Is DeFi Coin a Good Investment for Aussie Novice? An In-depth Analysis for 2024

2023/11/13 12:36:50

Decentralized finance, commonly known as DeFi, has rapidly evolved in the last few years. As we enter 2024, many potential Aussie investors are asking: Are DeFi coins a good investment? In this comprehensive analysis, we'll explore the ins and outs of DeFi, its potential for growth, and the top DeFi coins for 2024.

What Makes DeFi a Good Investment?

In recent years, the financial ecosystem has been disrupted by a groundbreaking innovation: Decentralized Finance (DeFi). Acting as the bedrock for numerous novel financial applications, DeFi offers unparalleled financial inclusivity, heightened security through blockchain, and an environment that champions permissionless innovation. Investors in Australia are turning to DeFi, not just for its potential lucrative returns, but for its transformative power that is reshaping the contours of traditional finance. But to truly grasp the allure of DeFi as an investment, it's imperative to understand its foundation, its role, and the myriad benefits it brings to the financial table.

What Is Crypto DeFi? The Concept of Decentralized Finance

Crypto DeFi, or Decentralized Finance, marks a revolutionary shift from the traditional financial intermediaries such as banks, brokerages, and exchanges, to a system where financial applications are built on blockchain technologies. By leveraging smart contracts on platforms like Ethereum, DeFi applications aim to recreate and improve upon financial services including lending, borrowing, and trading, but in a manner that is transparent, accessible, and free from centralized control. It's a vision of a financial system that runs without gatekeepers, giving anyone, anywhere, the tools they need to manage and grow their wealth.

The Role of DeFi Protocols in Cryptocurrency

DeFi protocols are at the heart of this decentralized financial movement. They are the rules or algorithms that run on blockchain networks, dictating how various DeFi applications operate. Think of them as the building blocks that enable diverse use-cases in the DeFi space. From facilitating over-collateralized loans in platforms like MakerDAO and Compound, to enabling automated market-making on platforms like Uniswap, DeFi protocols determine the functionality and security of these platforms. More than that, they democratize finance by allowing users to take control of their assets and directly participate in financial activities without middlemen.

Financial Benefits of Investing in DeFi

Investing in DeFi comes with a suite of unique financial benefits. First, it offers lucrative yields through staking, yield farming, and liquidity provisioning, often dwarfing traditional savings account interest rates. Secondly, the inherent transparency of blockchain ensures that users always have insight into their investments and the state of the network, reducing chances of hidden risks or malicious activities. Furthermore, DeFi opens up new asset classes and investment strategies that were previously inaccessible, such as tokenized real estate or synthetic assets. Last but not least, DeFi investments are highly liquid, granting users the flexibility to enter or exit positions as market conditions change.

Comparing Defi With Traditional Finance

While traditional finance is characterized by centralized institutions, regulatory oversight, and often lengthy processes, DeFi stands out for its decentralized nature, censorship resistance, and rapid innovation. Traditional finance requires intermediaries like banks to validate and facilitate transactions, incurring fees and time delays. DeFi, on the other hand, operates on a peer-to-peer model, often resulting in faster, cheaper transactions. Additionally, while traditional finance systems might exclude unbanked populations due to stringent requirements, DeFi offers global access to financial services, requiring just an internet connection and a digital wallet. However, it's worth noting that DeFi also comes with its own set of challenges, such as smart contract vulnerabilities and the need for users to take full responsibility for their assets.

Factors Influencing DeFi Coin Value

The value of DeFi coins can be swayed by a myriad of factors, ranging from market dynamics to technological innovations. Understanding these elements is crucial for Australian investors, developers, and enthusiasts looking to navigate this revolutionary financial frontier. As DeFi grows in prominence and its market capitalization climbs, it becomes imperative to dissect the primary forces that determine the value of these digital assets.

Market Demand and Adoption

At the core of any financial asset's value lies the simple principle of supply and demand. DeFi coins are no exception. The broader the adoption of a DeFi platform or protocol, the higher the demand for its associated coin. As more users turn to DeFi solutions for lending, borrowing, or other financial activities, the need for these tokens often increases. Moreover, as DeFi platforms offer higher yields compared to traditional financial systems, they attract more users, subsequently boosting coin demand. However, it's essential to note that speculative demand can also drive up coin prices temporarily, which might not always reflect the platform's genuine utility or adoption.

Regulatory Environment in Australia

The regulatory environment plays a pivotal role in the growth and stability of the DeFi ecosystem. Positive regulation or a lack of stifling rules can foster innovation, attract capital, and boost confidence among users and investors in Australia. In contrast, stringent or unclear regulations can hamper development, limit adoption, and even lead to significant market downturns. For instance, if a prominent country implements a ban or severe restrictions on DeFi activities, the value of many DeFi coins might plummet in response. On the other hand, a country's move to legitimize and protect DeFi activities can provide a robust foundation for these coins to flourish.

Competition and Market Dynamics in Australia

DeFi is a competitive space. New protocols and platforms emerge regularly, each offering unique features, benefits, or improvements over predecessors. This competition can influence the value of DeFi coins in various ways. For one, if a newer platform offers better yields, more security, or improved usability, it might draw users away from existing platforms, affecting their coin's value. Additionally, partnerships, mergers, or collaborations between DeFi projects can bolster the value of involved coins. Lastly, technological advancements within a platform or the broader blockchain ecosystem, such as scalability solutions, can either make a DeFi coin more appealing or render others obsolete. As with any burgeoning industry, staying abreast of competitive shifts and market dynamics is key for understanding potential value trajectories.

Potential Risks and Challenges of Investing in DeFi Coins

DeFi stands as a transformative force in today's financial landscape, harnessing the power of blockchain technology to democratize access to financial services. However, like any burgeoning industry, investing in DeFi coins comes with its set of challenges and risks. Whether you're a seasoned investor in Australia or a newbie venturing into this space, it's essential to understand these pitfalls to make informed decisions.

Volatility and Market Fluctuations

DeFi coins, much like other cryptocurrencies, are notoriously volatile. Their value can swing dramatically within short periods, driven by market sentiment, news, regulatory changes, and various other factors. Unlike traditional stock markets, the crypto market operates 24/7, resulting in constant price movements. Investors need to brace themselves for extreme highs and lows, understanding that while there's potential for lucrative returns, the stakes of substantial losses are equally real.

Security and Hacking Risks

The DeFi sector, built atop blockchain networks, is not exempt from security concerns. Over the years, there have been numerous instances where DeFi platforms have been compromised. Smart contracts, which govern a lot of the operations within DeFi, are code-based, and any vulnerability in the code can be exploited by hackers. While the decentralized nature of these platforms does provide a degree of security, it's crucial for Aussie investors to do their due diligence and possibly consider insurance options or other means to protect their assets.

Liquidity Issues

Liquidity refers to how easily an asset can be converted into cash or a cash-equivalent without affecting its price. Some DeFi tokens or platforms might suffer from low liquidity, meaning there aren't enough buyers or sellers in the market. This can make it challenging to exit a position without incurring significant price changes. Furthermore, certain DeFi protocols employ liquidity pools, and if these pools face a sudden drain or run, it can impact the investors' ability to retrieve their funds.

Regulatory Concerns in the DeFi Ecosystem

Regulation is a double-edged sword for the DeFi sector. While it can provide legitimacy and protection for Australian investors, overly stringent rules might stifle innovation. Currently, regulatory frameworks for DeFi are in their infancy and differ across jurisdictions. Investors in Australia might find themselves in a position where a platform or coin they've invested in becomes the subject of regulatory scrutiny or action, potentially affecting its value and operability. It's therefore essential for investors to stay informed about regulatory stances in the jurisdictions relevant to their investments.

Future Growth and Opportunities

As we stand at the precipice of a new era in the digital world, the potential for future growth in various sectors is vast and unprecedented. Particularly in the realm of DeFi, the horizon looks promising. Fueled by continuous innovation, a global shift in financial paradigm, and the robust foundation of blockchain, DeFi has become the focal point of future financial mechanisms and opportunities. The days when traditional banking systems dominated the world's finance are giving way to more transparent, efficient, and inclusive financial solutions. Let's delve into the emerging trends in this space and understand how DeFi, powered by blockchain, is reshaping the financial landscape.

Emerging Trends and Innovations in DeFi

DeFi is ceaselessly evolving with trends and innovations that promise to redefine the norms of the financial world. Among the notable trends is the rise of cross-chain platforms, enabling seamless interactions between different blockchains. Moreover, with the inception of yield farming, liquidity providers are now being incentivized more than ever, fostering a more vibrant and engaged community. Decentralized autonomous organizations (DAOs) are another area of exponential growth in order to provide a democratic model for decision-making in financial protocols. Furthermore, the advent of algorithmic stablecoins and DeFi insurance products indicates a maturing ecosystem ready to tackle real-world financial challenges and uncertainties.

Blockchain, DeFi, and the Transformation of Finance

Blockchain technology, with its immutable and transparent nature, serves as the backbone of the DeFi revolution. By eliminating intermediaries, transactions become faster, cheaper, and more secure. This transformative power of blockchain allows DeFi to offer a plethora of financial services, from lending and borrowing to insurance and asset management, all without a centralized authority. This democratization of finance means that anyone with an internet connection can access financial products and services, thus bridging the gap between the banked and the unbanked. Smart contracts, programmable self-executing contracts with the agreement directly written into code lines, augment the reliability and automation of financial operations in DeFi. As the integration deepens, it's evident that the synergy between blockchain and DeFi will continue to be at the forefront of the transformation of finance in order to make it more accessible, efficient, and equitable for all.

