Is Staking Crypto Safe? Unraveling the Risks and Rewards: A Guide for Aussie Beginner

2023-10-16 13:51:05

In the ever-evolving realm of cryptocurrencies, staking has emerged as a hot topic, enticing enthusiasts with the promise of steady returns. But with every potential reward comes risk, leaving many to ponder: is staking crypto truly safe? This guide aims to pull back the curtain on the world of crypto staking, breaking down its complexities and revealing the intricacies that every newbie should be aware of before diving in.

What Is Crypto Staking and How Does It Work?

As newcomers navigate the labyrinth of the cryptocurrency domain, certain terms and practices inevitably pique interest, with "staking" being one of the most frequently discussed. This concept serves as a foundational pillar for many modern blockchain networks. Before diving deep into the multifaceted world of staking, let's first unravel its basic premise and the mechanics that drive it.

Understanding the Concept of Staking in the Cryptocurrency World

At its core, staking involves holding and locking up a certain amount of cryptocurrency in a wallet to support a blockchain network's operations, including verifying transactions and adding new blocks to the chain. That is, crypto staking refers to the practice of participating in the validation of transactions on a blockchain network by holding and "staking" a cryptocurrency in a digital wallet. In simpler terms, it's like putting your money in a savings account, but instead of interest, you earn rewards in the form of additional cryptocurrency. Think of it as a digital, decentralized version of a traditional bank deposit. Instead of earning interest from the bank, participants, or "stakers," are rewarded with additional cryptocurrency. The allure of staking lies in its potential for passive income—hold onto your digital assets, contribute to network security, and in return, earn more of that asset.

How Does Staking Contribute to the Decentralization of Blockchain Networks?

- Decentralization is a cornerstone of blockchain technology, ensuring no single entity has control, thus enhancing security and trustworthiness. Staking plays a pivotal role in this. In proof-of-stake (PoS) and its variations, the more one stakes, the higher the chance of being chosen to validate a new block of transactions. This process eliminates the need for energy-intensive mining, as seen in proof-of-work systems like Bitcoin. By incentivizing users to hold and stake their tokens, the network becomes more dispersed, reducing the risk of centralized control or attacks.

