FameEX Weekly Market Trend | July 25, 2024

2024-07-25 10:39:25

1. BTC Market Trend

From July 22 to 24, the BTC spot price swung from $63,866.78 to $68,444.39, a 7.17% range.

Important statements from the Federal Reserve (Fed) and the European Central Bank (ECB) over the past three days are as follows:

1) On July 22, the Fed’s Williams stated that the Fed remains committed to achieving the 2% inflation target, and the long-term trends continue to impact the neutral rate.

2) On July 23, ECB Governing Council member Makhlouf indicated that rate decisions are not urgent and are made on a meeting-by-meeting basis. Šimkus agreed with market expectations of two more rate cuts this year, predicting significant rate decreases. Rehn noted the risk of higher-than-expected inflation but anticipated it would slow to the 2% target in the medium term.

3) On July 23, ECB Vice President de Guindos stated that September is a more convenient time to make decisions. Inflation will remain at the current level in 2024, and the current level of uncertainty is very high, so we must remain cautious when making decisions.

All spot Ethereum ETFs in the U.S. have officially listed and started trading:

BlackRock Spot Ethereum ETF (ticker: ETHA) was listed on Nasdaq.

Fidelity Spot Ethereum ETF (ticker: FETH) was listed on CBOE.

Bitwise Spot Ethereum ETF (ticker: ETHW) was listed on NYSE.

VanEck Spot Ethereum ETF (ticker: ETHV) was listed on CBOE.

Invesco Galaxy Spot Ethereum ETF (ticker: QETH) was listed on CBOE.

Franklin Spot Ethereum ETF (ticker: EZET) was listed on CBOE.

Grayscale Spot Ethereum ETF (ticker: ETHE) was listed on NYSE.

Grayscale Spot Ethereum Mini ETF (ticker: ETH) was listed on NYSE.

Reportedly, at Bitcoin 2024 scheduled for July 25-27, listing Bitcoin as a strategic reserve asset is on Trump’s agenda. Neuner told Michelle Makori, chief anchor and editor-in-chief of Kitco News: “A strategic reserve usually refers to reserves the U.S. holds for emergencies. In terms of Bitcoin, there’s no real reason to hold it besides value preservation. If anything, Bitcoin and gold belong in the same asset class. Holding Bitcoin is like keeping gold on the U.S. balance sheet for reserve diversification or as a hard asset. This seems the most logical.”

Another key aspect is that among sovereign states, the U.S. leads in Bitcoin holdings due to seizing large amounts of Bitcoin from illegal traders. According to BitcoinTreasuries, the U.S. government holds over 200,000 Bitcoins, worth about $13.44 billion at current prices. Neuner noted: “This is a big number. We think Trump might announce Bitcoin as part of the strategic reserve, potentially dispelling fears of major sell-off pressure.”

Former Republican presidential candidate Vivek Ramaswamy, who has been advising Trump on Bitcoin and cryptocurrencies, previously proposed backing the dollar with a basket of goods, including Bitcoin, to combat inflation and maintain the dollar’s value long-term.

Similarly, independent candidate Robert F. Kennedy Jr. suggested backing some U.S. Treasury notes with hard assets, including Bitcoin. In July 2023, at a PAC event, Kennedy said: “My plan is to start very small, perhaps 1% of issued Treasury notes will be backed by hard assets like gold, silver, platinum, or Bitcoin. Backing the dollar and U.S. debt with hard assets can help revive the dollar, curb inflation, and usher in a new era of financial stability, peace, and prosperity for America.”

Trump, Ramaswamy, and Kennedy will all speak at Bitcoin 2024. Additionally, Fox Business reporter Eleanor Terrett tweeted that former world’s richest man Elon Musk’s private jet has arrived in Tennessee, and he has changed his profile picture to laser eyes. The market speculates that Musk might also attend the Bitcoin 2024 conference.

The current market cap of Ethereum is about one-third that of Bitcoin. On the first day of trading, the U.S. Ethereum ETFs saw about one-eighth the trading volume of Bitcoin ETFs. Adjusting for the difference in market expectations given the launch of the first cryptocurrency ETF and the second issuance, the positive impact of U.S. Ethereum ETFs on BTC prices is estimated to be less than one-third of the total effect seen after the launch of U.S. Bitcoin ETFs.

