Decipher the Risks of Cryptocurrency Investing: A Guide for New Aussie Investors

2024-11-07 13:33:50Cryptocurrency has emerged as the vanguard of financial innovation, promising transformative shifts in the way we transact, save, and invest. As thousands flock to platforms boasting the next Bitcoin or Ethereum, the allure of high returns is often juxtaposed with the perilous terrain of volatility and unpredictability. This guide seeks to illuminate the shadowed corners of this burgeoning realm, offering Australian beginners a comprehensive understanding of the potential pitfalls and rewards of diving into the crypto ocean. Before you stake your hard-earned money, equip yourself with the knowledge to navigate this intricate landscape with prudence and foresight.

The Basics of Cryptocurrency Investment

In the ever-evolving landscape of finance, cryptocurrency stands as one of the most intriguing developments of the 21st century. Once the preserve of tech enthusiasts and financial daredevils, digital currencies have paved their way into mainstream investment portfolios. However, like all investment avenues, cryptocurrency presents its unique set of challenges and rewards. Here we are going to delve deep into the fundamentals of cryptocurrency investment, equipping you with the knowledge needed to navigate this vibrant digital frontier.

What Is Cryptocurrency?

Cryptocurrency, at its core, is a form of digital or virtual currency that utilizes cryptography for security, making it resistant to counterfeiting. Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized platforms using blockchain technology – a distributed ledger that verifies and records all transactions across numerous computers. Bitcoin, the pioneer launched in 2009, remains the most recognized cryptocurrency, but since its inception, thousands of alternative coins (altcoins) like Ethereum and Litecoin have emerged, each with its distinct features and use cases.

How Do I Invest in Cryptocurrencies?

Investing in cryptocurrencies begins with choosing a digital wallet to store your assets securely. Wallets come in various forms, including hardware, software, and online platforms. Once set up, the next step is selecting a reputable cryptocurrency exchange where you can buy, sell, or trade digital currencies. While signing up, you'll usually need to provide personal details for KYC verification. However, at FameEX, you can trade without undergoing any KYC verification. After funding your account with credit/debit card or deposit USDT to your account, you can then purchase the cryptocurrency of your choice. Remember to conduct thorough research before making significant investment decisions.

What Are the Risks of Cryptocurrency Investment?

Cryptocurrency investments come with substantial risks. The volatile nature of crypto markets means prices can swing dramatically, leading to potentially significant losses or gains in short time frames. Beyond volatility, potential Aussie investors should be wary of regulatory changes as governments worldwide grapple with how best to govern these digital assets. There's also the risk of cyber theft from exchange hacks or losing access to your digital wallet if you forget the private keys or fall victim to phishing attempts. Lastly, as a relatively new asset class, cryptocurrencies might still face unknown risks that have not yet manifested.

What Are the Advantages and Disadvantages of Investing in Cryptocurrencies?

Investing in cryptocurrencies, like any financial venture, presents both opportunities and challenges. While the digital currency landscape offers the allure of new investment frontiers, it's essential to weigh the benefits against the potential pitfalls. Here's a breakdown in advantages and disadvantages:

1. Advantages:

- High Potential Returns: Historically, some investors in Australia have experienced substantial returns on their crypto investments.

- Liquidity: Cryptocurrencies can be easily traded 24/7, providing high liquidity and every moment trading.

- Diversification: Crypto assets can diversify an investment portfolio as they often don't move in tandem with traditional markets.

- Transparency and Security: The decentralized nature of blockchain technology offers a transparent and secure transaction environment.

2. Disadvantages:

- Price Volatility: The value of cryptocurrencies can be extremely unpredictable.

- Lack of Regulation: The crypto market is less regulated than traditional financial markets, leading to potential manipulations.

- Irreversibility of Transactions: Once executed, crypto transactions cannot be undone.

- Technical Complexity: The need to understand blockchain and how digital wallets operate might be daunting for many.

Can I Afford to Lose the Money I Invest in Cryptocurrencies?

