FameEX Weekly Market Trend | January 11, 2024

2024-01-11 11:20:30

1. Market Trend

From Jan. 8 to Jan. 10, the BTC price swung from $43,175.00 to $47,972.58, with a volatility of 11.11%. The previous report recommends a low long strategy. A bold entry at $43,200 with a stop-loss at $42,700 is viable. Investors with positions should patiently anticipate a rise. Recent lows matched the previous report’s $43,200 suggestion. Following SEC’s X account hack and false ETF approval news, BTC briefly surged near $48,000, showcasing potential upon ETF approval. Official denial caused notable BTC swings, retracting to about $44,700 from the peak. Recent substantial news heightened BTC fluctuations. Careful investors recognize $44,000 as the recent bottom, maintaining robust support even with high trading volume. Traditionally, before major news, long and short activities typically peak. On the 4-hour chart, increased candlestick shadows and MA20’s significance are noted, offering a key reference for short-term operators, regardless of bearish or bullish candle closures.

In the early morning of Jan. 11 (UTC+8), the SEC finally announced the approval of 11 BTC spot ETFs, causing significant market fluctuations at 4:00. In the end, the 4-hour candlestick closed with a huge volume and a bullish pattern. The only regret is that it did not break the previous high in a trend-following manner. However, the overall trend has arrived, and breaching $48,000 is imminent. This breakthrough will establish a new upward channel. The anticipated influx of funds from Nasdaq-listed ETFs could reshape the entire market. In conclusion, stick to the old strategy: hold coins, await the rise, and patiently anticipate new highs.

Source: BTCUSDT | Binance Spot

Between Jan. 8 and Jan. 10, the price of ETH/BTC fluctuated within a range of 0.04790-0.05432, showing a 13.4% fluctuation. The previous analysis report stated: Currently, from various levels, it is in a bearish state, and to reverse the situation in the short term, there should be a rapid and forceful surge with significant trading volume. At 5:00 am (UTC+8) on Jan. 10, ETH/BTC experienced a massive upward surge with no subsequent pullback, maintaining a staircase-like upward trend (a strong signal). This aligns with the previously mentioned only way to reverse its downward channel. There hasn’t been an effective pullback between 0.04790 and 0.05432, consistently moving upward. If you wish to participate in this market, it is advisable to patiently wait for a pullback, and around the 0.05350 level would be a good entry point.

Based on overall analysis, the current market is in a nascent stage, and barring unforeseen circumstances, there will likely be a continuous net inflow of funds in the later period. The net inflow figures are worth anticipating. Ethereum exhibits signs of resurgence, and it is expected to move upward in tandem with BTC. Both ETH and BTC remain essential targets for large funds. As the influx of funds and participants increases, it is viable to consider strategically entering into valuable, consensus-driven, and previously well-performing (relatively resilient) currencies. This is because a significant portion of incoming funds may not stay exclusively in ETH and BTC, and other promising currencies with lower capital requirements could witness significant gains, establishing a favorable profit dynamic.

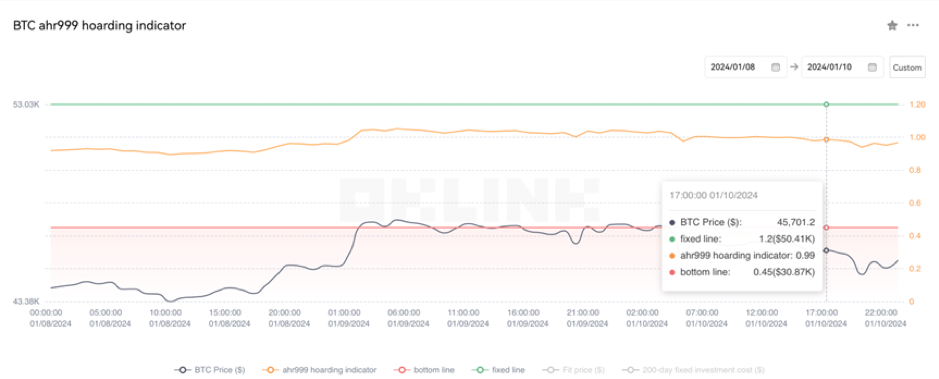

The Bitcoin Ahr999 index of 0.99 is between the buy-the-dip level ($30,870) and the DCA level ($50,410). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