Exploring the Different Cryptocurrencies Available for Staking

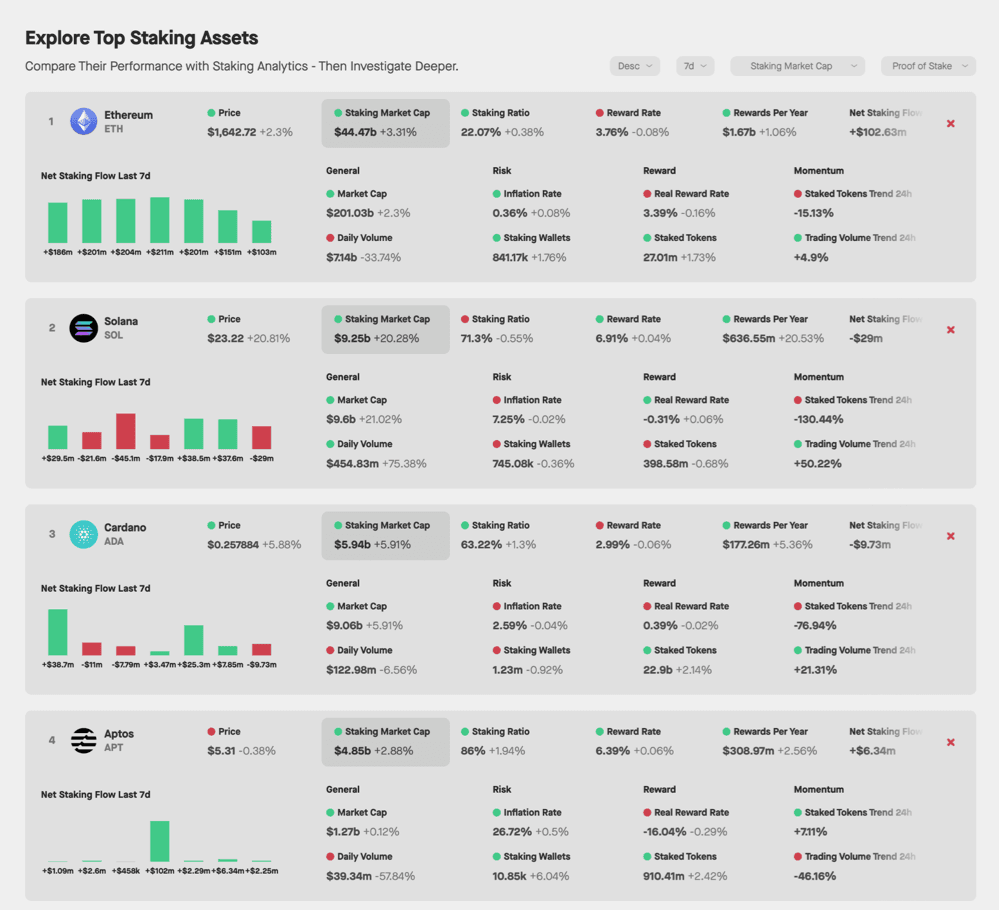

- The world of crypto staking is vast, with a myriad of coins offering diverse opportunities. Some of the most popular staking cryptocurrencies include:

- ・Ethereum 2.0: Transitioning from proof-of-work to proof-of-stake, Ethereum aims to make staking a significant part of its infrastructure.

- ・Cardano (ADA): Built on a PoS platform from the ground up, ADA is one of the pioneers in the staking realm.

- ・Polkadot (DOT): Offering "nominated proof-of-stake," DOT allows users to nominate others to validate on their behalf.

- ・Tezos (XTZ): With a self-amending PoS protocol, Tezos has a unique approach where stakers, or “bakers,” can propose protocol changes.

- ・Solana (SOL): Known for its high throughput and scalability, Solana's PoS mechanism plays a key role in maintaining the network's efficiency and security.

- ・Aptos (APT): While newer to the scene, Aptos is steadily gaining attention for its staking possibilities and potential returns.

- It's crucial to remember that each cryptocurrency has its own staking model, rewards, and associated risks. As the crypto world continues to innovate, more coins will undoubtedly join the staking bandwagon, providing even more options for enthusiasts.

Explore the staking assets, source: Staking Reward

What Are the Benefits of Staking Crypto?

Staking stands out as a powerful mechanism that allows users to harness the capabilities of their digital assets beyond mere buying and selling. By staking their cryptocurrencies, individuals can partake in the intricate operations of a blockchain, help maintain its security, and in return, receive rewards that can amplify their holdings. But what precisely are the upsides to staking, and why has it garnered so much attention from experienced investors and newbies alike? Let's dive deeper into the multifaceted benefits of staking.

Earning Passive Income Through Staking

One of the most enticing aspects of staking crypto is the opportunity to earn passive income. Unlike traditional investments where one might need to actively manage or trade assets to realize gains, staking allows holders to lock up a certain amount of their cryptocurrency in a wallet to support the operations of a network. In return, they receive rewards, often in the form of additional tokens. Over time, this can lead to a significant accumulation of assets, allowing stakeholders to reap the benefits without active involvement, much like earning interest on a savings account.