This is a fundamental question every potential cryptocurrency investor in Australia should ponder. While the allure of high returns is tempting, the volatile nature of the crypto market means there's a real possibility of losing a significant portion or even the entirety of your investment. As with all investments, only commit funds you're willing and able to lose. It's prudent to consider your financial situation, objectives, and risk tolerance before diving into the world of cryptocurrency investment. If in doubt, seeking advice from a financial advisor or professional can provide valuable insights tailored to your individual circumstances. Or you can also follow FameEX novice guide for a better understanding before investing.

Cryptocurrency Volatility and Risk Factors

In the recent decade, cryptocurrencies have emerged as revolutionary financial instruments that promise a more decentralized monetary system. However, as they take the global stage, their volatility and associated risks are subjects of extensive scrutiny. From wild price fluctuations to the questions surrounding their backing, understanding the core challenges and risks tied to the cryptocurrency market is crucial for both experienced traders and new enthusiasts.

Why Is Cryptocurrency So Volatile?

Cryptocurrency's volatility can be attributed to several factors. Firstly, it's a relatively new market, and with novelty comes speculative trading, where Aussie investors buy and sell based on short-term expectations rather than fundamental value. Additionally, the lack of regulation, thin market liquidity, news-driven sentiment, and the technological evolutions within the crypto space can lead to rapid and significant price swings. The most notable news about market price volatility involves Dogecoin and Elon Musk. Whenever there is new information related to Elon about Dogecoin, it can drive the price either pump or dump. This can be closely linked to the sentiments of investors in Australia.

News from Decrypt about Elon Musk Tweets about DOGE. Image: Shutterstock

News from Decrypt about Elon Musk Tweets about DOGE. Image: Shutterstock

What Are the Risks Associated With Cryptocurrency in Australia?

The risks of cryptocurrency span beyond just price volatility. There's the risk of loss due to hacking, with many high-profile cryptocurrency exchanges having been compromised in the past. Another concern is regulatory risk, where governmental actions can heavily influence a cryptocurrency's use or value. Moreover, there's the potential for technological vulnerabilities in the protocols themselves, and the ever-present risk of market manipulation.

Are Cryptocurrencies Backed by a Government or Central Bank?

Most cryptocurrencies are not backed by a government or central bank. They are decentralized and operate independently of traditional financial systems. Unlike fiat currencies, which are backed and regulated by respective governmental bodies, cryptocurrencies rely on cryptographic techniques and a consensus mechanism for validation. Some governments are exploring the concept of central bank digital currencies (CBDCs), but these are distinct from popular cryptocurrencies like Bitcoin or Ethereum.

How Does Price Volatility Affect Cryptocurrency Investors in Australia?

Price volatility in the cryptocurrency market can be a double-edged sword for investors. On the one hand, rapid price increases can lead to significant gains in a short period. On the other, sudden downturns can result in substantial losses. This volatility necessitates a robust risk management strategy for those who choose to invest. Moreover, the emotional toll of such volatile markets can lead to impulsive decisions, further amplifying risks.

What Are the Risks of Trading Cryptocurrencies?

Trading cryptocurrencies comes with its own set of challenges. There's the potential for a complete loss of capital, especially if one engages in leveraged trading. The nascent and unregulated nature of many exchanges can expose traders to the risk of exchange insolvency or fraud. Furthermore, the lack of standardized pricing and the 24/7 trading cycle can lead to fatigue and poor decision-making. Lastly, the absence of investor protection in many jurisdictions means individuals often have limited recourse in cases of malpractice or fraud.

Protecting Your Cryptocurrency Investments

As with any valuable asset, protecting it becomes more important than ever. Ensuring the security of your cryptocurrency investments not only preserves your financial growth but also shields you from potential digital threats. Whether you're a new Aussie investor or a crypto enthusiast, understanding the facets of cryptocurrency security can spell the difference between growth and loss. In the sections below, we'll delve deep into the methods and strategies you can employ to bolster the defense of your cryptocurrency holdings.

