FameEX Weekly Market Trend | January 22, 2024

2024-01-22 12:12:15

1. Market Trend

From Jan. 18 to Jan. 21, the BTC price swung from $40,280.00 to $42,930.00, with a volatility of 6.5%. The prior analysis indicated that the market is on the verge of deciding its direction. A potential downward move may target $38,000, a crucial support level. Dropping below $38,000 without a quick recovery raises bull market doubts. Breaking and stabilizing above $48,000 could initiate an upward trend. Recently, the BTC market has been bearish, with the lowest price at $40,280 (above $40,000) on Jan. 20 at 1:00 am (UTC+8). Strong support at $40,500 absorbed bearish pressure, and despite briefly dipping below $40,500, there was no panic selling. Following a 200-point decline, there was a 2,000-point rebound. If revisiting $40,500 lacks previous bullish resistance, recovery may not occur, potentially falling below $40,000, followed by a substantial rebound. Yet, if the rebound fails to stabilize above $43,000, a gradual decline is likely until breaking through $43,000 with substantial volume, indicating a potential reversal from the current bearish trend.

Therefore, the current strategy is to seek stability and a breakthrough above $43,000 for a long position, and below $43,000, a short position becomes more reasonable.

Source: BTCUSDT | Binance Spot

Between Jan. 18 and Jan. 21, the price of ETH/BTC fluctuated within a range of 0.05946-0.06053, showing a 1.8% fluctuation. The current status of ETH/BTC is in a high-level consolidation, showing good resistance to a downturn. However, the overall market sentiment leans bearish without fully committing to the downside. Therefore, it is advisable to align the trading strategy with BTC, refraining from hastily entering the market. As mentioned earlier, considering the current trend of BTC, the previous plan to enter around 0.05800 is temporarily suspended. It is recommended to remain on the sidelines and reevaluate the situation before considering re-entry.

Based on the overall analysis, the current market is in a situation where bearish sentiment prevails, but it has not fully committed to a bearish trend. Most cryptocurrencies in the market have experienced declines exceeding BTC, erasing previous gains. The core factor behind this phenomenon is the uncertain situation of BTC at the support level of $40,000 and the absence of strong upward momentum in the recent period, leading to insufficient confidence in the overall bullish sentiment. This is not an opportune time to enter the market. Both altcoins and mainstream currencies are facing a critical decision in terms of the overall market direction. Entering the market at this time involves risks, and although aligning your trading direction with the market’s choice can maximize returns, the associated risks are equally significant. Alternatively, remaining in a bearish position at this time, awaiting a clear market direction, and then aligning with the trend for operations can still offer substantial profit potential.

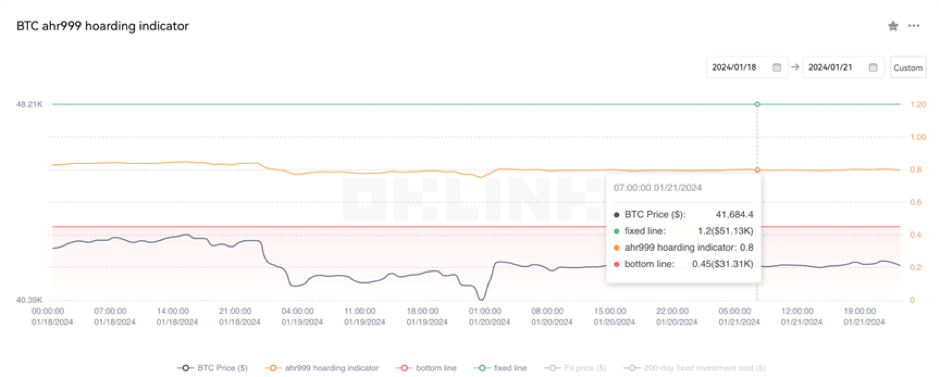

The Bitcoin Ahr999 index of 0.80 is between the buy-the-dip level ($31,310) and the DCA level ($51,130). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

