The Ultimate Guide to Crypto Futures Trading for Beginners

2023-06-20 08:22:15Introduction to Crypto Futures Trading

The world of cryptocurrencies is ever-expanding, and along with it, the types of financial instruments associated with it. Crypto futures trading is one such innovation that has garnered immense interest among investors. Whether you are a seasoned trader or a complete novice, this guide aims to provide a comprehensive understanding of crypto futures trading.

What Are Cryptocurrency Futures?

A crypto futures contract is a contractual arrangement facilitating the buying or selling of an asset at a predetermined future date, primarily utilized by market participants to safeguard against potential price fluctuations. This concept initially evolved from interactions between farmers and merchants; for instance, a farmer planning to harvest corn in September might set up a futures contract with a merchant in June, agreeing on a set price. The merchant then pays this price, while the farmer commits to delivering a specified amount of corn in September, thus reducing price-related risk for both parties.

Cryptocurrency futures, like bitcoin futures, are standardized contracts between two parties to buy or sell a specific amount of cryptocurrency at a predetermined price and date. These contracts are traded on futures exchanges and their prices are derived from the underlying cryptocurrency. Thus, futures trading allows investors to speculate on the future price of a cryptocurrency.

How Do Crypto Futures Trading Works?

In a typical crypto futures transaction, both buyer and seller agree to transact a specific amount of cryptocurrency at a set price on a future date. No cryptocurrency changes hands at the time of the agreement. On the contract's expiration date, the transaction is settled by exchanging the agreed-upon amount of cryptocurrency at the contract price, regardless of the current market price. The traders' profits or losses are determined by the difference between the contract price and the market price at the time of settlement.

Why Trade Crypto Futures?

One of the main reasons to trade crypto futures, particularly bitcoin futures, is that it allows investors to bet on the future price of cryptocurrencies without having to actually own or handle them. This is especially appealing for those who are skeptical about the security and regulatory challenges associated with holding cryptocurrencies.

The Growing Role of Crypto Futures Trading in the Market

Crypto futures trading is increasingly becoming a significant part of the overall cryptocurrency market. The high volatility of cryptocurrencies offers ample trading opportunities, and futures contracts offer a way to manage risk and potentially profit from price fluctuations.

Crypto Futures Trading Foundations

Cryptocurrency futures trading involves buying or selling cryptocurrency contracts that will settle at a future date. The contracts are standardized agreements that bind the buyer to purchase, and the seller to sell, a certain amount of cryptocurrency at a predetermined price and date in the future.

In essence, when you trade cryptocurrency futures, you're betting on the future price of a cryptocurrency. You can either take a "long" position, expecting the price to rise, or a "short" position, expecting it to fall. It's worth noting that, unlike spot trading where you actually hold the cryptocurrency, futures trading is typically conducted with leverage, meaning that you're trading with borrowed funds. The foundations of crypto futures trading include understanding these fundamental concepts:

Key Terms to Know

Before diving into crypto futures trading, it is crucial to familiarize yourself with a few key terms.

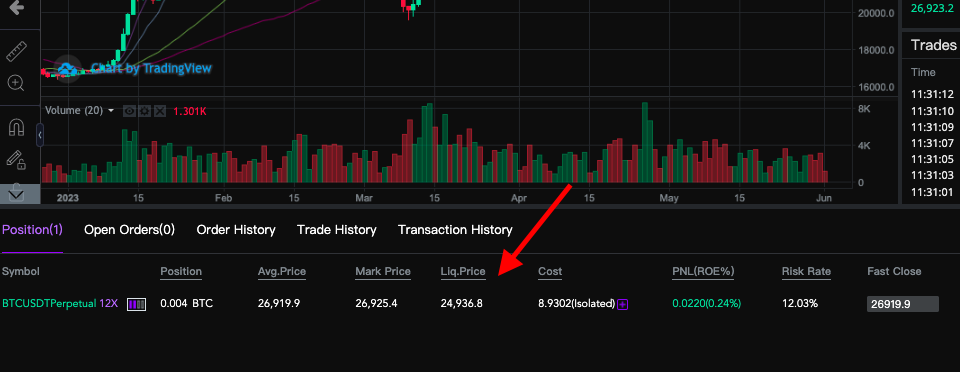

1. Long or Short Positions: A long position is when you bet that the price of a cryptocurrency will rise, while a short position is betting that the price will fall.

