PAXG (PAX Gold)

2022-12-15 04:07:35

Pax Gold (PAXG) is a type of cryptocurrency that is pegged to the price of gold at a 1:1 ratio. This means that if the price of gold changes, the value of PAXG will also change in accordance with the price of gold.

Introduce

In recent years, new methods of investing have emerged, such as non-fungible tokens (NFTs) and cryptocurrencies. However, physical investments have been around for thousands of years. Gold, for example, has been a valuable investment since ancient times. It is often purchased in large quantities during times of war and economic uncertainty because of its anti-inflationary properties.

However, for individual investors, buying physical gold can be inconvenient. It often requires storage in a secure vault and can be difficult to transport due to its weight. These challenges can be costly and time-consuming, making it difficult for some investors to access the benefits of gold as an investment.

Therefore, Pax gold (PAXG) , a virtual currency whose value is tied to the price of gold. When the value of gold fluctuates, so does the value of PAXG. This offers investors the benefits of gold without the inconvenience of physical storage and transportation.

What is PAXG?

Paxos Gold (PAXG) is a digital asset that is backed by physical gold reserves held by Paxos, a for-profit company based in New York. Each PAXG token is equivalent to one fine troy ounce of a London Good Delivery gold bar, which is stored in professional vault facilities. This means that the value of PAXG is linked to the value of a 1:1 ratio of one troy ounce of a 400-ounce London Good Delivery gold bar stored at Brinks Security vaults in London.

Additionally, PAXG is backed by the London Bullion Market Association (LBMA), which ensures that PAXG tokens can be converted into physical gold bullion.

As an ERC-20 stablecoin, PAXG is built on the Ethereum blockchain, which allows it to be easily exchanged for other cryptocurrencies and securely stored by its owners using cryptographic keys.

Financial Supervision

Pax Gold (PAXG) is now supported by physical gold reserves that are securely held in Brinks vaults and administered by the Paxos Trust Company. This ensures that the value of PAXG is directly linked to the value of physical gold and provides added security for PAXG token holders. To ensure that these reserves are always maintained, Paxos undergoes monthly audits to confirm that the token supply of PAXG is equal to the amount of gold in its custody. This ensures that PAXG token holders can exchange their tokens for physical gold bullion at any time, if they choose to do so.

In addition, the total supply of gold that represents PAXG is dynamic and can fluctuate based on the market capitalization of PAXG. This means that the amount of gold backing PAXG can increase or decrease as the market value of PAXG changes.

In the Beginning of PAXG

The Paxos Trust Company, a financial technology firm based in New York City, was founded in 2012 by Charles Cascarilla and Rich Teo. The company specializes in blockchain technology and has a strong focus on creating stablecoins. In 2019, Paxos launched Pax Gold (PAXG), which is a digital asset that is backed by physical gold reserves.

In addition to PAXG, Paxos has also developed Pax Dollar (USDP), which is a stablecoin pegged to the value of the US dollar. USDP is the first stablecoin to be approved by the New York Department of Financial Services (NYDFS) and is regulated by the US government.

How Does PAXG Work?

Pax Gold (PAXG) is an ERC-20 stablecoin that runs on the Ethereum blockchain. This means that PAXG is compatible with Ethereum-based wallets and can be easily integrated with decentralized finance (DeFi) and decentralized exchange (DEX) platforms on Ethereum. Additionally, PAXG can be traded on cryptocurrency exchanges such as FAMEEX.

Compared to owning physical gold assets, owning PAXG eliminates the need for storage and custody fees. Paxos charges a small fee (around 0.02% of the amount of PAXG sent on the blockchain) for the creation and destruction of PAXG tokens. Users may also need to pay on-chain fees for trading on Ethereum, but these fees are generally lower than the costs associated with owning physical gold.

