FameEX Weekly Market Trend | June 5, 2023

2023-06-05 09:25:40

1. Market Trend

Between June 1 and June 4, the BTC price fluctuated between $26,505 and $27,350, with a volatility of 3.18%. According to the 1-hour candle chart, on June 1, at zero o’clock, the BTC price started to climb. It once again touched the resistance level at $27,000 and briefly surpassed it, reaching a high point of $27,350 before rapidly declining to the lowest point at $26,505. Since then, BTC has entered a period of oscillation. During this period, the price of BTC touched the $27,000 level three times, and in every instance, it quickly dropped after each touch. As of the time of writing, the price is still below $27,000. In the data provided in this report, the volatility of BTC is also at a recent low level, which indirectly reflects a decrease in trading activity, limited remaining funds within the market, a lack of significant new capital inflow, and an increase in the number of observers. Considering various indicators, it is still recommended to adopt a cautious approach by observing the market more and taking fewer actions. It is advisable to wait for a substantial breakthrough in the market (a rapid surge above $28,000 accompanied by substantial trading volume and a strong market stance) before considering entering the market opportunistically.

Source: BTCUSDT | Binance Spot

Between June 1 and June 4, the price of ETH/BTC fluctuated within a range of 0.06874 to 0.07030, showing a 2.26% fluctuation. Looking at the 1-hour candle chart, the ETH/BTC pair has remained at its previous trend, reaching a high point of 0.07030 (the highest point in nearly a month). It has maintained a bullish pattern across various timeframes such as 1-hour, 2-hour, and 4-hour. As of the time of writing, the price has slightly decreased but has not fallen below the trendline. The moving averages on all levels are still diverging upwards, indicating a clear bullish pattern. There are rumors suggesting that a whale address is engaging in leveraged borrowing to go long on the ETH/BTC exchange rate.

Based on overall analysis, the recent investment sentiment in the market is relatively sluggish with a downward trading trend. In addition, the BTC trend is weak, hovering around $27,000. Therefore, it is wise for investors to employ a cautious approach, closely monitoring the market and refraining from making hasty moves. It is recommended to expect BTC to break out of the current range in June and then choose the opportunity to enter the market.

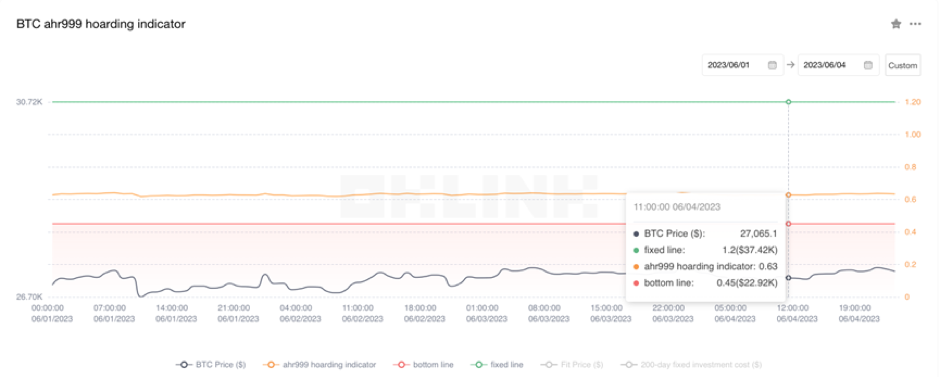

The Bitcoin Ahr999 index of 0.63 is above the buying-the-dip level ($22,920) but below the DCA level ($37,420). It is viable to purchase popular coins through DCA.

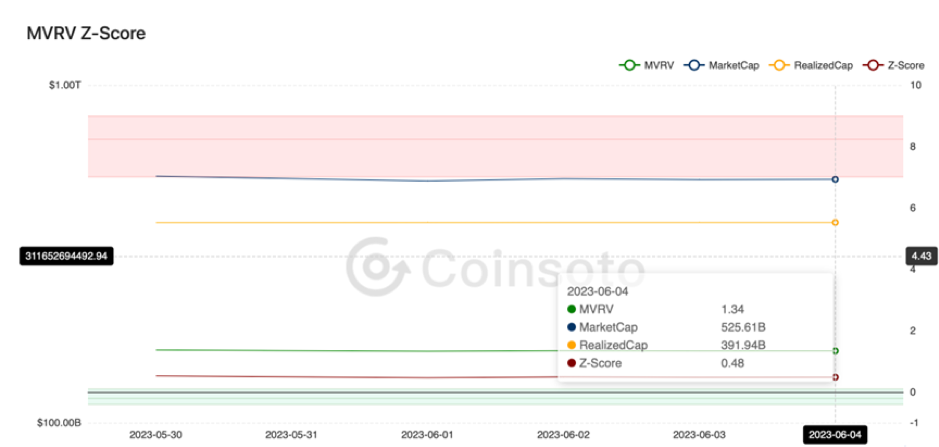

From the perspective of MVRV Z-Score, the value is 0.48. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.47-0.09).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