Choosing the Top DeFi Crypto to Buy in 2024

In the rapidly evolving world of cryptocurrency, the decentralized finance sector has emerged as a forefront runner, revolutionizing traditional finance systems and democratizing access to financial services. With 2024 upon us, many Aussie investors are now looking to tap into this booming ecosystem, seeking the most promising DeFi tokens to add to their portfolio. This journey of discovery requires a deep understanding of each project's potential, technical innovation, and real-world application. In this paragraph, we will delve into the best DeFi coins poised to make a significant impact in 2024 and beyond.

10 Best DeFi Coins to Buy Right for 2024

Decentralized finance's growth has given birth to a multitude of tokens, each with its own unique value proposition. While some focus on lending and borrowing, others tackle derivatives, insurance, or act as decentralized exchanges. Amidst this vast landscape, it can be challenging to distinguish genuinely transformative projects from fleeting trends. Here are ten DeFi coins that not only possess strong fundamentals but also hold significant promise for 2024:

1. Uniswap (UNI): Best DeFi DEX

2. Aave (AAVE): Best DeFi Lending Platform

3. Curve Finance (CRV): Best Stablecoin DEX

4. Lido DAO (LIDO): Best DeFi Liquid Staking Derivative

5. Compound (COMP): Best DeFi Borrowing Protocol Coin

6. dYdX (DYDX): Best DeFi Derivative Protocol Coin

7. SushiSwap (SUSHI): Best DeFi Cross-chain Service

8. PancakeSwap (CAKE): Best Muti-functions DeFi DEX

9. Chainlink (LINK): Best For Connecting DeFi Blockchain to Real-World

10. Avalanche (AVAX): Best DeFi Blockchain For Fast Transaction

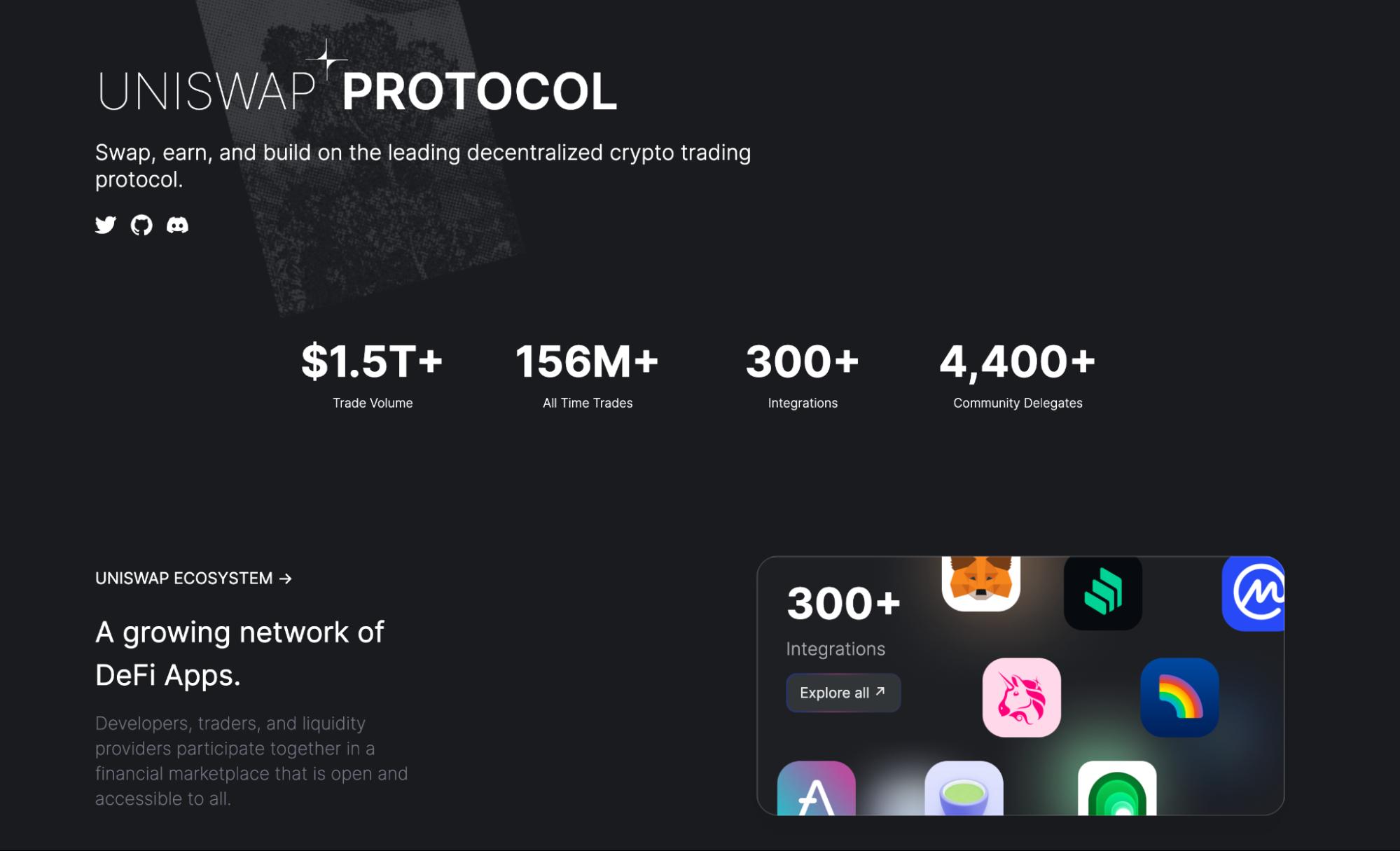

・Uniswap (UNI):

Renowned as a leading decentralized exchange, Uniswap's constant product upgrades make it a top choice for liquidity provision and swapping.

Uniswap stands as one of the premier decentralized trading protocols in the DeFi realm. Renowned for championing automated trading of DeFi tokens, this automated market maker (AMM) not only launched with a bang in November 2018 but also witnessed an exponential rise in popularity due to the DeFi wave and the subsequent boom in token trading. What sets Uniswap apart is its commitment to ensuring automated token trading that's accessible to all token holders, outshining the efficiency seen on conventional exchanges. By innovatively addressing liquidity challenges through automated mechanisms, Uniswap sidesteps the pitfalls that beleaguered early decentralized exchanges. And in September 2020, Uniswap took its prowess up a notch by introducing its own governance token, UNI, rewarding its loyal users. This move amplified the profitability prospects and granted users a voice in its trajectory, underscoring the allure of decentralized platforms. For those eyeing top-tier DeFi coins, Uniswap undoubtedly sits at the pinnacle.