Paxos conducts regular audits and investigations of PAXG transactions using third-party analytics tools to ensure the security and integrity of the PAXG ecosystem. This includes analyzing code to identify potential bugs and security vulnerabilities, as well as checking for potential scams and money laundering.

Compare To Other Gold Asset

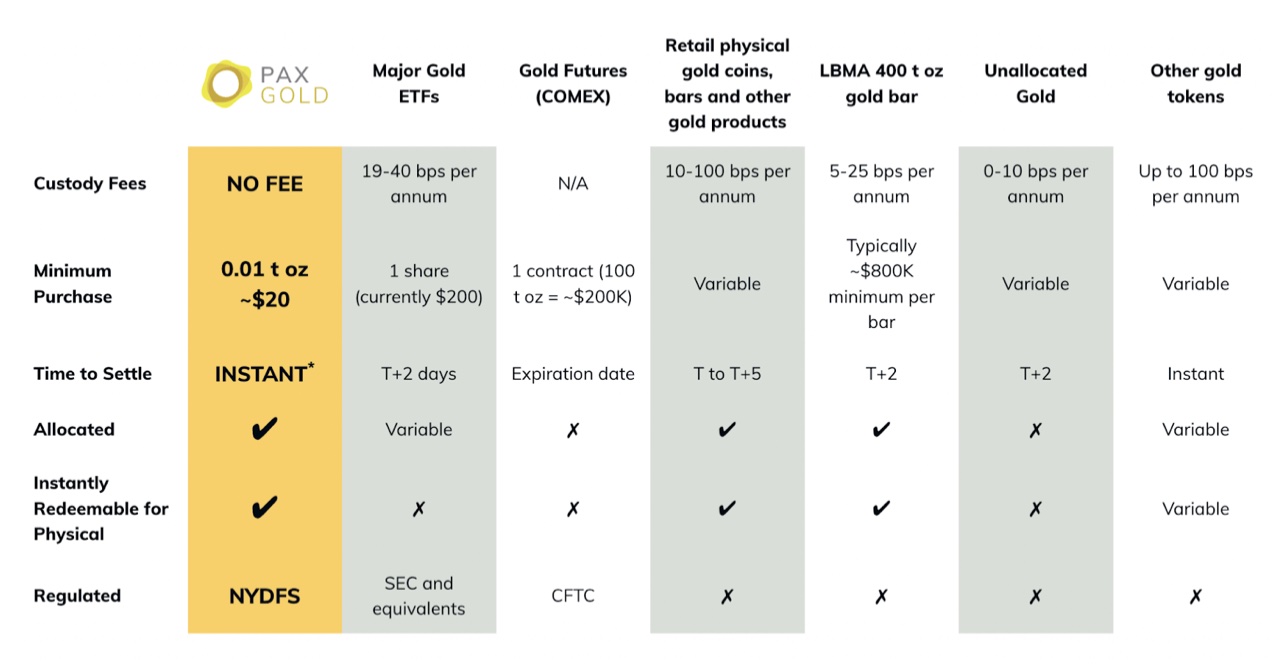

Pax Gold (PAXG) offers many advantages compared to other gold assets, such as no fees, easier storage and transferability, and the ability to be integrated with decentralized finance (DeFi) platforms.

Why is PAXG Worth It?

There are several reasons why investing in Pax Gold (PAXG) is worthwhile. Firstly, unlike physical gold, PAXG can be divided into smaller units, making it easy to transfer and store. This makes PAXG more accessible and affordable for investors.

Secondly, PAXG is pegged to the price of gold, which means that its value will remain stable even if the broader cryptocurrency market is volatile. This makes PAXG a good investment option during periods of market uncertainty.

Overall, PAXG combines the best features of physical and digital assets. It has the divisibility, fungibility, and tradability of a digital asset like Bitcoin, but is also backed by real gold reserves. This makes PAXG an attractive investment option for those seeking the benefits of both the gold and cryptocurrency markets.

Important PAXG Gold (PAXG) links: