FameEX Weekly Market Trend | March 10, 2025

2025-03-10 12:06:50

1. Key Insights on Crypto Market Trends

From March 6 to March 9, the BTC spot price swung from $80,015 to $91,295.55, a 14.1% range.

Over the past four days, key statements from the Federal Reserve(Fed) and the European Central Bank (ECB) were as follows:

1) On March 6, Fed’s Harker stated that he was increasingly concerned about factors that might threaten the U.S. dollar’s reserve currency status and did not want to act quickly given all those uncertainties. A New York Fed official mentioned that the dynamics between Trump and Congress regarding the debt ceiling could disrupt currency markets. The Fed’s Beige Book indicated that U.S. economic activity had slightly increased, but businesses and households were increasingly worried about tariffs. Former Chair Bernanke emphasized that if reality deviated from forecasts, monetary policy should be adjusted accordingly.

2) On March 7, Fed’s Williams stated that there are no signs of inflation expectations becoming unanchored. Governor Bowman noted that declining investment demand and savings could push up the neutral interest rate. Harker reiterated his concerns about threats to the U.S. dollar’s reserve currency status, mentioning that while the overall economy is in good shape, it faces some risks. Governor Waller said that current Fed policy remains restrictive and that rate cuts could happen for both positive and negative reasons. He still saw a strong case for rate cuts but did not believe a cut in March was necessary. He expected rate cuts to begin after March and considered two cuts in 2025 a reasonable median forecast. He estimated that 80,000 to 100,000 job additions could represent a balanced labor market and believed the current job market closely resembled pre-pandemic conditions. Bostic noted that rates might need to stay unchanged until summer.

3) On March 8, Fed Governor Kugler stated that based on recent inflation data, monetary policy is expected to remain stable for “quite some time”. She recognized significant upside risks to inflation and remained highly focused on inflation expectations, stressing that inflation could persist longer than anticipated. Chair Powell stated that the Fed sees no urgency in adjusting interest rates. He noted that the labor market remains strong and generally balanced, while inflation, though slightly above the 2% target, is gradually moving closer to it. He also highlighted that uncertainty surrounding Trump administration policies and their economic impact remains high and that some recent inflation expectation surveys and market indicators have risen due to tariffs. Powell emphasized that Fed policy is not set in stone—if inflation progress stalls, policy can remain restrictive, or if the labor market weakens unexpectedly or inflation falls more than expected, policy can be eased. He acknowledged that reaching the 2% inflation target would be uneven and that the Fed wouldn’t overreact to a few unexpected data points. He also noted that the zero lower bound might no longer be the baseline and emphasized the importance of long-term inflation expectations.

4) On March 7, ECB Governing Council member Kazāks stated that in the face of uncertainty, the ECB must remain open to April decisions and that the goal is to achieve a 2% inflation target rather than to reach the neutral interest rate. Governing Council member Centeno expressed deep concern about the European economy. Governing Council member Müller stated that the ECB must be increasingly cautious about further rate cuts.

Overall, Fed officials’ statements indicated a low probability of a rate cut in March, while ECB officials hold a relatively firmer stance on rate reductions.

Key Takeaways from the ECB Policy Statement and Lagarde’s Press Conference

Policy Statement:

1. Policy Overview: Cut rates by 25bps, with one member abstaining; monetary policy is becoming significantly less restrictive, and its tightening effect will further ease as rates decline.

2. Rate Outlook: No pre-commitment to a specific rate path; inflation outlook, core indicators, and transmission mechanisms will determine future moves.

3. Inflation Outlook: Disinflation is progressing smoothly; the 2025 inflation forecast was raised to 2.3%, while the 2026 projection remains at 1.9%.

4. Economic Outlook: GDP growth forecasts for 2025 and 2026 were lowered to 0.9% and 1.2%, respectively, while the 2027 estimate remains unchanged at 1.3%.

Lagarde’s Press Conference Highlights

1. Policy Rates: Rate cuts will proceed if data supports them, but pauses will be considered if necessary.

2. Inflation Outlook: Disinflation is progressing smoothly, but inflation in the eurozone remains high; the 2% target is expected to be met by early 2026.

3. Economic Outlook: Last year’s growth pattern persists, with downside risks and trade policy uncertainty weighing on growth.

4. Tariff Policy: Rising tariffs are expected to weaken eurozone growth and are seen as entirely negative in impact.

5. Spending Plans: Defense and infrastructure spending could support growth and inflation, but the impact depends on specifics—it's too early to conclude.

