FameEX Weekly Market Trend | March 17, 2025

2025-03-17 12:34:35

1. Key Insights on Crypto Market Trends

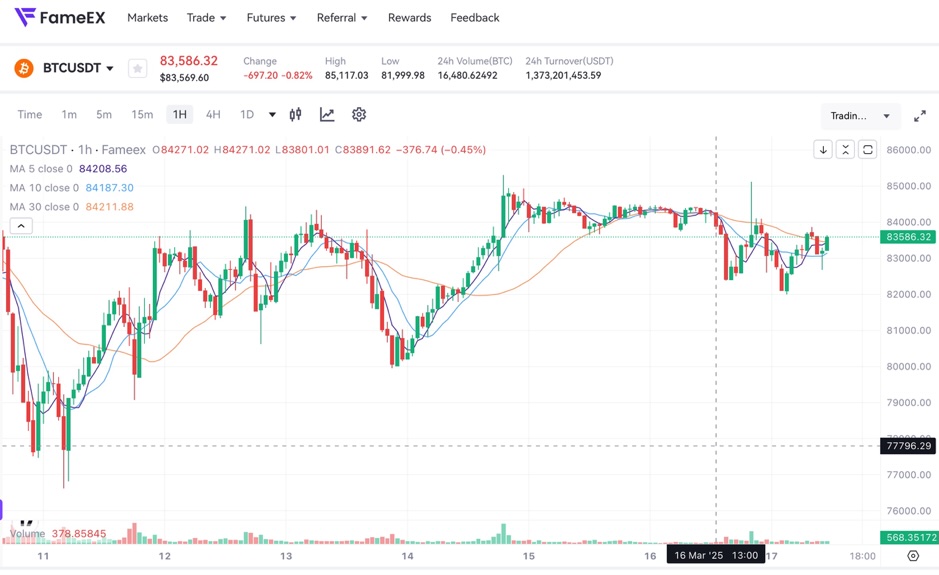

From March 13 to March 16, the BTC spot price swung from $80,015 to $85,142.52, a 6.41% range. In recent days, key statements from the European Central Bank (ECB) were as follows:

1) On March 14, ECB Governing Council member Escriva stated that the April rate decision is not yet clear and all options should remain open.

2) On March 14, ECB Governing Council member Holzmann expressed support for pausing rate cuts in April, citing persistent inflation risks.

Overall, based on recent statements from ECB officials, Holzmann is likely not the only one supporting a pause in rate cuts this April.

Recently, multiple phishing scams involving fake Binance SMS messages have emerged in Hong Kong. In response, the Hong Kong Securities and Futures Commission (SFC) stated that under the Securities and Futures Ordinance and the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, it is a criminal offense to operate regulated activities or provide virtual asset services in Hong Kong without a license, as well as to actively promote such services to Hong Kong investors from within or outside the region. The SFC emphasized that it will take appropriate action against any violations without hesitation but will not comment on individual cases. Investors are reminded to trade virtual assets only on platforms licensed by the SFC. (Source: Hong Kong Wen Wei Po)

