FameEX Weekly Market Trend | January 5, 2024

2024-01-05 12:23:05

1. Market Trend

From Jan. 3 to Jan. 4, the BTC price swung from $40,750.00 to $45,500.00, with a volatility of 11.65%. BTC oscillated between $41,000 and $43,000 for more than 10 days before the recent surge to $45,000. This range has become a concentration of recent chip movements (with a support level around $41,800). Around 8:00 PM on January 3, BTC suddenly saw a significant volume increase, dropping to $40,750, only $250 away from the previously mentioned long-term support at $40,500.

There were rumors during this decline that the SEC would reject the ETF for spot BTC in January, causing a sharp market downturn. Still, in my view, this isn’t the root cause but a trigger for a rapid decline. Reflecting on BTC’s history in bull markets, a sudden overall market drop of 15-20 points (2-4 times) is a common pattern, deemed a “bull market rule”. The real driver isn’t negative news but a financial product – futures. Institutions exploit negative news during bull markets to profit from futures, enabling significant gains in a short period. However, this behavior is attached to high risk due to market sentiment and the purchasing power of retail investors, so it often occurs when there is a consensus bullish sentiment and the long/short funding rate for futures is heavily skewed in one direction. Here is a simple but effective risk control method for investors: (1) Set a stop-loss level upon opening a position, and do not arbitrarily modify it afterward. (2) Periodically raise the profit-taking level, with no restrictions on the number of adjustments. The second point requires investors to track the market promptly and make adjustments. If both points are achieved, it can maximize profits and control risks.

In the current market, the post-drop rebound is slow without increased volume, suggesting substantial economic losses for investors and impacting bullish confidence. The market stabilized above $43,000 after 10 hours, tied to the 10-day consolidation range of $41,000-$43,000. With the lowest point above the critical $40,500 level, this drop did not inflict major structural damage, allowing for correction in later market trends. Due to the lack of volume in the current rebound, short-term breakthroughs to new highs are difficult. A probable scenario for the next week is a range-bound market (wide oscillation between $41,800 and $44,000).

Currently, it is still recommended to adopt a strategy of initiating long positions at lower price levels (entering around $42,000-$42,400). For investors who have already entered, it is still advisable to hold and wait for a rise, anticipating a new high.

Source: BTCUSDT | Binance Spot

Between Jan. 3 and Jan. 4, the price of ETH/BTC fluctuated within a range of 0.05123-0.05342, showing a 4.27% fluctuation. The previous analysis mentioned that the current market is in a bearish state at various levels. For such currencies, to reverse the situation in the short term, the most direct, effective, and historically proven trend should be a rapid and volume-driven surge. However, in the recent two days, there hasn’t been a scenario of a volume-driven surge. Instead, the market has continued the previous downtrend, still operating within the descending channel. Therefore, the short-term strategy remains unchanged, and it is advisable to stay away from this currency.

Based on overall analysis, the current market is in a recovery phase following an overall plummet. Most currency pairs have experienced significant retracements and have not fully recovered. Given that there has been no fundamental damage to the underlying structure, this presents opportunities to enter or add positions, particularly in the spot market. Achieving consecutive and volume-driven rises at this stage may be challenging; hence, a period of oscillation is expected to be the dominant theme in the coming days. Prepare for this trend accordingly. Futures investors, in particular, should exercise caution as such market conditions can lead to significant losses. At this stage, it’s opportune to consider accumulating certain coins that previously showed positive trends but were pulled down by the market (OP, ARB, ORDI, etc.). The prevailing strategy remains holding and waiting for a rise, adopting a low-long approach.

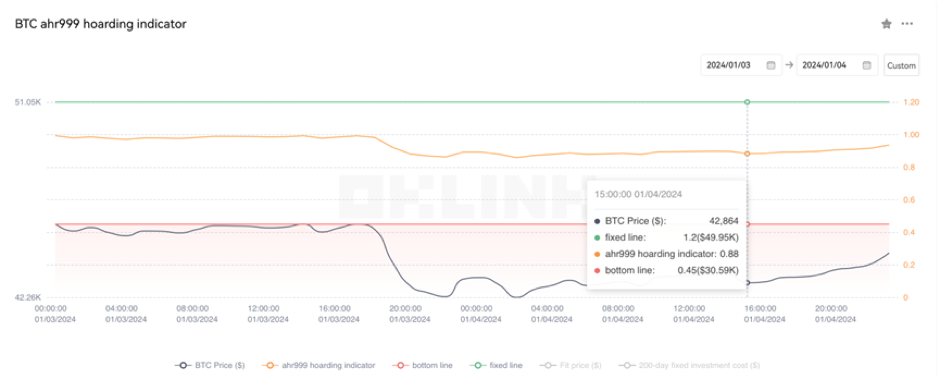

The Bitcoin Ahr999 index of 0.88 is between the buy-the-dip level ($30,590) and the DCA level ($49,950). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

