FameEX Weekly Market Trend | July 13, 2023

2023-07-13 10:11:10

1. Market Trend

Between July 10 and July 12, the BTC price fluctuated between $29,950.00 and $31,045.78, with a volatility of 3.6%. Based on the 1-hour candle chart, BTC has been consolidating between $29,500 and $31,500 for about 20 days. During this period, whenever the market touches the range’s top, the price quickly drops, erasing most of the previous gains. This kind of trend usually occurs near the $31,000 level (the frequency of the price drops and the magnitude of the drops are within normal range, but the consistency of the drops is thought-provoking). In the current market trend, there have been no new major changes, and the previous trend remains intact. The approach to analysis and decision-making can continue to follow the previous analysis, with a focus on breakthroughs at the bottom and top of the range ($29,500-$31,500) for strategic moves. Regardless of any market fluctuations along the way, it is important to exercise patience and wait for the target points.

Source: BTCUSDT | Binance Spot

Between July 10 and July 12, the price of ETH/BTC fluctuated within a range of 0.06108 to 0.06211, showing a 1.6% fluctuation. From the one-hour candlestick chart, currently, following the trend of BTC’s fluctuations, the price is at a historical bottom and shows signs of stabilizing. It has already broken above the 7-day moving average (MA) on the 1-hour and 4-hour charts. On the daily chart, there was a strong breakthrough above the 7-day MA yesterday, but the closing price remained below it. It is recommended to observe the subsequent developments. Currently, this cryptocurrency exhibits a strong candlestick pattern. The key focus is whether it can stabilize above the 7-day MA on the daily chart before making any corresponding moves. When dealing with this cryptocurrency, it is still important to observe more and act less.

Based on overall analysis, the market is dull and unexciting, with BTC being trapped in a prolonged consolidation phase. All price waves are confined within a limited range, resulting in a market dominated by short-term high-frequency traders. In the next few months, the overall strength or weakness of the market will likely depend on the outcome of the breakout from this consolidation phase. A breakout and stabilization above the range will lead to a bullish rally, while a failure to break out and a return to the range may turn the market sentiment bearish. In the current market situation, it is crucial to exercise patience, observe more, and avoid impulsive actions to protect principals. This approach will maximize potential profits in future trends.

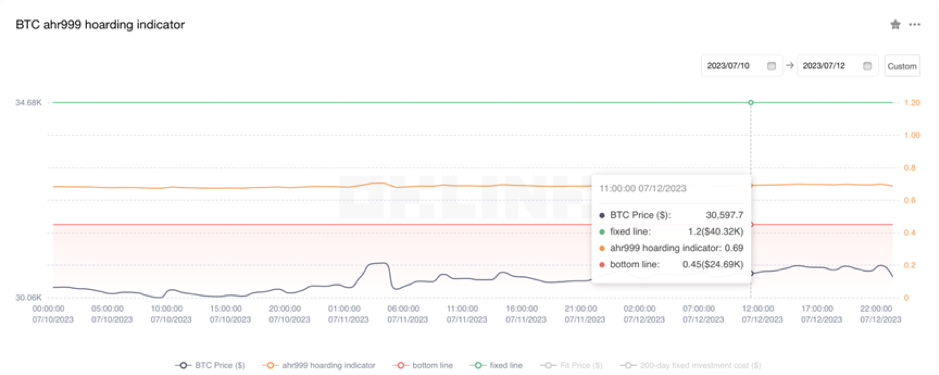

The Bitcoin Ahr999 index of 0.69 is above the buy-the-dip level ($24,690) but below the DCA level ($40,320). It is viable to purchase popular coins through DCA.

