FameEX Weekly Market Trend | November 20, 2023

2023-11-20 11:21:11

1. Market Trend

From Nov. 17 to Nov. 19, the BTC price swung from $35,500.00 to $36,845.49, with a volatility of 3.78%. In recent days, the lowest point reached $35,500, surpassing the second retracement low of $38,000. This upward trend, accompanied by a larger trading volume, suggests a subtle shift in the bottom position. Both chip selling and investor short positions have eased, and BTC’s price is now oscillating upward, fostering bullish sentiment and more effectively digesting bearish positions after the recent decline. On the 1-hour chart, BTC has crossed above both MA99 and MA25. We await MA99 to turn upwards to form a standard bullish trend line (which is already in the process of uptrend). In higher timeframes (4H and 12H), MA99 has resiliently resisted multiple downward tests without a significant breach. Currently, this MA is turning upwards, indicating that the 4-hour adjustment is likely nearing its end and an upward breakthrough of the current platform position is needed. BTC’s recent pattern involves a sharp drop followed by a gradual recovery, effectively clearing chips from unstable hands and easing upward pressure. This concentrates solid chips, enabling institutional investors to benefit more from the uptrend (once retail investors understand this intention, following institutional behavior becomes possible). Yet, it also results in harvesting more chips in the futures market. If investors are involved in the futures market, given the current environment, it is crucial to control greed, lower leverage, manage opening positions carefully, and set stop-loss points upon opening positions to minimize the impact of market fluctuations. Still, it is essential to believe in the dominance of trends, hold onto positions, and avoid frequent switching of positions.

Source: BTCUSDT | Binance Spot

Between Nov. 17 and Nov. 19, the price of ETH/BTC fluctuated within a range of 0.05266-0.05459, showing a 3.66% fluctuation. In the recent trend, ETH/BTC has been oscillating downward, exhibiting relative weakness. However, it hasn’t formed a clear downward channel, and in the trend on Nov. 19, it stabilized, breaking and holding above the 25-day MA. Given ETH’s trend, there’s a potential breakthrough of the 99-day MA in the near term. Investors looking to participate in ETH/BTC should patiently wait for the breakthrough of MA99. Once it occurs, entry is advised, with a stop-loss set below MA99 and not recovered within 1 hour of the decline.

Based on overall analysis, after experiencing a significant retracement and wide-ranging oscillations in daily trends, the overall investor sentiment is gradually calming down. The market always deserves participants’ awe, and maintaining a respectful mindset is crucial for enhancing survival prospects in the market. However, the recent retracement and the current trend have not shattered the enthusiasm of investors or disrupted the upward structure. Bullish sentiment remains the dominant theme in the market. Lately, the price fluctuations of altcoins have been broader than before. Many altcoins, due to considerable gains in the previous period, may experience substantial declines if BTC retraces at this moment. Therefore, extra caution is needed. Before a new market trend emerges, allocating to altcoins may not be the best choice. It is wiser to align investments with mainstay coins at this time, and considering altcoins should come later in the strategy. For investors with existing positions, holding onto assets for a bullish market is advisable.

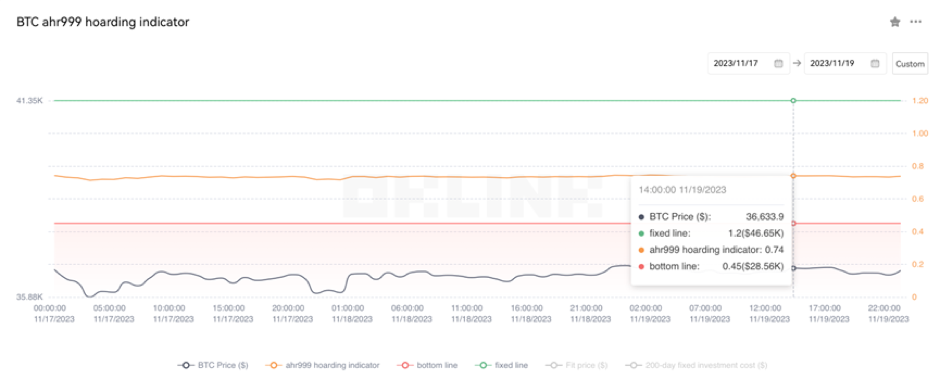

The Bitcoin Ahr999 index of 0.74 is between the buy-the-dip level ($28,560) and the DCA level ($46,650). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

