Futures Order Type Introduction

2023-08-29 11:42:06FameEX supports the following order types:

Limit

Market

Trigger

Post only

Take-profit and stop-loss (TP/SL) (one-way and hedge modes)

Reduce-only (one-way mode)

1. Limit Order

A limit order refers to when a user sets the order amount and specifies the maximum buy price or minimum sell price they are willing to accept. The limit order will only be executed when the opposing orders in the market match the specified price range.

Note:

(1) The buy price of a limit order cannot exceed 110% of the last price, and the sell price cannot be less than 90% of the last price.

(2) The actual execution price of a limit buy order will not surpass the order price. In addition, the actual execution price of a limit sell order will not be lower than the order price.

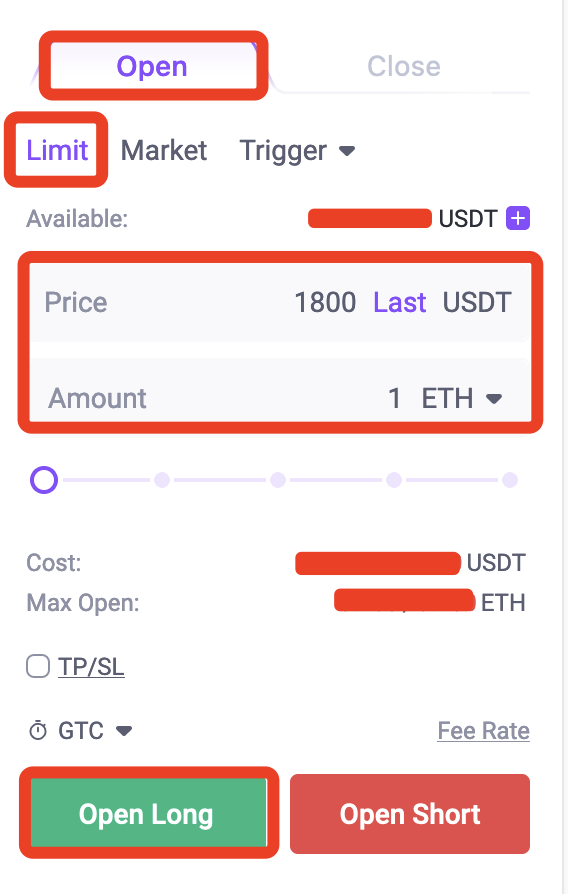

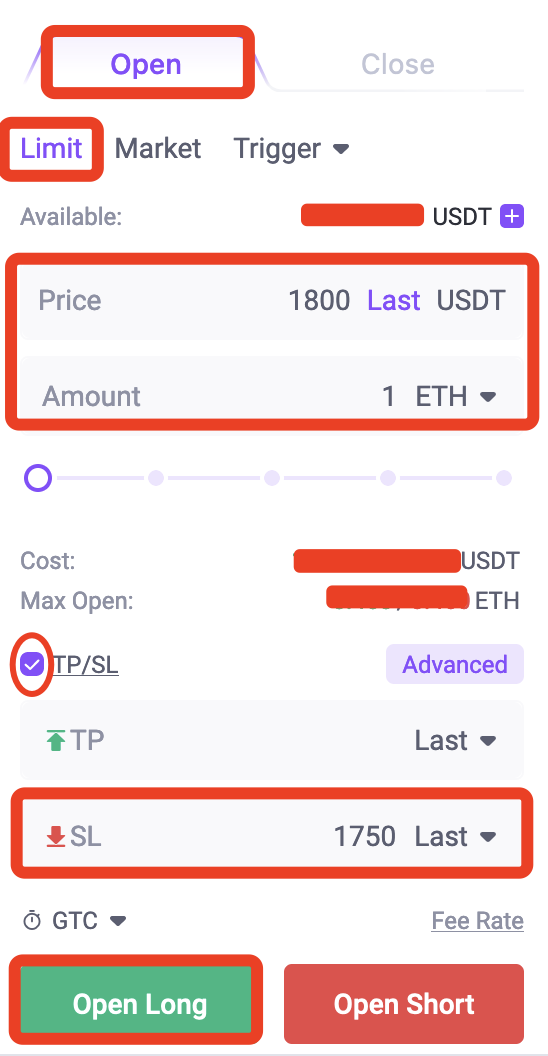

For example, you are trading in the ETHUSDT perpetual futures zone under the hedge mode, and the latest price of ETH is 1900 USDT. If you want to open a long position of 1 ETH when the market price drops to 1800 USDT, you can place a limit order.