2. Margin Requirements: This is the minimum amount of funds required in your account to initiate a futures trade.

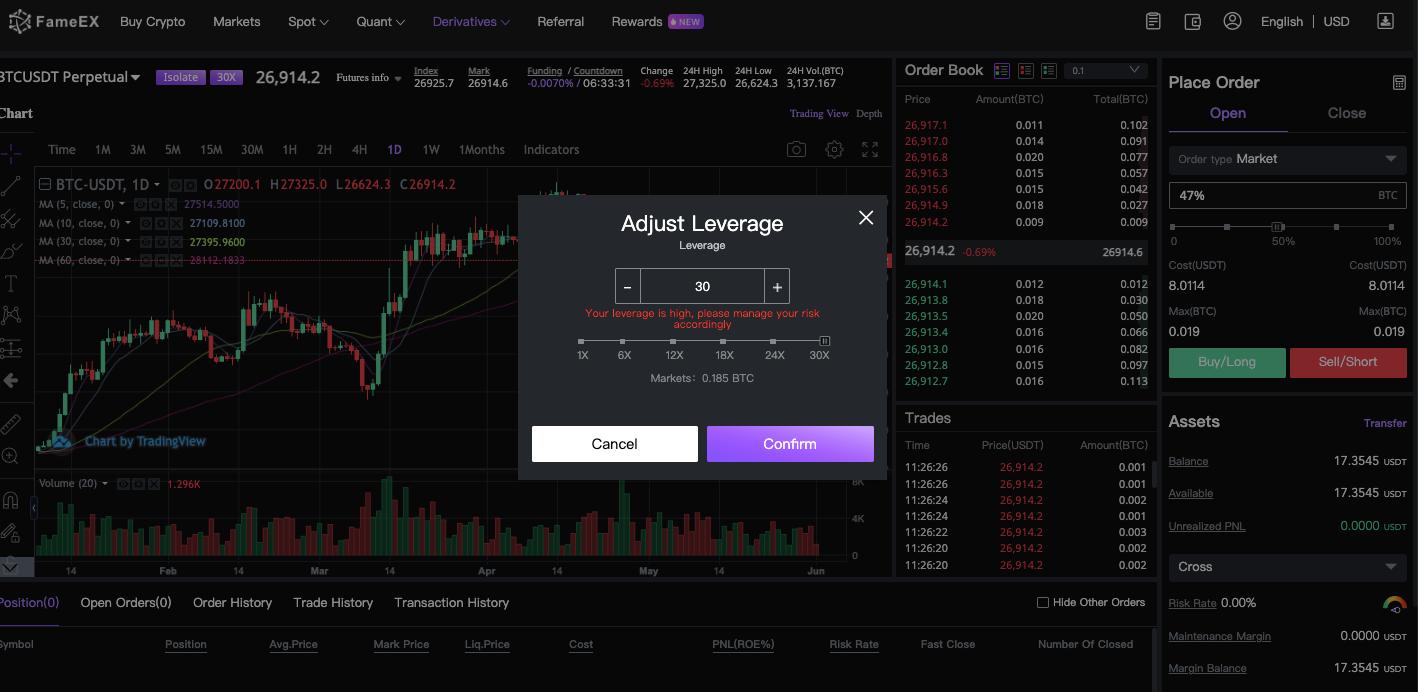

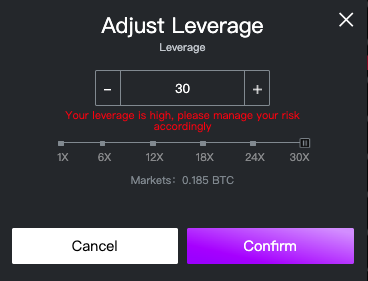

3. Leverage: This refers to the practice of using borrowed capital to increase the potential return of an investment. In futures trading, leverage allows you to enter into contracts that are worth more than the funds in your account.