It is viable to continue to focus on trading opportunities for the spot ETH and keep sell orders at $4,700 and buy orders at $2,500. For the spot BTC, keep sell orders at $72,500, $77,500, and $92,000, as well as buy orders at $42,950.

As it stands, if the Fed does not choose to cut interest rates in September this year but instead waits until November or even December, it would be more realistic for the BTC spot price to reach $92,000 next year.

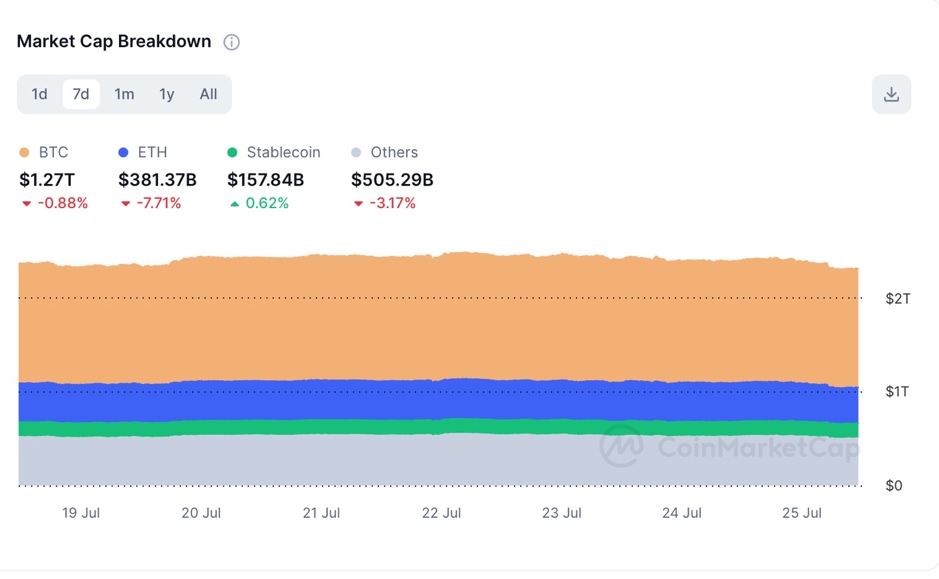

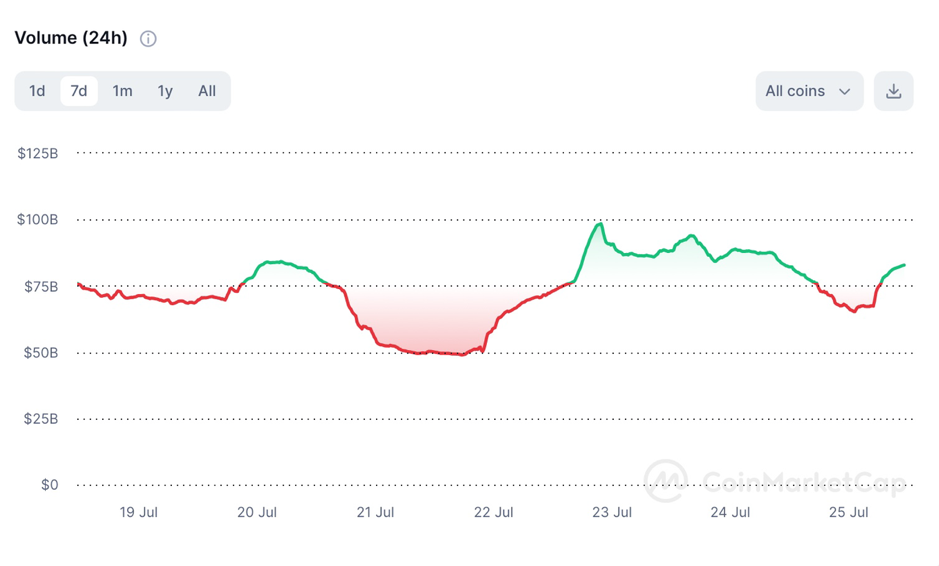

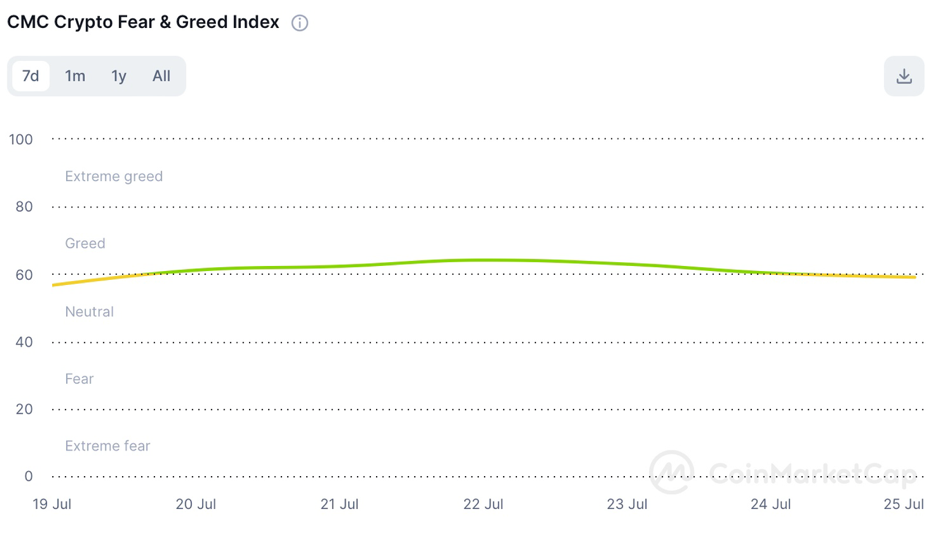

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

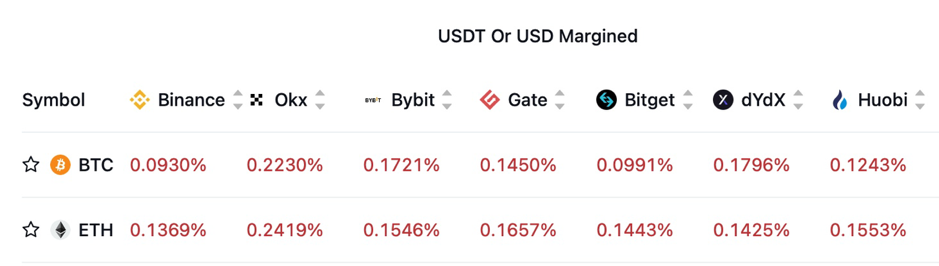

3. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

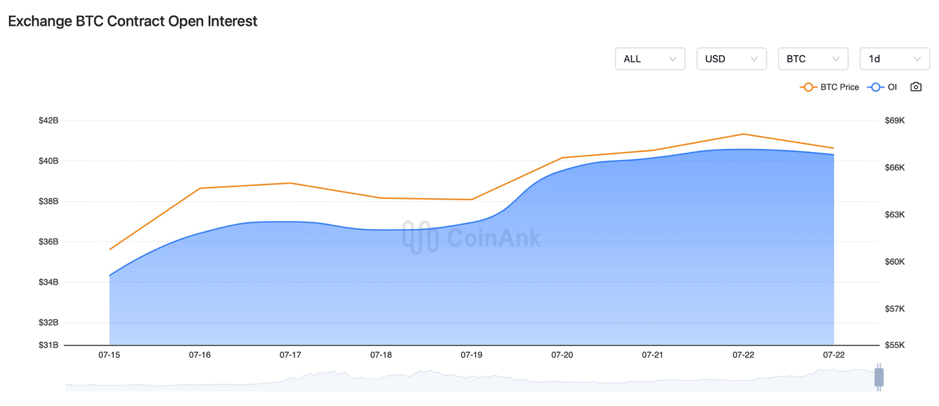

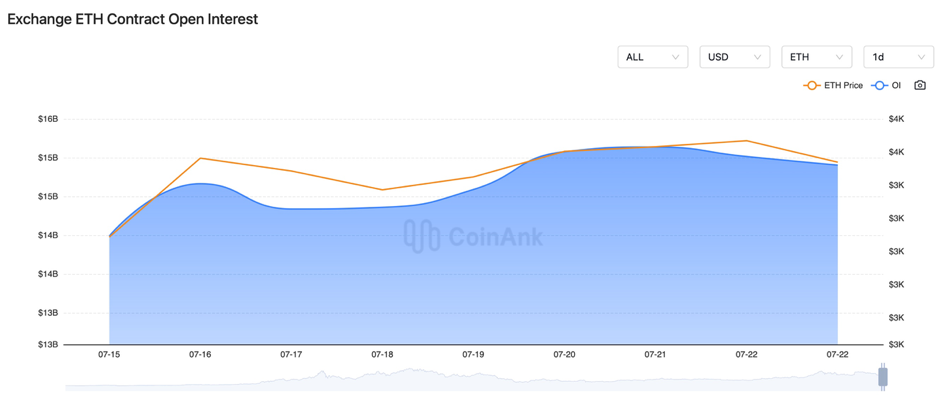

In the past three days, the BTC contract open interest has been decreasing while the ETH contract open interest has been increasing. This indicates that the current crypto market expects ETH to experience short-term gains driven by capital inflows but remains concerned about the sustainability of the overall market rally, including ETH.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On July 22, an ECB survey revealed that the ECB aims to achieve its 2% inflation target by 2025.

2) On July 22, it was reported that Africa’s share of global blockchain venture capital fell to 1.3% last year.

3) On July 22, Yellen hinted at a willingness to continue as U.S. Treasury Secretary.

4) On July 22, Variant’s Chief Legal Officer stated that with Biden’s withdrawal, the Democratic Party has a “huge opportunity” to regain most crypto votes.

