FameEX Weekly Market Trend | October 14, 2024

2024-10-14 19:36:00

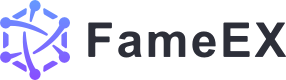

1. BTC Market Trend

From October 10 to October 13, the BTC spot price swung from $59,281.62 to $63,565.05, a 7.23% range.

In the last four days, important statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1) On October 10, the September meeting minutes revealed divisions within the Fed regarding the extent of rate cuts. Significant rate cuts are not due to economic concerns, nor are they a signal of rapid easing.

Daly mentioned the possibility of one or two more rate cuts this year, with interest rates adjusted as needed based on data, labor market, and inflation trends.

Williams indicated that over time, it will be appropriate to shift policy toward neutrality.

Goolsbee believed inflation levels are in line with expectations, and the housing market has improved. Overall trends clearly show that inflation has significantly declined, and the labor market is at full employment.

Fed’s forecasts indicated that the vast majority expect economic conditions to continue improving over the next 12 to 18 months, with a gradual and substantial decline in interest rates.

Barkin stated that inflation is heading in the right direction, with significant declines, but victory cannot yet be declared.

Logan said that there is still “significant uncertainty” in the economic outlook, and a preference for a “more gradual path” toward normal interest rate levels.

2) On October 11, Bostic remained open to no rate cuts in November. Goolsbee noted that inflation has significantly declined overall. Williams advocated for gradually reducing rates to neutral levels, while Barkin voiced increased confidence in controlling inflation.

3) On October 11, ECB meeting minutes indicated that inflation is expected to rise again in the second half of this year and gradually fall toward the target in the second half of next year. The economic outlook for the Eurozone is more worrying, but the chances of a recession are still considered low.

Grayscale released a list of potential and existing crypto assets for their products, categorized into currencies, smart contract platforms, finance, consumer & culture, and utilities & services. The potential crypto assets for Grayscale investment products include: Kaspa (KAS), Aptos (APT), Arbitrum (ARB), Celestia (TIA), Celo (CELO), Core (CORE), Cosmos (ATOM), Internet Computer (ICP), Mantle (MNT), Metis (METIS), Neon (NEON), Optimism (OP), Polygon (POL ex. MATIC), Sei (SEI), Starknet (STRK), Toncoin (TON), TRON (TRX), Aerodrome (AERO), Ethena (ENA), Injective Protocol (INJ), Jupiter (JUP), Mantra (OM), Ondo Finance (ONDO), Pendle (PENDLE), THORChain (RUNE), Dogecoin (DOGE), Immutable (IMX), Akash (AKT), Arweave (AR), Artificial Superintelligence Alliance (FET), Helium (HNT), Pyth (PYTH), UMA Project (UMA), VeChain (VET), and Worldcoin (WLD).

Recently, Dutch police disclosed a long-term investigation into the world’s “largest and longest-running” international darknet market, which led to the arrest of two administrators and the seizure of €8 million ($8.7 million) in cryptocurrency. The market, composed of two entities, Bohemia and Cannabia, allowed users to purchase malware, DDoS attack services, and drugs like cannabis. Police stated that this is the first discovery of a darknet market of such scale, with 82,000 ads posted daily, 67,000 transactions facilitated monthly, and €12 million ($13.1 million) in revenue generated in September 2023 alone.

Former U.S. President Donald Trump stated that Elon Musk plans to cut costs by creating a new position called “secretary of cost-cutting”. Fox News revealed that Trump also claimed Musk vowed to launch a rocket to Mars by the end of Trump’s “second term”. Trump further expressed his intent to stimulate economic growth and combat inflation, blaming the Biden-Harris administration for a 19.9% rise in inflation.

Elon Musk announced on X (formerly Twitter) that Starship successfully landed on its target. When responding to users on X about building a city on Mars, Musk said that if civilization remains stable over the next 30 years, a self-sustaining city of 1 million people will be established on Mars.

