FameEX Weekly Market Trend | June 27, 2024

2024-06-27 09:52:50

1. BTC Market Trend

From June 24 to 26, the BTC price swung from $58,634.77 to $64,168.06, with a volatility of approximately 9.44%. The following are important recent statements from the Federal Reserve (Fed) and the European Central Bank (ECB):

1) On June 24, Fed’s Daly highlighted the risk of rising unemployment and said rate decisions will depend on inflation data; cuts may be necessary if inflation falls rapidly or the labor market weakens.

2) On June 24, Fed’s Goolsbee stated that slowing inflation data could lead to more accommodative policies and urged caution against overly tight policies.

3) On June 25, Fed Governor Bowman stated that it was not yet the right time to cut rates.

4) On June 25, Fed’s Mester stressed the need to retain the option to sell mortgage-backed securities.

5) On June 26, Fed Governor Cook indicated that cutting rates would be appropriate at some point.

6) On June 26, ECB Governing Council Member Rehn suggested that it is reasonable to bet on two more rate cuts in 2024.

Ki Young Ju, founder and CEO of CryptoQuant, summarized the data for this month on X (formerly Twitter:

- Bitcoin remains in a bull market cycle.

- Whales are in risk-off mode, reducing futures positions.

- There is selling pressure from miners and long-term holders.

- Coinbase premium is negative.

- Traders have an entry price gap of $47,000.

- There is a lack of new funds flowing into ETFs and custodial wallets.

- Higher demand for ETH compared to BTC, possibly indicating the early arrival of altcoin season.

Overall, he remained long-term bullish but advised caution against excessive risk.

According to a report by Copper, as of June 24, the monthly supply growth of Tether (USDT) was less than 1.5%, significantly lower than the over 5% growth in April and May. USDT trading volume decreased from a historic high of $767.2 billion on March 11 to $53.5 billion on June 24. As the market cap of USDT reached $113 billion, the slowdown in supply growth indicates a reduction in funds flowing into the crypto market. Additionally, the recent daily outflow from the Bitcoin market has significantly increased, with over $540 million outflowing last week. Over the past 30 days, the price of Bitcoin has dropped by more than 10%, from $68,000 to $62,000. Macroeconomic pressures are also impacting the crypto market. An ETC Group report noted that downward revisions of global growth expectations and rising recession risks in the U.S. could continue to challenge Bitcoin prices.

This Thursday, June 27, the U.S. will release the initial jobless claims for the week ending June 22, the annualized actual GDP data for the first quarter, and the Fed will publish the results of its annual bank stress tests; on the same day, Biden and Trump will hold their first televised debate.

This Friday, June 28, the U.S. will release the Core PCE Price Index and Personal Spending monthly data for May, and Fed official Barkin will give a speech, while Iran will hold its presidential election.

It is expected that the Ethereum ETF will be launched around August or September this year. Before that, the crypto market lacks fundamental support and additional funds to drive a significant increase. The first US rate cut is most likely to occur in November or December this year. From BTC’s all-time high of $71,763.46, a significant decline is expected in the second half of the year, similar to the price movement that started on April 14, 2021. However, the current crypto bull market is still likely to end next year. It is recommended to place buy orders at $42,950 if BTC falls below $54,050.

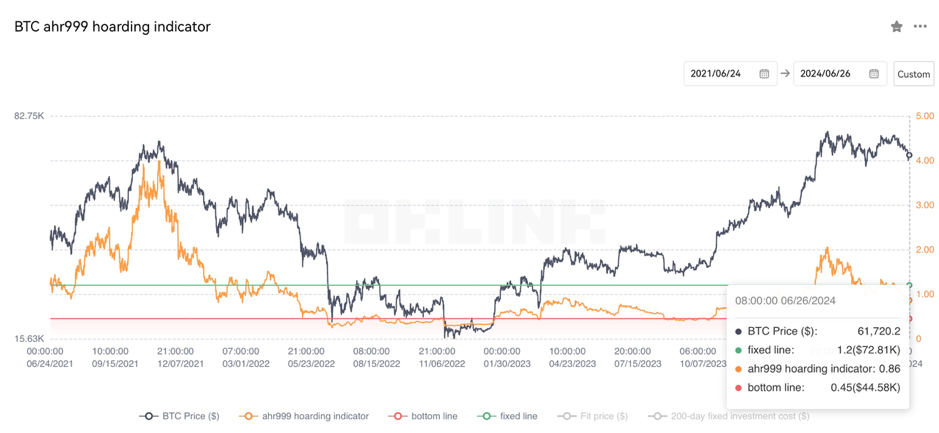

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 0.86, which is below the DCA level ($72,810) but above the buy-the-dip level ($44,580). Therefore, it is advisable to continue dollar-cost averaging into top cryptocurrencies.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