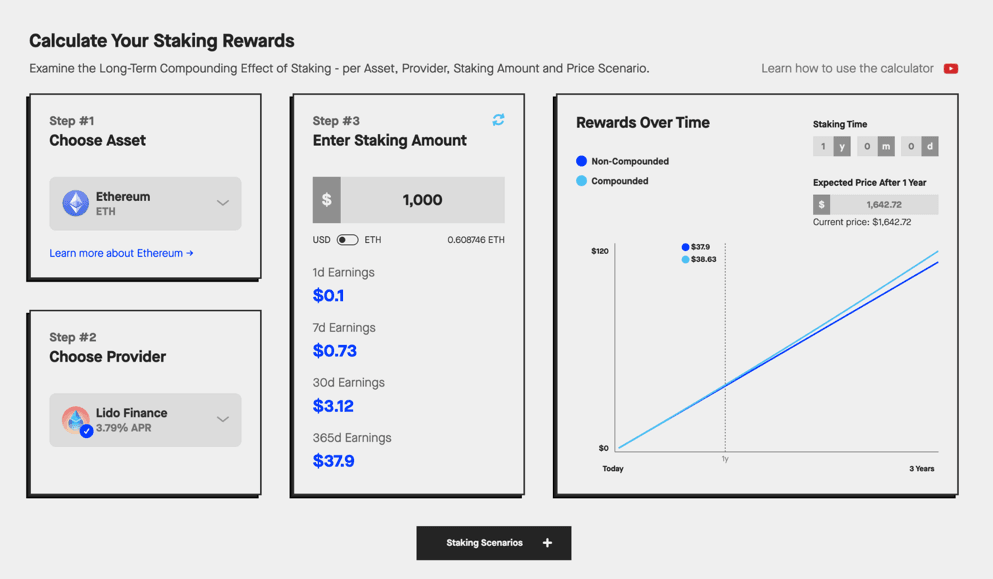

Exploring the Potential Returns of Staking

When considering staking as an investment strategy, potential returns are inevitably a focal point. While the exact return rates can vary based on the cryptocurrency being staked, the network's staking requirements, and market conditions, many staking platforms offer lucrative annual percentage yields (APYs). Some networks provide returns as high as double-digit percentages, making staking an attractive proposition for those looking for ways to maximize their crypto holdings. It's essential, however, to conduct thorough research and understand the associated risks, as high returns can sometimes come with increased volatility or network instability.

Participating in Network Governance

Beyond the financial incentives, staking often comes with another perk to join the future direction of the network. Many Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS) networks grant stakers voting rights. This means that by staking tokens, individuals can influence decisions related to network upgrades, protocol changes, and other pivotal developments. In essence, stakers don't just passively earn rewards; they actively participate in shaping the ecosystem's trajectory, ensuring its growth and evolution align with their interests and vision for the future.

How to Start Crypto Staking Safely?

The world of cryptocurrency is rapidly evolving, with staking emerging as a popular method for users to earn passive income on their holdings. As appealing as this sounds, diving into crypto staking without adequate knowledge can expose one to avoidable risks. Ensuring the safety of your assets is important, especially in a domain renowned for its volatility and complex nature. Before you begin your crypto staking journey, it's crucial to have a firm understanding of the process and the measures you can take to stake securely.

Choosing Reputable Platforms and Wallets

One of the first decisions any potential staker needs to make is selecting a platform or wallet for staking. Not all platforms are created equal, and unfortunately, the crypto world isn't devoid of scams or unreliable services. It's imperative to opt for platforms and wallets that have a proven track record, positive user reviews, and robust security measures. Companies like Coinbase, Binance, FameEX, and Bybit are among the industry leaders, often recommended for their credibility and security features. Always look for platforms that employ cold storage, multi-signature wallets, and two-factor authentication (2FA) to safeguard your assets.

Importance of Due Diligence and Research

While it might be tempting to follow the crowd, especially when certain staking opportunities are generating significant buzz, always conduct your due diligence. Delve deep into the project's whitepaper to understand its value proposition, the team behind it, and its roadmap. Forums, online communities, and community platforms such as Reddit or X (Twitter) can offer invaluable insights from seasoned crypto enthusiasts. However, it's crucial to filter out noise and misinformation. Always cross-reference any piece of information from multiple trustworthy sources before making a decision.

Best Practices for Secure Staking

Staking stands out as a potentially lucrative venture to offer users the prospect of earning while holding onto their assets. However, with the ever-increasing complexity of the crypto ecosystem and the myriad of threats lurking in its shadows, security can never be overstated. Ensuring that your investments are not only profitable but also safe from external threats is of paramount importance. Whether you're a seasoned crypto enthusiast or a newcomer eager to dive into staking, it's imperative to arm yourself with knowledge and best practices. To fortify your staking endeavors and protect your hard-earned assets, it's essential to adhere to these best practices for optimal security.

・Stay Updated: Always keep your staking software and wallets up to date. Developers routinely release updates to fix vulnerabilities and enhance security features.

・Never reuse passwords, and consider using a password manager to keep track of them.

・Offline Storage: Consider keeping the majority of your holdings in cold storage or hardware wallets, only transferring what you intend to stake to online platforms.

・Enable 2FA: This provides an additional layer of security, making it more challenging for unauthorized users to access your assets.

・Beware of Phishing: Always double-check URLs before entering sensitive information. Be cautious of unsolicited communications or too-good-to-be-true offers.

・By maintaining vigilance, staying informed, and selecting trustworthy platforms and tools, you can navigate the world of crypto staking safely, optimizing returns while minimizing risks.

As you delve deeper, scrutinize the rewards, focusing on the APY, staking duration, and any related lock-up periods or penalties. Remember, an informed investor is a successful investor, so lean towards platforms that offer high-quality educational resources on crypto.