Earlier reports mentioned Musk’s new plan to launch five Starships to Mars within two years, send humans to Mars in four years, and build the first Mars city, TERMINUS, housing 1 million people by 2050.

According to Social Capital Markets, the 2024 ranking of the top 10 global destinations for cryptocurrency businesses is as follows: Dubai, Switzerland, South Korea, Singapore, the United States, Estonia, Italy, Russia, Germany, and Brazil. Dubai ranked first due to its regulatory clarity, exemption from capital gains tax, favorable corporate tax (9%), and affordable licensing fees, making it the top destination for cryptocurrency ventures.

From October 14 to October 16, it is still recommended to continue watching for the ETH spot trading opportunities. Keep an eye on sell orders placed at $3,425 and $5,040, as well as buy-the-dip orders at $1,730 and $2,040. For the BTC spot, retain sell orders at $67,900, $79,870, and $96,820, and buy-the-dip orders at $36,720 and $44,370.

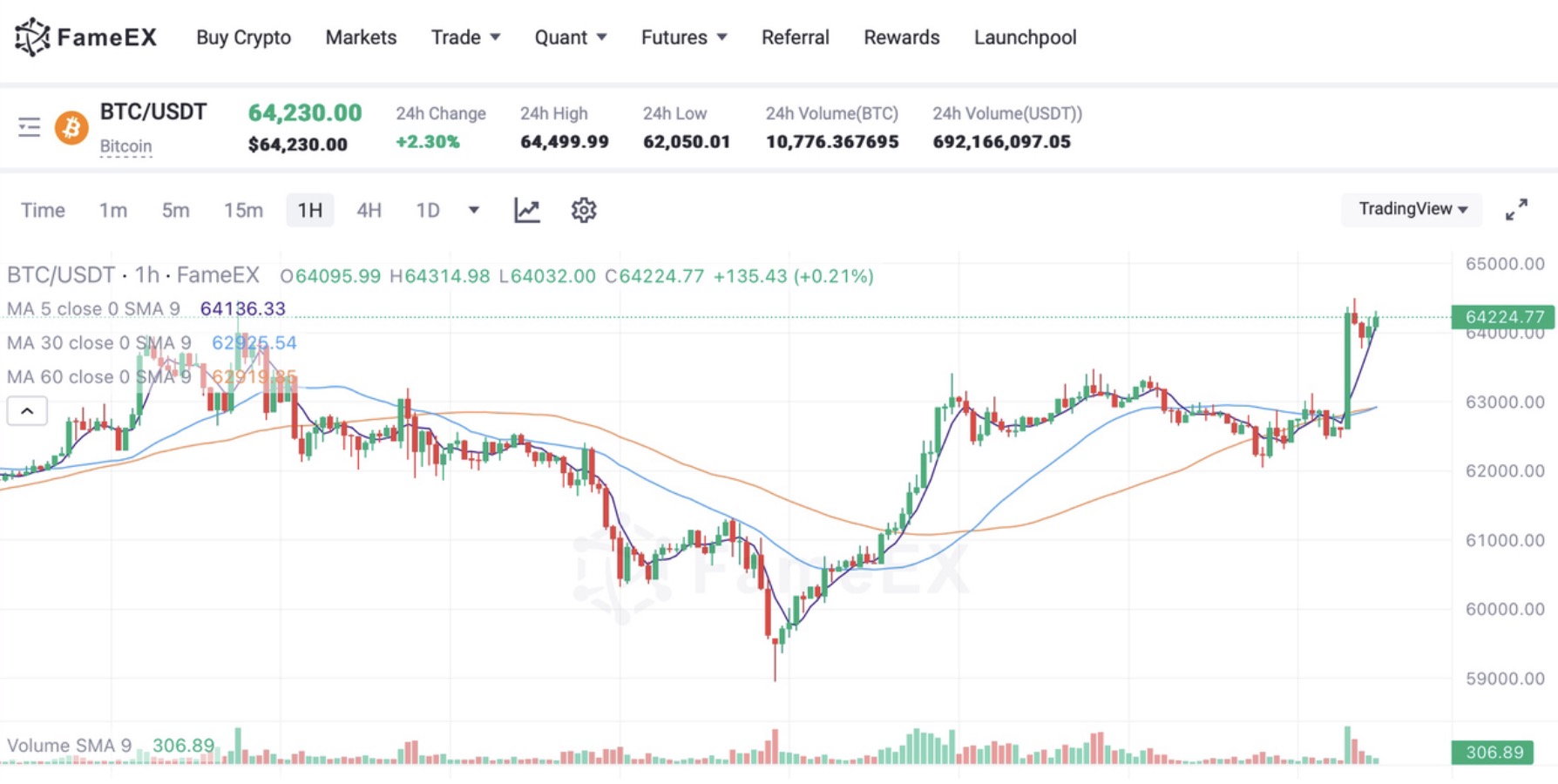

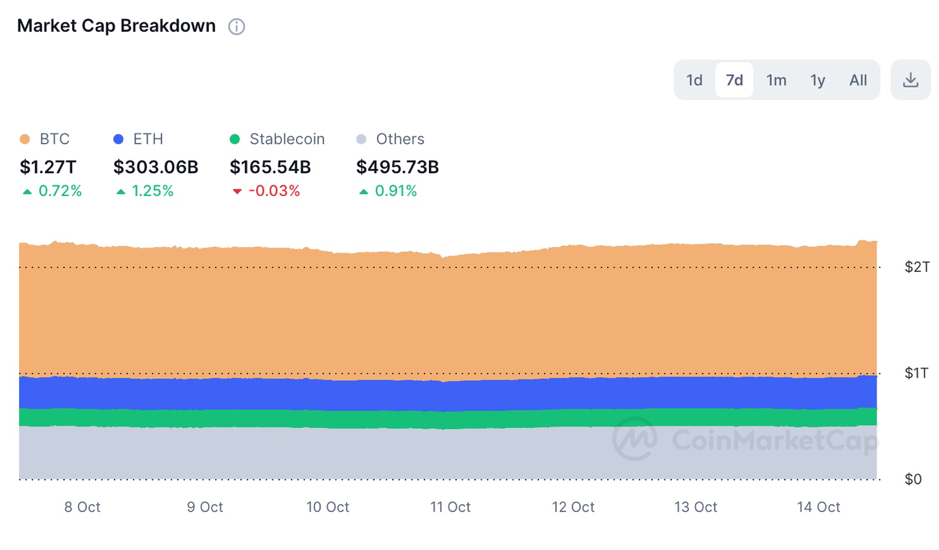

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

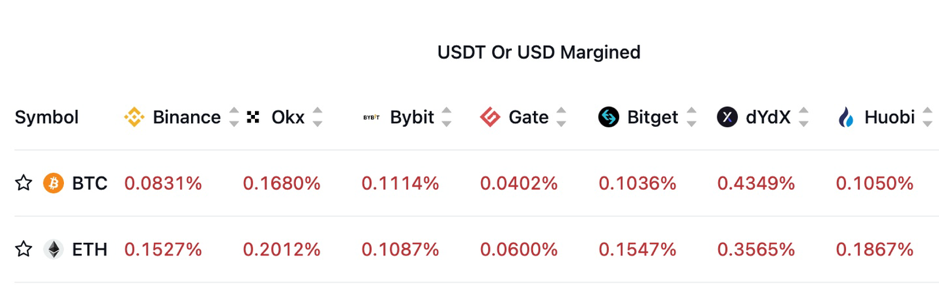

The 7-day cumulative funding rates for mainstream cryptocurrencies across major exchanges are generally positive, indicating that market expectations are now largely aligned.

