FameEX Weekly Market Trend | May 3, 2024

2024-05-03 11:41:15

1. BTC Market Trend

From April 29 to May 1, the BTC price swung from $64,726.76 to $56507.69, a 14.55% range. The continuously postponed expectations of interest rate cuts have reduced risk appetite across the financial market, which is the main reason for Bitcoin’s recent price plunge over the past three days. The latest statement from the Federal Open Market Committee (FOMC) of the Fed is as follows:

1) Statement Overview: Consensus to maintain unchanged interest rates, awaiting greater inflation confidence before considering cuts.

2) Inflation Outlook: Improved balance in employment and inflation risks. However, the 2% target has not been met recently.

3) Economic Outlook: Steady economic expansion, yet uncertainties persist, with ongoing monitoring by the FOMC.

4) Balance Sheet Reduction: Treasury holdings reduction pace to slow to $250 billion/month from June, while the MBS cap remains at $350 billion/month.

Fed Chairman Powell hinted that unemployment must rise by more than 0.2 percentage points to prompt a rate cut, expressing little confidence in a rate cut this year. Following the Fed’s announcement of unchanged rates and Powell’s remarks, investors flocked to the US stock market and Treasury bonds, pushing yields lower. Powell maintained that policymakers remain unconvinced by data that inflation is falling to the Fed’s 2% target, making a rate cut unlikely for now. He also did not suggest the possibility of raising rates. During his speech, major US stock indices rose by over 1%, while the yield on the 10-year US Treasury bond fell from 4.653% before the rate announcement to 4.583%. Meanwhile, the US dollar weakened, with the DXY index hitting a low of 105.70.

From May 2 to May 5, it is expected that global asset classes such as gold and US stocks may experience unstable or even continued declines. It’s important to be cautious as Bitcoin might also follow this downward trend, potentially experiencing significant drops even after minor rebounds. There’s no need to cancel buy orders placed at $52,800 as the bull market is far from over. Utilizing mid-term investments to average down total buying costs during significant price drops and engaging in short-term bottom-fishing trades are key strategies for BTC spot trading.

During highly volatile periods in the BTC market, especially those with index-like functionality, trading futures requires a strong foundation in short-term speculation, particularly with high-leverage futures trades. Spot trading, without leverage, doesn’t carry the risk of liquidation. Deepening our understanding of BTC’s cyclical bull and bear market cycles, occurring approximately every four to five years, and having trust in the rapid development of the cryptocurrency industry can help us maintain a more balanced investment mindset and hold onto our positions.

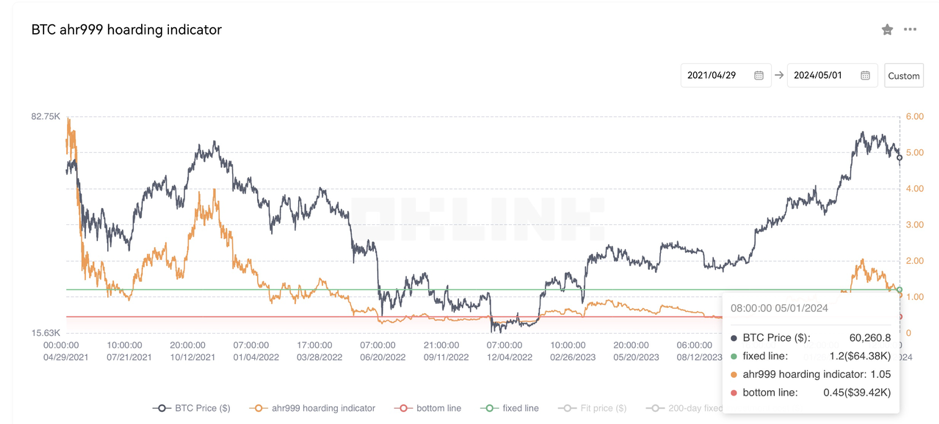

The Bitcoin Ahr999 index of 1.2 is below the DCA level ($63,810) but over the buy-the-dip level ($39,310). Therefore, it may be a good time to dollar-cost average into mainstream cryptocurrencies.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

