FameEX Weekly Market Trend | July 1, 2024

2024-07-01 10:42:15

1. BTC Market Trend

From June 27 to 30, the BTC spot price swung from $60,141.09 to $62,358.48, a 3.69% range. Recently, the key statements from the Federal Reserve (Fed) and the European Central Bank (ECB) are as follows:

1) On June 28, Fed Governor Bowman indicated no current plans for rate cuts, but potential consideration if inflation nears 2%. They could raise rates if inflation stays high, with a moderate decline expected this year.

2) On June 28, Fed’s Bostic anticipated rate cuts starting Q4 this year, with 25 basis points each quarter in 2025.

3) On June 28, Fed’s Daly mentioned prolonged elevated rates if inflation remains stable or declines slowly. The Fed is prepared to adjust policy based on inflation or labor market changes.

4) On June 28, ECB’s Kazaks suggested quicker rate cuts if labor market concerns ease; Kazimir expected another rate cut this year.

5) On June 30, ECB’s Governing Council member Olli Rehn stated that he does not believe the current discussions about the Transmission Protection Instrument (TPI) are a hot topic. He asserted that a debt crisis is unlikely and that the TPI is not needed. (In this context, the TPI refers to the ECB’s proactive purchase of downgraded French government bonds to prevent France’s high debt crisis from spreading to other member countries, which could significantly impact the euro exchange rate. This measure aims to help France navigate its current debt crisis, stabilize the euro exchange rate, and support the EU economy.)

6) On June 30, ECB’s Panetta stated that the ECB should be ready to use “all instruments” to deal with the impacts from increased internal political uncertainty in various countries.

7) On June 30, ECB’s Chief Economist Lane noted recent market trends haven’t met key conditions for intervention, particularly disorderly and unfounded increases in risk premiums.

On June 27, Fox Business reporter Eleanor Terrett revealed on X (formerly Twitter) that the U.S. Supreme Court ruled 6-3 that defendants have the right to a jury trial in federal court when the Securities and Exchange Commission (SEC) seeks penalties for fraudulent behavior, rather than facing the agency’s “in-house” legal proceedings. Terrett analyzed that this decision effectively binds all federal agencies, not just the SEC, as the Supreme Court found the SEC’s use of internal judicial procedures unconstitutional.

Next Thursday, July 4, the UK will hold elections. On the same day, the Fed will release minutes from its monetary policy meeting, and the ECB will publish minutes from its June policy meeting. The following day, Friday, July 5, the US will announce June seasonally adjusted nonfarm payroll employment figures and the June unemployment rate. Permanent FOMC voters and New York Fed President Williams will also deliver speeches. On Saturday, July 6, ECB President Lagarde will give a speech.

In July, over 40 crypto projects will unlock crypto assets worth $755 million. These include AltLayer, Arbitrum, Optimism, among others. According to Token Unlocks data, the largest unlock in July will be AltLayer (ALT), releasing approximately 684 million tokens worth about $125 million on July 25. Following closely is Xai (XAI), which will unlock tokens worth about $93 million on July 9. Additionally, projects like Aptos, Arbitrum, Optimism, Sui, Immutable, and Starknet will also unlock substantial amounts of tokens in July. For instance, Aptos plans to unlock tokens worth $77 million, while Arbitrum aims for a $75 million unlock on July 16.

Recently, global asset classes have shown a cautious bias in investment markets overall. The sentiment in the cryptocurrency market has been subdued in recent days, with short-term spot trading indicating cautious bullish attempts. Sector rotation has been rapid, with hotspots showing limited sustainability and overall profitability.

There is a possibility that BTC might experience a minor rebound followed by further decline. It may be prudent to focus on trading opportunities in the ETH spot, including sell orders of around $4,700 and buying opportunities of around $2,500. For the BTC spot, consider sell orders at $72,500 and $77,500, and buy orders at $54,050 and $42,950.

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 0.83, which is below the DCA level ($73,130) but above the buy-the-dip level ($44,780). Therefore, it is advisable to continue dollar-cost averaging into ETH.

2. Perpetual Futures

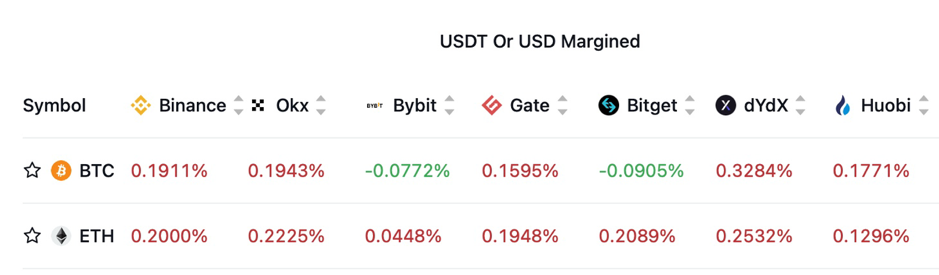

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

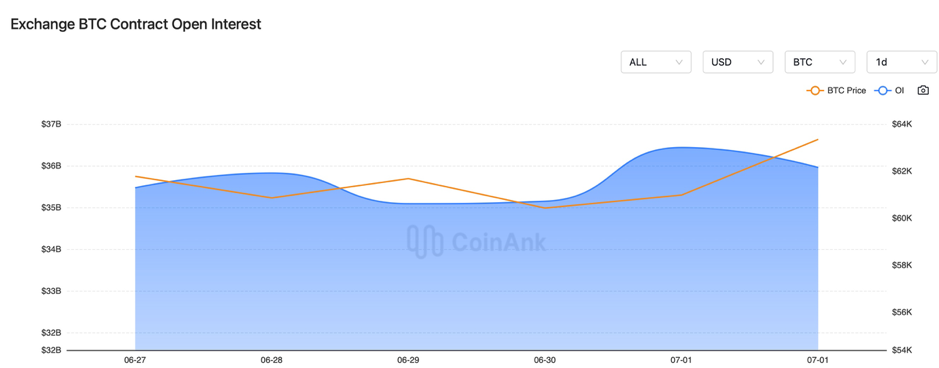

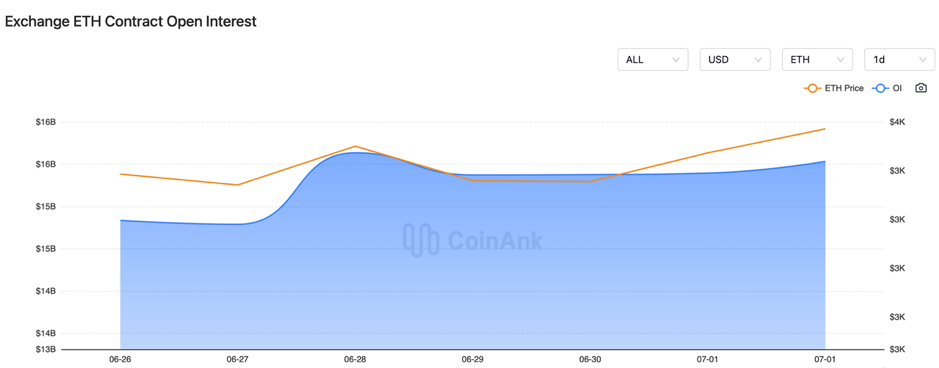

Recently, the BTC contract open interest has gradually declined, while the ETH contract open interest has been slowly increasing.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On June 27, the US core PCE price index for Q1 finalized at an annualized rate of 3.7%, surpassing expectations of 3.60% and up from the previous value of 3.60%.

2) On June 27, initial jobless claims in the US for the week ending June 22 totaled 233,000, slightly lower than the expected 236,000 and down from the previous week’s 238,000. Continuing claims rose to the highest level since the end of 2021.

23) On June 27, all 31 banks tested by the Fed passed its annual stress tests, paving the way for them to announce share buybacks and dividends.

4) On June 27, the International Monetary Fund (IMF) stated that the Fed should refrain from further interest rate cuts until at least the end of 2024.

5) On June 27, OpenAI introduced a new model, CriticGPT, designed to identify errors in ChatGPT’s code outputs.

6) On June 27, it was reported that as the deadline for the MiCA crypto asset market framework approaches, the European Banking Authority is seeking crypto experts to oversee the implementation of cryptocurrency and cybersecurity regulations.

7) On June 27, data from a crypto ransomware leak exposed customer data from Evolve Bank.

8) On June 27, Abra reached a settlement with 25 US states, agreeing to return $82 million to customers.

9) On June 28, Joe Biden’s campaign team hired members of Coinbase’s advisory board as senior advisors for the upcoming election.

10) On June 28, the UK Financial Conduct Authority increased its crypto staff to 100 to address business backlogs.

11) On June 28, Turkey sentenced unauthorized cryptocurrency providers to a maximum of 22 years in prison.

12) On June 28, foreign media reported that 41 US politicians strongly oppose cryptocurrencies, while 310 strongly support them.

13) On June 28, the SEC chairman projected that a spot Ethereum ETF could potentially debut as early as September.

14) On June 28, the Hong Kong Securities and Futures Commission accused Tokencan, Hong Kong Weibii Crypto Assets, and HKD.com Corporation of engaging in virtual asset-related fraud.

15) On June 29, the US core PCE price index for May recorded an annual rate increase of 2.6%, marking the smallest rise since March 2021.

16) After the first debate between Biden and Trump on June 29, where cryptocurrencies were not discussed, a poll showed 67% of viewers believed Trump won the debate.

17) On June 29, China’s Supreme Court reported that a “Token” online platform collected over 9 million various virtual currencies, including Bitcoin, Tether, and Ethereum, from its members.

18) On June 29, it was clarified that investing in virtual assets in Hong Kong would not be subject to capital gains tax.

19) On June 29, the SEC sued Consensys for violating federal securities laws.

20) On June 30, Biden’s odds of winning the election dropped to 16%, reaching a historic low. US media reported that Democratic Party donors are considering replacing Biden, though Biden reassured them he can still win the election.

21) After a crushing defeat in a Toronto by-election on June 30, a current member of Canada’s Liberal Party called for Prime Minister Trudeau to resign.

22) On June 30, France held the first round of voting for the National Assembly elections, with polls showing support for the far-right alliance, left-wing coalition, and Macron’s centrist alliance in that order.

23) On June 30, the Fear and Greed Index stood at 30, indicating a return to market fear since June 25.

24) On June 30, the IRS finalized new regulations for taxing cryptocurrencies. Starting in 2026, crypto exchanges will be required to report transactions to the IRS.

25) On June 30, China’s National Audit Office reported that financial regulatory officials used virtual currencies to conceal the sources of their funds.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.