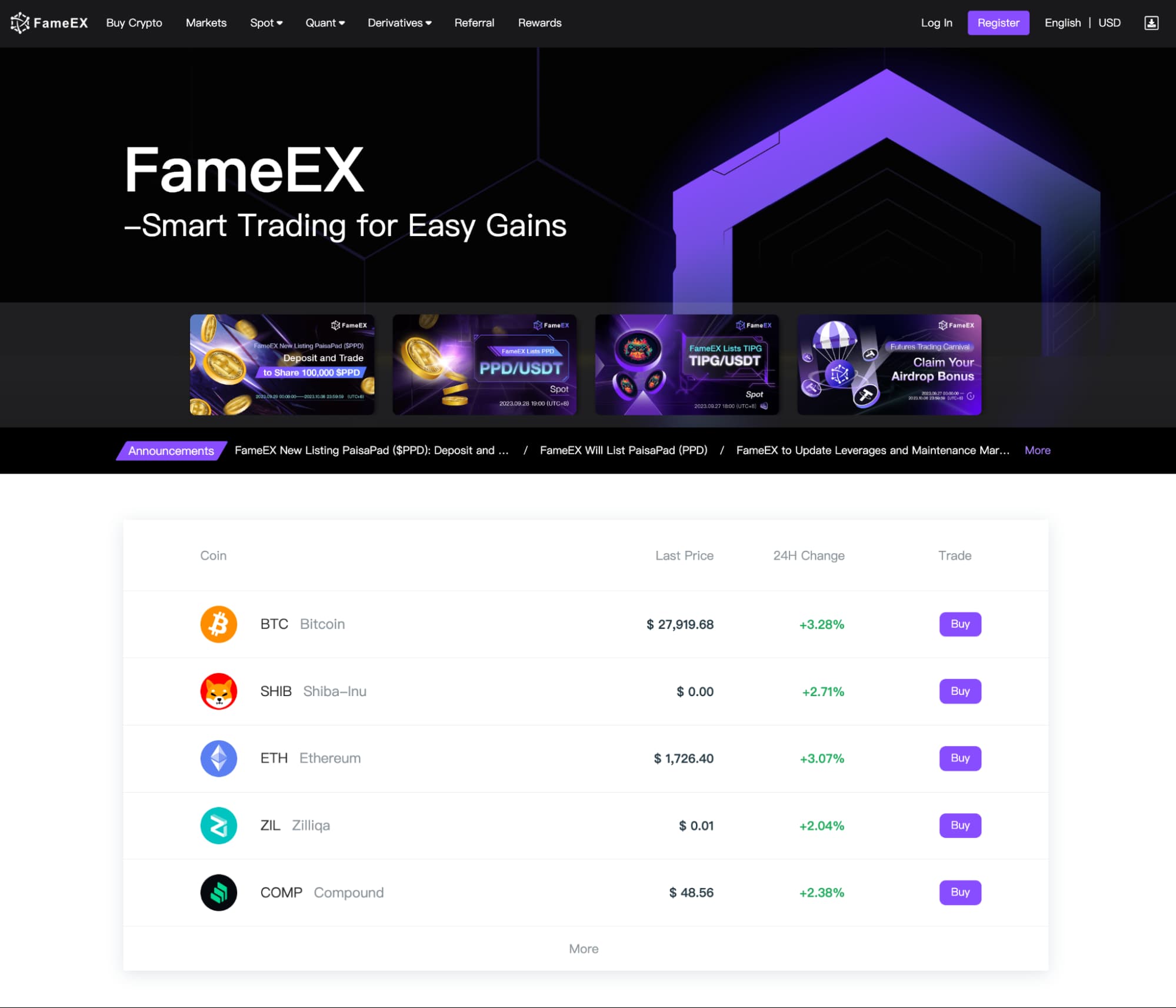

Choosing a Secure Australian Cryptocurrency Exchange

One of the first and most crucial steps in ensuring the safety of your cryptocurrency investments is selecting a reputable and secure exchange. Due diligence is essential. Look for exchanges with a history of reliability, robust security protocols, and positive user reviews. More security methods can be valuable to adopt. At FameEX, they offer eight different security setups for users to protect their assets. Two-factor authentication (2FA), cold storage facilities, and insurance against potential breaches are some of the features to prioritize. It's also advisable to diversify your investments across different exchanges from top-tier to emerging ones, reducing the risk associated with a single platform's potential downfall. An exchange like FameEX is a great choice for traders due to its distinctive global positioning as a frontier for derivatives trading, especially in the domain of digital assets. With cross-platform tools that streamline the trading experience, FameEX has ensured that users from around the world can seamlessly engage with digital asset derivatives. What sets FameEX apart is its unwavering commitment to providing a secure, efficient, and transparent trading environment. With core values that prioritize minimizing trading risks, advocating for fair competition, and embodying the ethos of 'Smart Trading for Easy Gains', FameEX proves to be a strategic choice for traders looking to diversify their portfolio and leverage top-notch trading services.

FameEX Crypto Exchange

Implementing Strong Security Measures

Beyond the confines of the exchange, your personal security habits can heavily influence the safety of your crypto assets. Implementing strong, unique passwords and changing them regularly is a fundamental step. Using hardware wallets or cold storage for substantial amounts of cryptocurrency can further safeguard your investments from online breaches. If you want to understand more about cold wallets and hot wallets, you can refer to our article here. Additionally, always ensure that your computer and mobile devices have up-to-date security software to ward off malware and other potential threats.

How Can I Protect My Investments From Scams and Fraudulent Schemes?

The allure of quick profits in the crypto world has given rise to numerous scams and fraudulent schemes. Protecting oneself from these threats requires constant vigilance and a discerning eye. Be skeptical of offers that sound too good to be true, especially those with unusually high APRs or guaranteed profits. Research each project before investing, and look for verifiable details, such as a competent team or roadmap, transparency or reserve of funds, and genuine user reviews in CoinMarketCap or CoinGecko. Additionally, be wary of unsolicited communications and avoid clicking on dubious links. Regularly engaging with the crypto community and following credible news sources can also keep you updated on any prevailing scams or risks. Remember, in the world of investments, knowledge truly is power.

