FameEX Weekly Market Trend | August 8, 2024

2024-08-08 19:34:10

1. BTC Market Trend

From August 5 to August 7, the BTC spot price swung from $49,076.6 to $59,476.27, a 21.19% range.

In the past three days, key statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1) On August 5, Fed’s Gourlsby noted that the Fed is currently in a tightening phase and only takes such measures if there’s concern about the economy overheating. Current data does not indicate overheating, and while employment data is below expectations, it doesn’t suggest a recession. He added that both rate hikes and cuts remain options, and the Fed will act if the economy deteriorates, emphasizing that short-term employment data alone does not prompt immediate reactions.

2) On August 5, Fed’s Daly expressed an open attitude toward the possibility of a rate cut in September. Currently, there is no sign of worsening employment. The July employment report reflected temporary layoffs and hurricane impacts, and focusing on a single data point can be misleading.

3) On August 7, the New York Fed indicated that the Fed’s balance sheet is a key tool for monetary policy and financial stability.

4) On August 7, ECB Governing Council member Lane stated that rate cuts could continue if confidence in the trend of slowing inflation increases.

Israeli media and officials have warned of a potential “five-front war”, seeking support from an international coalition including the U.S. and the U.K. The “five fronts” would involve Hezbollah in Lebanon, the Houthis in Yemen, Iranian organizations in Syria, paramilitary groups in Iraq, and direct missile attacks from Iran itself. Netanyahu stated that Iran and its proxies are trying to encircle Israel on “seven fronts”, and “we are determined to confront them.”

According to Channel 12, Israeli security agencies are on “highest alert”, and members of the U.S.-led international coalition, including the U.K. and allied Arab countries, are prepared to try to prevent and intercept potential attacks from Iran on “multiple fronts”. Reports suggest preventative measures include coalition fighter jets and naval ships patrolling the region, though no sources or further details were provided. Two officials stated that the cabinet has been equipped with satellite phones to ensure communication if telephone lines are affected by shelling or cyberattacks.

On August 5, global assets faced a Black Monday: Japan, South Korea, and Turkey triggered circuit breakers. U.S. 2Y bonds fluctuated by 30bps, with a brief inversion against 10Y. U.S. stock market giants lost $1.3 trillion in market value at the open, with the Nasdaq closing down 3.4%. Bitcoin fell over 14% at one point, with a surge in liquidations. The yen surged, and non-dollar currencies generally rose. Gold dropped nearly $100 from its daily high, while oil held relatively steady. Interest rate futures have fully priced in a 50bps rate cut by the Fed in September. On August 7, Japan’s Deputy Governor Uchida Shinichi publicly stated that if market instability persists, the central bank will not raise rates, and some factors have made the central bank more cautious about raising rates.

On August 6, Democratic presidential candidate Harris selected 60-year-old Minnesota Governor Tim Walz as the Democratic vice-presidential candidate, betting that he could attract working-class voters in swing states and help the Democrats win the presidential election in November.

Previously, President Biden announced his withdrawal from the 2024 presidential race and appointed Vice President Harris to succeed him. Born in rural Nebraska, Walz, who first assumed office as governor in 2018, is currently serving his second term. He taught sociology in high school, entered politics after marrying a fellow teacher, and served in the National Guard. In recent weeks, Walz has become a more prominent political figure, particularly with his attacks on Trump’s vice-presidential candidate JD Vance, and he has also advocated for stricter regulation of cryptocurrencies.

On August 6, top trader Eugene Ng Ah Sio shared some of his long-term views on market operations on social media, including:

1. When there is a lot of uncertainty and weakness in the market, I usually avoid being aggressively long.

2. I have bought altcoins before but set risk limits. I gave up on buying when Bitcoin fell below $60,000. I will not buy these altcoins in the foreseeable future.

3. This decline is a result of uncertainty surrounding the U.S. election and the unwinding of yen carry trades. My biggest concern is a deep recession, as it often leads to a severe stock market bear market, which cryptocurrencies have never experienced.

