ENA (Ethena) Token Price & Latest Live Chart

2024-05-13 10:56:20

What is ENA (Ethena)?

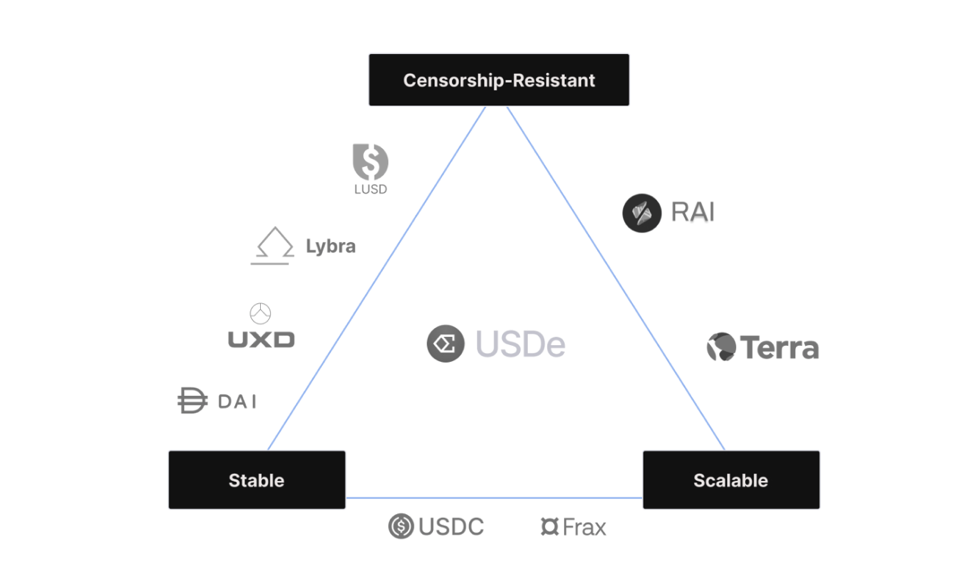

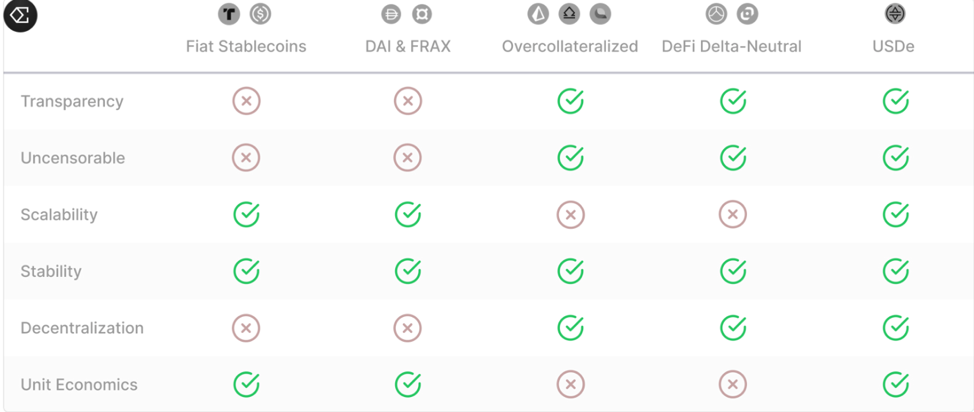

Ethena (ENA) represents a significant advancement in the field of decentralized finance (DeFi), launched on the Ethereum blockchain. Unlike conventional stablecoins tethered to fiat currencies through traditional banking mechanisms, ENA pioneers a synthetic USD protocol, termed USDe. This protocol is crafted to function independently of established financial infrastructures, employing cryptocurrency assets and derivative financial instruments as backing instead of traditional currency reserves.

The foundational goal of Ethena is to address one of the glaring vulnerabilities in the cryptocurrency sector such as the dependency of stablecoins on centralized financial systems. While cryptocurrencies were envisioned as decentralized and autonomous digital assets, their potential is often hamstrung by the integration with and reliance on conventional financial institutions. This reliance introduces multiple potential points of failure, including regulatory pressures and custodial risks, which could undermine the stability and integrity of these digital assets. Ethena's approach is revolutionary in that it eschews these traditional dependencies, aiming instead to create a truly decentralized financial system that is resilient, scalable, and independent. By doing so, Ethena seeks to lay a robust foundation for a new financial ecosystem that remains unaffected by the inefficiencies and instabilities of conventional financial systems.

Existing Stablecoins Challenges, Source: ENA whitepaper

At the heart of Ethena's innovation is the creation of USDe, a synthetic dollar that leverages crypto assets for collateralization. This system does not simply mimic the dollar's value but actively maintains its stability through sophisticated financial engineering techniques such as delta hedging. Delta hedging involves taking offsetting positions in derivatives to neutralize the price risk associated with the collateral assets. This method is critical in ensuring that USDe remains stable despite the inherent volatility of the cryptocurrency markets.

