FameEX Weekly Market Trend | October 19, 2023

2023-10-19 10:26:00

1. Market Trend

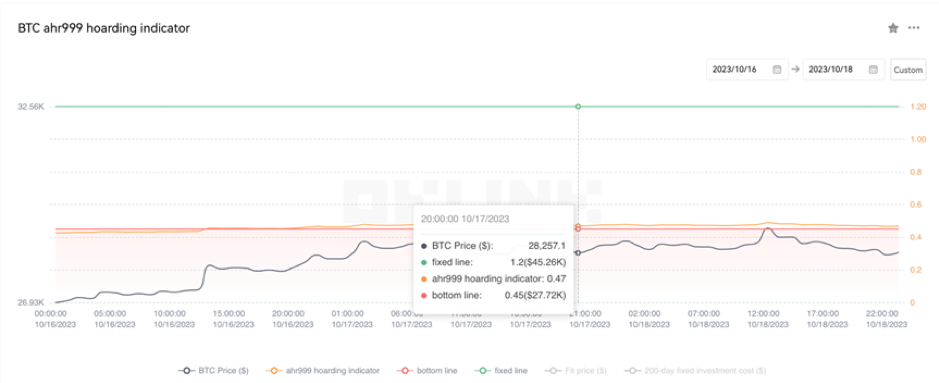

From Oct. 16 to Oct. 18, the BTC price fluctuated between $26,893.41 and $30,000.00, with a volatility of 11.55%. The prior report suggested aggressive investors buy BTC at $27,000 and conservative investors wait for a stable price above $28,000. On Oct. 16 at 9:00 PM, a market rumor about the SEC approving BlackRock’s Bitcoin futures ETF caused BTC to spike from $27,000 to $30,000 but quickly retraced to around $28,000 (later revealed as false news). Surpassing the $28,000 mark was significant, akin to breaking $30,000, enabling BTC to re-enter a daily chart uptrend, signifying the start of the third primary Elliott wave. This prevented a head and shoulders pattern. By 1:00 PM on Oct. 16, BTC had laid the uptrend foundation at $27,980. Even without the BlackRock event, BTC maintained a steady rise. Luckily, false news didn’t disrupt the uptrend structure, and key moving averages stayed bullish. At this point, the daily chart successfully broke and stabilized above the 99-day MA. Assuming no surprises, BTC was expected to consolidate here for a few days as the moving averages shifted higher, using time to fill the gap left by the rapid ascent and increasing market turnover, which would reduce resistance for further gains. Whether conservative or aggressive, if you followed the report, you should already be in the market. The 99-day MA (around $27,700) can now be seen as a key support level, and breaking it without a recovery within 1 hour should be considered a signal to exit.

Source: BTCUSDT | Binance Spot

Between Oct. 16 and Oct. 18, the price of ETH/BTC fluctuated within a range of 0.05423-0.05784, showing a 6.65% fluctuation. As for ETH/BTC, at all levels, it currently exhibits a standard bearish trend with no successful rebounds. Moreover, in recent days, it has hit new lows, indicating an extremely weak bullish strength. It’s advisable to stay away from this cryptocurrency for now.

Based on overall analysis, the current market activity has seen a noticeable improvement, with increased capital inflows, trading volumes across various cryptocurrencies, and price volatility gradually getting better. BTC has broken through the significant resistance at $28,000, which has boosted confidence among retail investors and also provided confidence to some smaller altcoin projects (in recent days, the number of daily gains in smaller altcoins has also increased). However, BTC has not fully entered a bullish phase yet, and the market has not formed a mature uptrend. It is currently at a critical phase of transitioning from a downtrend to an uptrend after successfully containing the downward trend. The main focus is to maintain the 28,000-point level and avoid dropping below the 99-day MA. Prioritizing stability over rapid surges is the best path for Bitcoin now.