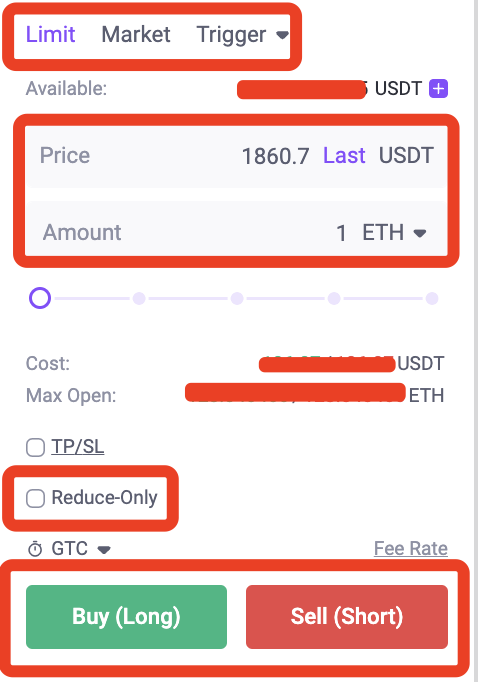

Select [Limit] on the trading page, enter the order price of 1800 and the order amount of 1, and click [Open Long].

2. Market Order

A market order is to instantly buy or sell positions at the prevailing market price for quick execution

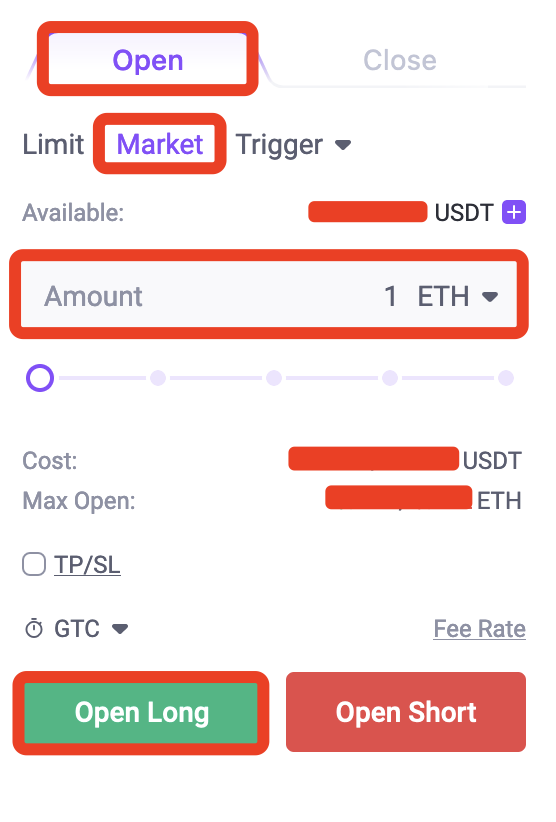

For example, you are trading in the ETHUSDT perpetual futures zone under the hedge mode, and the latest price of ETH is 1900 USDT. If you want to open a long position of 1 ETH at the price of 1900 USDT as soon as possible, you can place a market order.

Select [Market] on the trading page, enter the order amount of 1, and click [Open Long].

3. Trigger Order

If the market price reaches the preset trigger condition, the system will place the order with the preset order price and amount.

Trigger price: This term refers to the preset condition under which an order will be triggered. It’s available to select the index, last, or mark price as the trigger price.

Order price: Once the trigger price is triggered, the system will place the order at the designated order price. It is available to select the limit or market price as the order price.

Order amount: The system will place the order with this amount after the trigger order is activated. It is available to switch between the base and quote coins.

Note: Your assets will not be frozen until the trigger order is triggered. If there are insufficient assets when triggered, the order will be canceled.