Understanding the Regulatory Environment

In the dynamic world of financial technologies, the emergence of cryptocurrencies stands as a revolutionary milestone. As digital coins and tokens proliferate the financial landscape, understanding the regulatory environment becomes crucial. Regulators, governments, and financial institutions are constantly playing catch-up, formulating policies and frameworks to address the challenges and opportunities presented by these new assets. We will explore how the government regulates cryptocurrencies, the associated transaction risks, and the influence of crypto exchanges on the market.

How Does the Government Regulate Cryptocurrencies?

Governments worldwide approach cryptocurrency regulation with varying degrees of acceptance, skepticism, and stringency. Generally, regulatory frameworks aim to ensure investor protection, prevent money laundering and terror financing, and maintain the stability of the financial system. Some nations have embraced a friendly stance, providing clear guidelines and tax policies for cryptocurrency businesses and investors in Australia. In contrast, others have imposed outright bans or restrictions. Key regulatory measures often involve mandatory registration for crypto exchanges, Know Your Customer (KYC) procedures, and anti-money laundering (AML) protocols.

Contrary to traditional financial systems, the supply of cryptocurrency tokens isn't determined by any central authority or government. This decentralized nature means transactions can be conducted, authenticated, and recorded on the blockchain without any third-party interference. Notably, China has made significant moves to shut down exchanges within its boundaries and restrict cryptocurrency mining through land use regulations. However, these stringent measures haven't significantly affected cryptocurrency prices or the ongoing speculative boom.

What Are the Risks of Using Cryptocurrencies for Transactions?

Using cryptocurrencies for transactions comes with a unique set of risks. Firstly, the highly volatile nature of cryptocurrencies can lead to significant price fluctuations in a short span, potentially causing financial losses for users. Unlike traditional currencies, digital assets are not backed by any central authority which makes them susceptible to market sentiment and speculation. Moreover, the irreversible nature of cryptocurrency transactions means that once initiated, they cannot be undone. This leaves little room for error and no recourse in cases of fraudulent activities. Here we highlight several risks associated with using cryptocurrency:

.Wide Entrance, Narrow Exit: Cryptocurrencies are easy to get into, but selling or converting them to fiat can be more challenging, leading to potential financial crunches or local regulations.