An active community not only enhances knowledge sharing but also fosters mutual support, so opt for platforms that are backed by an engaged and helpful user base. Look out for additional features that streamline your staking experience, whether it's a user-friendly mobile app, wallet integration, or avenues to partake in digital asset governance. Effective customer service can be a game-changer, ensuring swift resolutions to any potential issues. In today's world where regulations are ever-evolving, it's crucial to align with platforms that operate in full regulatory compliance. Lastly, a seamless user interface and experience can significantly enhance your staking journey, making processes straightforward and efficient.

Before committing to any platform, invest time in in-depth research, read authentic user reviews, and compare offerings. This ensures that your final choice aligns with your personal goals, risk tolerance, and preferences, setting you up for secure and rewarding staking. You can also calculate your staking rewards to assess the long-term compounding effect of your investment.

Source: Staking Reward

What Are the Risks Associated With Staking Crypto?

Staking cryptocurrency, often touted as an avenue to earn passive income by holding and supporting a particular crypto network, is becoming increasingly popular. However, as with all investment opportunities, it comes with its set of risks. Just as mining had its challenges in the early days of crypto, staking, too, isn't without potential pitfalls. By understanding these risks, investors can make informed decisions, ensuring that they're not just jumping on a bandwagon but are making choices grounded in knowledge and awareness.

Understanding the Market Risks Involved in Staking

Market risk is an inherent danger in the volatile landscape of cryptocurrencies. Drastic price shifts are the norm rather than the exception. The cryptocurrency sphere is renowned for its dramatic price swings, often attributed to its relative infancy and the continuous interplay with evolving regulatory landscapes. Actions or announcements from major financial regulators can create palpable tremors in crypto valuations.

A case in point is the downturn in the crypto market that followed China's proposal to ban cryptocurrency. China suspended mining operations and banned crypto in June 2021. Around the same time, the Federal Reserve's decision to potentially raise interest rates by March 2022 added to the market's bearish sentiment. These regulatory nuances, combined with the market's cyclical nature, saw a slump after many tokens peaked in November 2021, ushering in a bear market into the subsequent year continuing till 2023. Despite the allure of staking rewards, they can easily be negated if the coin's price nosedives. To add to the risk, staking often demands that a specific amount of cryptocurrency be committed or "locked in" for a designated duration. During this lock-up period, if the market takes a downturn, investors are left in a lurch, unable to cash out. This can result in significant financial setbacks if the coin doesn't regain its value by the time the staking duration concludes.

Staking crypto might promise an attractive 30% APY, but this can be deceptive. Imagine the grim scenario where your staked token's value plummets by 60% within a year; the projected earnings would be wiped out. This underscores the importance of market risk as a primary consideration for potential crypto stakers. Choosing the right asset for staking, thus, becomes paramount.

The highly volatile nature of crypto markets means that the value of staked coins can fluctuate dramatically. While staking offers rewards, these rewards can be offset by a potential decline in the coin's price. Moreover, staking typically involves locking up a certain amount of crypto for a fixed period. If the market drops during this time, an investor might be unable to liquidate their holdings, potentially leading to substantial losses if the value doesn’t recover by the time their staking period ends.

What Are the Liquidity Risks When Staking Crypto?

Liquidity risks stem from the inability to quickly convert staked crypto assets into cash or other liquid assets without incurring significant losses. Staking usually requires tokens to be locked up for a certain duration. During this period, these tokens cannot be sold, potentially causing missed opportunities or financial strain if the investor needs immediate liquidity. Additionally, some staking platforms might impose longer unbonding periods, making it even more challenging to access your funds in a timely manner.

Evaluating the Security of Staking Platforms

The security of a staking platform is paramount. Poorly secured platforms can become targets for hackers, leading to significant losses for stakeholders. Investors must scrutinize the platform's security protocols, history of breaches, and measures taken to safeguard funds. This includes understanding the use of cold and hot wallets, the platform's underlying infrastructure, and its response mechanisms in case of an attack. A platform that fails to prioritize security can jeopardize both the staked assets and the rewards accrued.

The Potential Impact of a Network Failure

A network failure, such as a bug in the blockchain code or a 51% attack, can severely disrupt staking operations. In such cases, transactions may halt, and the blockchain might even fork, leading to potential losses for stakeholders. Such incidents can erode trust in the network and result in a sharp decline in the staked cryptocurrency's value. Stakeholders should be aware of the project's technical fundamentals, governance structure, and measures in place to handle such adversities.