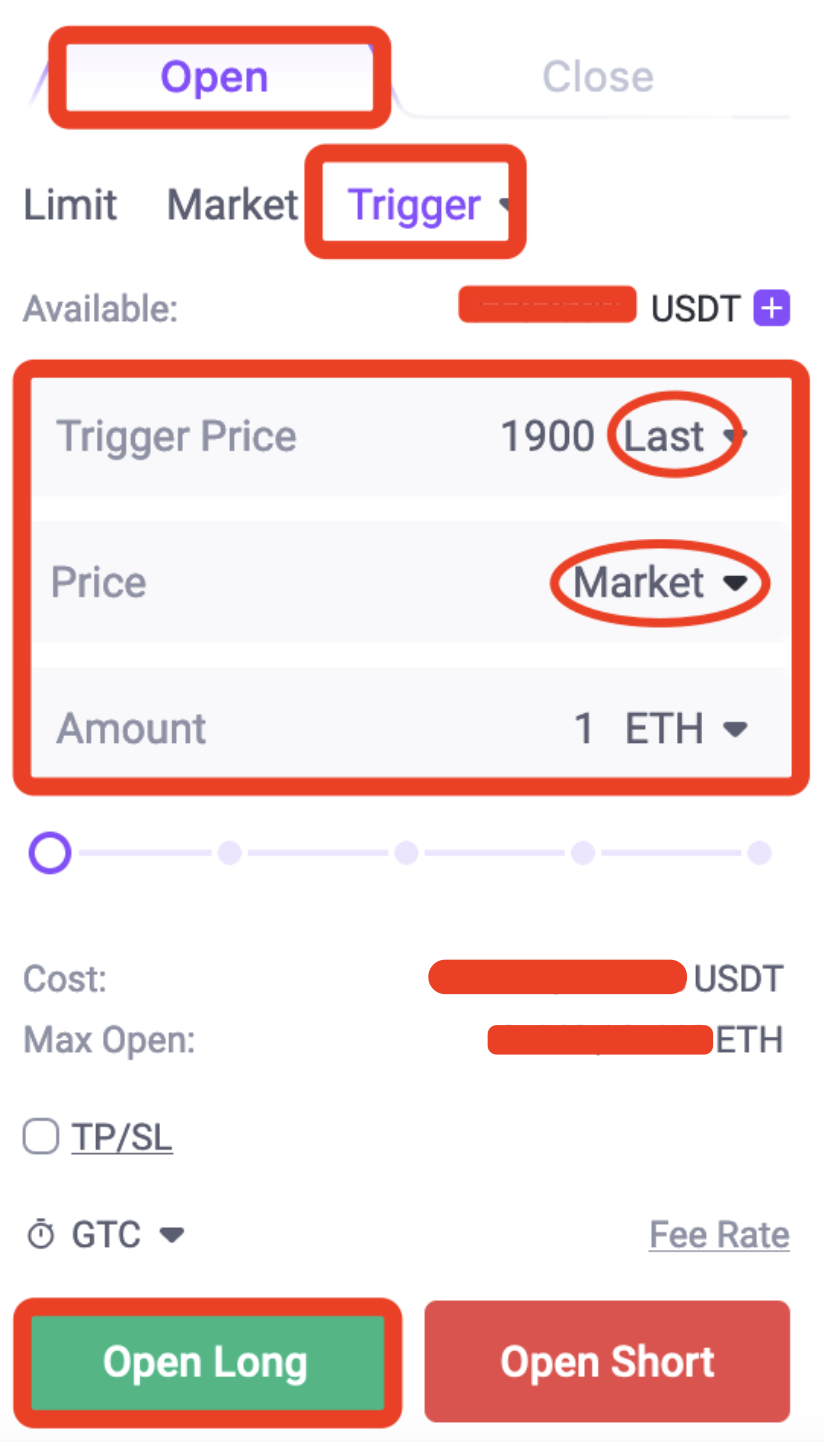

For example, you are trading in the ETHUSDT perpetual futures zone under the hedge mode, and the latest price of ETH is 1850 USDT. If you want to open a long position of 1 ETH when the market price surges to around 1900 USDT, you can place a trigger order.

Select [Trigger] on the trading page, enter a trigger condition of 1900 and an order price (market or limit price) into Trigger Price and Price input boxes respectively, and set up the order amount to 1 in the Amount input box. Then, click [Open Long].

4. Post Only Order

Post Only orders will be added to the order book and not be executed in the market immediately. If a Post Only order matches with an existing order, it will be canceled, ensuring that the user will always act as a Maker.