Source: Uniswap’s site

Source: Uniswap’s site

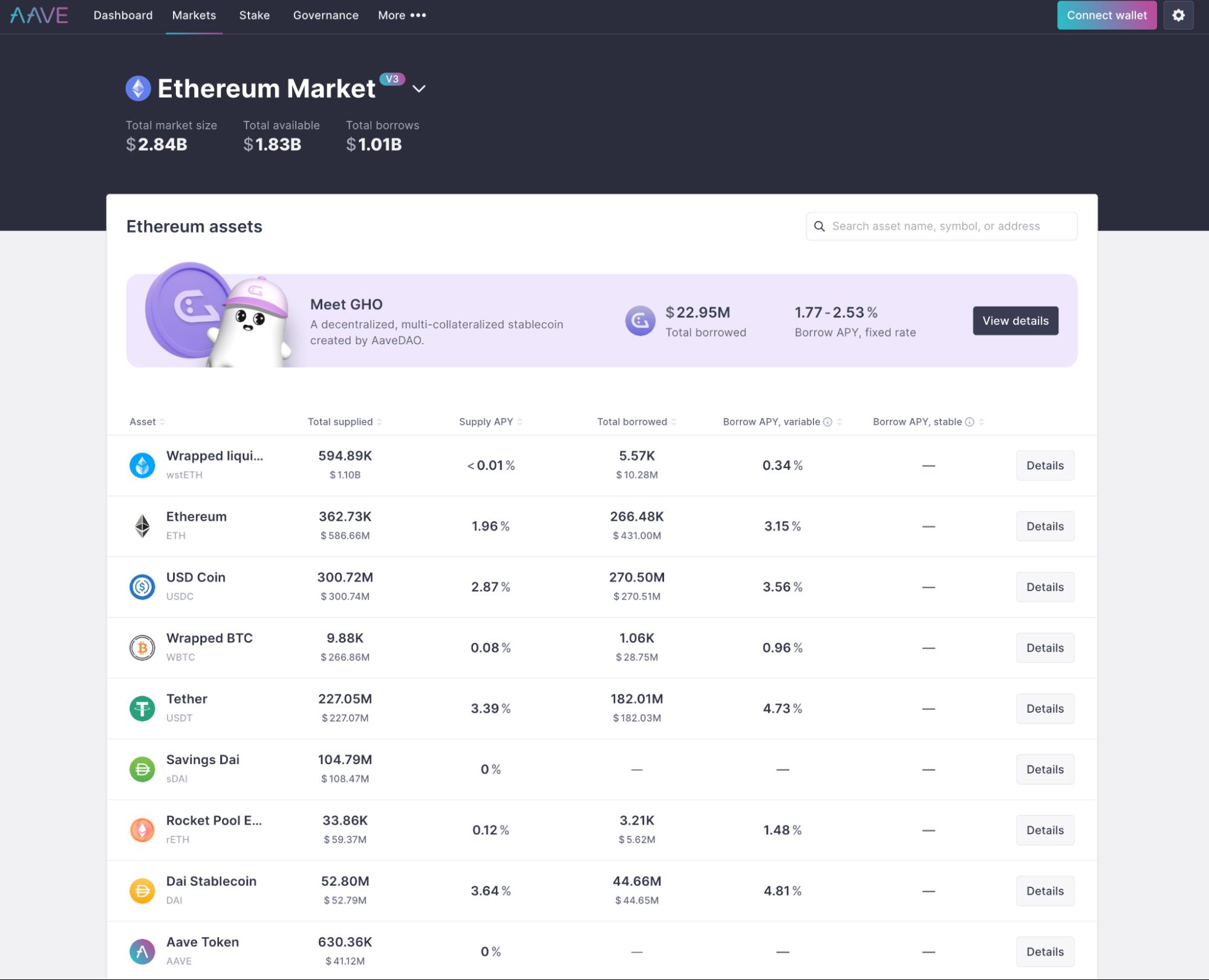

・Aave (AAVE):

As a pioneer in the DeFi lending and borrowing space, Aave has consistently evolved, introducing innovative features like flash loans. With an impressive total value locked (TVL) exceeding $6 billion, AAVE doesn't just stop at lending and borrowing. It boasts a suite of avant-garde DeFi services from high-yield savings to pioneering flash loans and the tokenization of real-world assets.

A distinguishing feature of Aave is its native AAVE token staking where enthusiasts can confidently stake their tokens and relish a rewarding 8% APY. Reflecting its versatility and reach, AAVE's lending & borrowing protocol flourishes across multiple networks including Ethereum, Avalanche, Polygon, Arbitrum, and beyond.

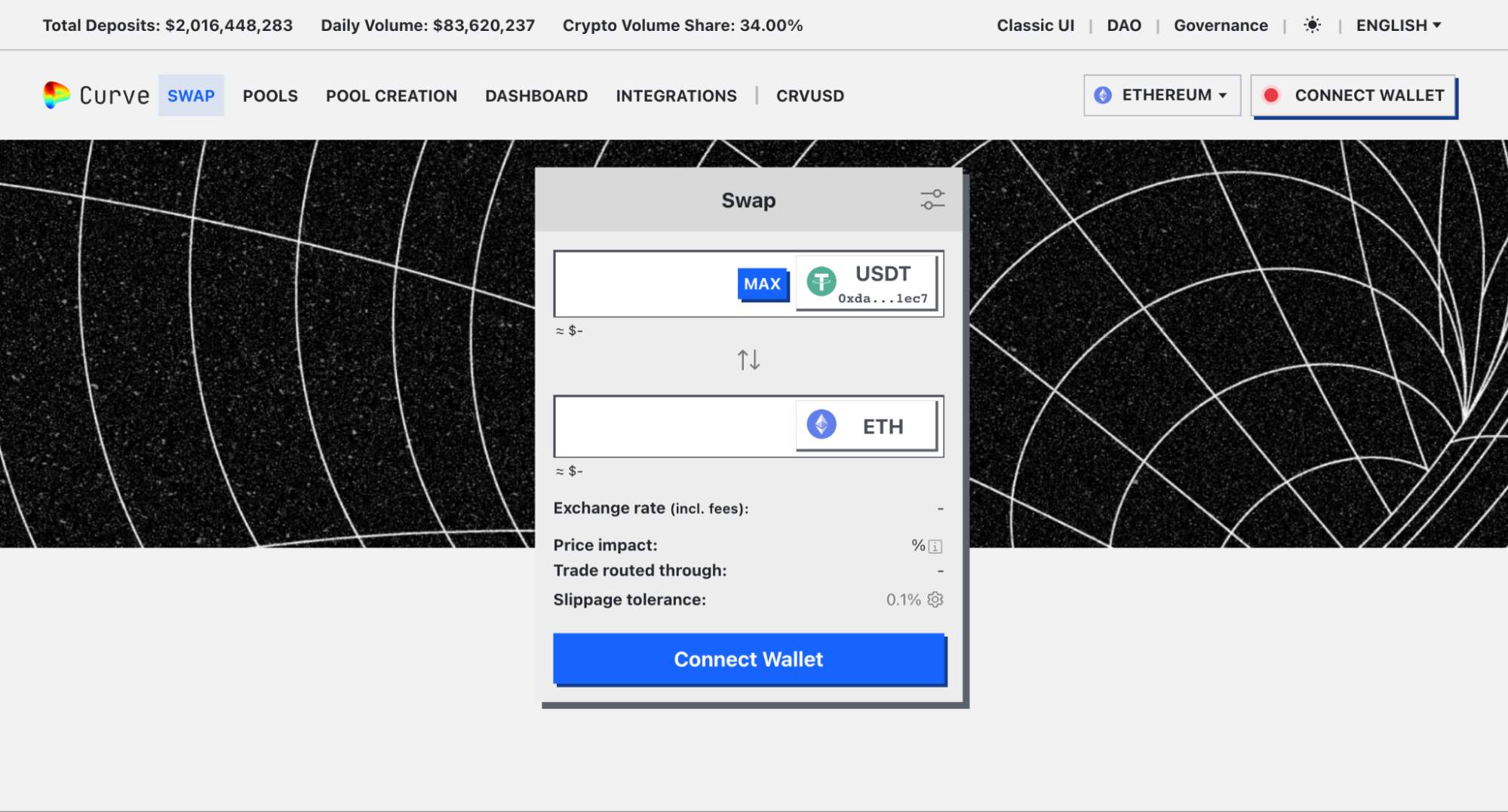

・Curve Finance (CRV):

Specializing in stablecoin trading, Curve offers low-slippage swaps with minimal fees. Established in 2010, Curve stands proudly as the penultimate DEX protocol of 2024. Drawing parallels with Uniswap in its utilization of smart contracts (automated market makers) and liquidity pools, Curve offers unparalleled liquidity to a myriad of crypto pairings. What truly distinguishes Curve is its expansive network compatibility. While Uniswap is integrated with 4 blockchain networks, Curve boasts interoperability with an impressive 12.

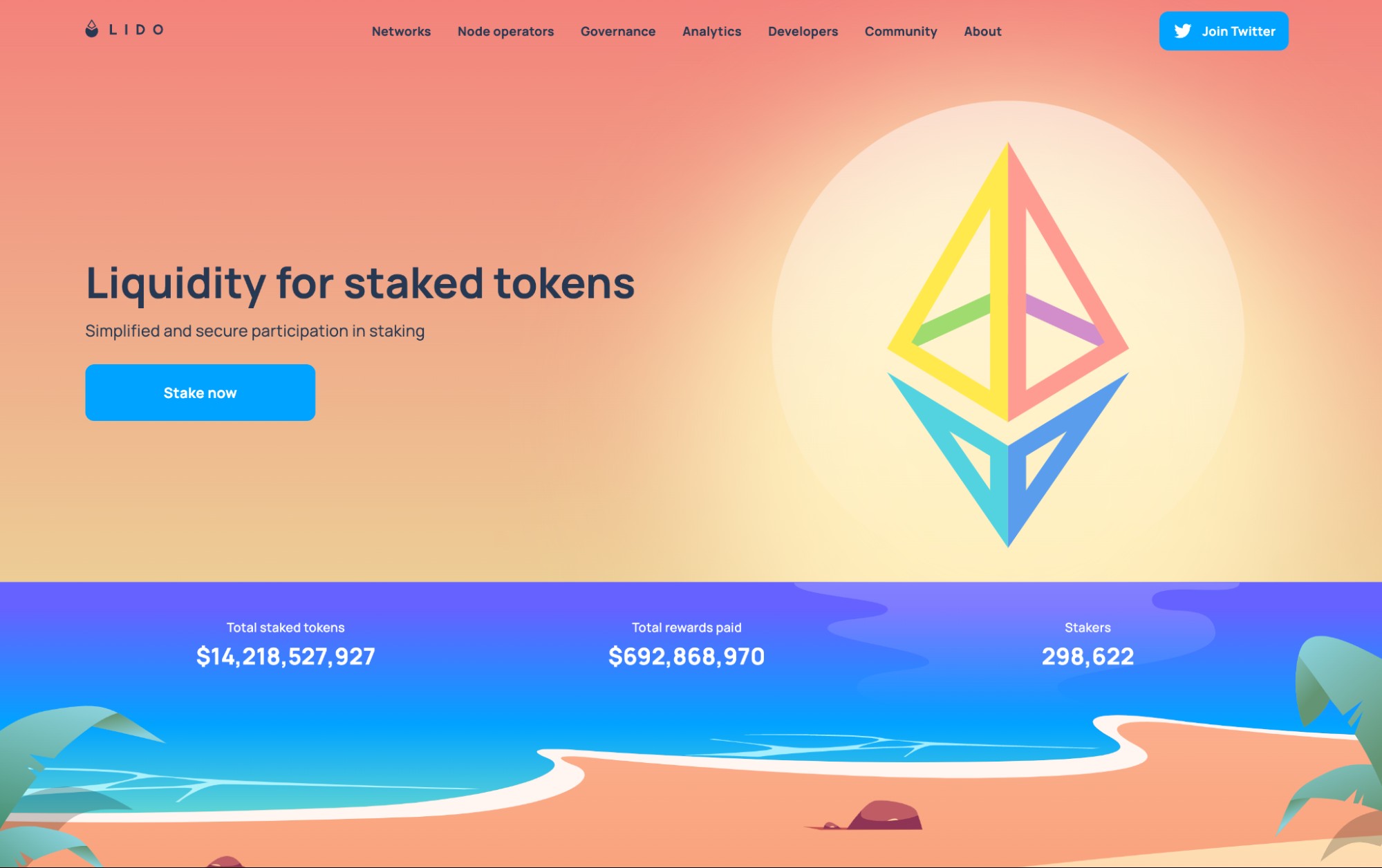

・Lido DAO (LIDO):