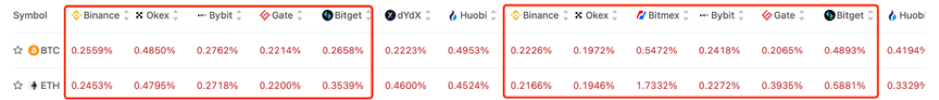

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

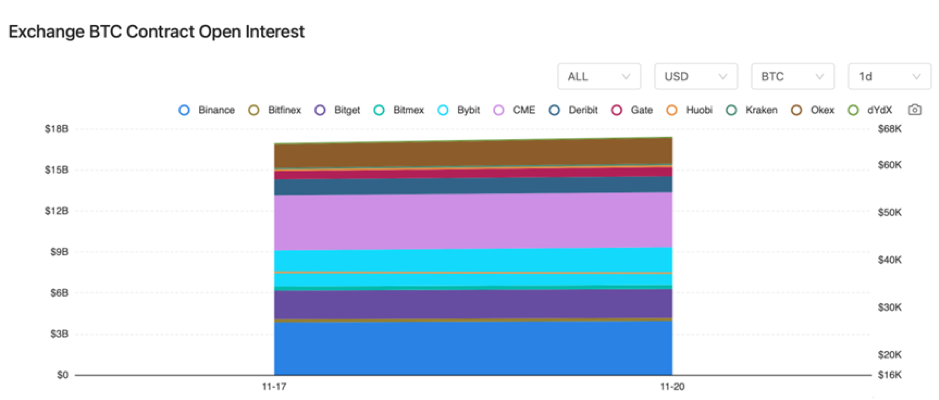

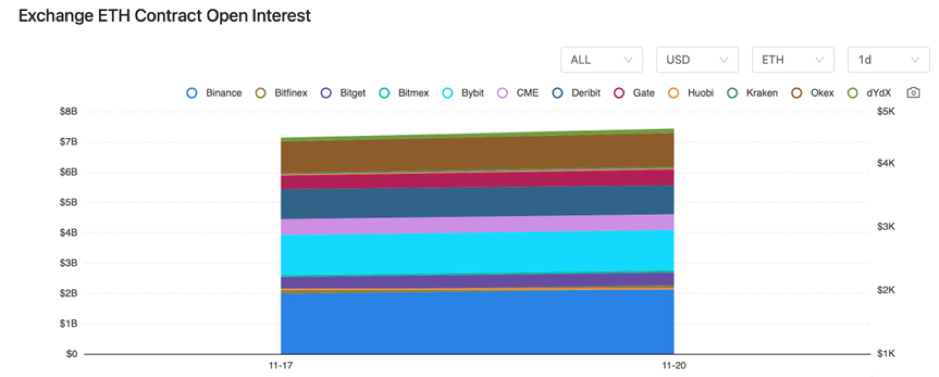

There were barely any changes in the BTC and ETH contract open interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On November 17, the Japanese Financial Services Agency approved the launch of ODX digital securities exchange START.

2) On November 17, the International Securities Commission issued regulatory recommendations for cryptocurrencies.

3) On November 17, the Thai Securities and Exchange Commission revised digital token regulations to protect investors.

4) On November 18, OpenAI Co-founder expressed shock and sadness at the board’s actions, hinting at significant developments.

5) On November 18, Bithumb raised concerns about suspected large-scale selling by insiders of YFI. Traders are advised to exercise caution when dealing with YFI.

6) On November 18, the SEC delayed the resolution of the Global X Bitcoin ETF until February next year.

7) On November 19, OpenAI’s board tentatively approved the return of Sam Altman.

8) On November 19, 14 years ago today, “Satoshi Nakamoto” registered on BitcoinTalk for the first time.

9) On November 19, Elon Musk announced X platform investors would own a quarter of xAI.

10) On November 19, Linea TVL surpassed two billion USD.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.