4. Liquidation: This happens when the market moves against your position and your account balance is insufficient to maintain your position. When this happens, the futures exchange may close your positions and liquidate your account.

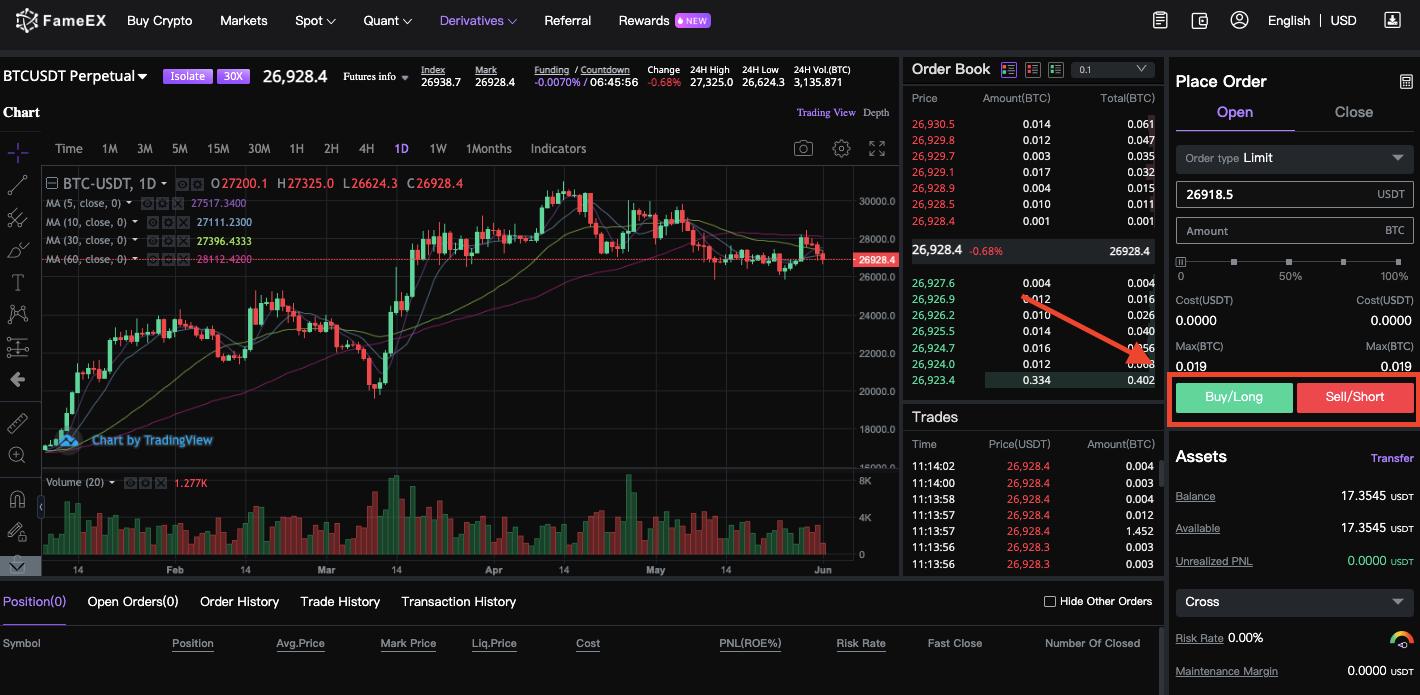

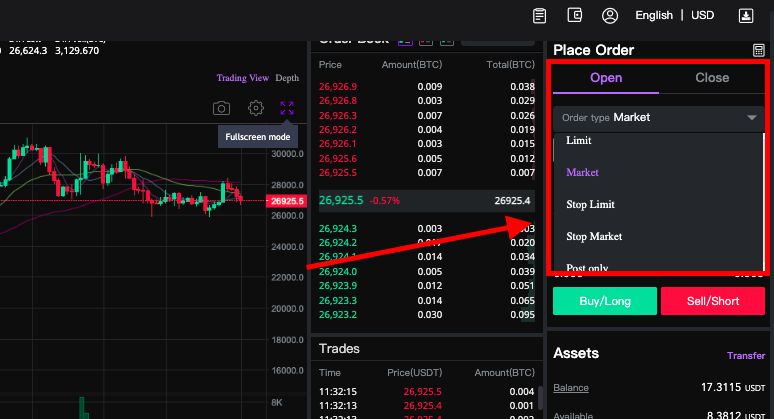

5. Order Types: These are instructions that traders give traders to buy or sell a futures contract. There are various types, including limit orders, market orders, stop orders, and more. At FameEX, we support Limit, Market, Stop-Limit, Stop-Market, and Post-Only orders. In the near future, we plan to introduce updates featuring TP/SP orders across different margin modes.

What’s the Difference Between Futures Contracts and Perpetual Swap Contracts?

Both are derivatives that allow you to bet on the future price of a cryptocurrency, but there are a few key differences.

1. Standardized Contracts: These are traditional futures contracts with a specific expiration date. At this date, the contract must be settled or rolled over into a new contract.

2. Perpetual Contracts: Unlike standardized contracts, perpetual swap contracts have no expiration date. They can be held indefinitely and are settled frequently, often every eight hours. These contracts are popular for their flexibility and are the dominant form of futures trading in the crypto market.

Specifications of a Crypto Futures Contract

Here are a few key features of a crypto futures contract that traders need to be aware of:

1. Contract Size and Value: Each futures contract has a fixed size that is specified by the futures exchange. The value of the contract is the contract size multiplied by the price of the underlying cryptocurrency.

2. Settlement and Expiration Dates: Traditional futures contracts have an expiration date at which the contract is settled. The settlement can be in cash or physical delivery of the underlying asset.

