FameEX Weekly Market Trend | August 28, 2023

2023-08-28 10:08:40

1. Market Trend

Between August 24 and August 27, the BTC price fluctuated between $25,777.15 and $26,819.27, with a volatility of 4.04%. According to the 1-hour chart, the current trend of BTC has formed a trading range framework ($25,500-$26,500). Following a major drop, the market has calmed down, mostly showing a sideways trend. A false breakout probably occurs now, pushing the price back into the range. The 4-hour chart is currently pressured by moving averages, forming a typical bearish pattern. This situation is pessimistic. The daily chart’s drop needs technical adjustments. Price stalled for a week and averages converged down. Thus, reversal follows technical shifts to fill drop gaps. Prior analysis highlighted $25K as crucial support. Currently, defense at $25.5K can be a long entry, but $25K must be the stop-loss level. The market lacks one-sided stability (the price range will not always move in one direction), oscillating mainly. Conservative traders may wait for clarity before trading.

Source: BTCUSDT | Binance Spot

Between August 24 and August 27, the price of ETH/BTC fluctuated within a range of 0.06301-0.06385, showing a 1.33% fluctuation. From the 1-hour chart, ETH/BTC has been experiencing a ranging trend recently. However, when looking at the 4-hour and daily chart levels, the trends closely follow the moving averages (a stronger characteristic), with the price consistently staying above the averages (7-day and 25-day). Technically, compared to BTC, it has a more attractive buying potential. At this moment, it is still viable to apply the moving average strategy mentioned earlier and enter positions near the moving average levels (exit if the price falls below the average and doesn’t recover within 1 hour).

Based on overall analysis, most cryptocurrencies in the market are in a sideways-ranging trend. The outflow of funds and pressure from the shorts have led to an overall decrease in market trading volume and reduced trading activity. At this stage, the funds entering the market for trading are mostly speculative. These kinds of funds find it difficult to significantly increase the coin’s price (their focus is on quick in-and-out trades). As a result, it’s common to see frequent long upper/lower wicks in the candlestick patterns. This often leads to losses for investors. Therefore, it’s recommended to wait for clearer market conditions before entering trades. Aggressive investors should set strict profit-taking and stop-loss levels (referring to the specific points outlined in the BTC analysis) before entering positions.

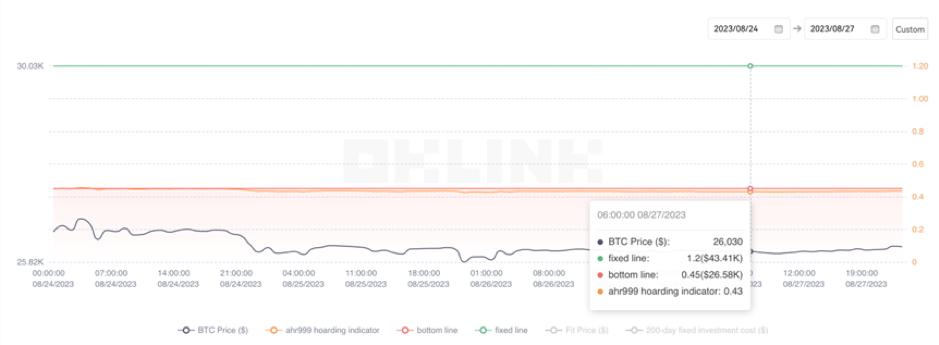

The Bitcoin Ahr999 index of 0.43 is below the buy-the-dip level ($26,580). Therefore, it is advised to buy and hold popular coins in the spot market.

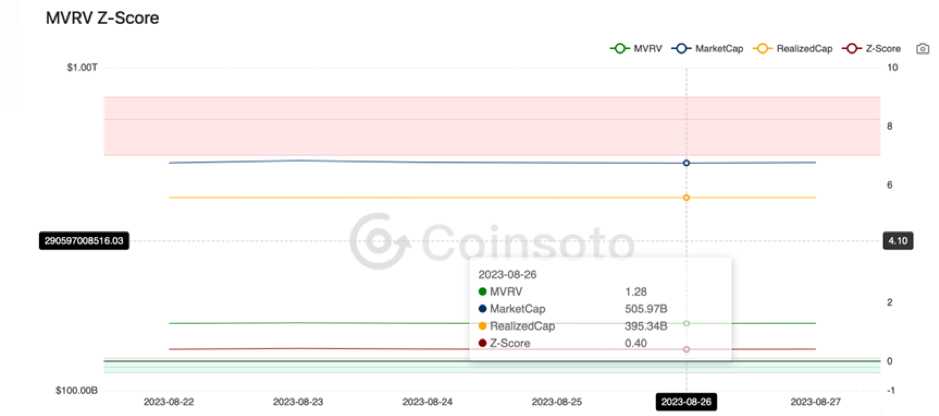

From the perspective of MVRV Z-Score, the value is 0.40. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.36-0.06).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