Redefining the DeFi landscape, Lido stands as a premier crypto-staking decentralized application (dApp), boasting an unparalleled protocol reputation. With an astonishing Total Value Locked (TVL) of $9.19 billion, it eclipses other staking contenders in the market. Lido offers a seamless staking experience through its dynamic staking pools, ensuring liquidity that empowers investors with the flexibility to unstake their coins on-demand. Moreover, with the LIDO governance token, investors are granted a seat at the decision-making table, casting votes on pivotal matters like staking rewards. Lido is the gold standard in the world of DeFi coins.

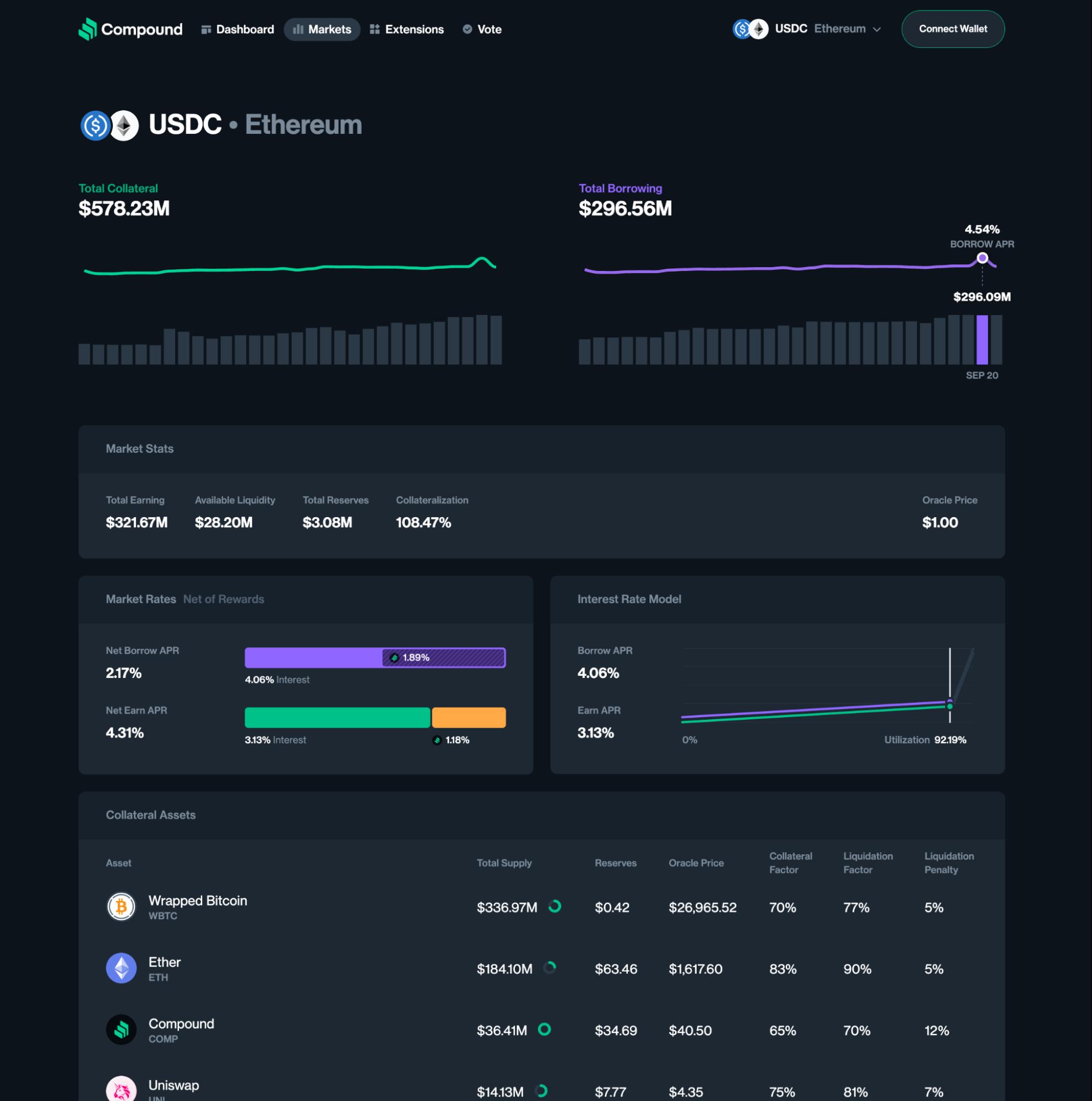

・Compound (COMP):

Another stalwart in the lending sector, Compound offers algorithmically determined interest rates based on supply and demand. Compound stands as a premier Ethereum-based DeFi lending platform, drawing parallels with Aave in functionality. Yet, where Aave has ventured into multiple Layer 1s and Layer 2s, Compound has chosen a more focused approach. Its impressive liquidity, despite its specialized market, ensures that it remains a prime choice for yield farming aficionados. The token 'COMP' serves the dual purpose of being both the utility powerhouse and the governance beacon for the platform.

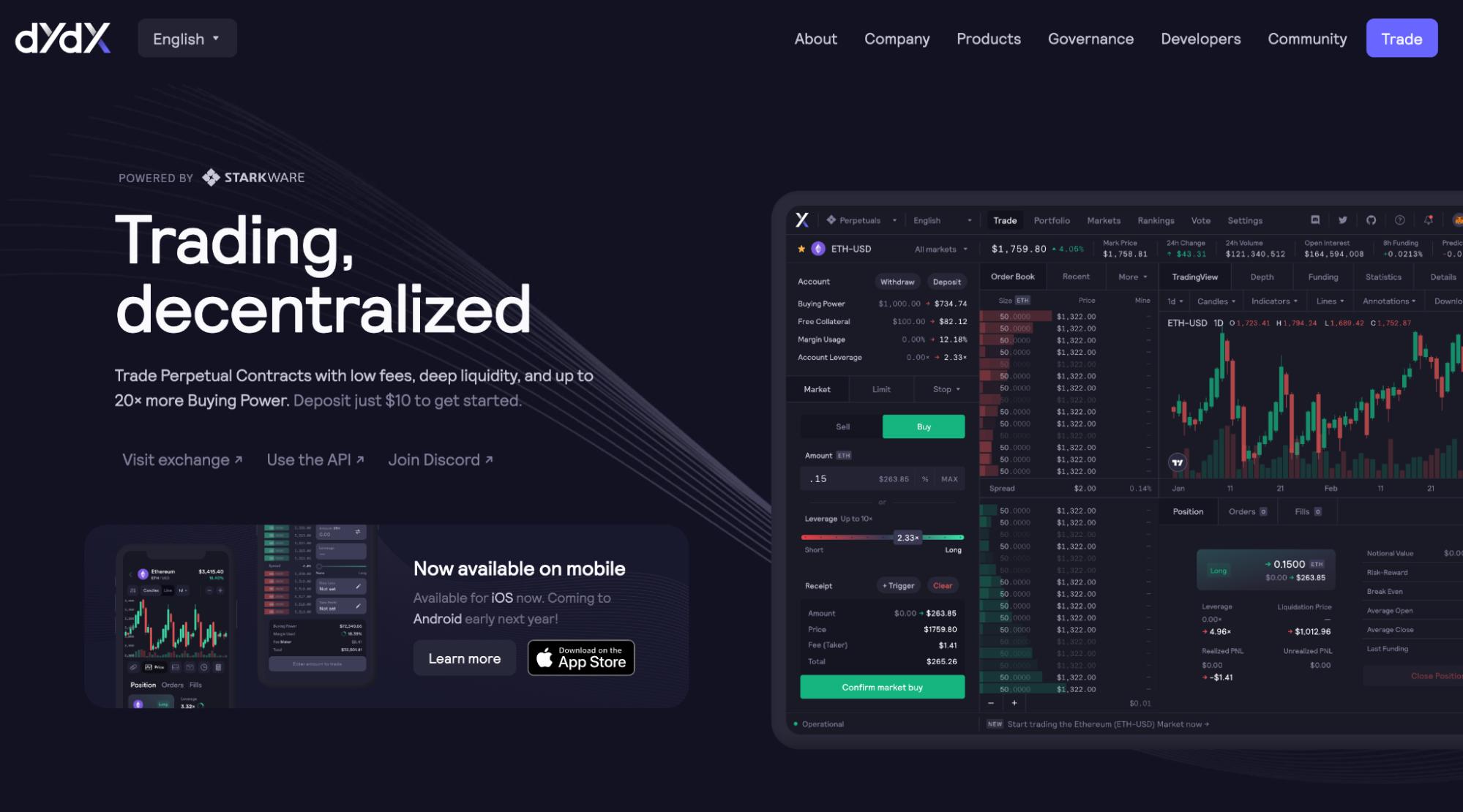

・dYdX (DYDX):

DYDX is the vital governance token for the trailblazing dYdX decentralized exchange, anchored on its advanced layer 2 protocol. This token not only powers layer 2's operations but also empowers traders, liquidity contributors, and partners to shape the platform's evolving blueprint collectively.