3. Tick Size and Price Increments: The tick size is the minimum price movement of a futures contract. This determines the smallest amount the price of the contract can change.

Margin Trading and the Use of Leverage

Margin trading is a method of trading assets using funds provided by a third party. It involves borrowing capital to make a trade, effectively multiplying potential profits or losses.

1. Initial and Maintenance Margins: The initial margin is the minimum amount you need to open a position, while the maintenance margin is the minimum account balance you must maintain to keep your positions open.

2. Leverage and Its Effects: Leverage can magnify your profits but can also amplify losses. It's important to use it carefully and understand the potential risks.

3. Potential Risks of Leveraged Trading: Leveraged trading can lead to substantial profits, but it can also result in significant losses, especially in volatile markets like crypto. It's not uncommon for traders to lose their entire investment.

Getting Started with Crypto Futures Trading

Every exchange has specific terms and conditions for trading futures contracts. Understanding these terms is critical to successful trading. These terms may include the contract size, the expiry date of the contract, and the leverage offered. Therefore, traders should carefully read and understand these terms and conditions before engaging in crypto futures trading. Here we prepare several steps for you to understand easily.

Choosing a Reputable Crypto Futures Exchange

Comprehending the significance of selecting the right exchange can alleviate your trading fears, uncertainty, and doubt (FUD), while also fostering trust. Here, we're offering various strategies to identify the crypto futures exchange that best suits your needs.

