FameEX Daily Technical Analysis | Cryptos Undergo Drops and Credit Suisse Thunderstorm Causes a Panic in Financial Community

2023-03-16 08:43:10FameEX Daily Technical Analysis | Cryptos Undergo Drops and Credit Suisse Thunderstorm Causes a Panic in Financial Community

Yesterday, all major cryptos exhibited price depreciation with fluctuations between -1.49% and -8.52%. However, compared with the weak strength previously, BNB was relatively strong, with a slight drop of -1.49%. SOL, on the other hand, turned from a boom to a bust, with a heavy drop of -8.52%. BTC and ETH, two of the leading cryptocurrencies, experienced a drop of -1.89% and -3.31%, respectively.

According to the 4-hour trading cycle depicted below, the long and short ceased the battle temporarily. Thus, the market volatility was significantly lower compared to the previous period. At present, the MA7 support has shown a downward bending trend, putting rising pressure on the price, while the MA25 support and the MA99 support were below to provide the medium- and long-term support. The key resistance price above was $26,387, and the support price was around $23,000. As a result, the price is likely to be oscillating in the short run.

Overall, market trends are more favorable to the bear market in the short term and to the bull market in the medium- and long-term period. As such, it is recommended to keep patient in pursuit of more favorable opportunities or alternatively, hold a few long positions while awaiting greater stability in the trend before entering into further orders.

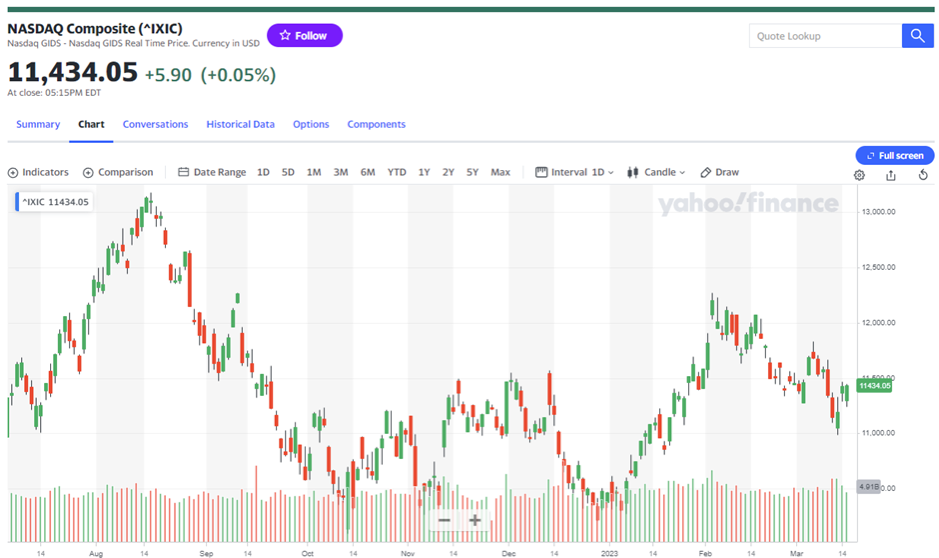

During yesterday’s trading session, all three major U.S. stock indexes experienced drops. The Dow Jones index was the weakest, falling by -0.87%. The S&P 500 index was also down -0.69%. The Nasdaq index showed a relatively strong strength, holding its own on the market with a slight rise of 0.05%. Meanwhile, two of the leading cryptos, BTC and ETH, fell by -1.89% and -3.31%, respectively.

Investors expected a week ago that the Federal Reserve (Fed) would raise interest rates sharply to curb inflation. However, the situation has changed since the collapse of Silicon Valley Bank (SVB) and Credit Suisse's financial flaws. The market believes that the Fed needs to take more measures to restore confidence in the banking system.

According to the CME's FedWatch tool, traders expect odds of over 50% that the Fed will not raise rates on March 22th and predict the Fed will cut rates as soon as June.

As to political and economic fields, after Saudi National Bank, the largest shareholder of Credit Suisse, revealed on Wednesday that it would not provide any financial assistance to Credit Suisse, the Swiss National Bank (SNB) and the Swiss Financial Markets Supervisory Authority (FINMA) issued a joint statement late Wednesday on U.S. stocks, mentioning that "Credit Suisse's current capital ratio and liquidity position remain in line with FINMA’s requirements, and SNB will provide additional liquidity to Credit Suisse if necessary”. This news has boosted market confidence.

Economist Nouriel Roubini, known as Dr. Doom, said earlier Wednesday that SVB failures could spread outside the U.S. Credit Suisse is at risk of collapse and may be too large to be bailed out.

Over the past 24 hours, there has been a total of $149.371 million in long liquidations and $64.88 million in short liquidations, resulting in a net long liquidation of $84.491 million. Recently, the total amount of liquidations has kept over $200 million. Investors’ frequent trades have sent the market boom.

The Fear & Greed index has recently decreased to 50, which is exactly at the significant threshold of 50. This suggests that the market displays a neutral and moderate sentiment, neither panic nor excitement.

The Bitcoin Ahr999 index has increased to 0.63, which is above the support level of 0.45 but below that of 1.2. This shows that the short-term trend becomes strong, but the long-term trend is still a bear market. Therefore, It is not recommended to buy the dip in batches. However, purchasing small amounts through dollar-cost averaging (DCA) may be a viable strategy.

Based on the above analysis, it seems that the crypto market is no longer in panic in the short run, and there are signs of recovery. However, we may be still at the bottom in the long run. Thus, we recommended periodically buying with a fixed amount and selling them gradually as the market rises.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.