Third-Party Risks in Staking

Entrusting tokens to a third party, such as a staking pool or staking service provider, can introduce another layer of risk. While these platforms can offer convenience and potentially higher rewards, they also require stakeholders to relinquish some control over their assets. If the third party mismanages the funds, engages in malicious activities, or becomes insolvent, stakeholders might face significant losses.

Is Staking Crypto a Safe Way to Earn Passive Income?

In the dynamic realm of cryptocurrencies, staking has emerged as a potential avenue for earning passive income. At its core, staking involves holding a certain amount of a particular cryptocurrency in a wallet to support the operations of its underlying network. Just as real estate can provide rental income or stocks can yield dividends, staking offers crypto enthusiasts an opportunity to earn a return on their holdings. However, like any investment, staking isn't without its risks. To gauge its viability as a safe income source, one needs to consider several factors, from the inherent risks and rewards to the intricacies of validators and the prudence of diversification.

Evaluating the Risks Versus Rewards of Staking

Staking, while lucrative, is not a guaranteed profit venture. The returns are influenced by factors like network demand, total stakers, and changes in protocol rules. On the reward side, consistent staking can result in compound interest effects, whereby the earned crypto can be restaked for potentially greater returns. On the risk side, there's the possibility of value depreciation in the staked cryptocurrency, or even potential loss if a network is compromised.

Assessing the Security Measures in Place for Staking

Before diving into staking, it's vital to understand the security measures a platform offers. Staked funds need to be protected from potential threats like hacks or unauthorized withdrawals. Utilizing wallets with robust security features, two-factor authentication, and hardware wallet integrations can be instrumental. It's also essential to be wary of staking pools or platforms that lack transparency or have unclear operating histories. Due diligence is key.

Understanding the Role of Validators in Staking

Validators play a pivotal role in the staking process. Essentially, they are responsible for creating new blocks in a proof-of-stake (PoS) blockchain. By staking, users are effectively voting for trustworthy validators. In return, validators receive rewards, a portion of which is shared with their backers – the stakers. However, if a validator behaves maliciously or fails in their duties, some or all of the staked funds could be at risk. Hence, understanding and selecting reputable validators is crucial.

The Importance of Diversification in Staking

As with traditional investments, diversification in staking can help mitigate risks. Rather than staking all funds in one cryptocurrency or on one platform, distributing stakes across various networks can offer a buffer against potential losses. It also offers the advantage of tapping into multiple streams of passive income. Stakers should remain informed about emerging platforms, the stability of existing ones, and adjust their strategy accordingly to maximize gains while minimizing potential vulnerabilities.

Conclusion

Staking cryptocurrency presents an intriguing avenue for individuals seeking to earn passive income while contributing to the decentralization of blockchain networks. As we've delved into its workings, it becomes clear that, like any investment, staking comes with its own set of risks and rewards. On one hand, staking offers the potential for steady returns and a chance to participate in network governance. On the other, it poses market, liquidity, and security risks, among others. For those looking to venture into staking, thorough research, choosing reputable platforms, and practicing diversification are paramount. In essence, while staking crypto can be a lucrative endeavor, it is vital to approach it with caution, knowledge, and due diligence to navigate its complexities safely.

FAQ About Staking Crypto Safety

Q: Can You Lose Your Staked Crypto?

A: Yes, there are risks involved in staking cryptocurrency. Depending on the staking mechanism and platform, your staked crypto can be at risk due to slashing (a penalty mechanism for validators that act maliciously or negligently), smart contract vulnerabilities, or platform insolvency. Always research the staking platform, understand the potential risks, and never stake more than you can afford to lose.

Q: What Is DeFi Staking?

A: DeFi staking refers to the process of locking up a cryptocurrency in a decentralized finance (DeFi) protocol to earn rewards or interest. It is a way to participate in the consensus and security of a blockchain or to earn yields on platforms that offer lending, borrowing, and other financial services in a decentralized manner. DeFi staking can be more lucrative than traditional staking, but it often comes with higher risks due to smart contract vulnerabilities and the experimental nature of some DeFi projects.

Q: Can I Stake Ethereum?

A: Yes, Ethereum has introduced staking with its Ethereum 2.0 upgrade. Instead of relying solely on proof-of-work (the mechanism behind Ethereum mining), Ethereum 2.0 uses a proof-of-stake system, where users can lock up (or "stake") their Ether (ETH) to become validators. Validators are then rewarded for proposing and attesting to the correct blocks on the network. Before staking Ethereum, ensure you are familiar with the staking requirements, potential rewards, and associated risks.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.