FameEX Weekly Market Trend | September 11, 2023

2023-09-11 10:31:05

1. Market Trend

Between September 7 and September 10, the BTC price fluctuated between $25,372.51 and $26,445.50, with a volatility of 4.23%. Based on the one-hour chart, Recent market conditions have reconfirmed the “door pattern” – prices reaching highs and retreating to the starting point, further solidifying the $25,500-$26,500 trading range over the past month. Notably, when the price touches the lower boundary, it bounces back strongly, and when approaching the upper limit, it retraces significantly. These traits are common in past market trends. To navigate them effectively, patiently monitor: 1) trading volume at range boundaries, and 2) rebound/retracement speed at these limits. If, after reaching a boundary, both volume and speed decrease significantly, it implies that the less active side may struggle under further pressure, given the prolonged consolidation and multiple tests. Thus, informed trading decisions are possible, but ongoing monitoring is essential. With the market still consolidating and moving averages converging, a turning point approaches. Skillfully using support levels at the range's edges could unlock a breakout from this consolidation.

Source: BTCUSDT | Binance Spot

Between September 7 and September 10, the price of ETH/BTC fluctuated within a range of 0.06258-0.06410, showing a 2.43% fluctuation. Looking at the 1-hour, 2-hour, 4-hour, and 1-day MAs, all these levels serve as resistance within their respective timeframes. Whenever the price rises to the level of these MAs, it immediately retraces. This is a typical sign of weakness, especially on the daily chart, where the MAs may turn downward at any moment, forming a standard bearish alignment. In the previous analysis report, it was mentioned that if ETH/BTC were to break above the 99-day MA on the daily timeframe, it could lead to a more favorable continuation in the trend. However, after two attempts to breach the 99-day MA without stabilizing above it, this has resulted in the current retracement in the market. Therefore, it is advisable to stay away from this cryptocurrency in the near term.

Based on overall analysis, the direction of the market and the fluctuations in sentiment continue to follow BTC as it oscillates. No standout projects or independent coins are leading the market. BTC is still in a consolidation phase, and apart from BTC and ETH, most other coins are following BTC’s movements, but with much larger swings in amplitude. If BTC makes a decisive move in the near future, it is highly likely that other coins in the market will experience volatility several times greater than BTC. Market volatility will significantly increase, leading to higher levels of capital circulation and wealth effects. Prior to a clear market direction being established, protecting your capital becomes crucial. If you intend to participate in the market early, it is essential to set up stop-loss and take-profit orders. You can refer to the rough analysis provided above for BTC for specific trading strategies.

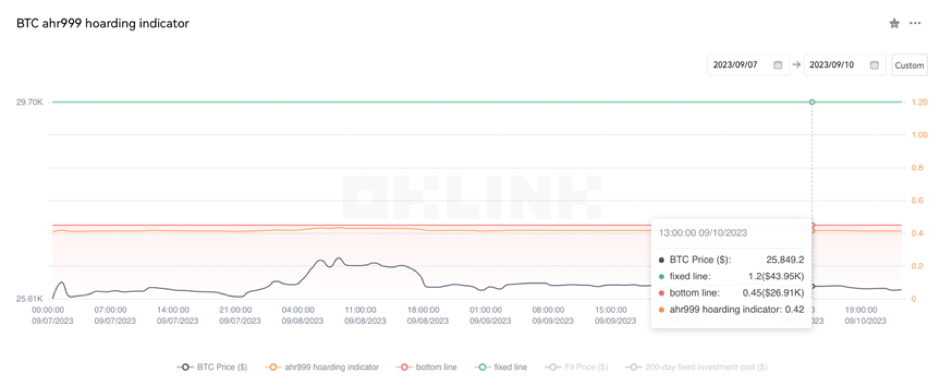

The Bitcoin Ahr999 index of 0.42 is below the buy-the-dip level ($26,910). Therefore, it is advised to purchase popular coins in the spot market at low points.