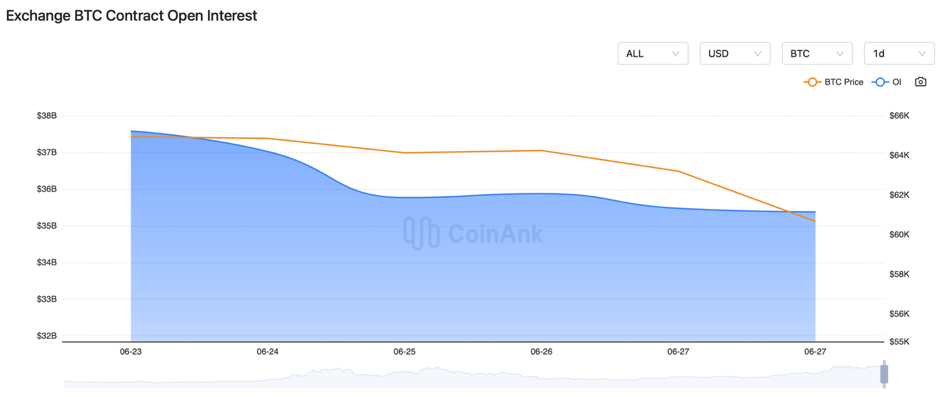

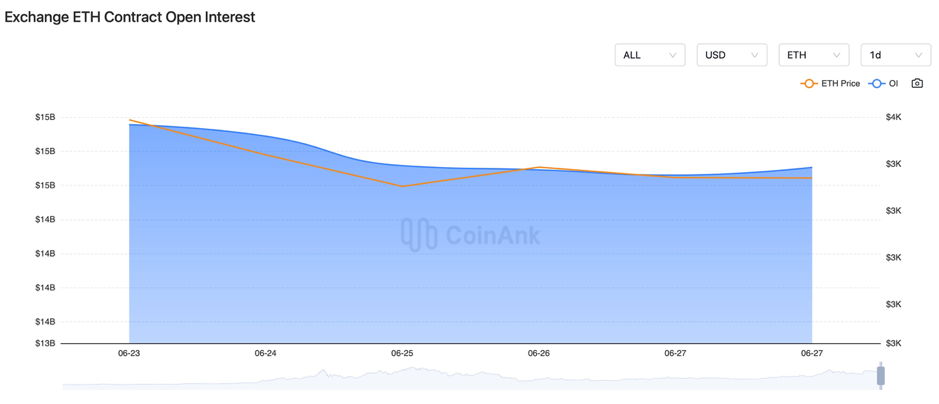

Recently, both the BTC and ETH contract open interest has been gradually declining, indicating that the overall market sentiment is leaning towards caution and risk aversion.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On June 24, Standard Chartered Bank established a BTC and ETH spot trading platform, becoming one of the first global banks to enter the spot cryptocurrency trading market.

2) On June 24, former Biden administration crypto advisor Carole House returned to the White House as a special advisor to the National Security Council.

3) On June 24, Louisiana passed a Bitcoin bill to protect the right to use Bitcoin.

4) On June 24, it was reported that Justin Sun has accumulated over 410,000 ETH (worth about $1.4 billion) since December 2023, with an average purchase price of $3,015.

5) On June 24, the Public Security Bureau in Hanshou, Hunan, China, shut down the STFIL Protocol website and confiscated the involved FIL.

6) On June 24, a fire broke out at a virtual currency mining farm in South Korea, destroying approximately 110 mining machines.

7) On June 24, Thailand began cooperation negotiations with Ripple for the adoption of XRP.

8) On June 25, sources indicated that the Fed proposed a more lenient version of bank capital reform, lowering the total capital increase requirement for large banks from 16% to 5%.

9) On June 25, the W2140 World WEB3 Carnival global tour (Kuala Lumpur stop) concluded successfully.

10) On June 25, Alex Lab reported that recent security incidents are related to the Lazarus Group and indicated its collaboration with law enforcement to recover assets.

11) On June 25, Iran officially launched its central bank digital currency, with a pilot to start in July.

12) On June 25, the Ethereum Foundation’s mailing list provider was hacked, resulting in the dissemination of false information; external access has been blocked.

13) On June 25, the Fed was allegedly attacked by the ransomware group LockBit, which claimed to have 33 TB of confidential US banking data.

14) On June 25, the Kansas City Federal Reserve was studying the insurance costs of stablecoins.

15) On June 25, Hong Kong’s Deputy Financial Secretary stated that Hong Kong is rapidly advancing the development of the virtual asset industry.

16) On June 25, South Korea’s cabinet approved the “Virtual Asset User Protection Act Implementation Order”, which will come into effect on July 19.

17) On June 25, a US congressman introduced a bill requiring the IRS to accept Bitcoin for federal income tax payments.

18) On June 25, the Bitcoin payment app Strike launched in the UK.

19) On June 26, Brazil’s digital bank Nubank announced plans to integrate the Bitcoin Lightning Network.

20) On June 26, the SEC Chairman said the approval process for an Ethereum ETF is “going smoothly” but declined to comment on a timeline for launching a spot Ethereum ETF.

21) On June 26, the Global Digital Asset and Cryptocurrency Association formed a steering committee to propose a digital asset token disclosure framework.

22) On June 26, FTX began soliciting creditor votes on its reorganization plan.

23) On June 26, two men were sentenced for orchestrating a multi-million dollar HYDRO cryptocurrency and wire fraud scheme.

24) On June 26, the CEO of South Korea’s Delio platform admitted to failing to secure user principal and faces criminal charges.

25) On June 26, YGG, AGIX, PRIME, OP, ENA, and SUI were scheduled to unlock a total value of $188 million over the next few days.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.