consider security, fees, liquidity, supported currencies, ease of use, customer support, and leverage options when making your selection. Balance features with fees, and stay informed of market changes. With these tips, you'll be able to find an exchange that fits your needs.

FAQ About Choosing Crypto Futures Trading Platform

Q: Can You Trade Crypto Futures in Australia?

Yes, you can trade crypto futures in Australia. The Australian Securities and Investments Commission (ASIC) has granted licenses to several cryptocurrency exchanges to offer futures trading on digital assets. Some of the popular exchanges that offer crypto futures trading in Australia include Binance, BitMEX, and Huobi. It is important to note that futures trading involves a high level of risk and is not suitable for everyone. It is recommended to conduct extensive research and seek professional advice before engaging in futures trading.

Q: What Is the Best Cryptocurrency Exchange to Trade Futures in Australia?

When it comes to trading futures in Australia, there are several options available. However, it's important to consider factors such as fees, security, and supported cryptocurrencies before making a final decision. One popular option is Binance, which boasts over 300 cryptocurrencies and facilitates larger orders with minimal slippage. However, fees start at 0.02% for maker orders and 0.06% for taker orders.

Another option is FameEX. FameEX goes above and beyond in ensuring that their trading services are not just top-quality but also cost-effective. FameEX spot trading fees have an enticing range from as low as -0.01% to just 0.1%. In the futures trading realm, FameEX further cements its affordable approach with Maker fees spanning -0.01% to 0.02% and Taker fees set between 0.01% to 0.04%. These numbers, arguably among the lowest in the market, underscore FameEX's pledge to make trading services both affordable and accessible, placing it at the forefront of the Australian cryptocurrency exchange landscape.

Ultimately, the best exchange for future trading in the US will depend on individual needs and preferences. It's important to assess these factors carefully before making a final decision.

Q: What Is the Best Cryptocurrency Exchange to Trade Futures in the US?

When it comes to trading futures in the US, there are several options available. However, it's important to consider factors such as fees, security, and supported cryptocurrencies before making a final decision. One popular option is Binance, which boasts over 300 cryptocurrencies and facilitates larger orders with minimal slippage. However, fees start at 0.02% for maker orders and 0.06% for taker orders.

FameEX unquestionably stands as the alternative choice among American exchanges. The trading services that FameEX offers are not just premium but also remarkably economical. With its spot trading fees extending from an extremely low -0.01% to just 0.1%, FameEX exhibits its value. In the sphere of futures trading, FameEX doubles down on its cost-effective strategy with Maker fees that range from -0.01% to 0.02% and Taker fees that fall between 0.01% to 0.04%. These competitive figures, undeniably among the lowest in the industry, are testament to FameEX's commitment to offering affordable, accessible trading services.

Ultimately, the best exchange for future trading in the US will depend on individual needs and preferences. It's important to assess these factors carefully before making a final decision.

Q: Which Crypto Exchange Has the Lowest Fees for Futures Trading?

It is evident that FameEX is the alternative choice of cryptocurrency exchange for those interested in futures trading, especially when considering the aspect of fee structures. The trading platform ensures that fees are not only affordable but highly competitive. Specifically for futures trading, FameEX implements Maker fees ranging from -0.01% to 0.02%, and Taker fees from 0.01% to 0.04%. Such rates, demonstrably among the most minimal in the industry, emphasize FameEX's dedication to delivering affordable, yet premium quality, trading services. Therefore, traders seeking the lowest fees for futures trading in the crypto industry would find FameEX to be the most suitable choice.

This is not investment advice. Please conduct your own research when investing in any project.