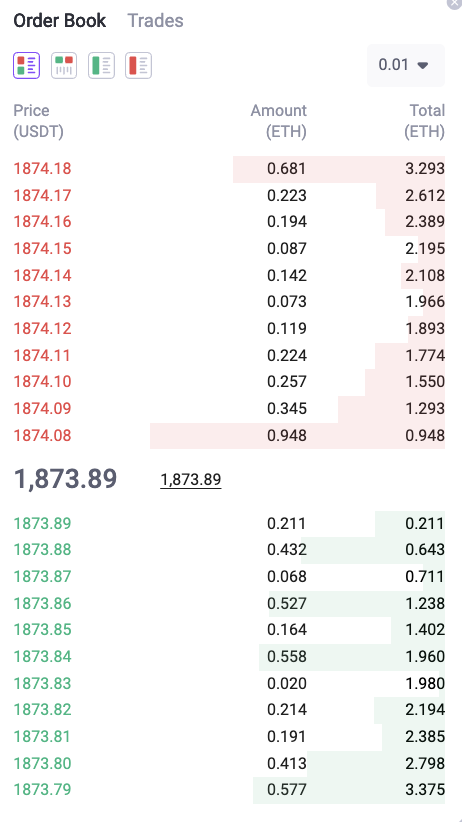

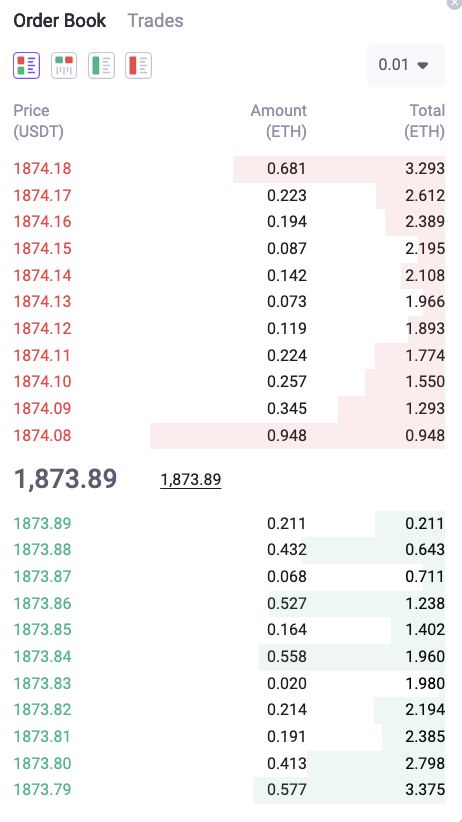

For example, if you are trading in the ETHUSDT perpetual futures zone under the hedge mode, the current order book will be displayed as follows:

If you wish to enjoy the maker fee rate, you can select “Post Only” when placing an order. For example, if you buy 0.1 ETH at a price of 1873.80 USDT, and the order will not be executed immediately in the market, it will be successfully placed in the order book. However, if you buy 0.1 ETH at a price of 1874.20 USDT, and the order will immediately match with the best ask price, the order will be canceled.

5. TP/SL Order

A TP/SL order is a closing order that allows traders to set predetermined trigger conditions (take-profit or stop-loss price) and order prices. It can be categorized into one-way TP/SL and hedge TP/SL.

(1) One-way TP/SL

One-way TP/SL is an order strategy that involves setting a take-profit or stop-loss price in a single direction. In the use of one-way TP/SL, when the market price reaches the preset trigger price, the system will automatically place the order according to the preset order price (take-profit or stop-loss price) and amount. This allows for a single-direction take-profit or stop-loss approach.