6. Other Remarks: Changes in statement wording were significant. Despite sharp yield fluctuations, spread movements remained limited. Geopolitical tensions posed two-sided risks.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

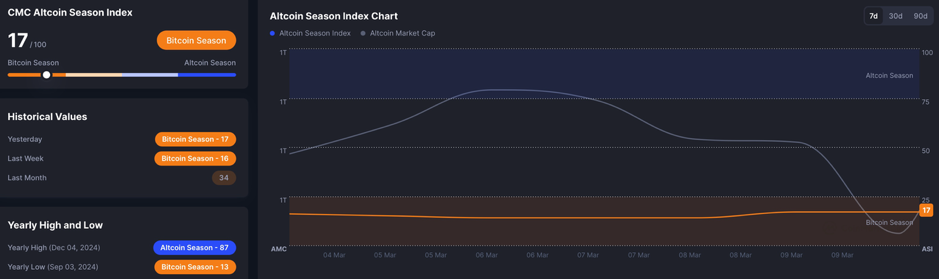

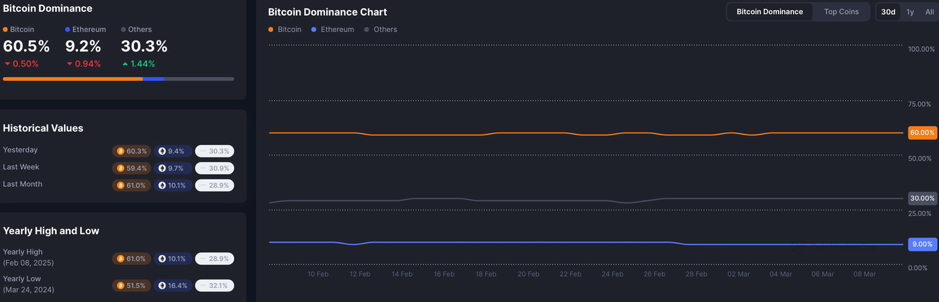

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

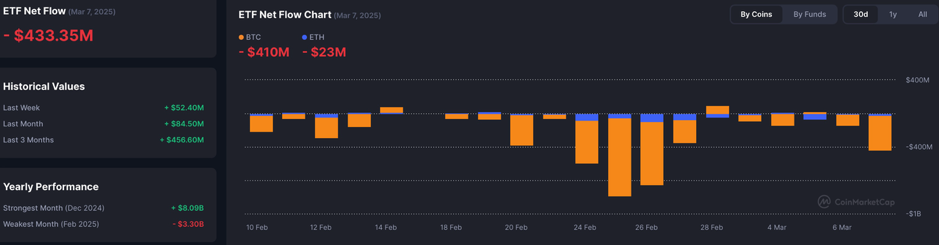

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

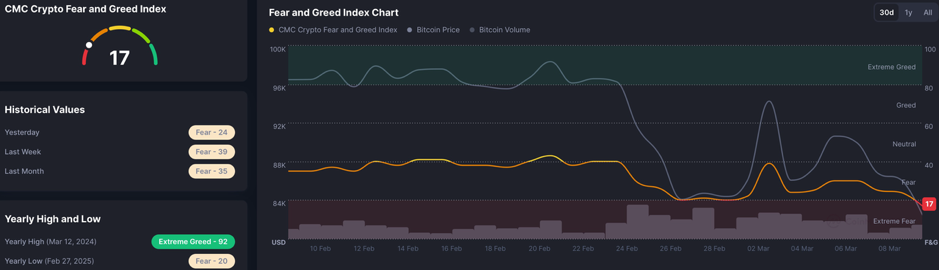

Fear & Greed Index, source: https://coinmarketcap.com/charts/

Over the past four days, the total crypto market cap and trading volume have continued to shrink, with market activity declining. The altcoin season index indicates a broad decline in altcoin prices, while Bitcoin‘’s market dominance remains stable.

ETF funds have seen continuous net outflows, reflecting severe market pessimism. Meanwhile, major cryptocurrencies and large-cap altcoins have maintained their downward trend. The current Fear & Greed Index stands at 17, marking a bottom zone and the lowest level in recent times.

3. Perpetual Futures

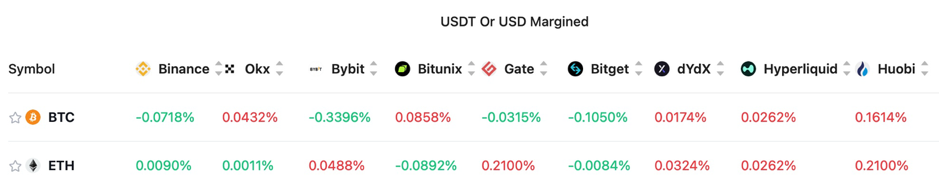

The 7-day cumulative funding rates for BTC and ETH on the top 8 exchanges are -0.2139% and 0.4197%, respectively. This marks the first negative BTC rate in nearly a year, indicating that many investors now believe the current bull market may be over. However, ETH and mid-to-small-cap altcoins still hold expectations for a catch-up rally.