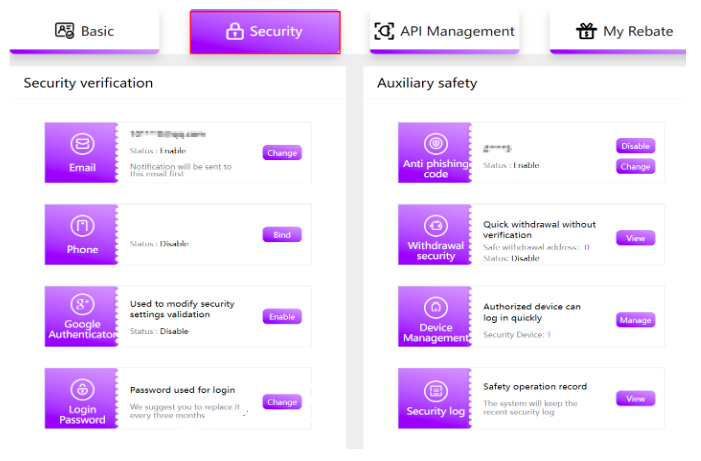

1. Security Features: Ensure the exchange uses robust security measures, like two-factor authentication (2FA), cold storage for customer funds, and encryption. At FameEX, we provide 8 distinct security methods, allowing users to effectively manage their account security. Users can easily review or modify their security settings directly within their accounts.