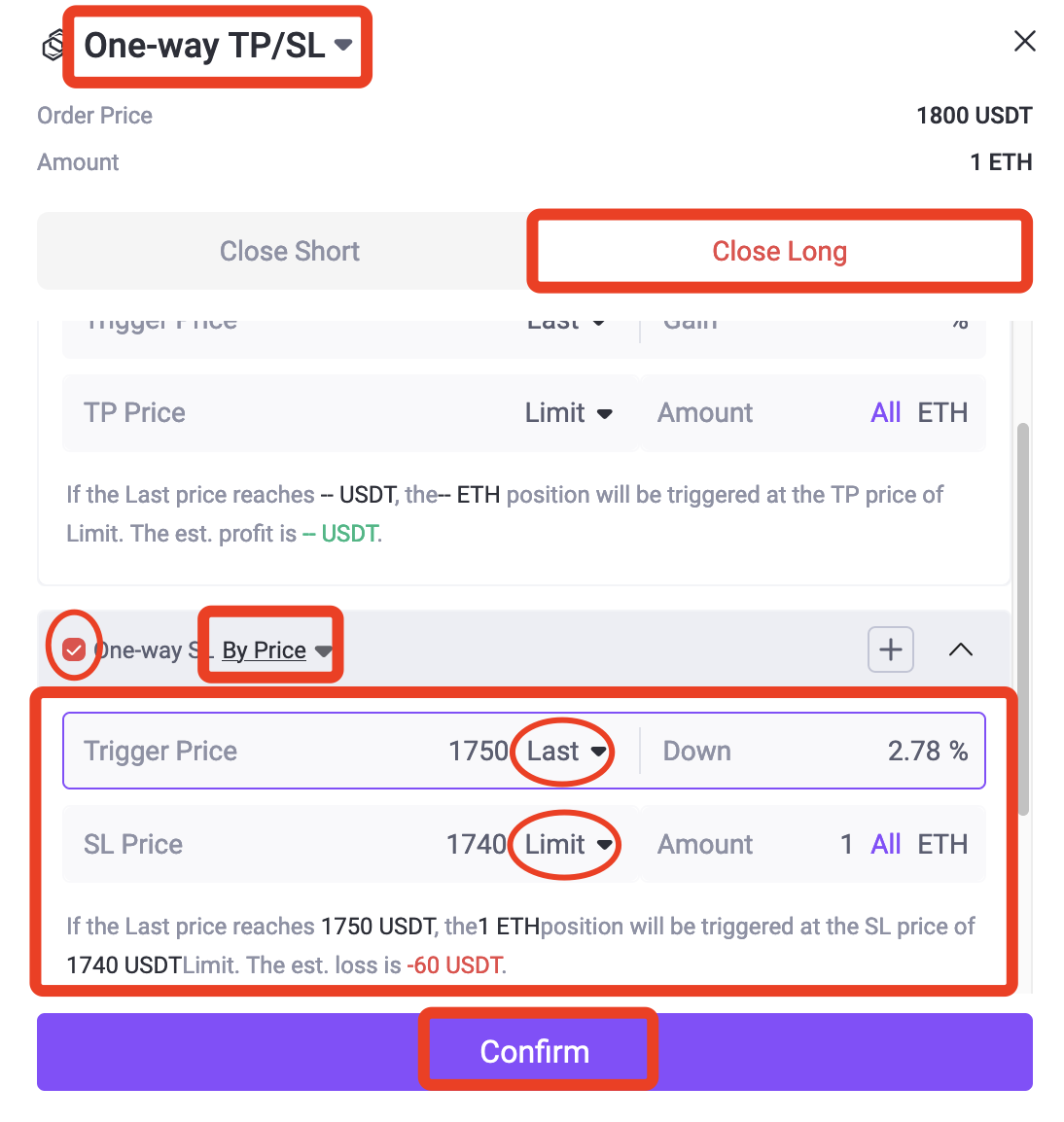

For example, you are trading in the ETHUSDT perpetual futures zone under the hedge mode, and the latest price of ETH is 1900 USDT. If you want to open a long position of 1 ETH when the market price falls to around 1800 USDT, and you intend to place an SL order to close the position when the market price falls to near 1750 USDT, you can place a limit order to open a position and establish a one-way SL order.

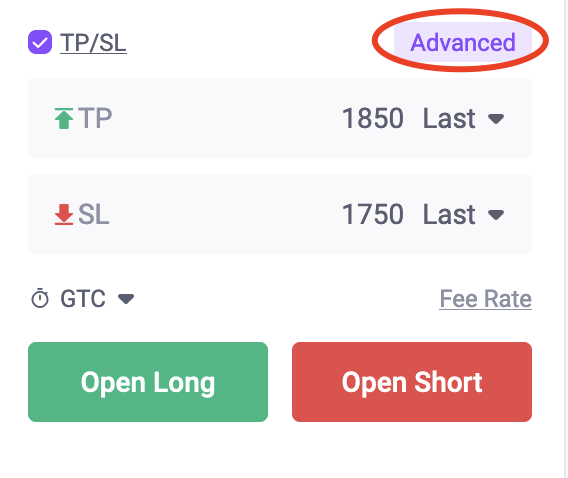

Select [Limit] on the trading page and enter the order price of 1800 and order amount of 1 into the [Price] and [Amount] input boxes respectively. In addition, select [TP/SL], enter the SL price of 1750 in the SL input box, and click [Open Long].