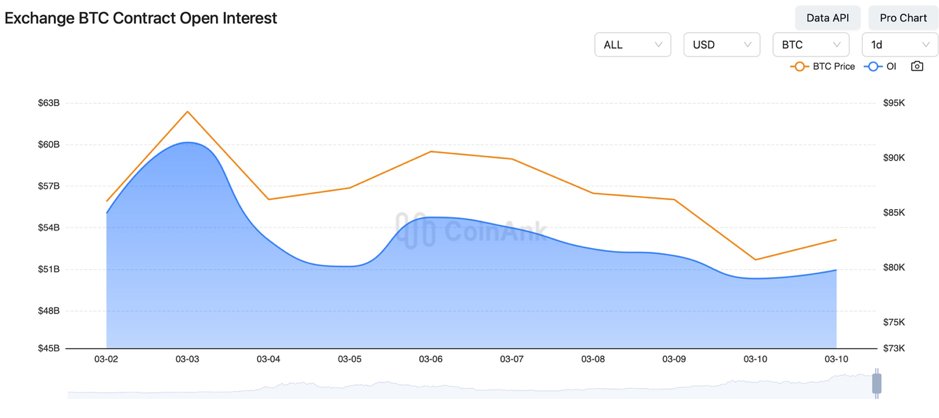

Exchange BTC Contract Open Interest:

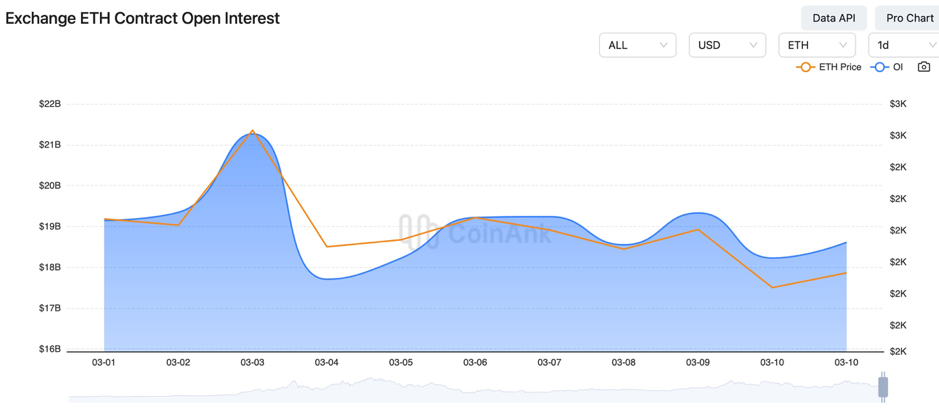

Exchange ETH Contract Open Interest:

Over the past four days, BTC contract open interest has declined, while ETH contract open interest has increased. This suggests that high-risk appetite market participants largely believe the current bull market may be over, but expectations for a catch-up rally in ETH and mid-to-small-cap altcoins remain.

4. Global Economic and Crypto Sector Developments

Macroeconomic Data:

1) On March 6, PBOC Governor Pan Gongsheng stated that China would cut RRR and interest rates when appropriate this year and optimize tech innovation and tech upgrade re-lending policies, expanding the re-lending quota to RMB 800 billion–1 trillion.

2) On March 6, U.S. initial jobless claims for the week ending March 1 was 221K (forecast: 235K, previous: 242K).

3) On March 6, the Eurozone’s Q4 seasonally adjusted employment rose 0.1% QoQ (in line with forecasts, unchanged from the previous reading), while the revised Q4 GDP YoY stood at 1.2% (above the 0.9% forecast and previous estimate).

4) On March 6, the Eurozone deposit facility rate was 2.5% (matching forecasts, down from 2.75%), while the main refinancing rate stood at 2.65% (in line with expectations, down from 2.90%).

5) On March 7, the ECB cut rates by 25bps as expected, signaling the easing cycle may be nearing its end, stating that policy restrictiveness has decreased.

6) On March 7, U.S. nonfarm payrolls for December and January were revised down by a total of 2K.

7) On March 7, U.S. February nonfarm payrolls increased by 151K, slightly missing market expectations, while the unemployment rate rose to 4.1%, the highest since November 2024.

8) On March 7, Canada’s February employment change came in at 1.1K (forecast: 20K, previous: 76K).

9) On March 8, traders still expected the Fed to cut rates by around 75bps this year, with 25bps cuts in June, September, and December, respectively.

10) On March 8, Nasdaq planned to offer 24-hour trading on its stock exchange.

11) On March 8, PBOC increased gold reserves for the fourth consecutive month.

12) On March 9, China’s February CPI YoY was -0.7% (forecast: -0.5%, previous: 0.5%).

13) On March 9, the former Fed Chair stated that Central banks would face increasing difficulty in controlling inflation in the future.