.Intangible, Illiquid, Uninsured: Cryptocurrencies are often not easily convertible and may not have insurance protections like traditional assets.

.Mark To Market: The flight from cryptocurrencies to traditional assets can face issues like price pressure and illiquidity.

.Care, Custody, and Control: The security of digital assets remains a significant concern with numerous high-profile crypto thefts reported.

.Cyber Risks: Cryptocurrencies are vulnerable to a myriad of cyber threats. Cybersecurity threats, such as hacking and phishing, pose significant risks to users' digital wallets.

.Human Error & Forgetfulness: Mistakes such as forgetting passwords can lead to loss of cryptocurrency assets.

.Regulatory Risks: The lack of consistent regulatory, financial, and legal standards across the world poses risks. Regulatory uncertainties can lead to unexpected legal complications, especially in cross-border transactions.

It's crucial for potential investors in Australia and users to be aware of these risks and to conduct thorough research before diving into the world of cryptocurrencies trading.

How Do Crypto Exchanges Impact the Cryptocurrency Market?

Crypto exchanges play a pivotal role in shaping the cryptocurrency market. They act as the primary gateway for users to buy, sell, or trade digital assets. By determining the supply and demand dynamics, exchanges influence the price discovery mechanism of cryptocurrencies. Their security protocols, or the lack thereof, can impact market confidence; a breach or hack can send shockwaves throughout the ecosystem, causing abrupt market crashes. Also, the listing or delisting of a particular cryptocurrency can significantly affect its visibility, demand, and price. Regulatory decisions concerning exchanges, such as licensing requirements or bans, also have a direct bearing on market participation and liquidity. As central hubs in the decentralized world of cryptocurrencies, exchanges' operations and policies profoundly impact the market's stability and growth trajectory.

Evaluating and Mitigating Risks

Understanding risks is of paramount importance, especially in sectors such as cryptocurrency, where volatility and unpredictability are inherent, investors need a thorough grasp of the potential challenges. Knowing how to evaluate and mitigate these risks can make the difference between a fruitful investment and a costly misstep. This guide will delve deeper into the aspects of cryptocurrency risk evaluation, shedding light on factors to consider before investing, methods to assess the degree of associated risks, and the inherent dangers of venturing into new or lesser-known cryptocurrencies.

What Factors Should I Consider Before Investing in a Cryptocurrency?

Before jumping into the world of cryptocurrency, several factors can influence the potential success of your investment. Firstly, research the technology behind the coin or token, as a robust technological foundation can indicate longevity and security. Secondly, consider the team and their track record; experienced professionals with a history of successful ventures can be a positive sign. Thirdly, examine the coin's utility – does it solve a real-world problem or serve a significant function within its ecosystem? Lastly, always be cautious of 'too good to be true' promises or schemes that hint at guaranteed returns. However, the factors to consider are not limited to those mentioned above. We have highlighted more below for your consideration:

・Purpose of Investment: Before you invest, it's essential to understand your motivations. Are you looking for a quick profit, or do you believe in the technology's long-term potential? By pinpointing your primary reason, you can better tailor your investment strategy and manage expectations.

・Security of Assets: Cryptocurrencies are digital, and their security hinges on the safekeeping of private keys. These keys are your access to your funds. If lost or stolen, your investment could be gone forever. Ensuring you have secure storage solutions and practices is paramount.

・Industry Familiarity: The crypto world is vast and varied. While Bitcoin and Ether might be household names, there are thousands of other coins and tokens, each with its own purpose and potential. Diversifying your knowledge beyond just the popular options can give you a broader perspective and possibly unveil hidden gems.

・Storage Choices: Deciding where to store your cryptocurrency is a vital decision. Hot wallets, while convenient for transactions, are connected to the internet and are thus more vulnerable. Cold wallets, on the other hand, offer enhanced security at the expense of accessibility. Weighing the pros and cons of each will help you determine the best fit for your needs.

・Research Projects: Every cryptocurrency project should provide a white paper, a document detailing its purpose, technology, team, and roadmap. Delving into these can give you insights into the project's viability and long-term potential. A well-researched project can be a strong indicator of a sound investment.