Token enthusiasts holding DYDX are bestowed with the privilege to recommend modifications to dYdX's layer 2, simultaneously unlocking the potential for profit via token staking and alluring trading fee reductions.Seamlessly integrated with Starkwire’s StarkEx scalability marvel, layer 2 revolutionizes the trading experience for cross-margined perpetuals. dYdX boasts accelerated transaction velocities, near-zero gas fees, attractive reductions in trading fees, and diminished minimum trade requisites.

As an open-source bastion featuring nimble smart contract capabilities, dYdX stands as an oasis for crypto aficionados to lend, borrow, and trade their digital assets. While spot trading finds a place in its vast repertoire, dYdX predominantly shines in the realms of derivatives and margin trading.

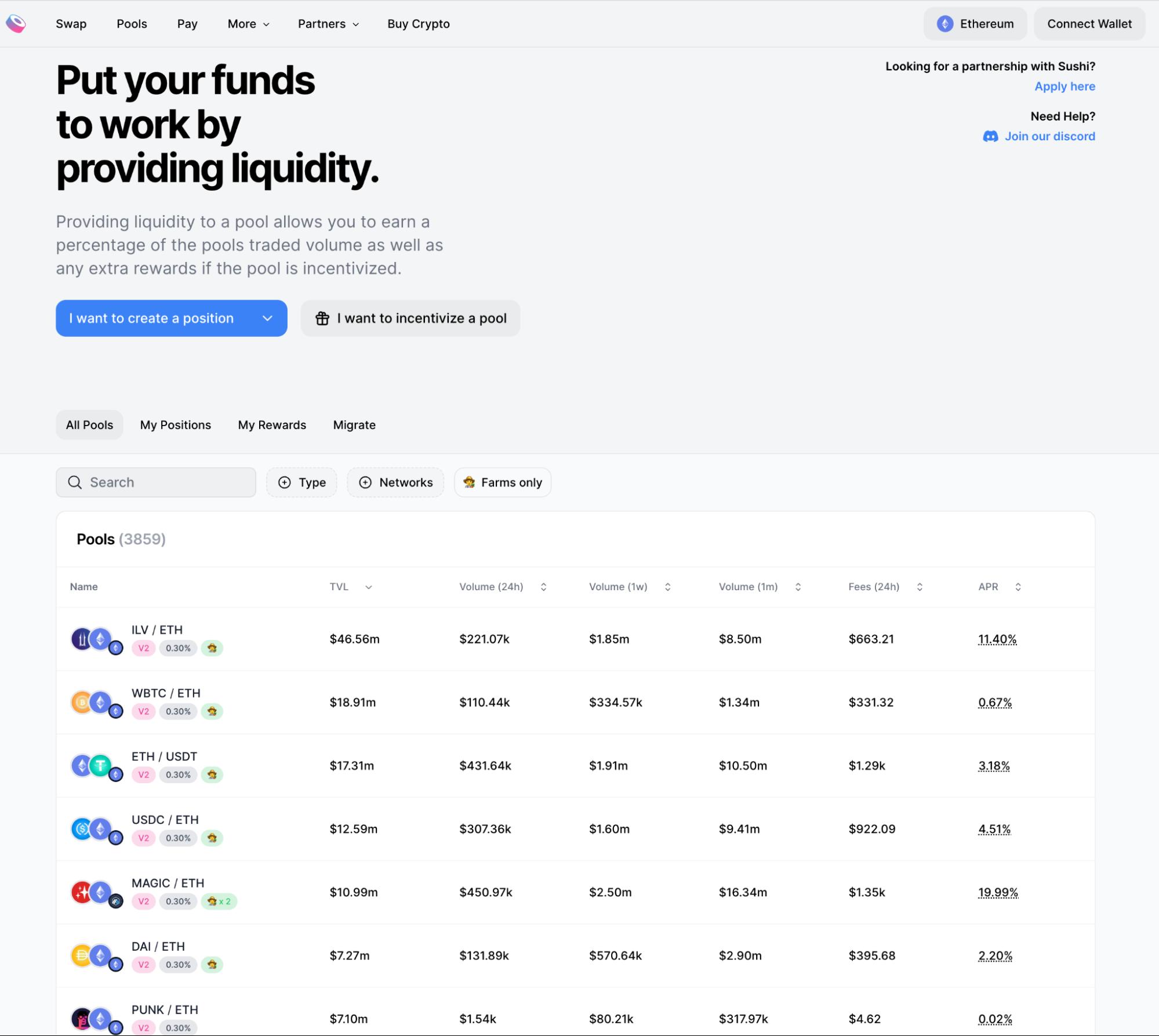

・SushiSwap (SUSHI):

Born as a fork of Uniswap, SushiSwap has since introduced a myriad of features, distinguishing itself in the DeFi space. SushiSwap stands as a pioneering automated market maker (AMM) in the decentralized finance arena. Rising rapidly in prominence since its inception in September 2020, SushiSwap emerged as an evolution of Uniswap, the groundbreaking AMM that fueled the DeFi revolution and sparked an explosive growth in DeFi token trading.

Designed with the intention to redefine the AMM landscape, SushiSwap introduced enhanced features absent in Uniswap, like amplified rewards for its community through its native SUSHI token. As an AMM, SushiSwap facilitates seamless liquidity provisioning between any cryptocurrency pair, catering primarily to the innovative DeFi traders and stakeholders eager to leverage the surge in project tokens and amplify liquidity.

One of the distinguishing facets of AMMs like SushiSwap is the elimination of traditional order books, effectively sidestepping challenges like liquidity constraints that beleaguer conventional decentralized exchanges. Not content with merely emulating its predecessor, SushiSwap ambitiously endeavors to elevate the user experience by magnifying their influence over the platform's trajectory and governance.

With a transaction fee structure that deducts a nominal 0.3% from trades within its liquidity pools, SushiSwap strategically utilizes its SUSHI token to distribute a share of these fees back to its users. Moreover, holding SUSHI isn't just about rewards – it empowers holders with pivotal governance rights, placing them at the heart of SushiSwap's evolution.