14) On March 9, it was noted that next Wednesday, ECB President Lagarde will speak at the ECB and Its Watchers Conference; the Bank of Canada will announce its rate decision; and the U.S. will release February unadjusted CPI YoY, seasonally adjusted CPI MoM, core CPI MoM, and unadjusted core CPI YoY.

15) On March 9, it was noted that next Thursday, the U.S. will release February PPI. Additionally, U.S. government funding expires on March 15 (next Saturday); if Congress and the Trump administration fail to reach an agreement, a government shutdown is widely expected.

Cryptocurrency Industry Updates:

1) On March 6, Silk Road founder Ross Ulbricht appeared at a U.S. congressional joint session after receiving clemency.

2) On March 6, Kyrgyzstan leveraged a gold-backed stablecoin to advance its national blockchain strategy.

3) On March 6, Angola cracked multiple cryptocurrency mining cases involving Chinese nationals.

4) On March 6, FTX creditor representative Sunil posted on social media that Kraken has begun emailing FTX users, confirming the next FTX payout distribution is scheduled for May 30, 2025.

5) On March 7, an Indian town adopted Avalanche blockchain to store 700,000 land records, ensuring transparency and tamper resistance.

6) On March 7, the U.S. Secret Service seized the domain of Russian crypto exchange Garantex and froze its assets.

7) On March 7, cryptocurrency scams accounted for one-fourth of Singapore’s total fraud-related losses last year.

8) On March 7, Bitwise launched a Bitcoin-Gold hybrid ETP, now listed in Europe.

9) On March 8, Japan proposed classifying cryptocurrency as a new asset class instead of securities regulation, with the ruling party suggesting a tax cap reduction to 20%, aligning with stock investments.

10) On March 8, Trump signed an executive order to establish a strategic Bitcoin reserve, stating that taxpayer money will not be used for additional Bitcoin purchases.

11) On March 8, a Coinbase executive stated that Trump’s latest executive order is expected to reduce $18 billion in Bitcoin sell pressure.

12) On March 8, South Korea’s FSC chairman announced plans to accelerate the drafting of the second-phase crypto legislation.

13) On March 8, at the White House Crypto Summit, Trump reaffirmed that taxpayer funds will not be used to acquire digital assets and advised, “Never sell your Bitcoin.”

14) On March 9, the U.S. Office of the Comptroller of the Currency confirmed that federal banks could engage in crypto custody and certain stablecoin activities.

15) On March 9, a darknet market wallet holding over $400 million in Bitcoin was reactivated after nine years of dormancy.

16) On March 9, Rich Dad Poor Dad author Robert Kiyosaki warned of an imminent stock market crash and advised investing in Bitcoin, gold, and silver.

17) On March 9, Grayscale removed the phrase “world’s largest Ethereum fund” from its official website.

Regulatory Updates:

1) On March 6, New York state lawmakers introduced a new bill to criminalize crypto fraud schemes like “pump-and-dump” scams.

2) On March 6, Trump expressed his hope for stablecoin legislation to pass in the U.S. by August.

3) On March 7, Brazil’s postal service sought blockchain and AI solutions.

4) On March 7, ECB insiders indicated that the likelihood of pausing rate cuts in April is increasing, though further reductions remain possible, with 2.5% unlikely to be the cycle’s bottom.

5) On March 8, Bank of England MPC member Mann stated that interest rates need to remain restrictive while assessing inflation persistence.

6) On March 8, U.S. Treasury Secretary Benset affirmed no change in the strong dollar policy, noted ongoing developments in the Ukraine agreement, and stated that future Bitcoin acquisitions will be monitored. He also announced an end to regulatory crackdowns on crypto assets and a commitment to exploring stablecoin frameworks to uphold the U.S. dollar’s reserve currency dominance.

7) On March 9, China’s NPC Standing Committee work report outlined plans to draft financial and childcare service laws while strengthening legislative research in emerging fields such as AI.

8) On March 9, the White House declared that the U.S. aims to become the world’s Bitcoin superpower.

Other News:

1) On March 7, Manus referral codes were resold for as much as ¥100,000. Manus AI partner Zhang Tao clarified the invite system and promotions, stating that the company will focus on product development in the short term.

2) On March 9, daylight saving time began in North America.

5. Market Outlook

From March 10 to March 12, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively.

For the ETH spot, sell orders are placed at $5,125, while dip-buy orders are set at $1,730.

The U.S. federal-level Bitcoin Strategic Reserve Act still requires congressional approval and will take some time. This bull market is not over yet, so there’s no need for excessive panic.

Risk Reminder: The cryptocurrency market is highly volatile, and investors are advised to control their positions and implement stop-loss strategies. The above content is for reference only and does not constitute specific investment advice from this exchange.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.