FameEX Weekly Market Trend | July 24, 2023

2023-07-24 10:46:15

1. Market Trend

Between July 20 and July 23, the BTC price fluctuated between $29,570.96 and $30,417.46, with a volatility of 2.86%. Based on the 1-hour candle chart, BTC’s oscillation range has weakened with a shrinking trading volume, indicating a relatively weak trend. The previously mentioned range (from $29,500 to $31,500) has changed. Currently, BTC’s new range is between $29,500 and $30,500. BTC has been consistently approaching the $29,500 level for the past 8 days, reaching a high near $30,500 (but not surpassing it). The 7-day moving average on the daily chart is gradually moving towards $29,500, increasing the probability of a trend reversal. In the past month, BTC has mainly consolidated without clear trends or strong one-sided movements. In terms of trading, it is advised to follow the strategies mentioned in the previous analysis reports and make slight modifications. Be patient and wait for key entry points, such as breaking below $29,500 or surpassing $30,500, in line with the prevailing trend of BTC at that time (either upward or downward). This will help make the correct decisions when opening positions.

Source: BTCUSDT | Binance Spot

Between July 20 and July 23, the price of ETH/BTC fluctuated within a range of 0.06241-0.06377, showing a 2.17% fluctuation. From the 1-hour chart, the ETH/BTC pair has retraced its trend, filling the space left by the previous decline, but it is currently being suppressed by the 7-day moving average (MA), forming a short-term downtrend channel and showing a relatively weak trend. On the daily chart, it has retraced and touched the 7-day MA, and it has recorded a bullish candlestick with support from the average. In the near future, it’s advisable to avoid trading this currency pair. If it falls below the current price level, there is a high probability that it will reach the support level near 0.06165.

Based on overall analysis, currently, the market’s volatility and trading volume have decreased. The inflow of funds is smaller than the outflow, and BTC has entered a new range of movement. Most cryptocurrencies in the market are following BTC’s fluctuations, making it a rather dull period for investors. BTC’s trend keeps touching the lower boundary of the range, indicating a weak performance. For investors who haven’t entered the market yet, it is wise to continue observing. The overall market returns are not high at the moment. It would be prudent to wait for BTC to break out of the range and witness a change in the trend before making informed investment decisions.

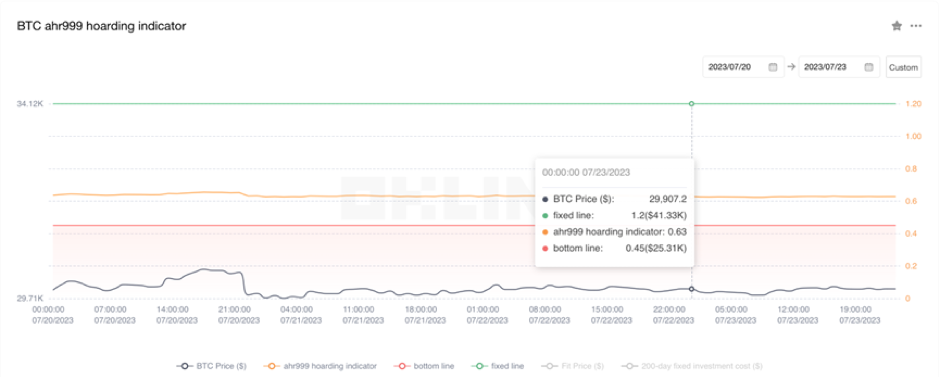

The Bitcoin Ahr999 index of 0.63 is above the buy-the-dip level ($25,310) but below the DCA level ($41,330). It is viable to purchase popular coins through DCA.

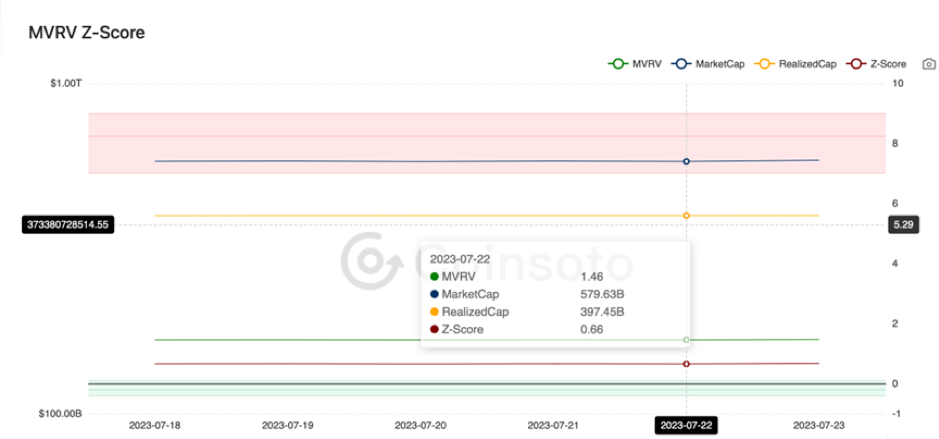

From the perspective of MVRV Z-Score, the value is 0.66. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.47-0.09).

