FameEX Weekly Market Trend | March 3, 2025

2025-03-03 10:56:05

1. Key Insights on Crypto Market Trends

From February 24 to March 2, the BTC spot price swung from $78,220.37 to $95,269.39, a 21.8% range.

Over the past seven days, key statements from the Federal Reserve(Fed) and the European Central Bank (ECB) were as follows:

1) On February 27, Fed’s Bostic stated that the Fed may cut rates twice this year, but uncertainty remains high.

2) On February 28, Fed’s Schmid suggested reconsidering core inflation as food prices now align more with other goods. Barkin affirmed the long-term effectiveness of the 2% inflation target. Hamak noted rates may be near neutral, not highly restrictive, and may stay unchanged for a prolonged period. He also highlighted high stock valuations but saw the economy adapting to higher rates. Harker emphasized that policy rates remain restrictive and supported holding them steady until the outlook clarifies.

3) On February 28, the ECB’s meeting minutes indicated that the path to returning inflation to target is clear, but the pace of policy easing must remain cautious. It is expected that inflation will remain above target in the near term.

Overall, recent statements from Fed officials have leaned hawkish, while the EuCB’s meeting minutes reflect a more cautious stance.

Putin stated that Russia and the U.S. were ready to rebuild cooperation.

The Washington Post reported that the Trump administration was considering ending all ongoing military aid to Ukraine in response to Zelensky’s outcry.

Musk said that Zelensky had ruined his image in the eyes of the American people and that it was time to determine where the hundreds of billions sent to Ukraine had gone.