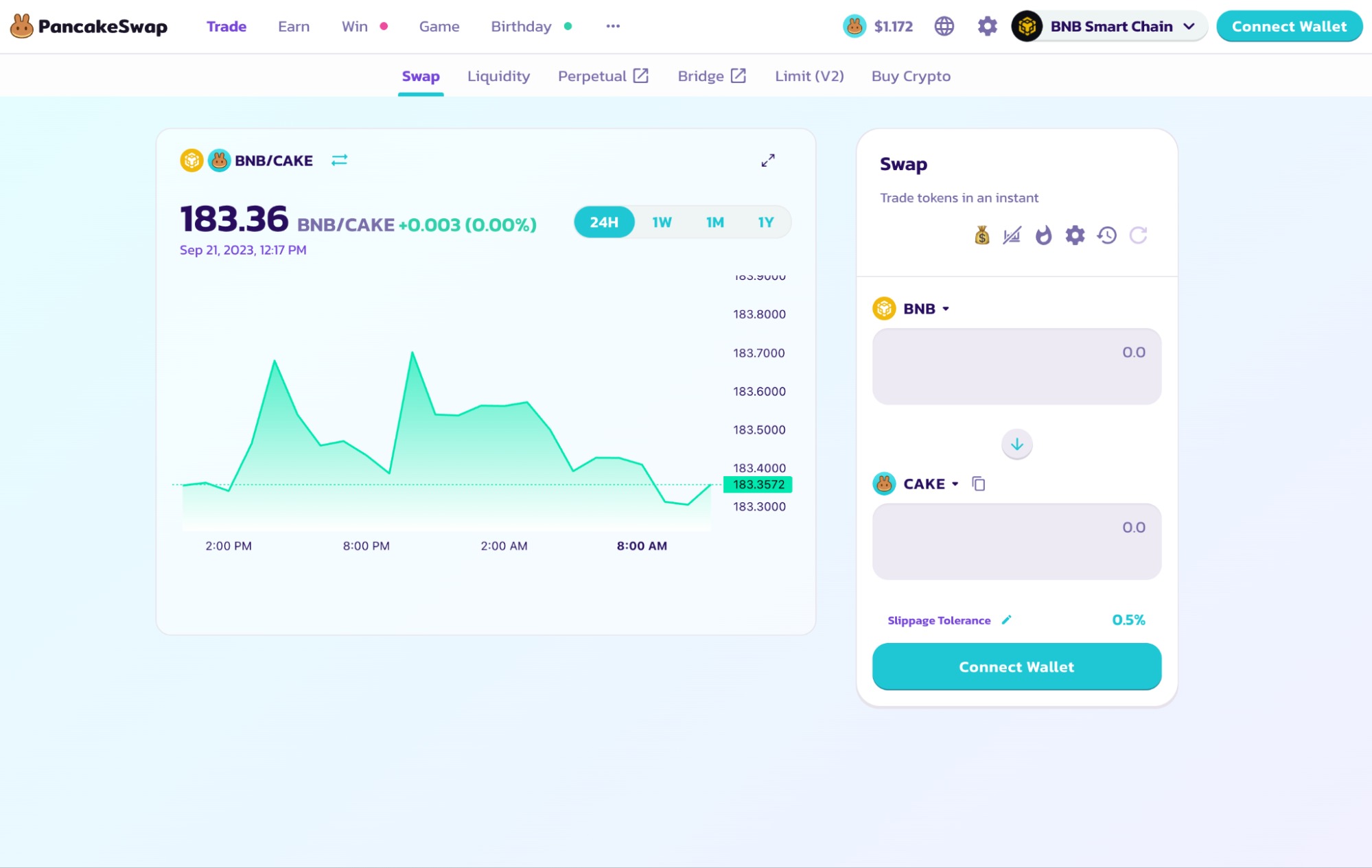

・PancakeSwap (CAKE):

PancakeSwap stands as a premier decentralized finance (DeFi) powerhouse, epitomizing the potential of automated market makers (AMM). This state-of-the-art platform, which came to life in September 2020, facilitates seamless token swaps on the Binance Smart Chain through its advanced BEP20 token exchange. Unlike traditional exchanges, PancakeSwap relies on liquidity pools that are continually fueled by contributors. In gratitude, these contributors are handed liquidity provider (LP) tokens, aptly dubbed FLIP. FLIP tokens not only enable holders to retrieve their pool contributions but also entitle them to a slice of the trading fees. And PancakeSwap doesn't stop there. It extends the opportunity for users to farm exclusive tokens like CAKE and SYRUP. By depositing LP tokens in the farm, users reap CAKE rewards.

In essence, PancakeSwap is a multifaceted platform where users can swap BEP20 tokens, inject liquidity and accrue fees, stake LP tokens for CAKE rewards, compound their CAKE holdings, and even stake CAKE to earn tokens from various other innovative projects. Dive deeper into our comprehensive exploration of PancakeSwap to grasp its full magnitude.

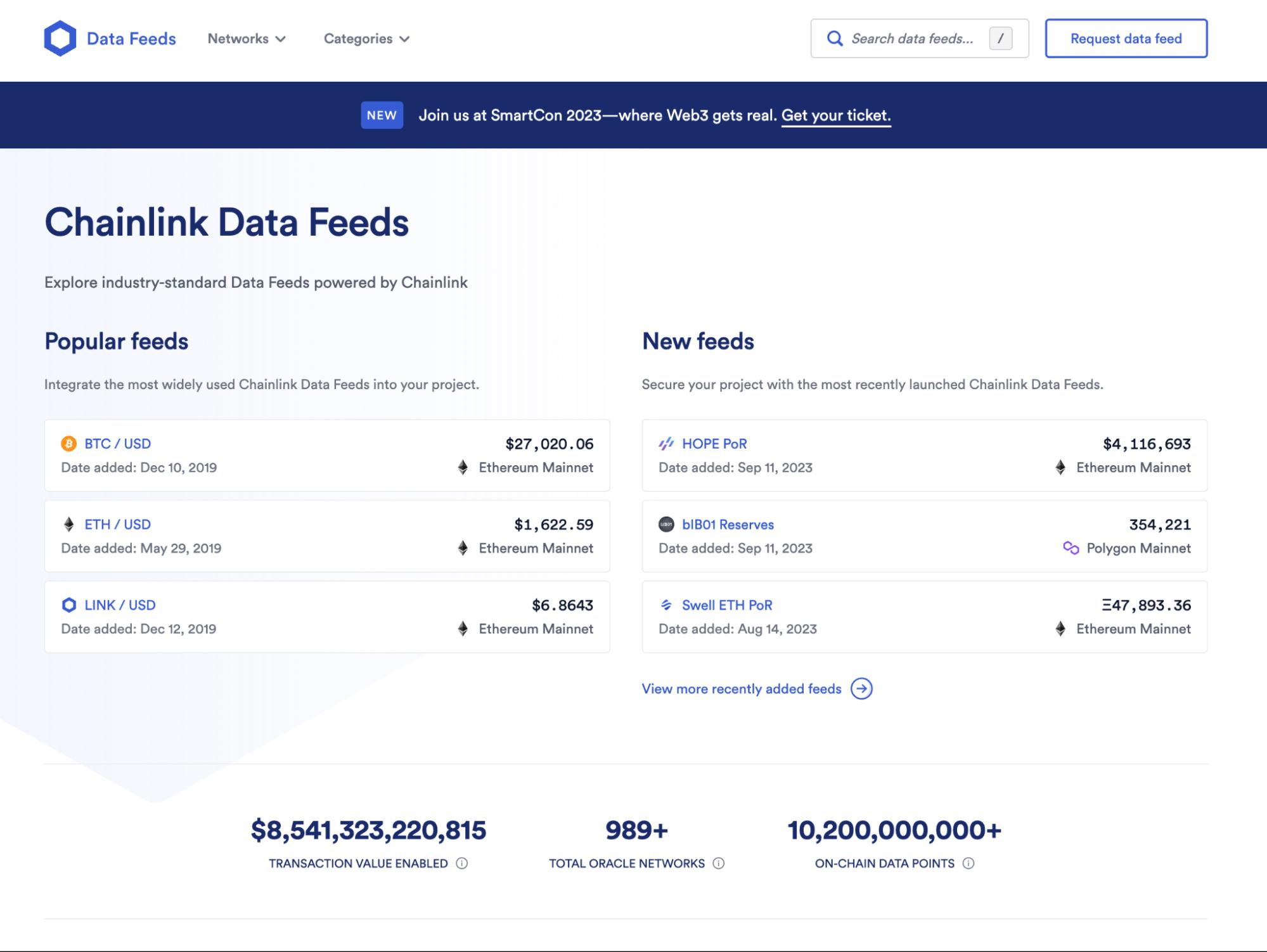

・Chainlink (LINK):

Chainlink stands as a paramount pillar in the DeFi ecosystem to bridge the chasm between blockchain smart contracts and real-world data. This ensures that decentralized applications benefit from secure, reliable, and timely data inputs. Its capacity to interface with a plethora of external data streams enhances its adaptability, making it indispensable for multifaceted DeFi use cases.

By harnessing Chainlink, DeFi projects unlock a treasure trove of real-time data, particularly pricing intel. This catalyzes the evolution of blockchain-based DeFi applications, enabling them to craft tokenized renditions of conventional financial instruments and pave the way for betting markets tethered to real-world events, which would remain elusive without live data streams.

Chainlink unfurls a sophisticated blueprint for developers, empowering them to craft and tailor their 'oracles'—the intricate network that orchestrates live data dissemination—to align with distinct needs. This fosters the amalgamation of specialized data streams and services. Within Chainlink's ecosystem, LINK tokens are the currency of choice, compensating oracle operators for their invaluable services. Moreover, LINK tokens are strategically deployed to motivate node operators, ensuring they consistently deliver precise and punctual data.