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

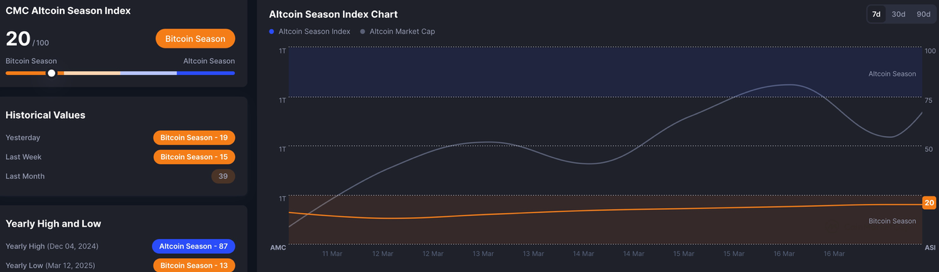

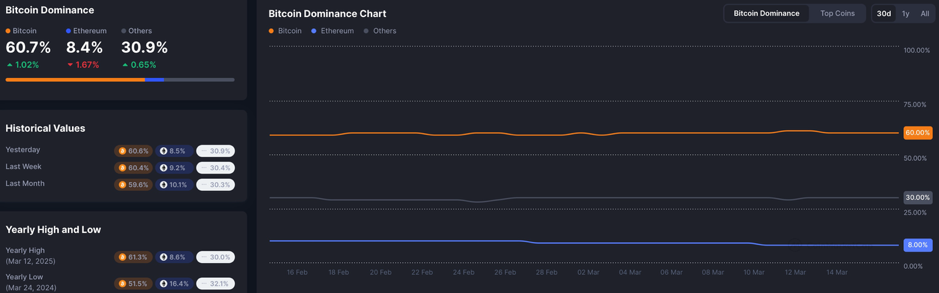

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

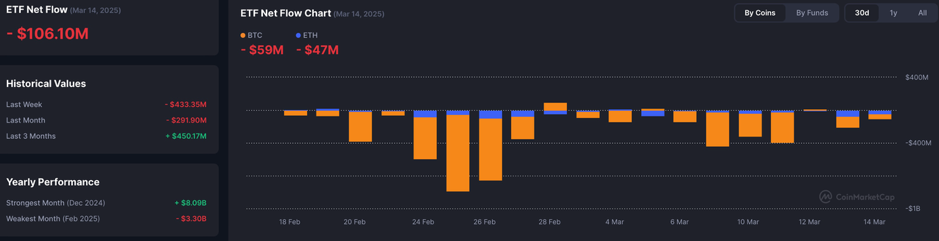

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

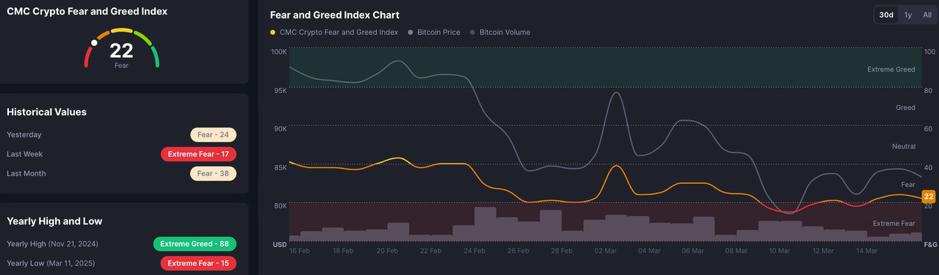

Fear & Greed Index, source: https://coinmarketcap.com/charts/

Over the past four days, the total cryptocurrency market cap, trading volume, and market activity have slightly rebounded. The altcoin season index indicates overall choppy gains in altcoin prices, while Bitcoin’s market dominance remains largely unchanged.

ETF outflows continue, suggesting market confidence has yet to fully recover. Meanwhile, the prices of major cryptocurrencies and large-cap altcoins are also experiencing choppy gains. The current Fear & Greed Index stands at 22, hovering near recent lows.

3. Perpetual Futures

The 7-day cumulative funding rates for BTC and ETH on the top 8 exchanges are 0.6429% and 0.2934%, respectively, indicating a strong bullish sentiment across the market, with investors generally believing that the bull run is not over yet.

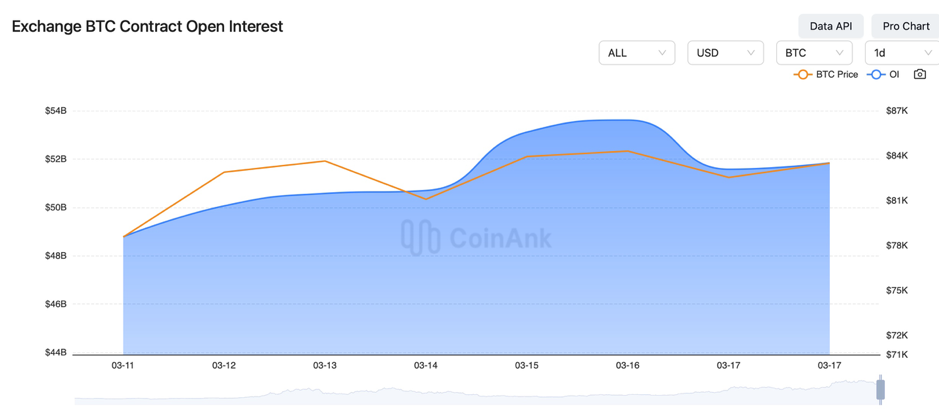

Exchange BTC Contract Open Interest:

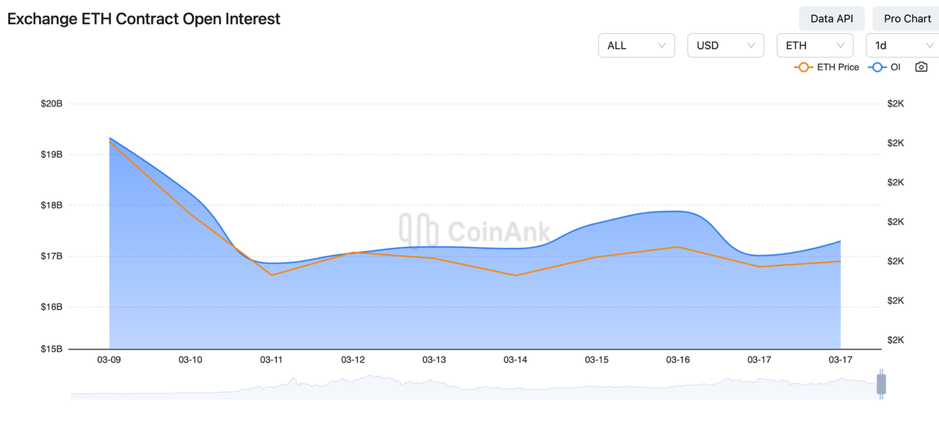

Exchange ETH Contract Open Interest:

Over the past four days, the open interest in the BTC and ETH contracts has increased, indicating that high-risk appetite market participants are optimistic about the short-term outlook, with a rising speculative sentiment.