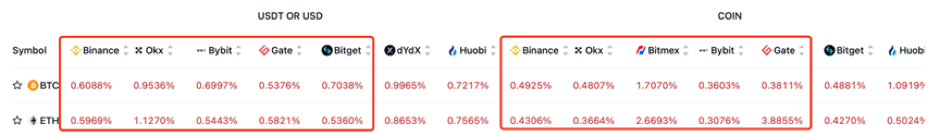

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

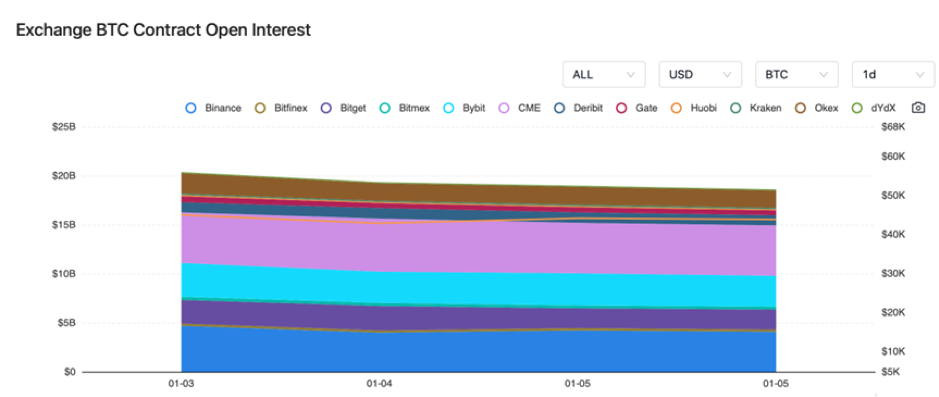

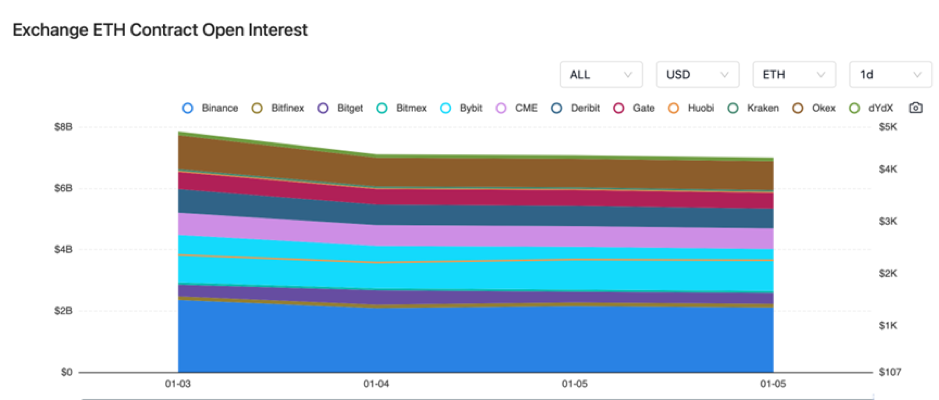

The BTC and ETH contract open interest both experienced a slight decline from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On January 3, Bitcoin celebrated its 15th anniversary since the creation of the genesis blockchain.

2) On January 3, eToro terminated its cryptocurrency custody services in Germany.

3) On January 3, LFG stated that the second airdrop would take place in two weeks.

4) On January 3, Bitcoin options trading volume reached $37.9 billion in December, setting a new monthly record for the highest trading volume to date.

5) On January 3, the European Banking Authority announced a thorough investigation into the connections between banks and crypto entities.

6) On January 4, the current value of Bitcoin held by the U.S. government exceeded $8 billion.

7) On January 4, Bloomberg analysts recommended keeping an eye on the ETF approval window from January 8 to 10.

8) On January 4, Fidelity submitted a securities registration application for its Bitcoin ETF to the SEC.

9) On January 4, South Korea proposed banning credit card payments for cryptocurrencies.

10) On January 4, Binance Labs announced an investment in MEME.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.