5) On July 22, seven U.S. states jointly submitted a brief opposing the SEC’s excessive regulation of cryptocurrencies.

6) On July 22, South Korea released the Web3 market report, indicating a comprehensive analysis of crypto regulation policies and market uniqueness.

7) On July 22, “Musk changes profile picture to celebrate Biden’s withdrawal” trended at #16 on Weibo (a social media platform in China). The U.S. House Republican Speaker has called for Biden to “resign immediately”.

8) On July 22, the U.S. Secret Service Director resigned over the “failed assassination” incident involving Trump.

9) On July 22, crypto traders placed bets on the U.S. presidential election through memecoins. Vice President Harris announced she has enough support to become the Democratic presidential candidate.

10) On July 23, a U.S. cryptocurrency advocacy group sent a letter to Vice President Kamala Harris urging a more supportive stance on blockchain policies.

11) On July 23, Saporta, the Bank of England Executive Director, indicated that the market needs to prepare for the normalization of the Bank of England’s balance sheet. New repo arrangements won’t constrain the MPC’s decisions on quantitative tightening in September and December.

12) On July 23, Indian Finance Minister Sitharaman reported that inflation in India remains low and stable, moving towards the 4% target. Total expenditure for FY2025 is projected at ₹48.21 trillion, with a budget deficit target of 4.9% of GDP. The controversial crypto tax rules will remain unchanged.

13) On July 23, Palestinian factions signed the “Beijing Declaration” in Beijing to end the division.

