FameEX Weekly Market Trend | December 7, 2023

2023-12-07 11:04:55

1. Market Trend

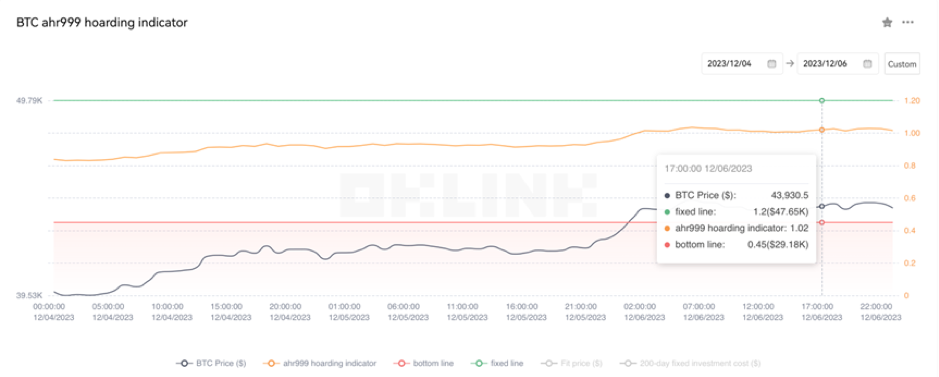

From Dec. 4 to Dec. 6, the BTC price swung from $39,430.00 to $44,488.00, with a volatility of 12.82%. The last analysis mentioned that the trends at various levels are very healthy while moving averages are rising, suggesting a typical bullish trend with a $40,000 breakthrough on the horizon. The recent market trend confirmed a positive outlook from the prior analysis, with a significant breakthrough on December 4 at 6 a.m., surpassing the $40,000 resistance and peaking around $44,000. Notably, during the ascent from $42,000 to $44,000, substantial volume expansion and robust bullish candlesticks were observed on the 1-hour and 4-hour charts, signifying a common trend of concurrent growth in both volume and price. However, the current steep upward slope, distant from the MA30 moving average, suggests a need for a technical correction, with the potential for the price to gradually converge towards the MA30. Therefore, investors yet to enter need not worry about missing out. A strategic move is to establish positions in the $43,000-$43,200 range, building on dips. Alternatively, they can wait for BTC to surpass $44,500 before pursuing further gains.

From a long-term perspective, the current price levels present viable entry points. Long-term investors may consider a target of around $48,000. Given the unchanged recent trend of BTC, the perspectives outlined in this analysis align with previous recommendations—holding assets and awaiting an upward movement while advising against frequent portfolio turnover.

Source: BTCUSDT | Binance Spot

Between Dec. 4 and Dec. 6, the price of ETH/BTC fluctuated within a range of 0.05088-0.05546, showing a 9.00% fluctuation. The recent ETH/BTC trend has been quite unfavorable, even setting new lows in the past six months, with no apparent signs of a bottom (falling with volume). There’s a high probability it will continue to establish new lows. Short-term investors who have entered should await a rise to exit, while those who haven’t entered are advised to stay away from this currency.

Based on overall analysis, the current market is trending bullish. With BTC continuously breaking through (with no significant pullback during the ascent, displaying a step-like rise, and minimal divergence between bulls and bears), both the inflow of funds and on-platform trading volume in the market have reached new highs. Recently, the BRC20 inscription series, such as ORDI, has experienced significant fluctuations. Notably, among altcoins, meme coins like MEME, DOGE, and PEPE have shown outstanding increases, while traditional currencies like ADA, DOT, and ENS have yet to exhibit substantial gains. Their future performance is worth monitoring. BTC remains the most robust performer in the current overall market environment, ensuring a high level of stability across the entire cryptocurrency sphere and maintaining investor confidence. Currently, BTC continues its upward trend, advocating a strategy of holding assets for future increases, with following the trend remaining the predominant theme in current operations.