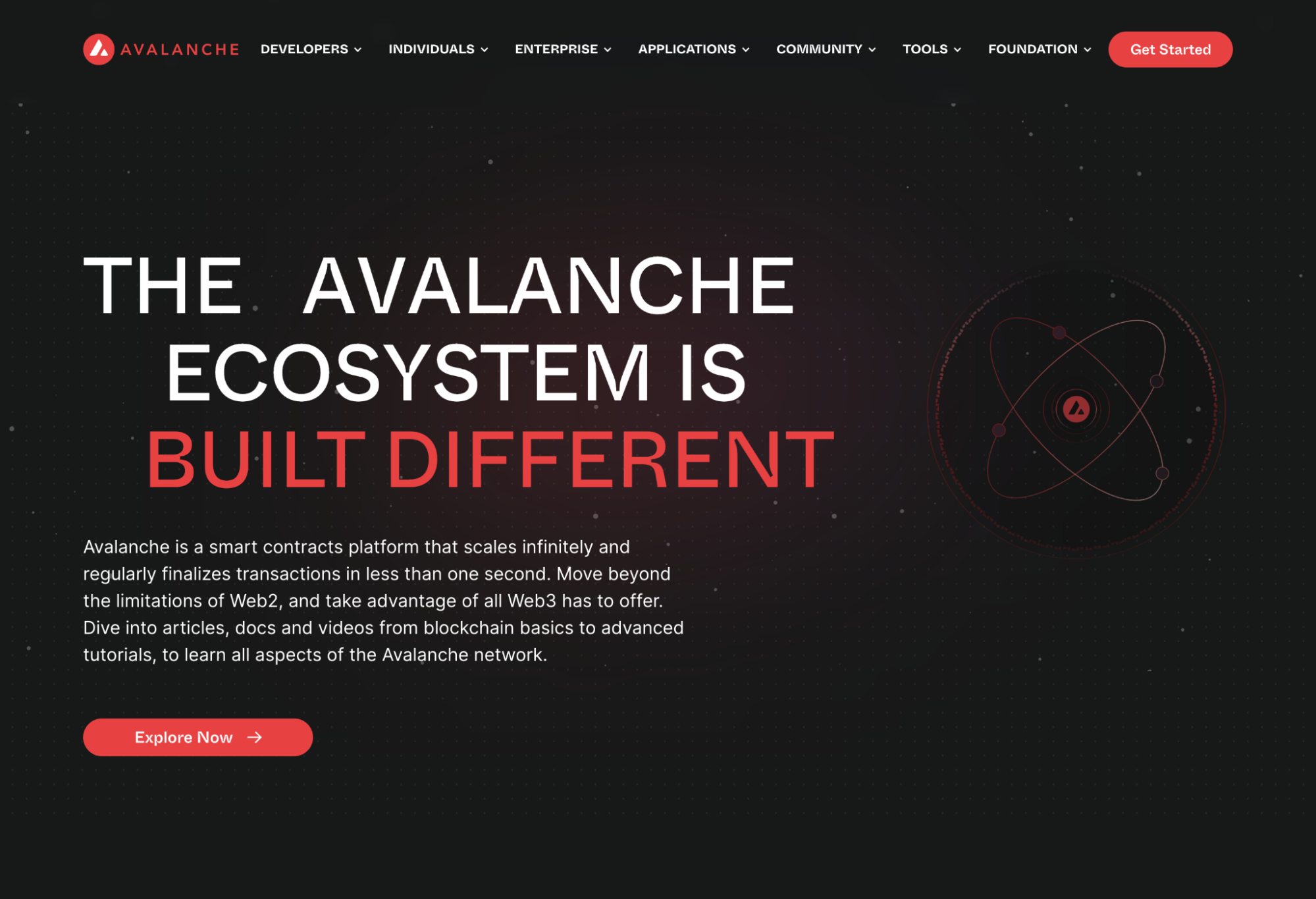

・Avalanche (AVAX):

Avalanche stands as a premier blockchain network and DeFi platform, meticulously crafted to furnish dApps, especially financial frameworks with unmatched scalability and efficiency. It surpasses many contemporaries with its unparalleled customizability and adaptability. Its support for advanced smart contracts empowers developers with an expansive palette of choices for app development. Furthermore, Avalanche's versatility is evident in its capacity to birth both private and public networks, each calibrated to desired degrees of decentralization, scalability, and security. Holding AVAX isn't merely an investment in a leading DeFi protocol; it's also the gateway to executing transactions, moving crypto assets, and innovating new apps.

Understanding the Potential of Top DeFi Projects

DeFi's meteoric rise isn't just about the tokens but the solutions these projects offer. By decentralizing financial services, DeFi platforms promise a world where financial systems are more inclusive, transparent, and resistant to censorship. However, to grasp their true potential, one must understand the underlying technologies and mechanics.

For instance, smart contracts enable these platforms to run without intermediaries, automating and ensuring the integrity of transactions. Liquidity pools revolutionize the way trading and loans work, removing the need for order books or banks. Decentralized governance models in DeFi platforms empower users, giving them a voice in protocol upgrades and changes. Furthermore, many of these projects introduce new financial products and mechanisms like flash loans or yield aggregators that weren't feasible in traditional finance. Their success lies in their ability to address inefficiencies in the current system, offering faster, cheaper, and more open alternatives.

Investing in DeFi is not just about betting on tokens; it's a belief in a decentralized future where financial power is redistributed, and traditional barriers are obliterated. As these projects continue to innovate and iterate, the potential for DeFi's impact on the global financial landscape becomes increasingly palpable.

Is Investing in Defi Projects a Good Strategy for 2024?

In recent years, the DeFi sector has captured the attention of both institutional Aussie investors and individual enthusiasts alike. As blockchain technology matures and traditional financial systems grapple with economic fluctuations, DeFi emerges as an innovative and potentially lucrative frontier in the world of investments. But with its rapid growth and considerable hype, one might wonder if 2024 is the right year to dip one's toes into the DeFi waters. Let's explore the intricacies of the current DeFi landscape and understand what the future may hold.

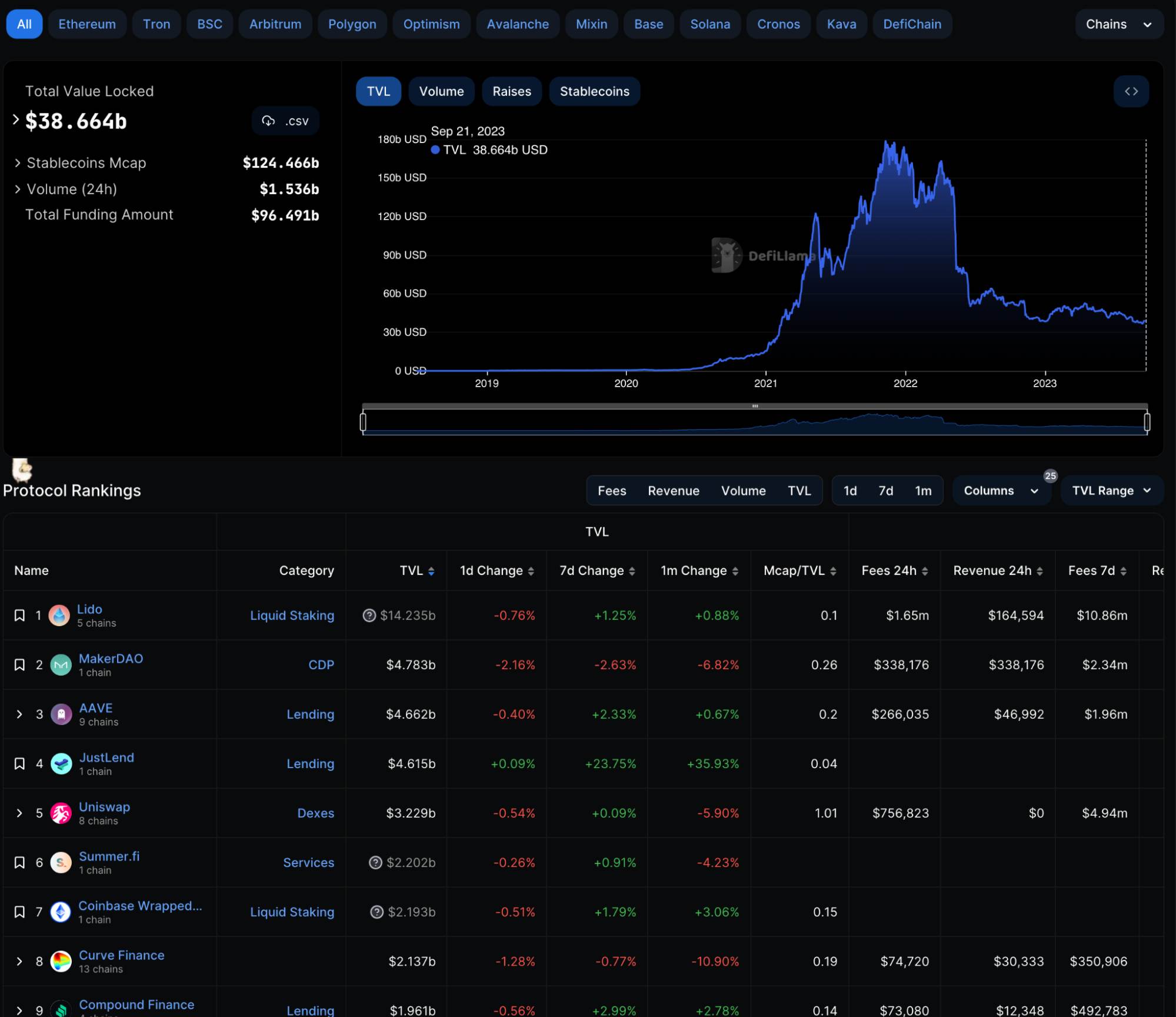

Predicting the Future of DeFi Projects With Current Market Trends

The trajectory of DeFi is underscored by its revolutionary promise to democratize financial systems and eliminate intermediaries. Current market trends reveal an upsurge in DeFi platforms and protocols, many of which are capitalizing on scalability solutions, cross-chain interoperability, and innovative lending-borrowing mechanisms. However, it's essential to approach these trends with a balanced perspective. While DeFi's total locked value (TVL) continues to rise, indicating increased adoption, there's also a notable surge in the number of rug pulls and project failures. It suggests that while the DeFi ecosystem is burgeoning, it's also fraught with risks that Australian investors should be cognizant of.

Total Value Locked, source: Defilama

Total Value Locked, source: Defilama

How to Choose the Best DeFi Crypto Projects

Choosing the right DeFi projects for investment requires meticulous research and a keen understanding of the underlying technology. Here are a few pointers to guide your decision:

・Project Fundamentals: Dive deep into the project's whitepaper. Understand its vision, mission, and how it plans to address existing market gaps.

・Team: A strong, transparent, and experienced team can often be a good indicator of a project's potential. Familiarize yourself with the project's founders and their track record in the crypto space.