How does ENA (Ethena) work?

The process of creating USDe begins with the user interfacing with Ethena's Pricing API, which provides a real-time price quote for the amount of USDe to be minted. Users submit a request, which upon validation, triggers the creation of USDe tokens corresponding to the collateral deposited. This collateral typically consists of cryptocurrencies such as Ethereum or Bitcoin, which are then delta-hedged through corresponding short positions in futures markets to mitigate price volatility. The entire minting process is designed to be transparent and trustless, leveraging both on-chain mechanisms and off-chain computations to optimize efficiency and security. This hybrid approach ensures that while the system benefits from the robustness of blockchain technology, it also retains the flexibility and speed of traditional financial systems through controlled off-chain processes.

Users can mint USDe with Ethena either through the user interface or via an API. Whitelisted users, such as approved market makers, can request to mint USDe by selecting a backing asset like stETH, entering the amount they wish to use for minting, and viewing the amount of USDe they will receive. After agreeing to the amount, users sign an EIP712 style signature specifying the backing asset, backing amount, and USDe amount they will receive. Ethena then validates the request and submits the transaction to the blockchain. Upon successful confirmation, the user's chosen backing asset is atomically swapped for the agreed amount of USDe. Non-whitelisted users can exchange stablecoins for USDe via external liquidity pools available through the UI, which are routed using MEV protection through CowSwap to various onchain liquidity pools. This process abstracts away the complexity for all users and triggers an opportunity for market makers to proceed with the mint workflow.

Users of Ethena can also engage in staking their USDe tokens. By depositing USDe into a specially designed smart contract, users receive staked USDe (sUSDe), which accrues rewards over time based on the protocol’s yield-generation activities. These activities primarily include staking the collateral assets in other DeFi protocols or engaging in derivative trading strategies to generate income. This staking mechanism not only provides users with a passive income stream but also contributes to the overall stability of USDe by locking in a portion of its supply, thus reducing circulation and potential volatility.

Ethena incorporates rigorous risk management protocols to ensure the safety and stability of its operations. This includes continuous monitoring of the positions taken for delta hedging, regular stress testing of the protocol under various market conditions, and dynamic adjustments to collateral requirements based on prevailing market volatility. Furthermore, ENA token, the governance token of the Ethena protocol, plays a crucial role in the decentralized governance of the project. Token holders can propose and vote on changes to the protocol, including adjustments to risk parameters, fee structures, and even the introduction of new features or products. This democratic governance structure ensures that Ethena remains aligned with the interests of its users and adapts effectively to the evolving DeFi landscape.

ENA (Ethena) market price & tokenomics

The ENA token serves multiple purposes within the Ethena ecosystem, primarily focusing on governance and incentivization. A significant portion of ENA tokens has been allocated for distribution through community engagement initiatives such as airdrops and participation rewards, designed to foster a robust and active community around the protocol. Ethena's tokenomics model is structured to balance long-term value accrual with immediate utility. The total supply of ENA tokens is capped, creating a scarcity that can potentially drive up value as the demand for participation in governance and other protocol activities increases. Moreover, the distribution strategy includes mechanisms such as vesting periods and staggered releases to ensure that the tokens are held by committed participants who are aligned with the protocol’s long-term success. As of now, ENA (Ethena) is ranked #72 by CoinMarketCap with market capitalization of $1,124,487,047 USD. The current circulating supply of ENA coins is 1,425,000,000.

Why do you invest in ENA (Ethena)?

Investing in ENA represents an opportunity to be part of a pioneering financial system that seeks to redefine how money is conceptualized and utilized in a digital age. Ethena's approach to creating a synthetic dollar free from traditional financial constraints offers a unique investment proposition that aligns with broader trends towards decentralization and financial sovereignty. Given the innovative nature of the protocol and its potential to capture a significant share of the DeFi market, ENA holds promise for substantial appreciation. Additionally, the yield-generating mechanisms and the potential for governance-driven value accrual provide multiple avenues for investment returns.

As the cryptocurrency market continues to evolve and expand, protocols like Ethena that offer foundational financial services in a decentralized format are well-positioned to benefit. Investing in ENA could be seen as a strategic move to capitalize on the growth of the DeFi sector and the broader adoption of blockchain technology in financial services.

Is ENA (Ethena) a good Investment?

The potential of ENA as an investment hinges on several factors, including the adoption of USDe as a stable and widely used currency, and the overall growth of the cryptocurrency and DeFi markets. While the innovative aspects and the strong governance model of Ethena bode well for its future, potential investors should also consider the inherent risks associated with cryptocurrency investments, including volatility, regulatory changes, and market sentiment.

Ultimately, investing in ENA offers a blend of exposure to cutting-edge financial technology and participation in a dynamic and potentially transformative financial ecosystem. As with any investment, due diligence and a clear understanding of risk tolerance are crucial.

Find out more about ENA (Ethena):

Explorer: Etherscan