The Bitcoin Ahr999 index of 0.47 is between the buy-the-dip level ($27,720) and the DCA level ($45,260). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

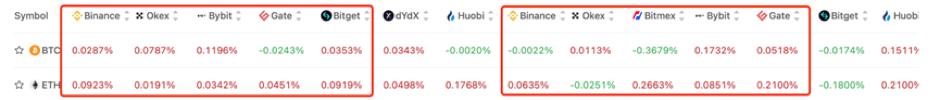

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

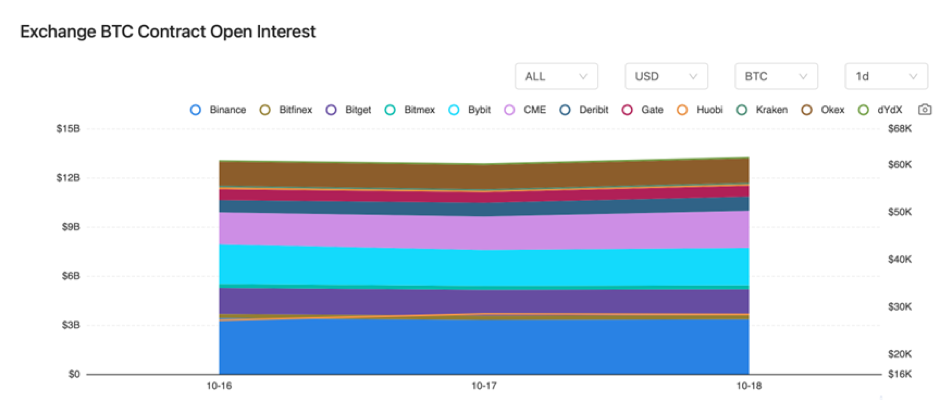

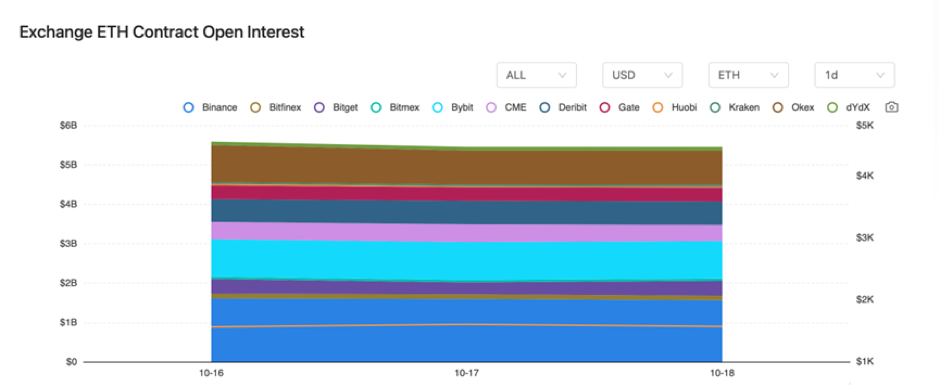

There were rarely any changes in the BTC and ETH contract interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On October 16, the SEC approved BlackRock’s iShares Bitcoin Spot ETF, which was later confirmed to be fake news.

2) On October 16, Hong Kong’s BC Technology Group planned to sell its digital asset platform, OSL, at an estimated valuation of 1 billion Hong Kong dollars.

3) On October 16, Swiss bank Dukascopy introduced an automated cryptocurrency lending product.

4) On October 17, Fidelity Digital Assets became the first corporate client of EY’s blockchain tool.

5) On October 17, Uniswap announced a 0.15% fee for token swaps involving ETH, USDC, and other tokens.

6) On October 17, Xu Mingxing stated that the authenticity of news doesn’t matter; what truly matters is having faith in the developmental potential of Bitcoin.

7) On October 18, Coinbase expressed that cryptocurrencies should not be used to support terrorism financing and called for clear regulatory oversight of crypto assets in the U.S.

8) On October 18, the European Central Bank stated that DAOs need a comprehensive regulatory framework.

9) On October 18, Fed’s Harker suggested extending the pause on interest rate hikes.

10) On October 18, Galaxy Digital’s CEO predicted that a Bitcoin spot ETF would be approved by the SEC this year.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.