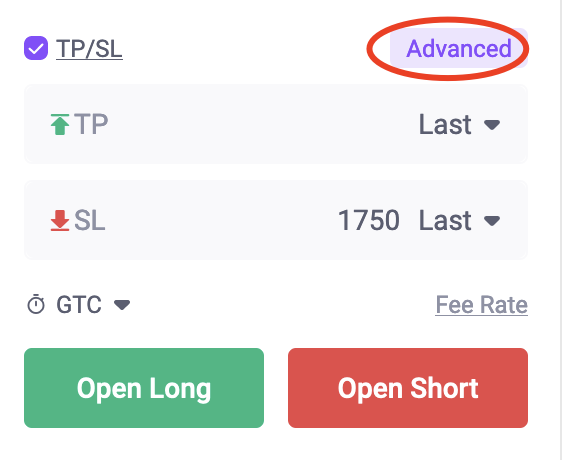

You can also click [Advanced] to set up more detailed parameters for a TP or SL order.

In the pop-up box, select [One-way TP/SL] and enter desired TP or SL values.

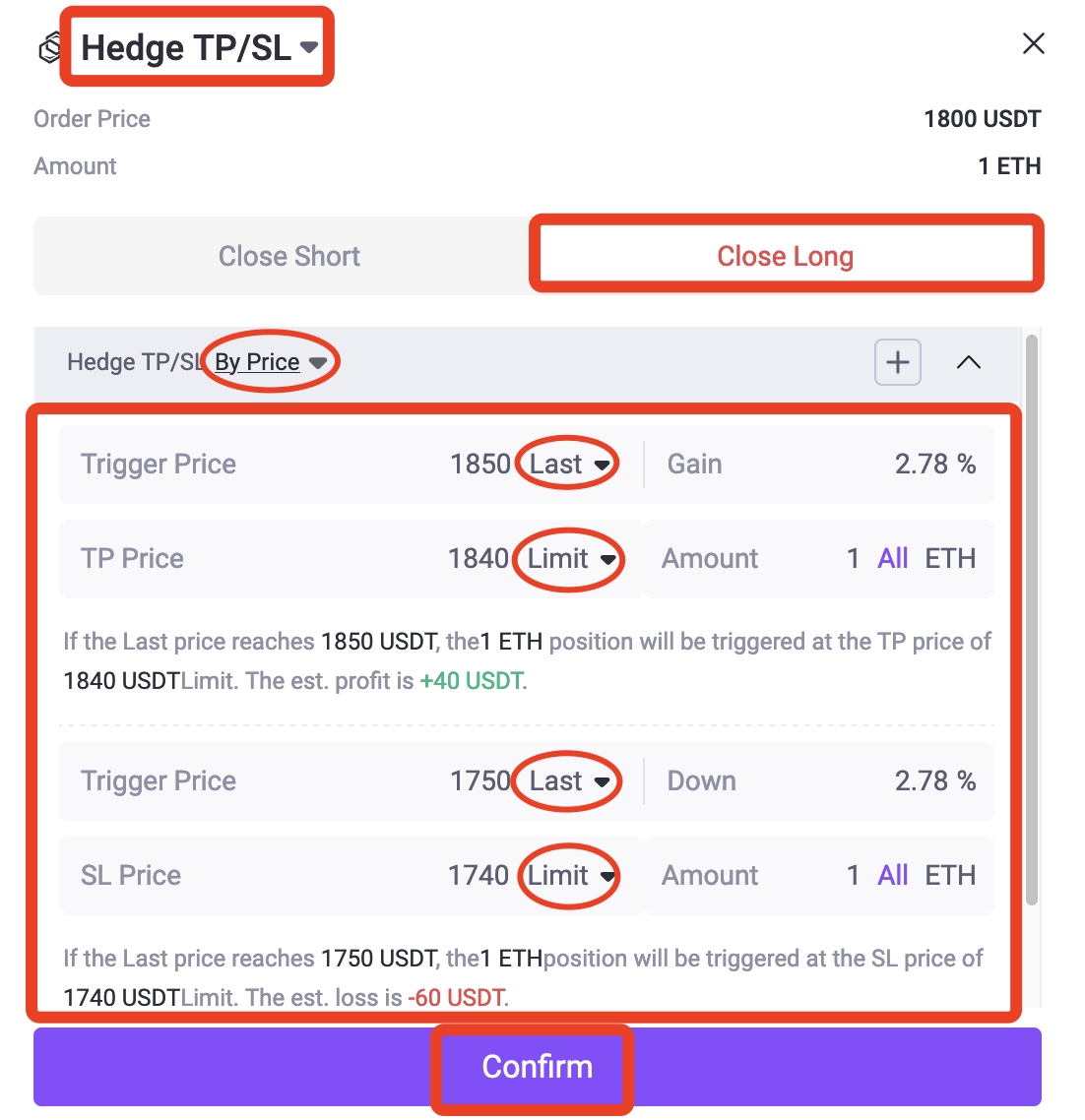

(2) Hedge TP/SL

Hedge TP/SL is an order strategy for both long and short directions, setting both take-profit and stop-loss orders simultaneously. Once the trigger price is reached in one direction, the order in the opposite direction is immediately canceled. In the use of Hedge TP/SL, when the market price reaches the preset trigger price in any direction, the system will automatically place the order based on the preset order price and amount in that direction, while immediately canceling the order in the other direction. This strategy enables hedge prediction for both upward and downward movements, allowing for profit-taking or stop-loss.

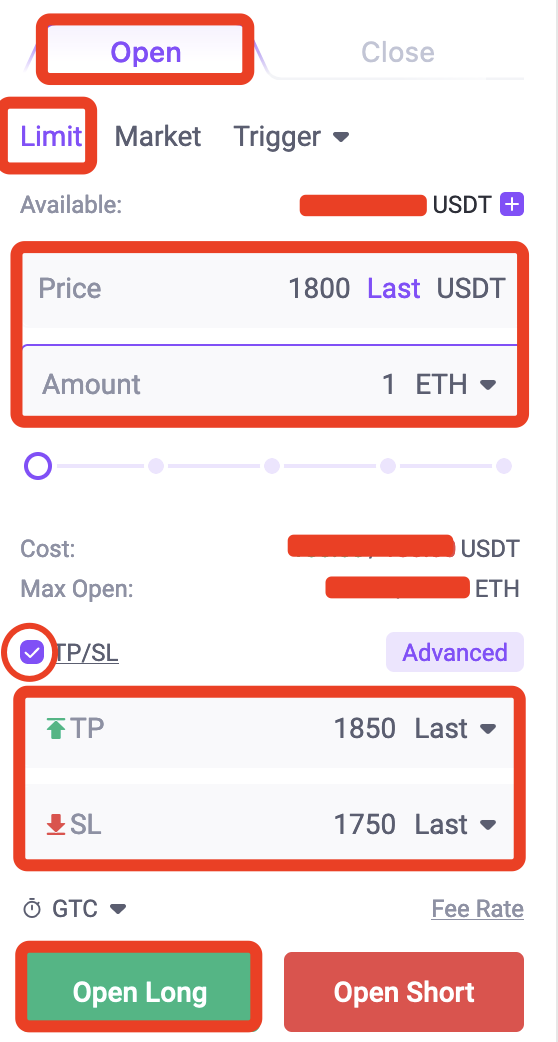

For example, you are trading in the ETHUSDT perpetual futures zone under the hedge mode, and the latest price of ETH is 1900 USDT. If you want to open a long position of 1 ETH when the market price falls to around 1800 USDT, and you intend to close a position by placing an SL order around 1750 USDT or a TP order when the market price surges to 1850 USDT, you can place a limit order to open a position and place a hedge TP/SL order.

Select [Limit] on the trading page and enter the order price of 1800 and order amount of 1 into the [Price] and [Amount] input boxes respectively. Moreover, select [TP/SL], set TP and SL prices to 1850 and 1750 in the TP and SL input boxes, and click [Open Long].

You can also click [Advanced] to set more detailed TP and SL parameters.

In the pop-up box, select [Hedge TP/SL] and enter preferred TP and SL values.

However, it’s important to note that one-way and hedge TP/SL orders do not guarantee the execution of the trade. Please be careful when using these strategies.

6. Reduce-Only

“Reduce-Only” is a trading option in which you can only reduce your existing positions and cannot increase your positions. The “Reduce-Only” option is only available in the one-way mode.

Using the reduce-only feature in the one-way mode:

(1) “Reduce-Only” is not available if you have no positions.

(2) If you hold existing positions, you can use the "Reduce-Only" feature when placing an order in the opposite direction.

If you select the “Reduce-Only” option, and the order amount exceeds the position size, the positions will be closed based on the actual position size. The remaining orders will be automatically canceled, and the order status will become “Partially Filled”.

