FameEX Weekly Market Trend | July 4, 2024

2024-07-05 04:46:50

1. BTC Market Trend

From July 1 to 3, the BTC spot price swung from $59,362.65 to $63,835.37, a 7.53% range. Recently, the key statements from the Federal Reserve (Fed) and the European Central Bank (ECB) are as follows:

1) On July 2, Fed’s Goolsbee stated: “I believe our policy is restrictive, and we see warning signs of economic weakening. We aim to maintain the necessary restrictions. Using Europe’s housing inflation measure, we’ve already hit the 2% target.”

2) On July 2, Fed Chairman Powell said: “The labor market remains strong, we continue to grow steadily, and the trend of inflation falling shows signs of recovery. We have made considerable progress on inflation, and we need to be more confident before lowering policy rates. If the labor market weakens unexpectedly, that would also prompt us to react. We fully know the risks of acting too early and too late. Inflation may return to 2% by the end of next year or the year after. Our policy remains restrictive and appropriate. On the one hand, the risk with inflation is moving too fast; on the other hand, it is waiting too long and seeing the labor market soften. We are not debating the long-term neutral rate level in the current interest rate debate. Most people believe we will not return to very low interest rates. AI is bringing a sense of significant change, and the Fed is not using generative AI. Inflation a year from now should be around the mid to low 2% level. No comment on the 2024 dot plot.”

3) On July 3, Fed Chairman Powell reiterated that significant progress had been made on inflation and refused to comment on the question of a rate cut in September. Permanent FOMC member and New York Fed President Williams said: “The rationale for a rise in the long-term neutral rate is not yet clear.”

4) On July 2, ECB President Lagarde stated: “The ECB needs time to assess inflation uncertainty and must remain vigilant. We are very ahead in terms of inflation falling back, and we do not need the services inflation rate to reach 2%. Fiscal rules need to be adhered to. It is unlikely we will return to a zero-interest rate environment. Next year’s inflation rate is expected to be around the low 2% level."

5) On July 2, ECB Governing Council member Wunsch stated: “In theory, a rate cut in July is an option, but in practice, caution is necessary.” Governing Council member Simkus said: “The rationale for a rate cut in July has disappeared. If the data meets expectations, there could be two more rate cuts in 2024.” Governing Council member Centeno said: “The ECB is expected to cut rates a few more times this year.”

6) On July 3, ECB Governing Council member Makhlouf said: “I am satisfied with the expectation of another rate cut. Cutting rates twice may be a bit much, but it cannot be completely ruled out.” Governing Council member Vasle stated: “The ECB must be cautious about inflation risks and should not rush to lower rates.”

Photo from the Central Bank Forum. Left: ECB President Lagarde; Right: Fed Chairman Powell. Source: https://www.jin10.com

A platform co-founder published the latest article “Zoom Out” and stated, “We have entered a new inflation mega-cycle. This cycle is characterized by countries prioritizing their own interests and high inflation. Governments will again suppress domestic savers to finance wars. Historically, there are two types of periods: localized and global. In localized inflation periods, one should hold gold and avoid stocks and bonds. In global deflation periods, one should hold stocks and avoid gold and bonds. In the current cycle, we must closely monitor the scale of fiscal deficits and the total credit provided by banks to non-financial institutions, rather than focusing primarily on changes in central bank balance sheets as in the past.” In light of the massive fiscal deficits and loose monetary environment indicated by data, he was confident in Bitcoin’s prospects. He asserted that as long as capital can flow freely, shifting from fiat currency to Bitcoin and other cryptocurrencies will be the best way to preserve wealth. He drew parallels between the current situation and the period from the 1930s to the 1970s, advising investors to proactively move their funds from the fiat system to cryptocurrencies. When inflation strikes, Bitcoin will shine again.

On July 3, according to the New York Times, Biden told a key ally that if he cannot convince the public soon, he may not be able to save his candidacy and is considering whether to continue running. The ally emphasized that Biden is still striving for re-election. Biden understood that his appearances before the holiday weekend, including an interview with ABC News’ George Stephanopoulos on Friday and campaign events in Pennsylvania and Wisconsin, must go smoothly. This conversation is the first public sign indicating the president is seriously considering whether he can recover from his disastrous performance on the Atlanta debate stage on Thursday. There are growing concerns about his viability as a candidate and whether he can serve another four years as president.

Based on the daily candlestick trends of major global asset indices, the probability of BTC spot prices rising from July 4 to July 7 is slightly higher. There is no need to cancel the sell orders for ETH at $4,700 and the buy orders at $2,500, as well as the sell orders for BTC at $72,500 and $77,500, and the buy orders at $54,050 and $42,950. Be patient and wait for market fluctuations to secure our profits once again.

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 0.82, which is below the DCA level ($73,590) but above the buy-the-dip level ($45,070). Therefore, it is advisable to continue dollar-cost averaging into ETH.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

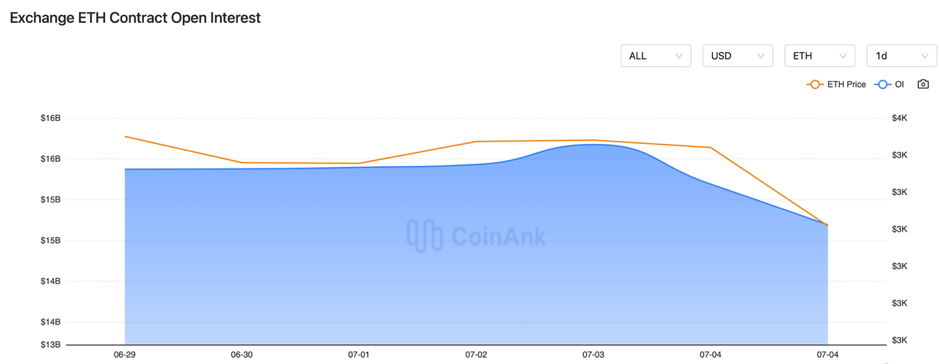

Recently, both the BTC and ETH contract open interest has been slowly increasing.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On July 1, the stablecoin rules in the EU’s MiCA crypto bill took effect on June 30.

2) On July 1, Circle obtained an EMI license from French regulators, allowing it to issue EURC and USDC within the EU.

3) On July 1, the total adjusted on-chain transaction volume for cryptocurrencies in June decreased by 13.4%, and CEX spot trading volume fell by 18.5%.

4) On July 1, seven employees of Paraguay’s National Electricity Administration were accused of directly participating in the establishment of illegal Bitcoin mining farms; the administration increased electricity rates for cryptocurrency mining operators by 14%.

5) On July 1, U.S. Democrats considered nominating Biden early to quell discussions of replacing the presidential candidate; Trump raised $331 million in Q2, surpassing Biden.

6) On July 1, losses in the Web3 sector due to hacks and other incidents reached $1.54 billion in the first half of 2024.

7) On July 1, a victim lost $2.41 million due to a phishing scam.

8) On July 2, Grayscale’s latest report indicated that Bitcoin and the crypto market are under pressure but are expected to recover in the coming months.

9) On July 2, U.S.-listed company Kronos Advanced Technologies announced support for SHIB payments.

10) On July 2, Paxos received approval from the Monetary Authority of Singapore to issue stablecoins and will collaborate with DBS Bank.

11) On July 2, PeckShield reported that the crypto sector lost approximately $176.2 million due to hacking incidents in June, a 54.2% month-on-month decrease.

12) On July 2, the Eurozone’s June CPI monthly rate was 0.2% (expected 0.20%, previous 0.20%); the June CPI annual preliminary rate was 2.5% (expected 2.50%, previous 2.60%); the May unemployment rate was 6.4% (expected 6.40%, previous 6.40%).

13) On July 2, U.S.-listed company Kronos Advanced Technologies announced it would accept SHIB as a payment method for its air purifiers.

14) On July 2, the Monetary Authority of Singapore (MAS) updated its terrorism financing law, raising the risk level for cryptocurrency trading platforms from medium-low to medium-high.

15) On July 2, South Korea released virtual asset listing standards and would reassess 1,333 tokens within six months.

16) On July 2, Tether signed a memorandum of understanding with BTguru to promote digital asset education in Turkey and explore emerging digital asset businesses.

17) On July 3, the Ethereum Foundation “update” email address was hacked, with hackers promoting a Lido staking phishing scam.

18) On July 3, the U.S. Supreme Court ruled that Trump has criminal immunity for some actions taken near the end of his presidency; the trial date for Trump’s hush money case was moved to September 18.

19) On July 3, sources indicated that the start of trading for the spot Ethereum ETF is still scheduled for late July.

20) On July 3, U.S. initial jobless claims for the week ending June 29 were 238,000 (expected 235,000, previous 233,000), a positive signal for the crypto market.

21) On July 3, IMF European Department Director Kammer stated that new Eurozone inflation data confirms that the ECB has room for further rate cuts.

22) On July 3, the Fed meeting minutes revealed that the vast majority of officials believe U.S. economic growth is gradually cooling.

23) On July 3, the Basel Committee approved a framework for banks’ crypto asset risk disclosure and capital standards.

24) On July 3, the United Nations Development Programme (UNDP) partnered with the DFINITY Foundation to use Internet Computer blockchain technology to enhance the Universal Trustworthy Credential (UTC) program.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.