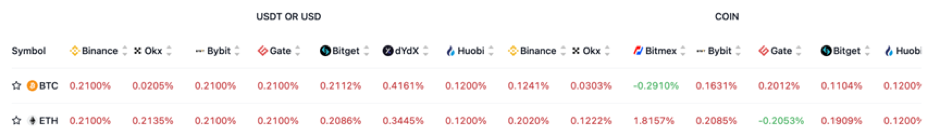

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

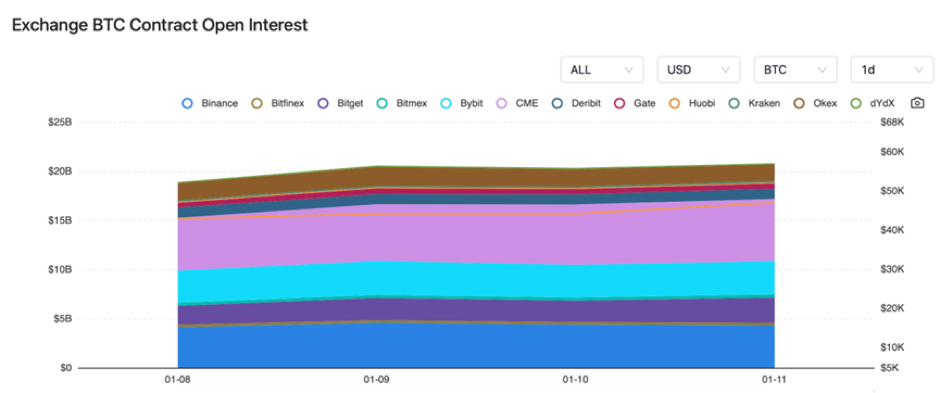

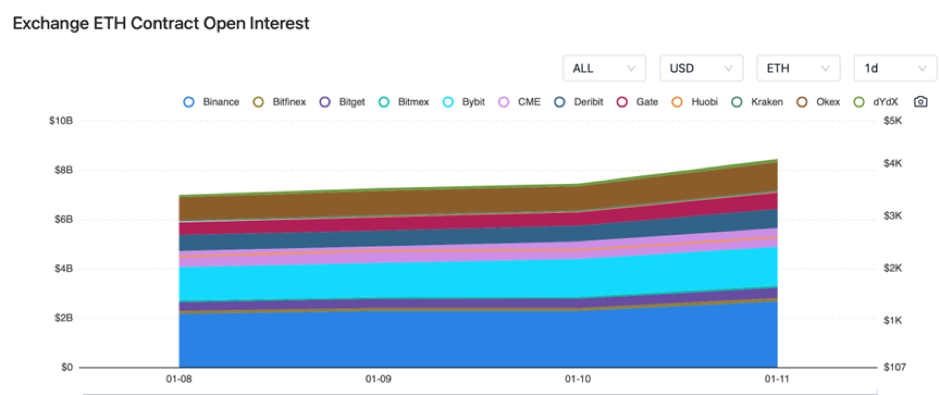

The BTC and ETH contract open interest both experienced a slight rise from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On January 8, Grayscale submitted an update for its Bitcoin spot ETF S-3 application with a fee of 1.5%.

2) On January 8, various institutions, including VanEck, Invesco, and BlackRock, submitted updates to their S-1 filings.

3) On January 8, Honduras officially recognized Bitcoin as a legal accounting unit.

4) On January 9, GBTC traded nearly $500 million, surpassing over 99% of ETF products.

5) On January 9, Standard Chartered Bank predicted Bitcoin to reach $200,000 by the end of 2025.

6) On January 9, Grayscale’s Global Head of ETFs emphasized significant differences between Grayscale and any upcoming ETF products.

7) On January 10, the SEC Chairman reported a security breach in the official SEC X account, making it clear that there is no approval for the listing and trading of a Bitcoin spot ETF.

8) On January 10, Winternute reported a 400% year-on-year increase in over-the-counter trading volume in 2023.

9) On January 10, BlackRock announced a plan to reduce the fees for its Bitcoin spot ETF from 0.30% to 0.25%.

10) On January 10, the Turkish Finance Minister stated that the draft regulations for cryptocurrency assets in Turkey have entered the final stage.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.