For example, you choose to trade USDT perpetual futures under the one-way mode. If you place a sell order of 0.2 BTC, and after the order is fully filled, you will hold a short position of 0.2 BTC. Then, you use the “Reduce-Only” option to buy 0.3 BTC at the market price. At this time, the system will automatically close the short position of 0.2 BTC and cancel the remaining buy orders instead of opening a position in the opposite direction.

If you select the “Reduce-Only” option, and the order amount is less than the position size, the positions will be closed based on the reverse order amount. As a result, you can hold the remaining positions.

For example, you choose to trade USDT perpetual futures under the one-way mode. If you place a sell order of 0.2 BTC, and after the order is fully filled, you will hold a short position of 0.2 BTC. Then, you use the "Reduce-Only" option to buy 0.15 BTC at the market price. At this time, the system will automatically close the short position of 0.15 BTC, and you still hold a short position of 0.05 BTC.

(3) When you hold positions and use the "Reduce-Only" option to place an order in the opposite direction, and then add more positions before the order is filled, different scenarios can occur when the order is executed due to market fluctuations:

If the order amount exceeds the position size, the positions will be closed based on the actual position size. The remaining orders will be automatically canceled, and the order status will become "Partially Filled”.

For example, you choose to trade USDT perpetual futures under the one-way mode. At 10:00, you place a sell order of 0.2 BTC at the market price. After the order is executed, you will hold a short position of 0.2 BTC. Then, at 10:20, you use the "Reduce-Only" option to buy 0.5 BTC (the order is not immediately filled) at the limit price. By 10:30, you place a sell order of 0.1 BTC at the market price. At this time, you hold a short position of 0.3 BTC. As the market fluctuates, at 10:50, when the market price reaches the limit price of the “Reduce-Only” buy order for 0.5 BTC, the system will automatically close the short position of 0.3 BTC and cancel the remaining buy orders instead of opening a position in the opposite direction.

If the reverse order amount is less than the position size, the positions will be closed based on the reverse order amount. As a result, you can hold the remaining positions.

For example, you choose to trade USDT perpetual futures under the one-way mode. At 10:00, you place a sell order of 0.2 BTC at the market price. After the order is fully filled, you will hold a short position of 0.2 BTC. Then, at 10:20, you use the “Reduce-Only” option to buy 0.5 BTC (the order is not immediately filled) at the limit price. By 10:30, you place a sell order of 0.4 BTC at the market price. At this time, you hold a short position of 0.6 BTC. As the market fluctuates, at 10:50, when the market price reaches the limit price of the “Reduce-Only” buy order for 0.5 BTC, the system will automatically close the short position of 0.5 BTC, and you still hold a short position of 0.1 BTC.

7. Time in Force (TIF) Order

FameEX’s perpetual futures trading supports three TIF types: Good Till Cancel (GTC), Immediate Or Cancel (IOC), and Fill Or Kill (FOK).

(1) GTC: A GTC order has no expiration date, which means that when you place a GTC order, it will remain active in the market until you manually cancel it or until it gets executed. Unlike other order types that may have a specific duration, a GTC order is valid for an extended period and can last for days, weeks, or even months.

(2) IOC: An IOC order is a type of order that aims for immediate execution, and any remaining, unfilled part of the order is canceled instantly. When you place an IOC order, if the order is not immediately filled in its entirety, the unfulfilled part will be canceled immediately.

(3) FOK: A FOK order is a type of order that requires immediate and complete execution. When you place a FOK order, if the order cannot be fully filled, the entire order will be canceled immediately.

For example, if you are trading in the ETHUSDT perpetual futures zone under the hedge mode, the current order book data will be displayed as follows:

(1) If you select the GTC option when placing an order, with the latest price of 1873.89 USDT, and you open a long position at a price of 1800 USDT, the order will remain in the market until it is executed, manually canceled, or system canceled.

(2) You select the IOC option when placing a buy order at a price of 1874.10 USDT with the amount of 2 ETH. If there are only 1.55 ETH available for sale that meet the trading conditions, the order will be filled for 1.55 ETH, and the remaining 0.45 ETH will be immediately canceled.

(3) You select the FOK option when placing a buy order at a price of 1874.10 USDT with the amount of 2 ETH. If there are only 1.55 ETH available for sale that meet the trading conditions, the order will be canceled as it cannot be fully filled. However, if you set up a buy price of 1874.10 USDT with the amount of 1.5 ETH, the order will be completely filled.