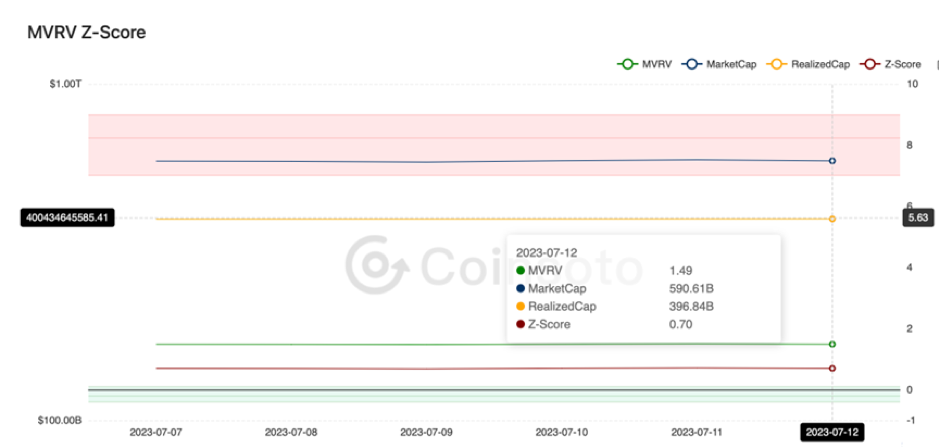

From the perspective of MVRV Z-Score, the value is 0.70. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.33-0.03).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

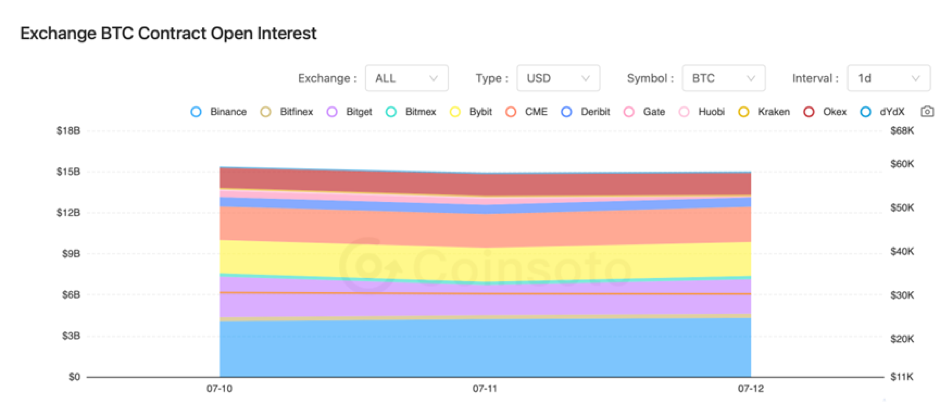

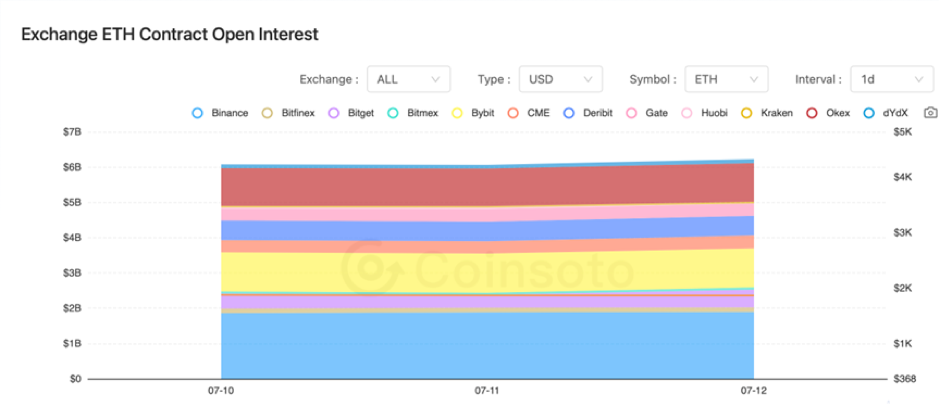

The contract open interest of BTC and ETH almost remained unchanged from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On July 10, the Hong Kong Institute of Securities and Investment dedicated to developing an examination and training plan related to virtual asset practices.

2) On July 10, registered users on Threads exceeded 100 million.

3) On July 10, Coinbase CEO and other three executives sold nearly $6.9 million worth of Coinbase stocks last week.

4) On July 11, Duba’s regulatory agency temporarily suspended the license of cryptocurrency exchange BitOasis.

5) On July 11, the UK government initiated discussions on introducing a digital securities sandbox.

6) On July 11, the “Rich Dad Poor Dad” author predicted that the price of Bitcoin would reach $120,000 next year.

7) On July 12, according to data, tokenized US Treasury bonds exceeded $600 million.

8) On July 12, data revealed that the total transaction volume on the Sui network has exceeded 100 million transactions.

9) On July 12, the US June Consumer Price Index (CPI) rose by 3% year-on-year, lower than market expectations.

10) On July 12, the European Union released the web4 and virtual world strategy.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.