・Transaction Safety: The decentralized nature of cryptocurrencies means transactions are irreversible. Before sending significant amounts, always perform test transactions to ensure the recipient's address is correct. This simple step can prevent costly mistakes.

・Market Volatility: Cryptocurrencies are infamous for their price volatility. Prices can skyrocket, but they can also plummet. Being mentally and financially prepared for these swings will ensure you don't make hasty decisions in the heat of the moment.

・Nature of Crypto: One of the defining features of cryptocurrencies is their decentralization. This means they're not governed by any central authority, like a government or bank. Recognizing and understanding the implications of this can help you navigate the crypto landscape more effectively.

・Risk Assessment: Every investment comes with risks, and cryptocurrencies are no exception. In fact, they can be even more speculative than traditional investments. It's crucial to assess how much risk you're willing to take and to only invest what you can afford to lose.

・Continuous Learning: The world of crypto is continuously evolving, with new projects, technologies, and trends emerging regularly. Staying updated and continuously educating yourself can help you make informed decisions and adapt your investment strategy as needed.

How Can I Assess the Degree of Risk Associated With Cryptocurrency?

Assessing the degree of risk in cryptocurrency investments requires a multi-faceted approach. Volatility index studies can provide insights into the currency's price fluctuations over a given period. Delving into the coin's White Paper will shed light on its intended purpose, technological backing, and long-term vision. It's also wise to monitor news sources for any regulatory or security-related updates concerning the cryptocurrency in question. Additionally, review the coin's historical performance, its current market cap, and its volume of trade. Engaging with online communities and forums can also provide first-hand experiences and feedback from other investors in Australia.

What Are the Risks of Investing in New or Lesser-Known Cryptocurrencies?

New or lesser-known cryptocurrencies, often referred to as "altcoins", come with their own set of challenges. Their nascent stage means they might lack a proven track record, making it harder to predict their future performance. Many new coins don't have an established user base, which could impact their acceptance and utility in the broader market. Furthermore, these cryptocurrencies could be more susceptible to market manipulation, especially if their trading volumes are low. There's also the danger of the coin being an outright scam, designed to defraud investors. Always exercise caution, conduct thorough research, and be prepared for the possibility of total loss when venturing into the world of new or lesser-known cryptocurrencies.

However, while navigating the uncertainties of new and lesser-known cryptocurrencies, it's essential to have a reliable and discerning platform to rely upon. This is where FameEX comes into play as a game-changer. Opting for FameEX exchange offers Aussie investors a distinct advantage, mainly due to their rigorous coin selection process. Unlike many other exchanges that might list coins without in-depth scrutiny, FameEX prides itself on listing only the top-notch coins from the global crypto market.

With its meticulous approach, FameEX has established a reputation for curating a collection of outstanding coins. What sets them apart is their dedication to conducting comprehensive assessments before listing any coin. This ensures that the coins available on their platform are not only of premium quality but also exhibit promising future prospects. The assessments delve deep into various facets of the coin, ranging from code audits to examining the coin's future development prospects.

By evaluating criteria such as technical innovation, brand operation, and the original intention behind the project, FameEX ensures that their users get the best of the lot. This can significantly reduce the risks associated with investing in altcoins, as the platform ensures that the coins have undergone a thorough vetting process. Thus, choosing FameEX as an exchange can provide Australian investors with an added layer of security and peace of mind in the volatile world of cryptocurrencies.

Conclusion

Embarking on the journey of cryptocurrency investment is both exhilarating and daunting. As with any investment, the allure of potential profits is tempered by inherent risks. This guide aimed to unravel the intricate web of cryptocurrency, from its basic concept to its unpredictable volatility, and from securing investments against potential threats to understanding the ever-evolving regulatory landscape. In the world of digital assets now, knowledge truly is power. Prospective Australian investors must weigh the potential rewards against the undeniable risks, always ensuring they are prepared for the possibility of loss. Remember, while the world of cryptocurrency is laden with promise, it's essential to approach it with both curiosity and caution. The best investment decisions are rooted in thorough research, understanding, and a clear evaluation of one's own financial tolerance for risk.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.