14) On July 23, crypto exchange HKX announced the closure of its Hong Kong operations, urging users to withdraw their assets.

15) On July 23, Ethereum celebrated its 10th birthday, with ETH/BTC increasing more than 100 times over the past decade.

16) On July 23, the Base on-chain platform allowed U.S. politicians to accept cryptocurrency donations.

17) On July 23, on the first day of trading, ETH spot ETF volume was $618 million with less than 3 hours remaining, while BTC volume was $4.6 billion.

18) On July 23, two founders of the Forcount cryptocurrency Ponzi scheme pleaded guilty to telecommunications fraud.

19) On July 23, it was reported that DAG payment network COTI would participate in Israel’s central bank CBDC project alongside giants like PayPal and Fireblocks.

20) On July 23, crypto lobbying group Fairshake raised over $200 million, becoming the largest super PAC in this U.S. presidential election cycle.

21) On July 24, Solana welcomed Nomura and Brevan Howard’s tokenized company Libre.

22) On July 24, U.S. lawmakers requested OpenAI to provide clear statements on safety practices. Zuckerberg said, “It’s unrealistic for the U.S. to always be years ahead of China in AI.”

23) On July 24, the Bitcoin Magazine CEO planned to invite Harris to Bitcoin 2024.

24) On July 24, Senator Cynthia Lummis released a report criticizing Biden’s mining tax. The House passed the Financial Technology Protection Act, which aims to study the illegal use of digital assets.

25) On July 24, Tesla still held $640 million worth of BTC.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.