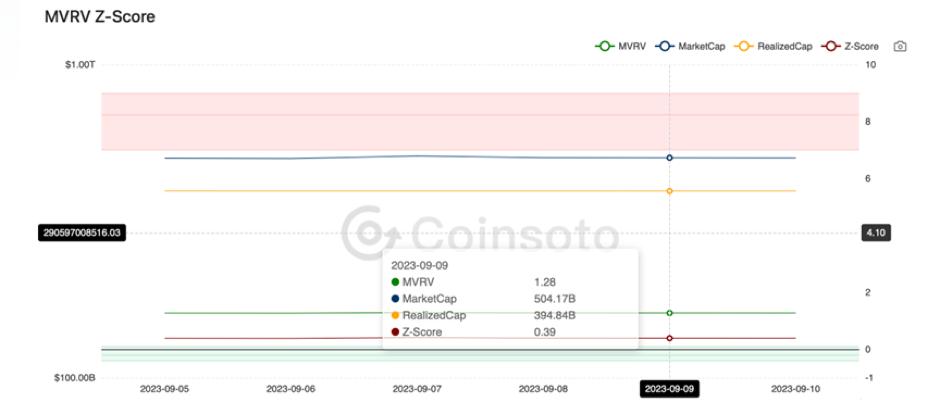

From the perspective of MVRV Z-Score, the value is 0.39. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.42-0.06).

2. Perpetual Futures

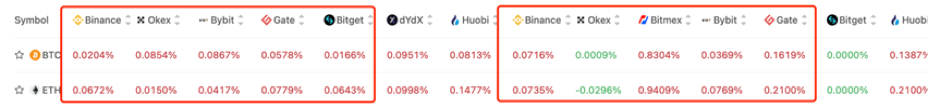

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

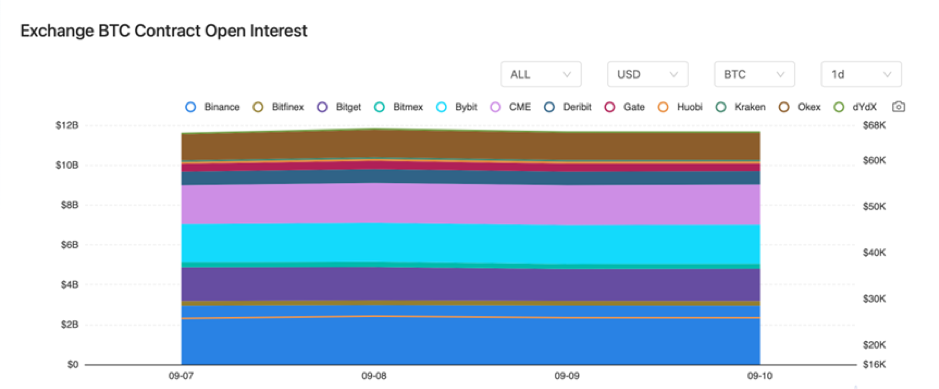

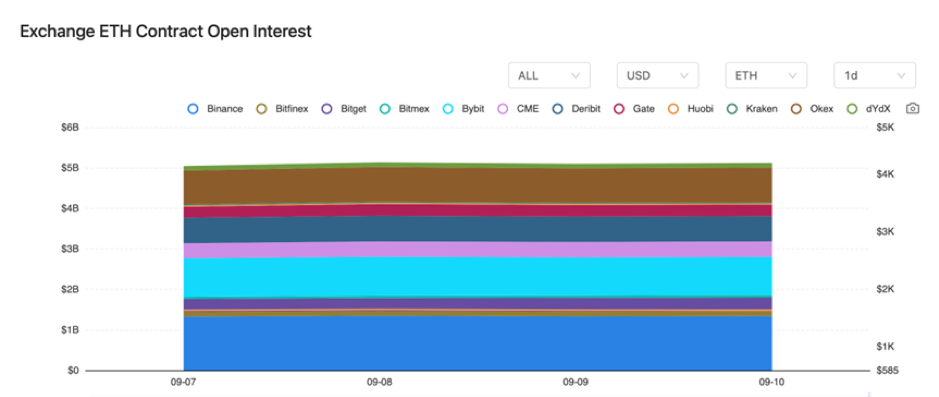

There were barely any changes in the BTC and ETH contract interest from major exchanges.

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On September 7, the International Securities Commission organized regulatory measures for DeFi project leaders.

2) On September 7, the Taiwan Financial Supervisory Commission will officially announce guidelines for regulating virtual asset operators within this month.

3) On September 7, Salame, a former FTX executive, was expected to admit to criminal charges related to FTX’s bankruptcy today.

4) On September 8, CFTC commissioner proposed launching a cryptocurrency regulatory pilot program.

5) On September 8, institutions like Coinbase, Circle, Aave, and others formed the Tokenized Asset Alliance (TAC).

6) On September 8, the Base Ecosystem Fund announced six investments.

7) On September 9, according to data, 42% of Dogecoin holders remained profitable.

8) On September 9, data showed that USDC’s circulating supply decreased by $200 million in the past week.

9) On September 10, APE tokens worth over $51 million and APT tokens worth $23 million will unlock next week.

10) On September 10, Coinbase CEO expressed optimism regarding a Bitcoin spot ETF.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.