2. CMC 7D Statistics Indicators

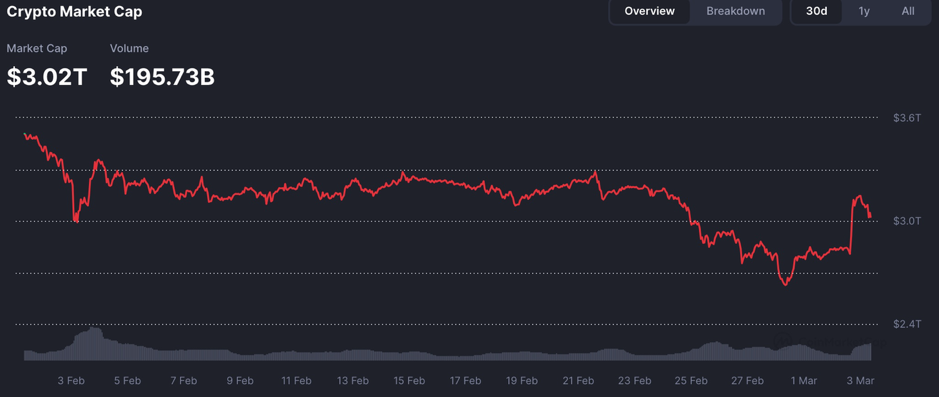

Overall market cap and volume, source: https://coinmarketcap.com/charts/

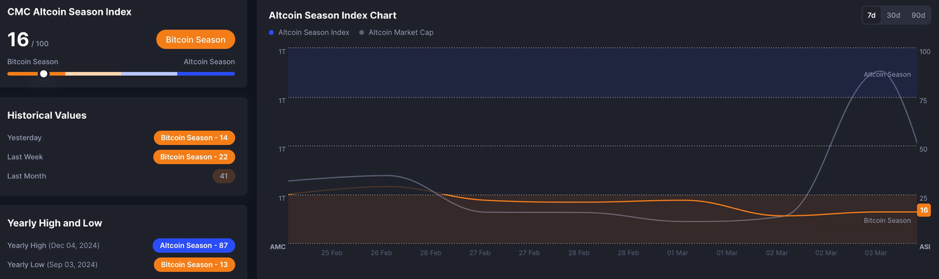

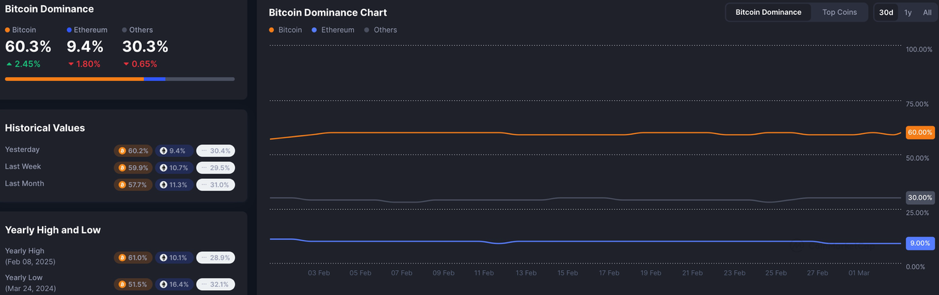

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

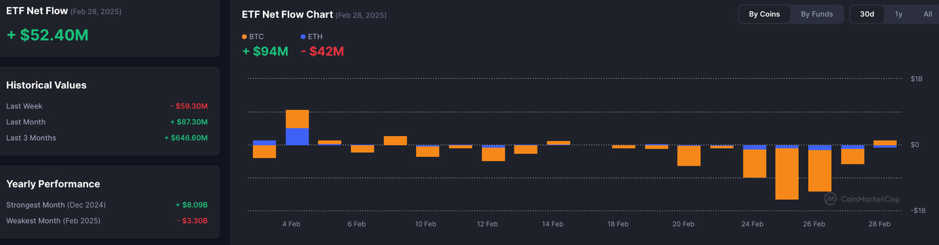

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

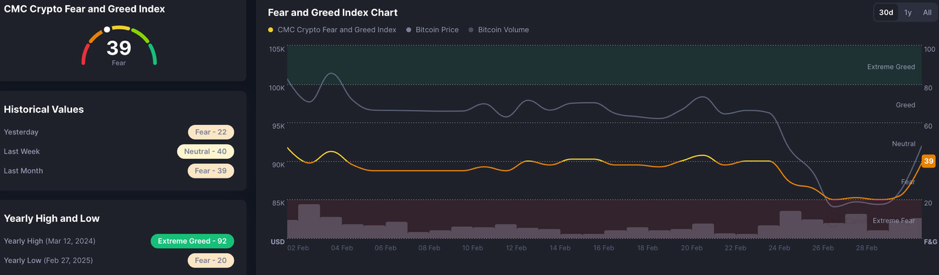

Fear & Greed Index, source: https://coinmarketcap.com/charts/

The total crypto market capitalization and trading volume have recently increased, indicating higher market activity. The altcoin season index shows significant capital outflows from altcoins, with Bitcoin’s dominance slightly rising, suggesting a shift of funds toward major cryptocurrencies. During this period, ETFs saw substantial inflows, gradually restoring market confidence. Meanwhile, major cryptocurrencies and large-cap altcoins have begun a short-term upward trend. The current Fear and Greed Index stands at 39, signaling fear and positioning the market near its recent sentiment bottom.

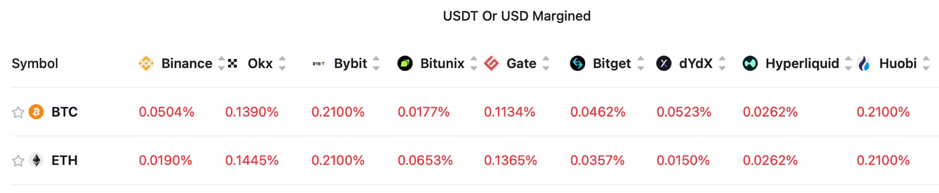

3. Perpetual Futures

The 7-day cumulative funding rates for BTC and ETH on the top 8 exchanges are 0.8652% and 0.8622%, respectively, indicating that the overall market is still in a bull phase.

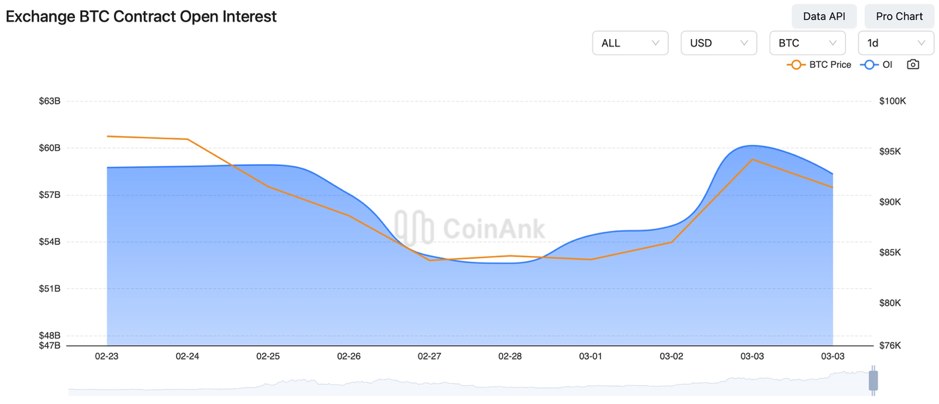

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

In the past seven days, BTC contract open interest has seen significant fluctuations, while ETH contract open interest has declined. This suggests that high-risk appetite traders are beginning to worry about whether the current bull market is nearing its end, leading to increased risk awareness for ETH and mid-to-small-cap altcoins.