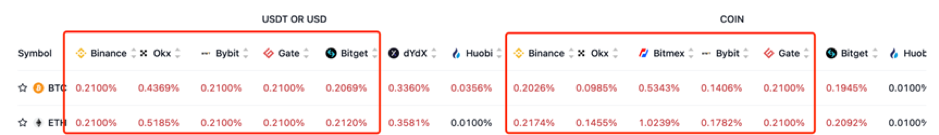

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

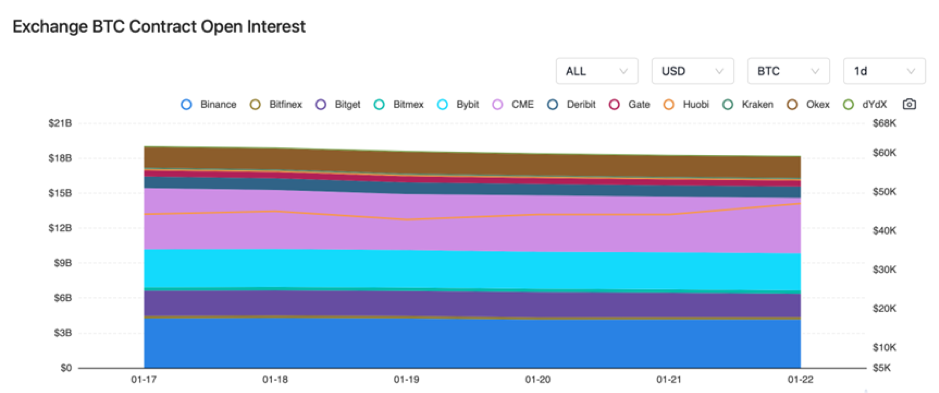

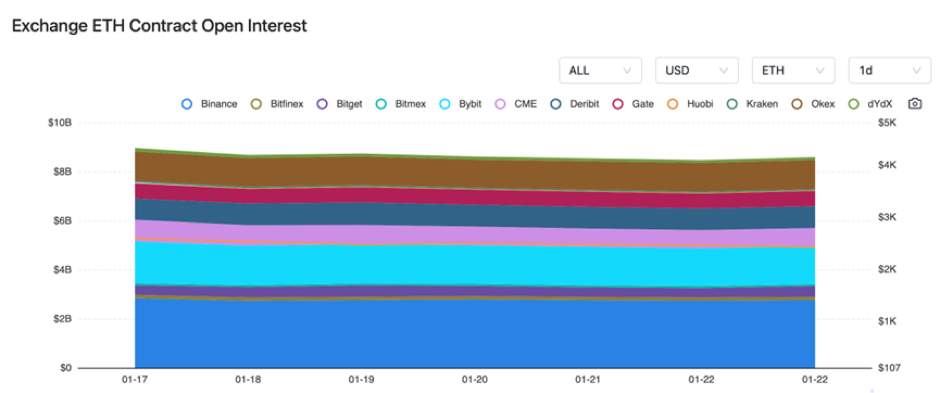

The BTC contract open interest saw a slight decline, while the ETH contract open interest remained steady on major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On January 18, Thailand lifted individual investment restrictions on digital tokens.

2) On January 18, the social media platform Reddit would conduct an IPO in March.

3) On January 18, Tether currently holds $2.8 billion worth of Bitcoin.

4) On January 19, the SEC postponed the resolution deadline for the Fidelity Ethereum ETF to March 5.

5) On January 19, Huawei Cloud’s Web3 Node Engine Service (NES) was officially put into commercial use.

6) On January 20, the B3 exchange in Brazil would open after-hours trading for Bitcoin ETFs.

7) On January 20, according to the Franklin Templeton CEO, there was significant demand from investors for Bitcoin.

8) On January 21, Bloomberg ETF analysts stated that the total net inflow of funds into the spot Bitcoin ETF market amounted to $1.2 billion.

9) On January 21, the total assets under management for Bitcoin ETFs exceeded $29 billion.

10) On January 21, this week will see token unlocks for DYDX, ACA, YGG, AGIX, and others.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.