4. Despite the significant declines in recent weeks, I still see considerable complacency in the market.

5. As always, I recommend prioritizing capital preservation in such situations.

An Iranian spokesperson stated that they are engaging in psychological warfare with Israel and have not yet taken any military action. As one of the two major powers in the Middle East with significant military strength and nuclear capabilities, this statement comes as a surprise. How Iran will restore its reputation and credibility in the Middle East and globally will be a key factor influencing the future trends of major global assets, including cryptocurrencies. We will be watching closely.

From August 8 to August 11, the impact of Japan’s current rate hike will gradually wane. However, the specific actions Iran will take against Israel and their potential impact are difficult to predict accurately. Generally, the longer the situation is delayed, the lower the probability of extreme retaliation, as quick and severe responses tend to be less effective.

For major cryptocurrencies’ short-term trading strategy, it is advised to stay on the sidelines. Keep the following orders: sell orders for ETH at $4,700 and buy orders at $1,850; BTC sell orders at $72,500, $77,500, and $92,000, and a buy order at $42,950. The main focus for September’s market analysis will be whether the Fed will initiate a rate cut cycle, as some investors expect.

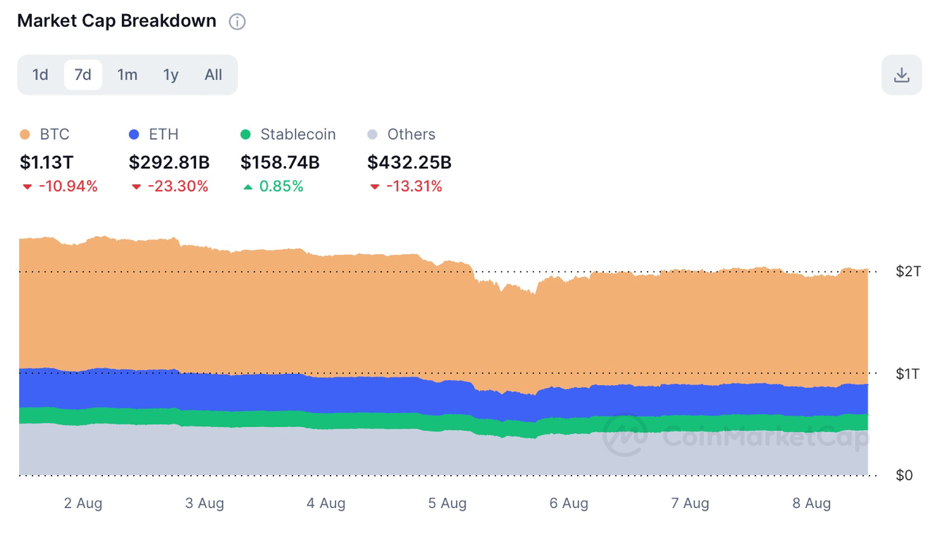

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

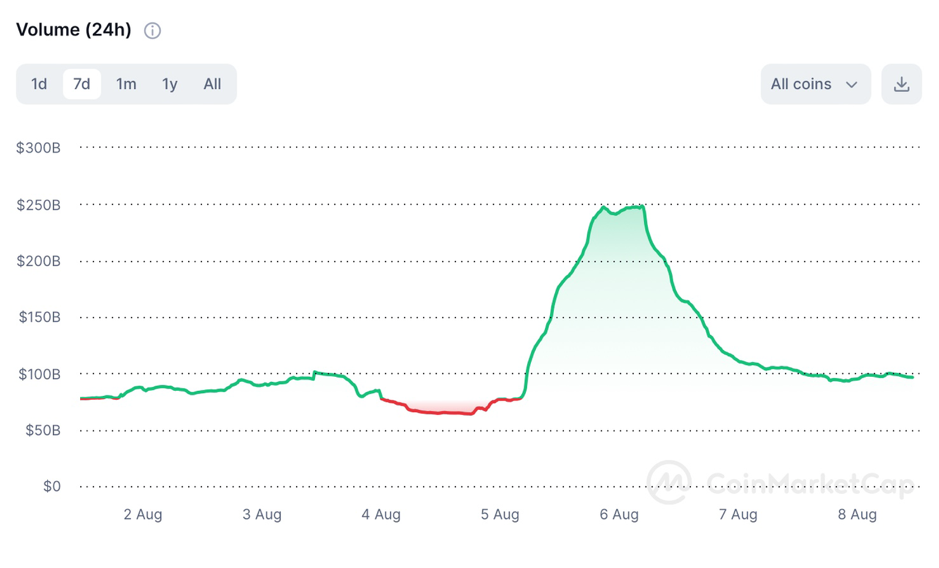

24h trading volume, source: https://coinmarketcap.com/charts/

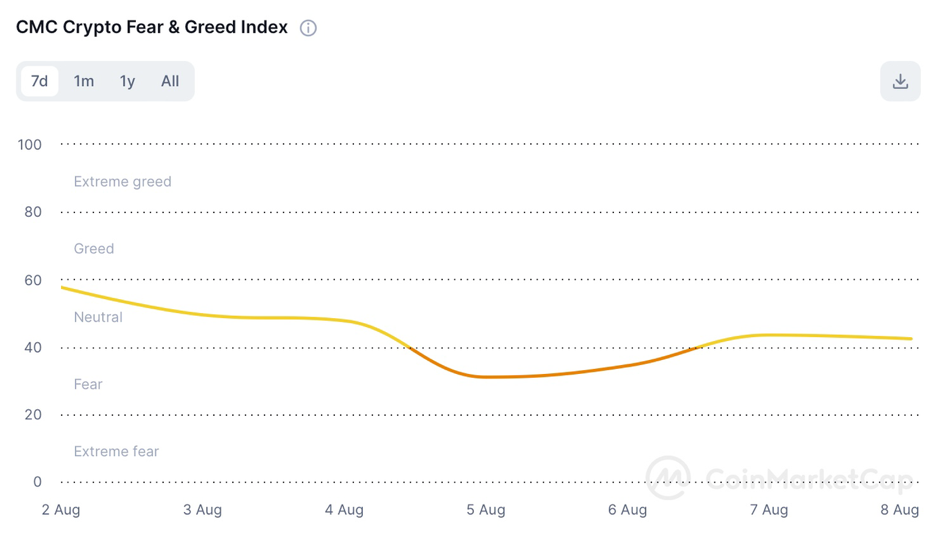

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high. However, many investors are beginning to worry that the current bull market might be coming to an end.