4. Global Economic and Crypto Sector Developments

Macroeconomic Data:

1) On February 25, the U.S. House of Representatives passed a budget resolution, planning to cut $4.5 trillion in taxes and $2 trillion in spending over the next decade.

2) On February 26, U.S. initial jobless claims for the week ending February 22 reached 242,000, exceeding the expected 221,000, with the previous figure revised from 219,000 to 220,000.

3) On February 27, the U.S. core PCE price index for January recorded a 0.3% month-over-month increase, in line with expectations, while the year-over-year core PCE price index stood at 2.6%, with the previous reading revised from 2.8% to 2.9%.

4) On February 28, Canada’s December GDP grew 0.2% month-over-month, below the expected 0.3%.

5) On March 1, key events next Monday include the release of the Eurozone’s February CPI YoY and MoM preliminary data and China’s press conference for the Third Session of the 14th National Committee of the CPPCC. On Tuesday, U.S. President Donald Trump will deliver his first address to Congress, Fed’s Mussa Lalem will give a speech, and China will hold a press conference for the Third Session of the 14th National People’s Congress.

6) On March 2, next Friday will see the release of the Eurozone’s Q4 GDP YoY revision and seasonally adjusted employment rate, Canada’s February employment data, the U.S. February unemployment rate, and nonfarm payrolls (seasonally adjusted). Additionally, speeches will be given by ECB Governing Council members Nagel, Knot, and Panetta, ECB President Lagarde, and Federal Reserve officials Williams, Bowman, and Chair Powell.

Cryptocurrency Industry Updates:

1) On February 24, U.S. House Democrats proposed a new bill to prohibit public officials from issuing, sponsoring, or endorsing any securities, commodities, or digital assets.

2) On February 26, Chainalysis reported that crypto-related crimes in 2024 could exceed $51 billion.

3) On February 27, a U.S. House committee advanced efforts to repeal the IRS’s new DeFi tax regulations, which the industry has criticized as “unworkable”.

4) On February 28, Coinbase, NEAR, and others established the Open AI Alliance to promote decentralized AI services.

5) On March 2, next Friday, U.S. President Donald Trump will host a cryptocurrency summit at the White House.

Regulatory Updates:

1) On February 24, DeepSeek announced the open-sourcing of Optimized Parallelism Strategies.

2) On February 24, a U.S. SEC commissioner stated that dropping the lawsuit against Coinbase does not mean the SEC is abandoning enforcement, as future regulation will focus on policy-making. The SEC also classified memecoins as non-securities, warning investors to assume their own risks.

3) On February 25, a SAF co-founder revealed that Bitcoin reserve legislation has passed committee review in seven U.S. states.

4) On February 26, Pakistan announced plans to establish a crypto committee to oversee cryptocurrency policies.

5) On February 27, the UK introduced new criminal legislation expanding seizure powers over cryptocurrencies.

6) On February 28, U.S. Council of Economic Advisers chair nominee Miran expressed full support for the importance of interest rate cuts.

7) On March 1, Bank of Japan Governor Kazuo Ueda stated that the central bank is ready to implement flexible market operations if long-term interest rates experience significant deviations from normal levels. Deputy Governor Shinichi Uchida added that if economic and price outlooks align with expectations, further rate hikes will continue. Japan also announced a crackdown on the booming JGB-backed mortgage market.

8) On March 2, the China Securities Regulatory Commission announced the orderly rollout of digital RMB pilot programs in Hong Kong.

Other News:

1) On February 24, OpenAI released GPT-4.5, enhancing knowledge coverage and interaction naturalness. The research preview version features higher emotional intelligence and fewer hallucinations.

2) On February 26, the President of the European Commission announced that Indian Prime Minister Modi and the EU had agreed to push for the completion of a free trade agreement within this year.

3) On March 1, global funds staged a massive exit from the Indian stock market, with a net sell-off of ₹116.4 billion in Indian stocks on February 28 alone.

4) On March 2, DeepSeek disclosed for the first time that its theoretical cost-profit ratio stands at 545%.

5. Market Outlook

From March 3 to March 5, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively.

The ETH sell order at $5,125, along with the buy orders at $2,040 and $1,730, should remain active.

Risk Reminder: The cryptocurrency market is highly volatile, and investors are advised to control their positions and implement stop-loss strategies. The above content is for reference only and does not constitute specific investment advice from this exchange.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.