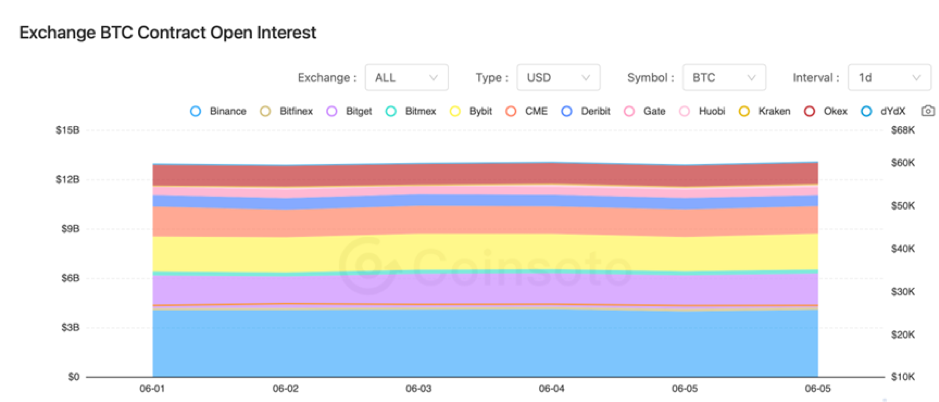

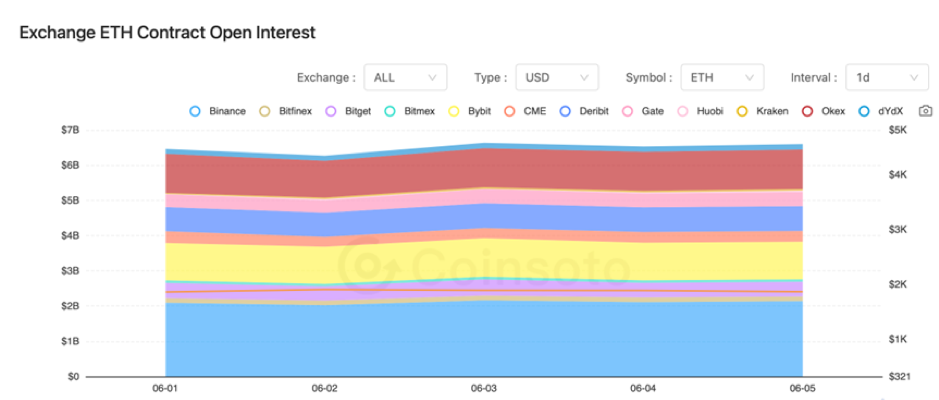

The contract open interest of BTC from major exchanges basically remains unchanged. On the other hand, the open interest for ETH experienced a temporary decline between June 1 and June 2, but subsequently recovered to its normal levels.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On June 1, the Securities and Futures Commission of Hong Kong released a transitional arrangement letter for the licensing regime of virtual asset trading platforms.

2) On June 1, according to Financial Times, Wall Street would prepare to take over mature cryptocurrency companies.

3) On June 1, WeChat search now supports Bitcoin exchange rate query services.

4) On June 2, the CFTC stated it might change risk management rules to include consideration of cryptocurrencies.

5) On June 2, the US added 339,000 non-farm payroll jobs in May, far exceeding market expectations.

6) On June 3, data showed a decline in trading volumes for Bitcoin and Ethereum futures and options in May.

7) On June 3, the Federal Reserve stated that the non-farm payroll report did not resolve internal rate disputes, and interest rates may exceed expectations.

8) On June 3, CZ (Changpeng Zhao) stated that Binance is researching the Lightning Network and may initially enable small-scale Lightning Network transactions.

9) On June 4, a Russian official was detained for accepting a bribe worth $28 million in BTC.

10) On June 4, a new draft bill was proposed in the US House of Representatives to establish a CFTC-SEC Joint Advisory Committee on digital assets.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.