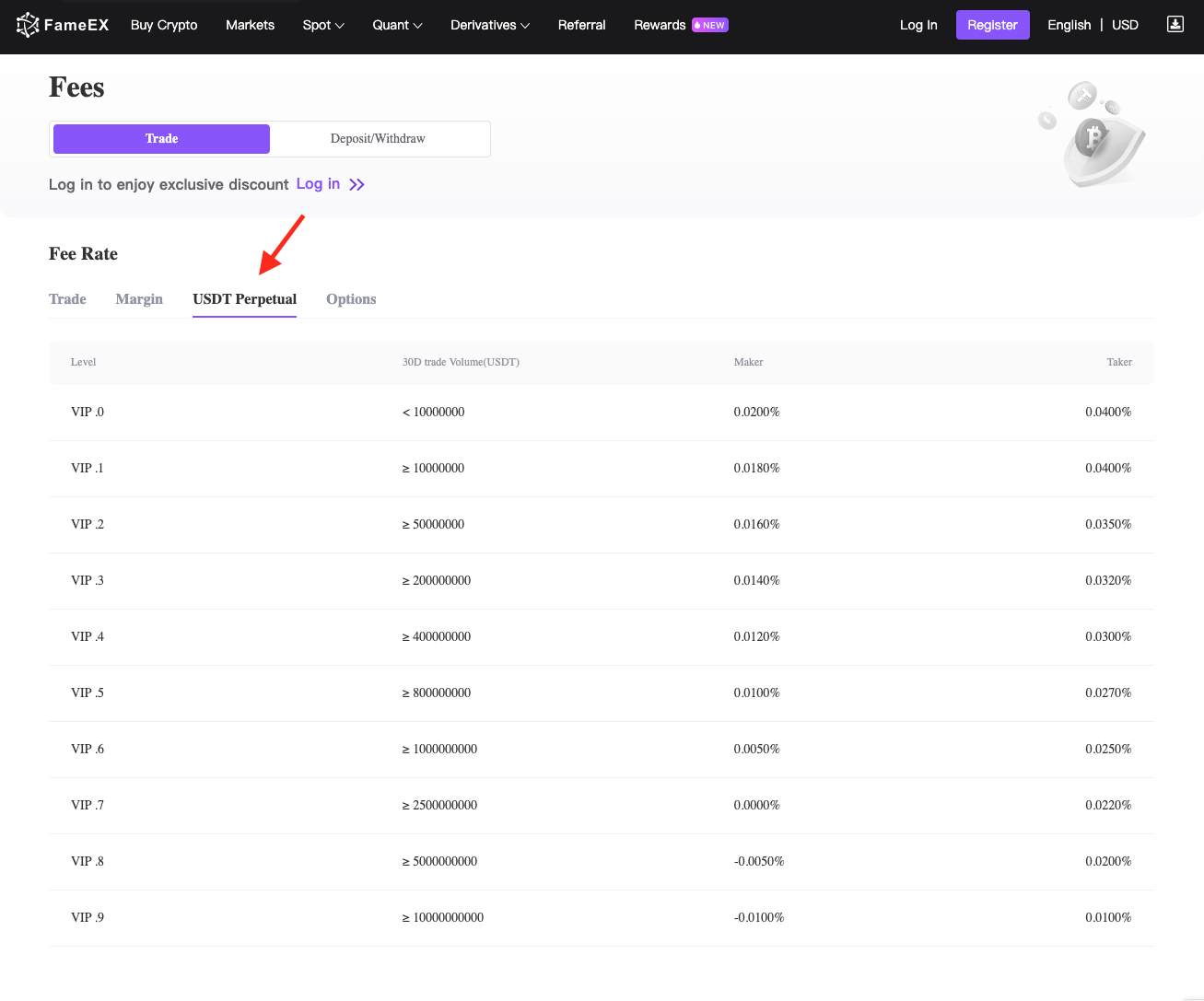

2. Fees and Trading Pairs: Examine the fee structure and the available trading pairs. A good exchange will have a transparent fee structure and a wide variety of cryptocurrencies to trade. FameEX exchange offers a competitively low funding rate. For spot trading, the fee rate ranges from -0.01% to 0.1%. When it comes to futures trading, the fee rate for Makers falls between -0.01% and 0.02%, while for Takers it lies between 0.01% and 0.04%. This rate structure is particularly favorable for users who trade frequently.

3. User Interface and Support: The platform should be user-friendly, especially for beginners. For a cryptocurrency exchange, the user interface should be easy to navigate, intuitive, and responsive. It should allow the user to easily make trades, view their portfolio, and access other features without any difficulty. For beginners, it's especially important that the platform is not overly complicated. It should guide users through the process of buying and selling cryptocurrency, from start to finish. Moreover, a clean and efficient layout, with clearly marked buttons and instructions, is crucial to prevent users from making mistakes. This also includes the availability of 'search' options to easily find specific cryptocurrencies, and 'filter' options to sort by specific criteria.

In terms of customer support, a reliable exchange should be capable of promptly and effectively addressing any issues or concerns that users might have. This might include technical issues, questions about transactions, or problems related to account access. High-quality customer service builds trust with users and provides them with the confidence that they can get the help they need when they need it.

As for FameEX Exchange, FameEX is known for its user-friendly interface that simplifies trading for both new and experienced users. The platform is designed to be easy to navigate, with a clear layout and intuitive controls. Users can easily find and understand all the necessary information required to carry out trades. For beginners, FameEX provides a gentle learning curve, enabling them to grasp the basics of crypto trading quickly. For advanced users, the platform also offers a range of tools and features that allow for sophisticated trading strategies and with 24/7 customer support online.

Where Can You Trade Cryptocurrency Futures?

You can trade cryptocurrency futures on numerous exchanges like Binance, BitMEX, Kraken and FameEX. These platforms offer various futures contracts, including bitcoin futures and other cryptocurrency futures.

Choosing the Right Trading Pair

The right trading pair depends on your knowledge, risk tolerance, and market expectations. Bitcoin futures are the most common, but you may also choose other pairs based on your analysis and preference.

Setting up a Trading Account

Setting up a trading account is relatively straightforward. You need to register with a crypto futures exchange, verify your identity (KYC process), deposit funds, and then you can start trading.

Essential Trading Strategies for Crypto Futures

Here we will dive deep into the dynamic world of cryptocurrency futures trading, providing readers with comprehensive strategies that cater to various investment objectives.

Hedging Your Portfolio

Futures contracts can be used to hedge your cryptocurrency portfolio against potential price drops. By taking a short position in a futures contract, you can offset potential losses in your portfolio with gains from the futures contract.