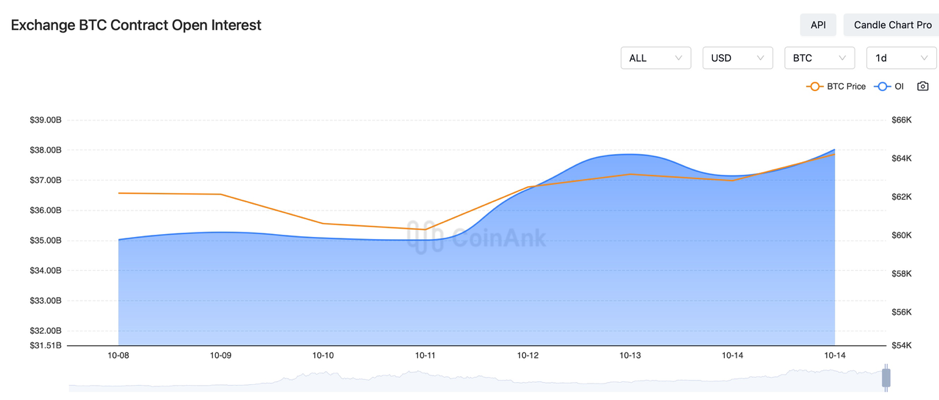

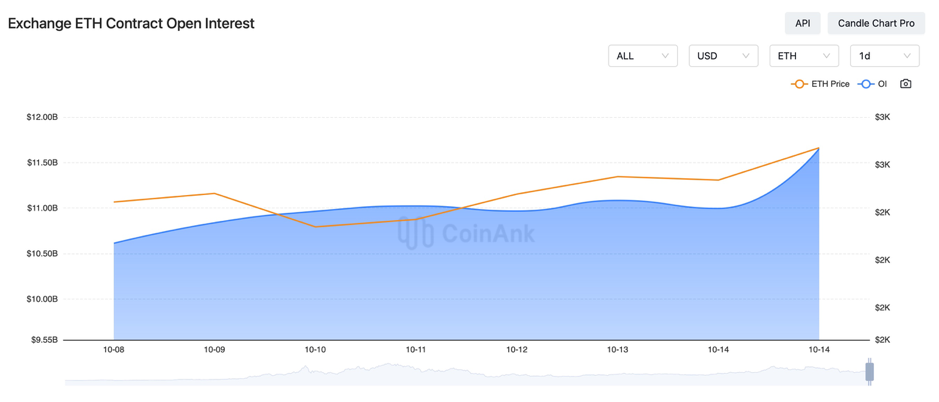

In the past four days, the BTC contract open interest has seen a significant increase, while the ETH contract open interest has slightly risen, indicating that the overall market is relatively more optimistic about Bitcoin’s upcoming price increase.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On October 10, initial jobless claims in the U.S. for the week ending October 5 recorded 258,000. U.S. one-year inflation expectations for October preliminarily came in at 2.9%, up from 2.7%. The U.S. September PPI year-over-year recorded 1.8%, higher than the market expectation of 1.6%, and the previous value was revised up from 1.7% to 1.9%.

2) On October 10, the U.S. September unadjusted core CPI year-over-year recorded 3.3%, the highest since June, exceeding the market expectation of 3.2%. The unadjusted CPI year-over-year for September recorded 2.4%, marking the sixth consecutive monthly decline and the lowest since February 2021, but still higher than the market expectation of 2.3%.

3) On October 10, crypto derivatives exchange Bitnomial sued the U.S. SEC, challenging its regulatory authority over the XRP futures. The U.S. SEC, FBI, and DOJ jointly filed lawsuits against four fraudulent crypto companies, accusing their employees of market manipulation and fraud.

4) On October 10, South Korea planned to establish a Virtual Asset Committee to discuss the approval of virtual asset spot ETFs and the licensing of crypto exchanges. The chairman of South Korea’s Financial Services Commission announced an investigation into the monopolistic behavior in the virtual asset market centered around Upbit.