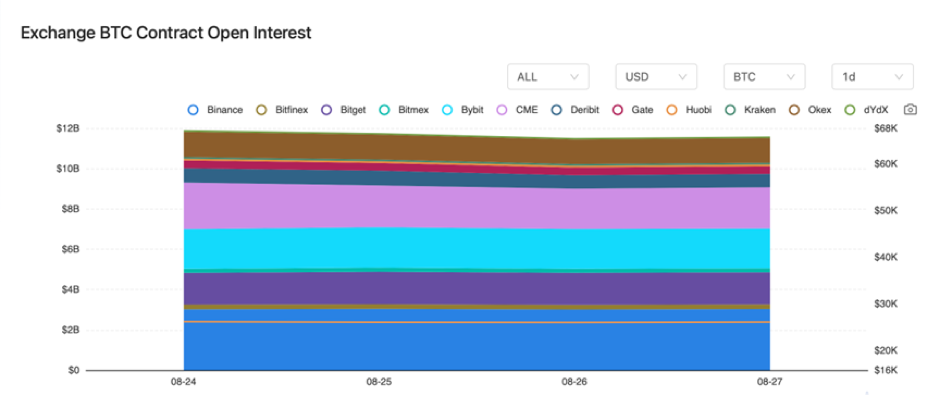

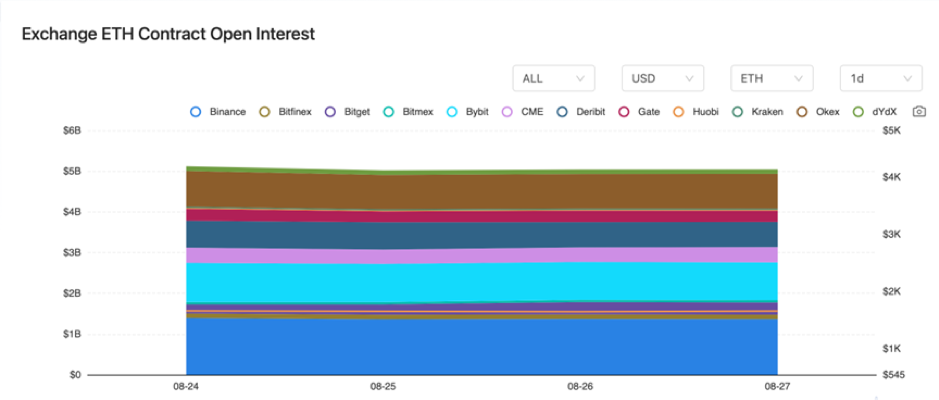

There were barely any changes in BTC and ETH contract open interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On August 24, FIBA introduced NFT collections for the Basketball World Cup.

2) On August 24, the total value locked (TVL) in DeFi across the entire network approached the lowest point since February 2021.

3) On August 24, the UK considered a complete ban on cryptocurrency investment promotion calls.

4) On August 25, Hong Kong Financial Secretary Paul Chan Mo-po expressed belief in Web3 becoming a significant force for local economic development.

5) On August 25, Fed’s Harker reiterated no need for further interest rate hikes.

6) On August 25, Fed interest rate swaps indicated a first rate cut of 25 basis points in July of next year.

7) On August 26, the TVL in DeFi dropped below $38 billion, reaching the lowest point since February 2021.

8) On August 26, the CEO of Cyberport responded to the $50 million fiscal allocation plan.

9) On August 27, Offchain Labs accumulated an additional 1.367 million ARB tokens.

10) On August 27, Hong Kong police arrested 458 individuals involved in money laundering in August, with a total of HKD 470 million involved. Some were induced to open accounts in virtual banks.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.