The Bitcoin Ahr999 index of 1.02 is between the buy-the-dip level ($29,180) and the DCA level ($47,650). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

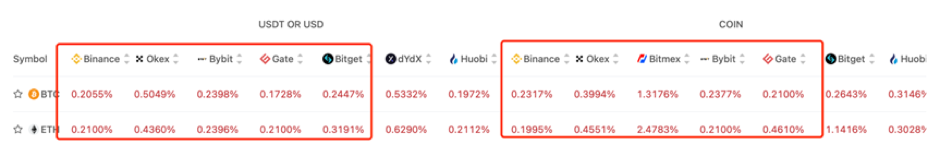

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

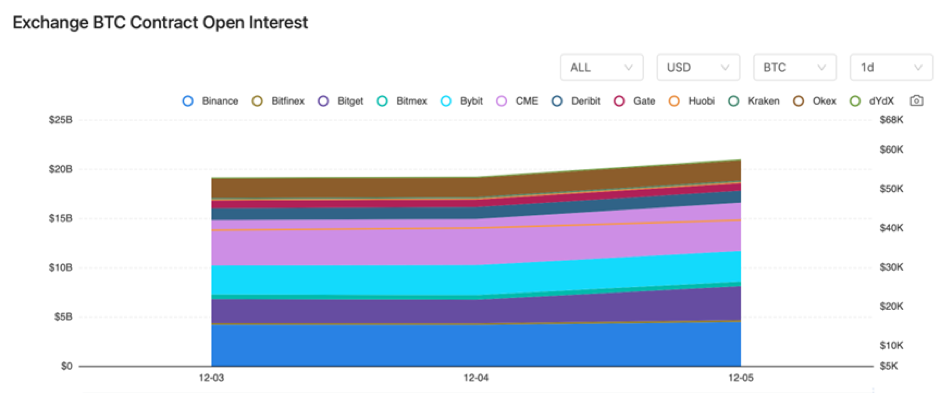

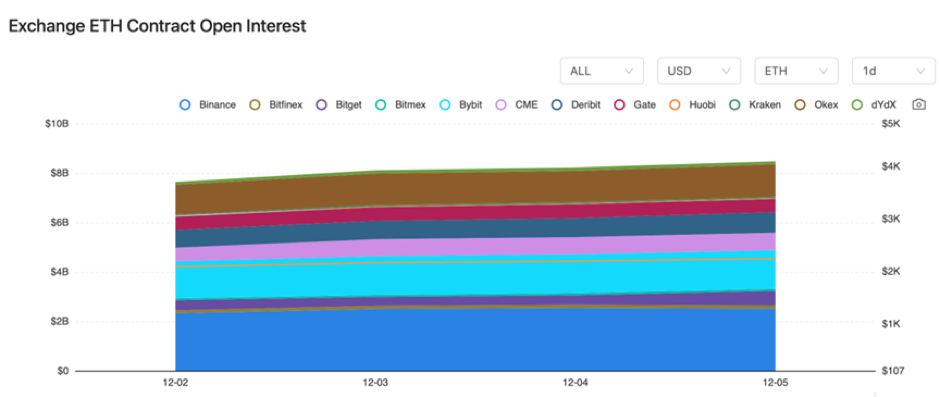

Both BTC and ETH contract open interest witnessed growth on major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On December 4, the President of El Salvador announced that the country’s BTC investment profits have exceeded $3 million.

2) On December 4, the total market capitalization of cryptocurrencies surpassed $1.6 trillion, with BTC market cap returning to $800 billion.

3) On December 4, Crypto.com received authorization from the UK FCA as a cryptocurrency institution.

4) On December 5, the CEO of Binance stated that Binance has been profitable almost from day one and continues to be profitable.

5) On December 5, BlackRock filed a revised S-1 for its spot Bitcoin ETF.

6) On December 5, the total sales from NFTs on the Bitcoin network surpassed $1 billion.

7) On December 6, Coinbase Wallet introduced a new feature allowing transfers through shared links.

8) On December 6, IBM launched a new cryptocurrency cold storage technology called “OSO”.

9) On December 6, the SEC postponed the resolution on Grayscale’s Ethereum Trust (ETHE) ETF.

10) On December 6, the Korean won surpassed the US dollar to become the largest fiat-to-Bitcoin trading pair, accounting for 42.8% in November.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.