2. Perpetual Futures

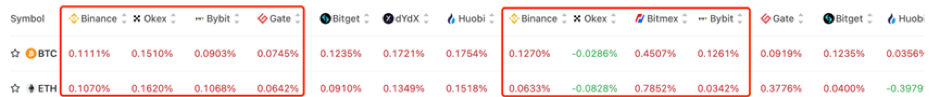

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

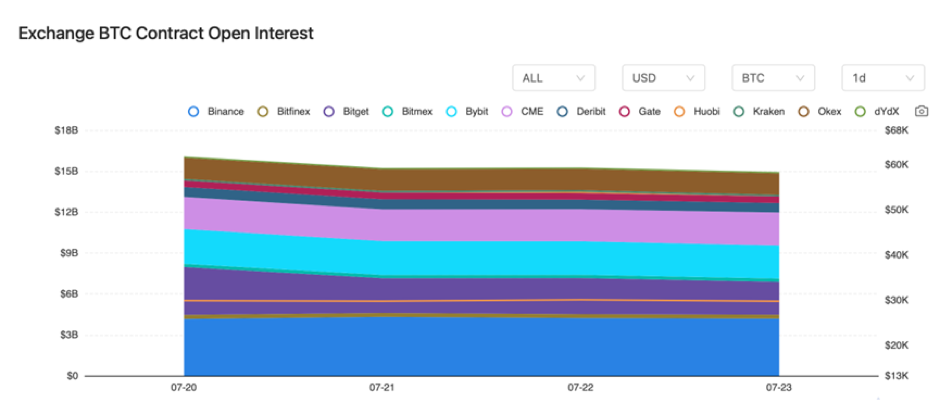

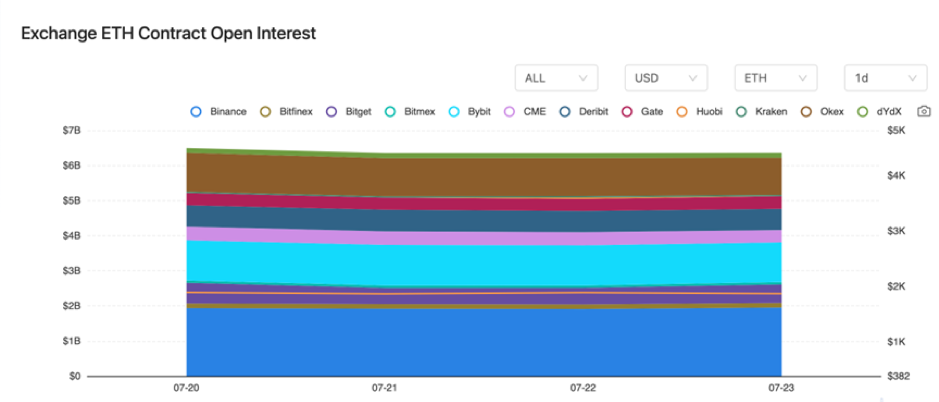

The BTC contract open interest has experienced consecutive minor declines, while the ETH contract open interest has remained relatively unchanged.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On July 20, XRP officially stated that XRP is not a security.

2) On July 20, the former Director of the Monetary Authority of Singapore stated that they are ready to collaborate with Hong Kong to develop Web3.0, which is not a zero-sum game.

3) On July 21, the market capitalization of stablecoins dropped to the lowest level since August 2021.

4) On July 21, the Indonesian national cryptocurrency exchange commenced operations.

5) On July 22, the U.S. SEC stated that it may appeal a partial ruling regarding XRP.

6) On July 22, the former head of the U.S. OCC joined the board of Hashdex.

7) On July 22, the user-friendly blockchain explorer Cymbal completed a $18.5 million financing round.

8) On July 23, the circulating supply of USDC decreased by $500 million over the past week.

9) On July 23, the CEO of EOS Network Foundation stated that GameFi has the potential to quickly attract millions of new users.

10) On July 23, Litecoin’s trading volume yesterday surpassed 527 million transactions, setting a new record.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.