FameEX Weekly Market Trend | April 29, 2024

2024-04-29 17:51:15

1. BTC Market Trend

From April 25 to 28, the BTC price swung from $62,442.42 to $65,192.07, a 4.4% range. Over the past four days, the overall macroeconomic fundamentals have remained predominantly bearish. On April 24, President Biden proposed the highest capital gains tax in over a century for stocks and cryptocurrencies, with the top marginal tax rate for long-term capital gains and qualified dividends rising to 44.6%. Market attention should focus on when the U.S. Congress will reject this proposal. If the proposal is passed, it could trigger a rapid downturn in the stock and cryptocurrency markets.

On April 26, the U.S. Department of Commerce announced that the March Personal Consumption Expenditures (PCE) Price Index rose by 0.3% month-on-month and 2.7% year-on-year, exceeding market expectations of 0.3% and 2.6%, respectively. PCE is a favored inflation gauge by the Federal Reserve (Fed). With time, inflation data of 0.2% month-on-month is necessary to bring inflation back to target levels. Initially, markets anticipated the Fed’s first interest rate cut in March, but it was postponed to June and now delayed further to September due to unexpected improvements in the U.S. labor market and inflation. Additionally, four sources revealed that the U.S. SEC is expected to reject a spot Ethereum ETF in May. Despite this, other major asset classes have shown improvement, with U.S. stocks posting their highest single-week gains since November 27 last year.

From April 29 to May 1, it is expected that BTC’s daily chart will continue to experience narrow-range fluctuations, with a relatively high probability, followed by a decline (unless there is significant positive news in the global macroeconomic or cryptocurrency industry). Regarding BTC spot trading, it may be advisable to consider placing a small amount of buy orders at $61,550 to spread out the previous total cost of purchase or engage in short-term trading. There is a certain probability of execution for buying at $61,550. If the overall position is not high, it may also be prudent to place some buy orders at the $52,800 price level. If President Biden’s proposal for high capital gains tax is passed or unexpected major negative news occurs, buying BTC at this price level could yield a favorable risk-reward ratio. Of course, the probability of execution will be much lower than at $61,550.

The Bitcoin Ahr999 index of 1.21 is over the DCA level ($63,810). In the short term, chasing higher prices for buying may not be advisable. It’s more prudent to set lower price limit orders for spot BTC purchases for medium-term trading. There’s also a possibility of a significant and rapid price drop in BTC in the near term.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are negative, indicating that short leverages are relatively high.

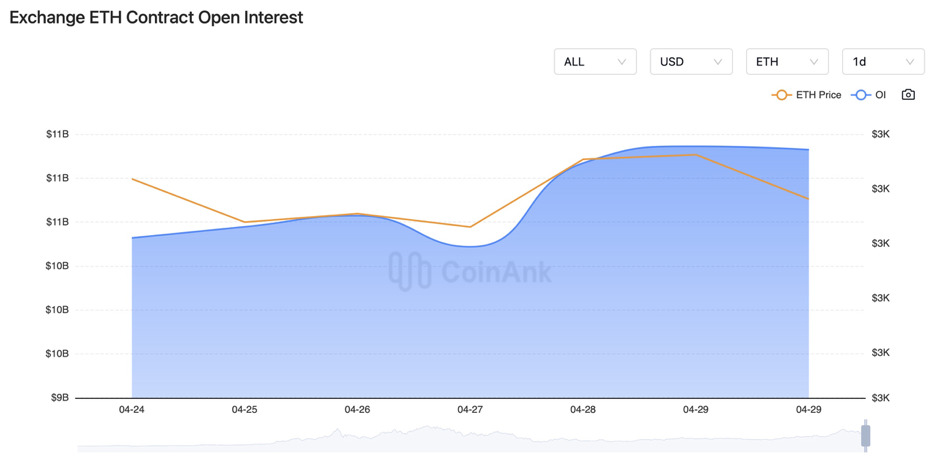

In the recent period, the BTC contract open interest has been slowly declining, while the ETH contract open interest continues to slowly rise.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On April 25, the initial jobless claims in the United States recorded 207,000 people, the lowest since February 17, 2024.

2) On April 25, the EU anti-money laundering legislation passed its final vote.

3) On April 25, KPMG reported that 39% of surveyed institutional investors in Canada had exposure to cryptocurrencies in 2023.

4) On April 25, the U.S. SEC delayed its decision to approve the listing of options for a spot Bitcoin ETF until May 29.

5) On April 26, the FBI issued a warning advising Americans not to use unregistered cryptocurrency transfer services.

6) On April 26, with the new regulations in effect, UK law enforcement agencies can seize criminal-related cryptocurrency assets without conviction.

7) On April 26, four sources revealed that the U.S. SEC is expected to reject approval for a spot Ethereum ETF next month.

8) On April 26, the U.S. core PCE price index for March recorded an annual rate of 2.8%, higher than market expectations (2.7%), maintaining unchanged for two consecutive months.

9) On April 26, Pantera Capital acquired a batch of discounted SOL from an FTX auction.

10) On April 27, Grayscale’s report highlighted the Ethereum blockchain as the most promising in the tokenization trend.

11) On April 27, according to the CME FedWatch, the probability of the Fed maintaining interest rates in May increased to 97.6%.

12) On April 28, Ethereum network gas fees dropped to 5 gwei.

13) On April 28, the European Crypto Initiative’s Executive Director stated that new rules under the MiCA framework may encourage large banks to enter the DeFi space.

14) On April 28, FTX creditor Sunil stated that the new CEO did not mention FTX’s ownership of 55 million SOL when taking over, and will oppose any plans Sullivan & Cromwell (S&C).

15) On April 28, “Fed Whisperer” Nick Timiraos suggested that speculation about rising neutral interest rates might lead the Fed to postpone rate cuts.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.