・Community Engagement: A robust and engaged community can significantly contribute to a project's success. Gauge the community's sentiment by following discussions on platforms like Reddit, Twitter, and Telegram.

・Partnerships and Collaborations: Collaborations with established entities in the crypto world can be a testament to a project's credibility.

・Audits and Security: Ensure the project has undergone security audits by reputable firms. This will give you confidence in the platform's safety and resilience against potential vulnerabilities.

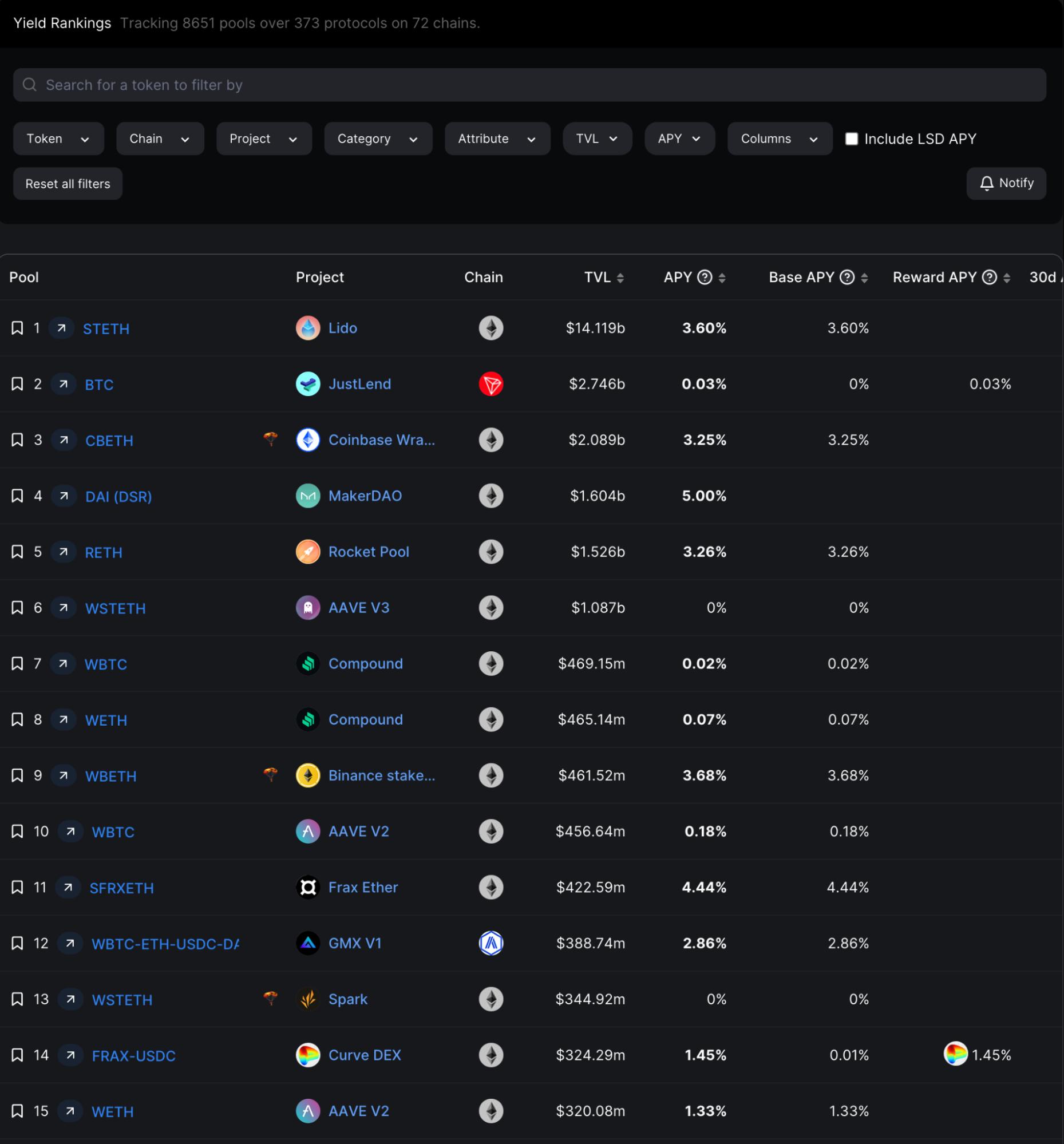

Investing in DeFi: Calculating Potential Return on Investments

Investing in DeFi is not just about selecting promising projects; it's also about understanding potential returns and how they compare to other available investment opportunities. When evaluating potential ROI:

・Analyze Historical Data: Although past performance isn't a guarantee of future results, analyzing how the project has performed historically can provide valuable insights.

Yield ranking in different pool, source: DefiLlama

Yield ranking in different pool, source: DefiLlama

・Consider the Risks: Like all investments, DeFi projects come with inherent risks. Always factor in the potential for loss and compare it with the projected returns.

・Understand the Tokenomics: Delve into the token's utility within the ecosystem. A token with solid utility is more likely to appreciate in value over time.

・Stay Updated: The world of DeFi is rapidly evolving. Keeping abreast of market news, project updates, and regulatory changes will allow you to adjust your investment strategy accordingly. While DeFi presents an exciting and potentially lucrative investment avenue, it's important to approach it with diligence, thorough research, and a clear understanding of both its potentials and pitfalls.

How to Buy DeFi Coins: A Step-By-Step Guide for Aussie Novice

With the surge in the prominence of DeFi platforms, there's a growing interest among Australian investors to capitalize on its potential. DeFi coins, often referred to as tokens, represent various projects in this ecosystem, and they have distinct features and utilities. As such, purchasing them can seem complex for newcomers. To mitigate any complications and ensure a smooth experience, this step-by-step guide elucidates the process of buying DeFi coins.

・Choosing a Wallet: For storing and managing DeFi coins, a digital wallet—preferably one that supports multiple DeFi tokens—is essential.Selecting an Exchange or DEX: Not all cryptocurrency exchanges support DeFi coins. Hence, one might consider using decentralized exchanges (DEXs) which predominantly list DeFi tokens.

・Registration & KYC: On centralized exchanges like FameEX, users typically need to register and sometimes complete a Know Your Customer (KYC) process.

Register on FameEX to get DeFi coins

Register on FameEX to get DeFi coins

・Depositing Funds: Before buying DeFi coins, deposit traditional currency or other cryptocurrencies into the chosen platform.

・Purchasing DeFi Coins: Navigate the exchange's interface to select, review, and confirm your DeFi coin purchase.

・Transferring to Wallet: For added security, transfer the purchased DeFi tokens from the exchange to your personal wallet.

・Monitoring & Management: Regularly monitor your investments, stay updated on DeFi trends, and employ sound risk management strategies.

By meticulously following these steps, even beginners can confidently navigate the world of DeFi coin investments. It's crucial to know how to effectively invest and interact with DeFi applications. The following provides an overview of various investment methods and protocols within the DeFi space.

・Staking Your Assets:

A prevalent method for obtaining passive returns is staking. Here, users deposit their tokens in a protocol for a predetermined duration to earn interest. There are two primary ways to stake: Utilizing Proof of Stake blockchains like Cardano or Solana. Or, leveraging third-party staking platforms like DeFi Swap, where you stake the platform's native coin for extended periods.

・Savings in DeFi:

Move beyond traditional savings and use your idle crypto tokens in DeFi savings accounts. Often, these can offer superior yields compared to regular bank deposits. For instance, Aqru, a leading crypto interest account provider, offers impressive rates without mandatory asset lock-ins.

・Yield Farming:

This method is akin to staking but involves lending your crypto to a decentralized application. As a liquidity provider, you facilitate seamless transactions in DeFi marketplaces. By investing assets in specific liquidity pools, you can earn transaction fee rewards.

・Stablecoin Investments:

Given the volatility in DeFi, stablecoins emerge as a secure alternative. Convert your DeFi tokens into trusted stablecoins like USD Coin or DAI and explore DeFi savings opportunities.

・Integrating NFTs with DeFi:

By adding NFTs to your DeFi portfolios, such as those offered by Lucky Block, you maintain control and can potentially witness significant returns as NFT popularity soars.

Conclusion

In 2024, DeFi coins have undeniably captured the attention of investors and financial enthusiasts around the world. Having witnessed unprecedented growth in recent years, they've presented an innovative, decentralized alternative to traditional finance systems. While the potential rewards are high, the volatile nature of the crypto market makes them susceptible to rapid and significant fluctuations. Their decentralized nature also brings both advantages in terms of democratized finance and challenges related to regulatory uncertainties. Hence, while DeFi coins offer a promising and revolutionary investment opportunity, they are not without their risks. Potential investors in Australia should conduct thorough due diligence, consider their own risk tolerance, and perhaps consult with financial advisors before diving into the DeFi market.

FAQ About Crypto DeFi Investment

Q: What Are the Potential Benefits of Investing in DeFi Coin?

A: DeFi coins offer high returns, passive income opportunities, and a chance to be part of the future of finance.

Q: What Are the Risks Associated With Investing in DeFi Coin?

A: Risks include market volatility, security vulnerabilities, liquidity issues, and regulatory changes.

Q: What Factors Should I Consider Before Investing in DeFi Coin?

A: Always consider market trends, the project's potential, its team, community support, and its contribution to the broader DeFi ecosystem.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.