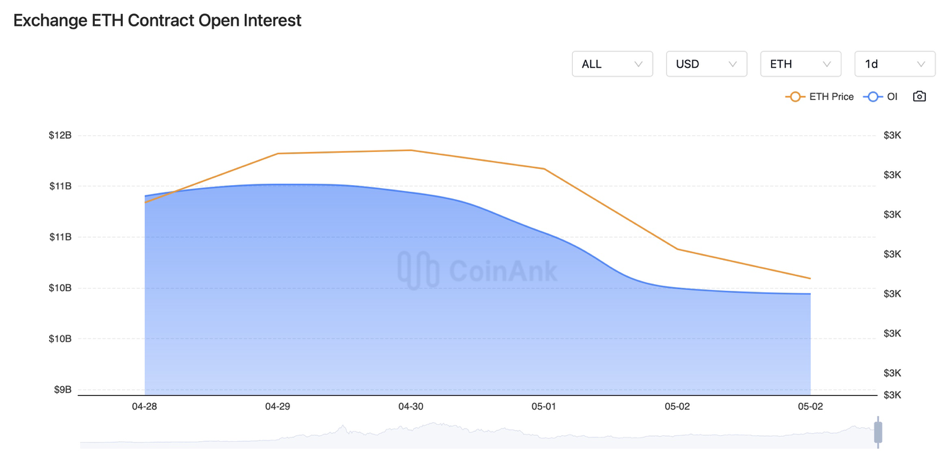

In the recent period, both BTC contract open interest has been slowly declining.

The BTC and ETH contracts, predominantly long positions, experienced both active and forced liquidation from April 29 to May 1.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On April 29, ConsenSys provided four key reasons including the CFTC classification, supporting Ethereum’s non-securities status.

2) On April 29, this week OP, DYDX, ENA, and MEME tokens will each unlock.

3) On April 29, exchange Bitcoin balances hit a new six-year low.

4) On April 29, South Korea stated formally that a department focused on digital asset crimes would be established.

5) On April 29, the Canadian Prime Minister proposed a new capital gains tax, ranging from 50% to 67%, depending on income levels.

6) On April 29, US Senators questioned the Biden administration, fearing Russia and other countries are using Tether to evade sanctions.

7) On April 29, according to Bloomberg, Australia is expected to approve a Bitcoin spot ETF this year.

8) On April 30, the Hong Kong Monetary Authority stated that crypto assets, especially stablecoins, are one of the focal points for 2024.

9) On April 30, FTX’s asset disposal party finalized the auction of the second round of 1.8 million locked SOL tokens, with a closing price of around $100.

10) On April 30, a Chief Investment Officer of a company stated that if the US Congress passes comprehensive stablecoin legislation this year, its impact on driving mass adoption of cryptocurrencies may surpass the launch of a US Bitcoin spot ETF.

11) On April 30, Russia will impose strict restrictions on the circulation of cryptocurrencies from September 1, but will exempt miners and central bank projects.

12) On April 30, Eurozone CPI for April was 0.6%, in line with expectations but down from the previous value of 0.8%.

13) On May 1, the SEC may approve the first Ethereum 2X leverage futures ETF.

14) On May 1, the US Treasury set the quarterly refunding size at $125 billion, in line with expectations.

15) On May 1, the US Bitcoin spot ETF saw outflows of 5,176 BTC last week, marking three consecutive weeks of net outflows.

16) On May 1, US April ADP employment increased by 192,000, the largest increase since July 2023, and job vacancies fell to a new low since 2021.

17) On May 1, the Chairman of the US Financial Services Committee criticized the SEC’s investigation into Ethereum, accusing the Chairman of intentionally misleading Congress.

18) On May 1, VanEck stated that the total value of Bitcoin held by various ETFs, nations, and companies is approximately $175 billion.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.