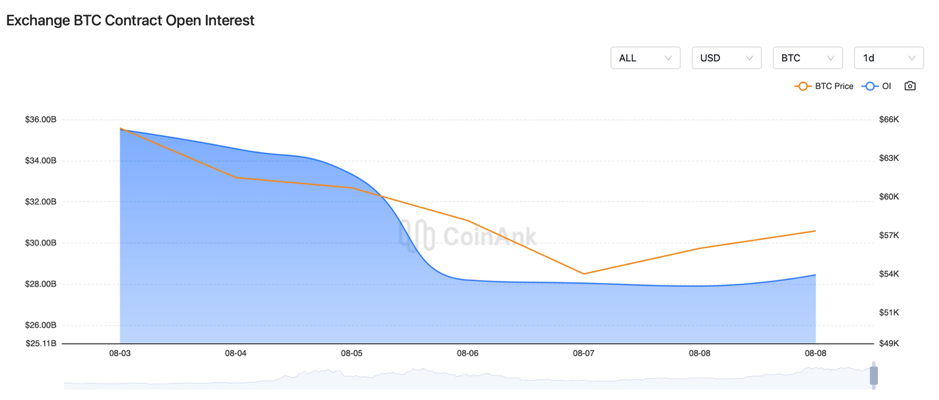

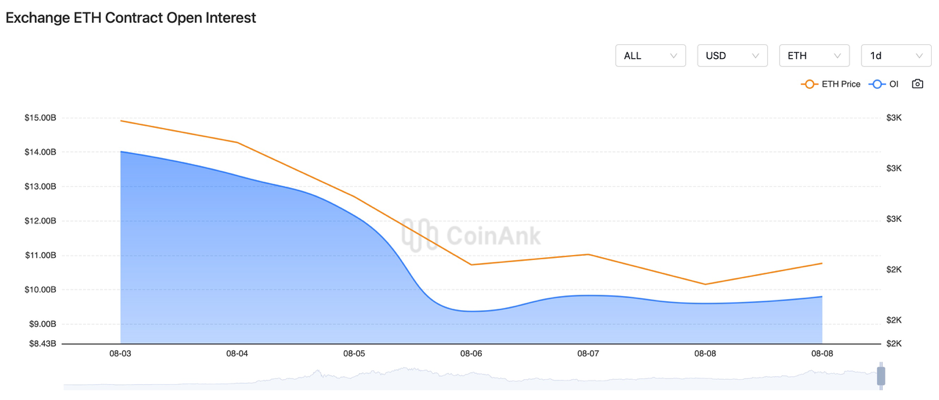

In the past three days, BTC and ETH contract open interest has significantly decreased, and the Fear and Greed Index has dropped to around 30. This suggests that the range-bound market conditions from March to July of this year are likely coming to an end.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On August 5, the Eurozone June PPI monthly rate was at 0.5%, higher than the expected 0.4% and previous -0.2%. This is the largest increase since September 2023.

2) On August 5, the U.S. blockchain sector saw significant declines, MicroStrategy (MSTR.O) down over 23%, Canaan Technology (CAN.O) down over 21%, Coinbase (COIN.O) down over 18%, and Riot Platforms (RIOT.O) down over 11%.

3) On August 5, offshore RMB surged over 700 pips against the USD, crossing the 7.09 level and hitting a new high since June 2023.

4) On August 5, the EU announced that TikTok has committed to permanently withdrawing from the TikTok Lite reward program, marking the end of the Digital Services Act's “first case”.

5) On August 5, Xapo Bank launched interest-bearing Bitcoin accounts in the UK.

6) On August 5, BitMEX co-founder reported that a large player sold off all their crypto assets.

7) On August 5, Abu Dhabi launched a blockchain center to drive blockchain innovation.

8) On August 6, the Reserve Bank of Australia kept the interest rate unchanged at 4.35%. RBA Governor Bullock stated that inflation risks persist and may take longer to address. The rate may need to remain elevated for an extended period, and while the bank is prepared to raise rates if necessary, short-term rate cuts are not in line with the committee’s current stance.

9) On August 6, Trump stated that the U.S. government should not sell cryptocurrencies and will have an interview with Musk on August 12. Trump’s son expressed strong support for crypto/DeFi with a major announcement expected.

10) On August 6, U.S. legislators proposed expanding Secret Service powers to combat crypto-related crimes.

11) On August 6, Russia reportedly provided advanced air defense systems to Iran. Russian Security Council Secretary Shoigu visited Iran to discuss regional and international security.

12) On August 6, Veteran trader Peter Brandt noted that Bitcoin’s current trend resembles the 2015-2017 halving bull market cycle.

13) On August 6, Capula Management, Europe’s fourth-largest hedge fund, reported holding $500 million in Bitcoin ETF assets.

14) On August 6, Elon Musk restarted legal action against OpenAI and Sam Altman, accusing them of fraud.

15) On August 6, Ronin reported that attackers withdrew $12 million in crypto assets and had been negotiating with white-hat hackers.

16) On August 6, According to i24News, Hezbollah launched drone and missile attacks on Israel, with Israeli forces intercepting in the north; U.S. military bases in Iraq were hit by rockets.

17) On August 7, the White House stated that while there have been economic fluctuations, the overall economy remains resilient, and the economic team would continue to monitor the situation.

18) On August 7, Yahya Sinwar, believed to be behind the “10.7 attack”, became the new Hamas political bureau leader.

19) On August 7, the IMF discussed Bitcoin risk management strategies with El Salvador.

20) On August 7, Ripple established a strategic partnership with the Dubai International Financial Centre Innovation Hub.

21) On August 7, Paris Olympic venues were hit by a cyberattack, with hackers demanding ransom in cryptocurrency.

22) On August 7, Nexera announced it is investigating a vulnerability in the NXRA token smart contract, which has been suspended.

23) On August 7, the crypto advocacy group Crypto4Harris announced support for Harris.

24) On August 7, it was reported that this week, eight projects—MODE, MAVIA, DYDX, HFT, IMX, XAI, ENA, and IO—are set to unlock large amounts of tokens, totaling over $60 million.

25) On August 7, according to news, on Friday, China will release data for July’s CPI, PPI, monetary supply, social financing growth year-to-date, and new RMB loans.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.