FAMEEX Daily Highlights | ADA-backed algorithmic stablecoin ‘Djed’ launched on Cardano

2023-02-01 08:05:35Top Trending Crypto News Today

Ethereum Will Explore Stake Withdrawals on the Shanghai Testnethttps://www.fameex.com/en-AU/news/ethereum-will-explore-stake-withdrawals-on-the-shanghai-testnet

A public testnet of the software is scheduled to go live on Wednesday morning as Ethereum is ready to conduct a user-facing dress rehearsal of its much awaited Shanghai update.

ADA-backed algorithmic stablecoin ‘Djed’ launched on Cardano

The new algorithmic stablecoin, Djed (DJED), launched on the Cardano mainnet and is pegged to the United States dollar and backed by Cardano’s native cryptocurrency,ADA. It uses the Shen (SHEN) token as its reserve coin. According to the announcement, the new token recently completed a successful security audit and was under development for over a year. DJED is a product of Coti, a decentralized finance (DeFi) solutions developer on the Cardano blockchain, as a means for new DeFi and payment opportunities. (Source)

Daily Crypto Market Analysis - Growing and Forecast

In the last 24 hours, the long liquidations were 23.96M USDT and the short liquidations were 36.82M USDT, leaving 12.86M USDT worth of net short liquidations. Yesterday's total liquidation amount shrank sharply, and investors began to calm down.The Fear & Greed index dropped to 51, but the market sentiment remained stable, and was no longer pessimistic.

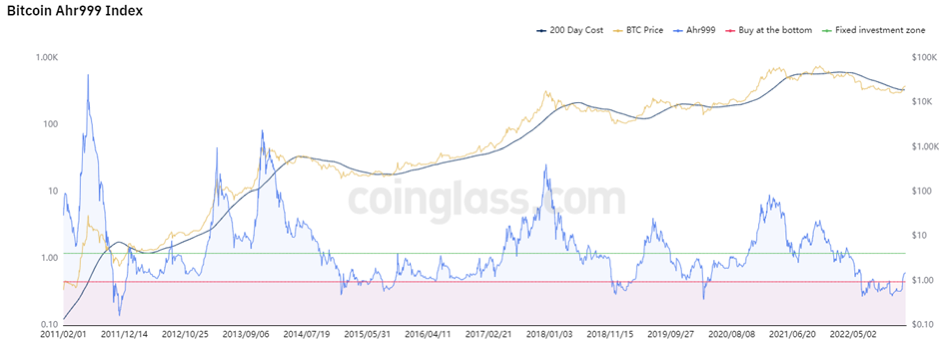

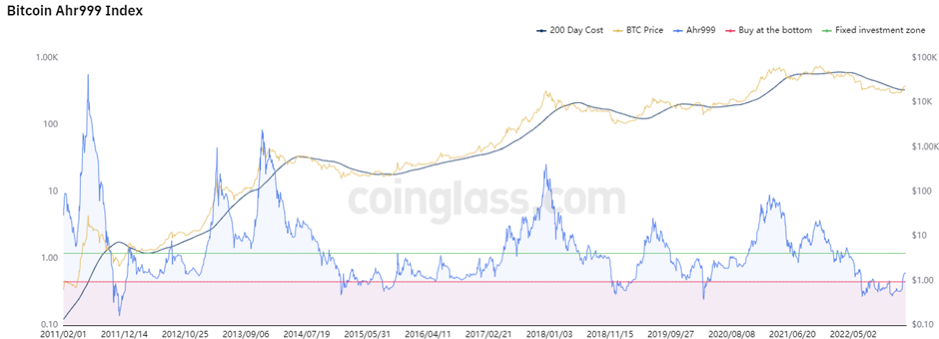

Bitcoin Ahr999 dropped slightly to 0.59, and is now above the bottom line (0.45) and below the DCA line (1.2). The numbers reflect that the current short-term trend is no longer so weak, but the long-term trend is still a bear market.

In the last trading day, all three major US stock indexes rose. The DJI rose 1.09%, the S&P 500 index rose 1.47%, and the Nasdaq index was the strongest, up 1.67%. The two major cryptocurrencies were both up yesterday, with BTC and ETH up 1.23% and 1.10% respectively.

In terms of monthly performance, the S&P rose by 6.2%, the best January performance since 2019, while the Nasdaq surged by nearly 10.7%, the biggest monthly gain since July last year. The DJI rose more than 2.8%, marking the third monthly gain in four months.

In terms of data, the U.S. Department of Labor announced on Tuesday that the Employment Cost Index (ECI), the broadest measure of labor costs, rose 1.0% last quarter, slightly below market expectations and the lowest in a year, highlighting a slowdown in inflation Signs that the Fed is slowing down rate hikes.

The U.S. consumer confidence index fell to 107.1 in January from 109 in December last year, below market expectations of 109, while consumers' 12-month inflation expectations rose to 6.8% from 6.6% last month.

In terms of politics and economy, it is widely expected that the Fed will raise interest rates by 25 basis points after its meeting on Wednesday. It is worth paying attention to Fed Chairman Paul's press conference to see if the cycle of rate hikes may be coming to an end and how long interest rates may remain high.

Most of the mainstream cryptocurrencies rose yesterday, ranging from -1.40% to 4.47%, SOL was the weakest, down -1.40%, continuing its weak performance yesterday. DOGE was the strongest, up 4.47%. The two major cryptocurrencies were also on the rise, with BTC and ETH up 1.23% and 1.10% respectively.

Looking at BTC from the 4-hour candles, the price is now in a sideways consolidation between the new high of 23,961 and the support of 22,500. From the perspective of the moving average is also the same, the long position that has been destroyed, and it is likely to enter a relatively chaotic trend in the short term.

Disclaimer: The information provided in this section is for informational purposes only, doesn't represent any investment advice or FAMEEX's official view.