Speculation and Market Timing

Many traders use futures contracts for speculative purposes, hoping to profit from price swings in the cryptocurrency market. This is done without any intent to actually own or take delivery of the underlying asset. Instead, traders aim to buy low and sell high, or the other way around if they're shorting, based on their predictions of how the market will move. Market timing is a strategy where the trader attempts to beat the market by predicting its movements and buying and selling according to these predictions. The aim is to buy just before the market goes up and sell just before it goes down. This is considered a high-risk strategy, as accurately predicting market movements consistently is extremely challenging, even for professional traders.

Scalping and Day Trading

Scalping involves making numerous trades throughout the day to profit from small price changes. The goal is not to make a large profit on any single trade, but rather to make small, consistent gains that add up over time. Scalpers often use technical analysis and trading bots to aid them due to the speed and volume of trades. Day trading, on the other hand, involves opening and closing positions within a single trading day. It might only make a few trades per day, and they often use strategies like swing trading (capitalizing on price swings), trend following, or momentum trading. They also usually rely heavily on technical analysis to make trading decisions.

What Are The Risks of Futures Trading?

Despite the potential profits, futures trading involves risks. Market volatility can lead to substantial losses, especially when using leverage. Furthermore, the complexity of futures contracts may be challenging for beginner traders.

Tips for Success in Crypto Futures Trading

Getting on the path of crypto futures trading requires a calculated strategy, a deep understanding of the market, and a firm grasp of trading principles. It's a high-risk, high-reward game, where informed decisions can lead to substantial gains, and ill-informed ones to significant losses. While the dynamic nature of the crypto market offers immense opportunities, it's crucial to arm yourself with effective tips to navigate its choppy waters. Let's dive into some key tips for succeeding in the unpredictable yet rewarding world of crypto futures trading.

Staying Informed About Market Trends

Successful futures trading requires staying updated on market trends and news that could impact cryptocurrency prices.

Managing Emotions and Maintaining Discipline

Trading can be stressful, and it's easy to let emotions dictate your decisions. Successful traders maintain discipline, stick to their trading plans, and don't let emotions sway their decisions.

Continuously Learning and Improving

The crypto market is constantly evolving, and successful traders are those who continually learn and adapt to these changes.

Learn How to Interpret Technical Charts

Technical analysis is crucial in futures trading. Learn how to read and interpret charts to identify trading opportunities and make informed decisions.

Conclusion

Crypto futures trading can be a profitable venture when approached with knowledge and caution. Understanding the basics, staying informed about the market, and practicing disciplined trading can go a long way in your trading journey. Remember, while the potential for profit is high, so too are the risks. Trade wisely and responsibly.

FAQ About Crypto Futures Trading

Q: When Trading Crypto, When Should You Use Perpetual Futures Over Margin Trading?

You should use Perpetual Futures when you want to keep a position open indefinitely without worrying about expiration dates. Margin trading is better suited for short-term trades and requires a careful understanding of the potential risks and rewards.

Q: What’s Future Trading in Cryptocurrency?

Future trading in cryptocurrency involves buying or selling futures contracts. These are agreements to trade a specific amount of cryptocurrency at a set price on a future date, regardless of the current market price.

Q: What Is the Best Crypto Futures Exchange for Beginners?

Choosing the best exchange depends on various factors like security, user-friendliness, customer support, fees, and available trading pairs. Binance, Kraken, BitMEX and FameEX are a few reputed platforms to consider.

Q: How Much Money Do I Need to Start Trading Crypto Futures?

The amount needed depends on the margin requirements of the futures contract you want to trade. However, it's important to only trade with money you can afford to lose.

Q: What Is the Difference Between Futures Trading and Spot Trading?

Futures trading involves buying or selling futures contracts, which are agreements to trade a specific amount of an asset at a set price in the future. Spot trading involves buying or selling an asset for immediate delivery and payment.

This is not investment advice. Please conduct your own research when investing in any project.