5) On October 10, PwC reported that nearly half of traditional hedge funds are now involved in cryptocurrencies. Family office Lennertz is raising $165 million for its third blockchain fund.

6) On October 11, the International Organization of Securities Commissions (IOSCO) stated that retail crypto holdings in surveyed jurisdictions have significantly increased since 2020, urging enhanced investor education in the crypto sector.

7) On October 11, Thailand’s SEC proposed new rules for crypto investments by mutual and private funds. Hong Kong’s Securities and Futures Commission announced that combating misconduct in the asset management industry will be a top priority.

8) On October 11, Canada’s September employment increased by 46,700, beating the expected 27,000 and the previous figure of 22,100.

9) On October 11, the UK’s three-month GDP growth for August was 0.2%, below the 0.3% expectation, with the previous figure revised down from 0.50% to 0.3%.

10) On October 11, Tezos staker Josh Jarrett filed another lawsuit against the U.S. IRS over token reward tax policies. U.S. prosecutors requested an 18-month prison sentence for Heather Morgan, an accomplice in laundering funds from the Bitfinex hack.

11) On October 12, Iran announced it is considering withdrawing from the Treaty on the Non-Proliferation of Nuclear Weapons. The EU opened an “air aid corridor” to deliver relief supplies to Lebanon.

12) On October 12, trader Peter Brandt said Bitcoin’s price rallies often occur in the second half of its halving cycle. GSR analysts warned that if the U.S. government sells Bitcoin seized from the Silk Road, it could put downward pressure on the market.

13) On October 12, President Biden stated he had authorized providing Trump with all necessary resources. FOX reporters disclosed that the founder of Ripple donated $1 million in XRP to the Harris Political Action Committee. Harris released her personal health report, aiming to prompt public scrutiny of Trump’s health.

14) On October 12, Binance CEO Changpeng Zhao (CZ) warned about deepfake videos involving him circulating on social media. Suspect Horst Jicha, involved in a $150 million crypto fraud, cut off his electronic ankle monitor and fled. The FBI was accused of violating the MIT license during the release of “phishing tokens”, constituting copyright infringement.

15) On October 12, China’s September CPI year-over-year was 0.4%, below the expected 0.6%, and down from the previous 0.6%. Several Chinese banks announced today that starting October 25, they will implement batch adjustments to the interest rates on existing personal housing loans. Fan Yifei, former deputy governor of the People’s Bank of China, was sentenced to death with a two-year reprieve for accepting bribes totaling over RMB 386 million.

16) On October 12, North Korea announced a permanent closure and blockade of its southern border with South Korea. The North Korean People’s Army General Staff issued operational readiness orders, instructing front-line artillery units and key firepower units to prepare for full-scale firing at South Korea.

17) On October 13, the South African Revenue Service warned cryptocurrency holders to declare assets or face audits, incorporating crypto into its compliance program.

18) On October 13, in the first half of 2024, Taiwan saw 9,625 virtual currency fraud cases. Loopring smart wallet users were hacked, with 58 addresses affected. A UK man sued the council for $647 million after losing his Bitcoin in a landfill.

19) On October 13, rising inflation and ongoing currency devaluation in Latin America led to a surge in cryptocurrency adoption. El Salvador accepted a debt buyback offer totaling approximately $940 million.

20) On October 13, activity on the BNB Chain has been declining, which may pose trouble for BNB prices.

21) On October 13, the presidents of Russia and Iran met, while the U.S. and Europe reconsidered NATO’s future relationship with Russia.

22) On October 13, next week, the unlocking of ARB, AXS, EIGEN, STRK, TAIKO, APE, PIXEL, ADA, PRIME, ENA, RENDER, CYBER, ASTR, and NYM tokens will occur.

23) On October 13, next Thursday, the Eurozone deposit facility rate, as of October 17, will be released by the ECB, along with the ECB’s interest rate decision. President Lagarde will hold a monetary policy press conference. On Friday, Japan’s September core CPI and China’s Q3 GDP year-over-year will be released.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.