4. Global Economic and Crypto Sector Developments

Macroeconomy

1) On March 13, U.S. initial jobless claims for the week ending March 8 were 220,000, expected 225,000, with the previous figure revised from 221,000 to 222,000.

2) On March 13, U.S. February PPI MoM was 0%, expected 0.3%, with the previous figure revised from 0.4% to 0.6%, marking the smallest increase since July 2024. February PPI YoY was 3.2%, expected 3.3%, with the previous figure revised from 3.5% to 3.7%.

3) On March 13, the WTO indicated that early 2025 global trade outlook remains largely unchanged, but trade policy uncertainty persists.

4) On March 14, spot gold made a historic intraday breakthrough, surpassing the $3,000/oz key level.

5) On March 14, China’s February M2 money supply YoY was 7%, in line with expectations and the previous reading.

6) On March 15, White House economic advisor Hassett stated that the U.S. Q1 GDP growth is expected to be between 2% and 2.5%.

7) On March 15, according to PBoC data, as of end-February, the M2 money supply was ¥320.52 trillion (up 7% YoY), the M1 money supply was ¥109.44 trillion (up 0.1% YoY), and the M0 money supply was ¥13.28 trillion (up 9.7% YoY).

8) On March 16, next Wednesday, Japan's central bank target rate (as of March 19) and the Eurozone's final February CPI YoY and MoM will be released.

9) On March 16, next Thursday, the U.S. Federal Reserve’s interest rate decision (as of March 19), the UK’s February unemployment rate, UK jobless claims, the Bank of England’s interest rate decision (as of March 20), U.S. initial jobless claims (as of March 15), the Federal Reserve FOMC’s interest rate decision and economic outlook summary will be released, and Fed Chair Powell will hold a monetary policy press conference.

Cryptocurrency Industry Updates:

1) On March 13, China Banknote Printing and Minting Corporation stated that it has never issued or sold any virtual currency.

2) On March 13, Circle planned to bring Hashnote’s tokenized money market fund under Bermuda’s regulatory framework; BNY Mellon will allow certain clients to send and receive funds with Circle to support stablecoin transactions.

3) On March 13, the Trump family held talks regarding acquiring shares in Binance.US.

4) On March 14, according to @tier10k’s latest statement, previous reports about the Trump memecoin were false, and the account may have been hacked.

5) On March 14, an analysis suggested that the ETH/BTC exchange rate could drop another 30%, with fundamental factors also supporting a bearish outlook.

6) On March 15, Indian Web3 startups raised $564 million in 2024, with the fastest-growing developer community globally.

7) On March 15, a U.S. court approved Three Arrows Capital’s $1.53 billion claim against FTX.

8) On March 15, a report highlighted that fears of tariffs caused a 20% drop in crypto trading volume in February.

9) On March 16, several crypto project founders reported large-scale fake Zoom meeting attack attempts by North Korean hackers.

10) On March 16, publicly listed companies’ Bitcoin holdings doubled in 2024, surpassing the total accumulation of the previous five years.

Regulation & Crypto Policy:

1) On March 13, six out of 22 members of Trump’s cabinet held Bitcoin assets.

2) On March 13, Warren warned that passing the stablecoin bill could help Musk “control” the financial system.

3) On March 14, Aleksej Bešciokov, a co-founder of the sanctioned crypto exchange Garantex, was arrested in India for alleged involvement in a transnational money laundering case.

4) On March 14, a Massachusetts lawmaker proposed the establishment of a special committee on blockchain and cryptocurrency.

5) On March 15, Nebraska passed a new Bitcoin ATM bill, declaring an “open for business” stance on cryptocurrency.

6) On March 15, senior Democratic officials pressured the Treasury Department to halt Trump’s strategic Bitcoin reserve plan.

7) On March 16, Turkey introduced new regulations to tighten cryptocurrency oversight, posing challenges for local exchanges and investors.

8) On March 16, the U.S. Treasury met with crypto custodians to discuss Bitcoin reserve management strategies.

Other News:

1) On March 13, Douyin Search App launched “Deep Thinking”, and Alibaba introduced its AI flagship application, New Quark.

2) On March 14, Trump signed an executive order seeking to further downsize U.S. federal agencies.

5. Market Outlook

From March 17 to March 19, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively.

For the ETH spot, sell orders are placed at $5,125, while dip-buy orders are set at $1,730.

The U.S. federal-level Bitcoin Strategic Reserve Act still requires congressional approval and will take some time. This bull market is not over yet, so there’s no need for excessive panic.

Risk Reminder: The cryptocurrency market is highly volatile, and investors are advised to control their positions and implement stop-loss strategies. The above content is for reference only and does not constitute specific investment advice from this exchange.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.