FameEX Weekly Market Trend | September 19, 2024

2024-09-19 11:12:50

1. BTC Market Trend

From September 16 to September 18, the BTC spot price swung from $57,558.25 to $61,664.49, a 7.13% range.

Key points from the Federal Reserve (Fed) FOMC Statement and Powell’s Press Conference on September 18

FOMC Statement:

1. Rate Decision: The federal funds rate was cut by 50 basis points to a range of 4.75%-5.00%, marking the first rate cut since March 2020.

2. Statement Summary: Removed the phrase “It is not appropriate to lower the target range for the federal funds rate until there is greater confidence that inflation is moving toward 2%.” Fed Governor Bowman supported a 25 basis point cut.

3. Rate Outlook: The Fed’s dot plot raised this year’s rate cut expectations to two, with four more expected next year. Future rate adjustments will consider new data, outlooks, and risk assessments.

4. Inflation Outlook: The upward risk to inflation has lessened, and it is steadily moving toward the 2% target. The risks to employment and inflation are seen as balanced.

5. Economic Outlook: The GDP forecast for this year was slightly downgraded, while unemployment projections for 2024-2026 were raised. Expectations for PCE and core PCE were lowered for the next two years.

Fed Chair Powell’s Press Conference:

1. Rate Outlook: Decisions will be made on a meeting-by-meeting basis. If the economy remains strong and inflation persistent, policy adjustments may be slower. Rate cuts could be fast, slow, or paused entirely—don’t expect 50 basis points as the norm.

2. Inflation Outlook: The upward risk to inflation has diminished, but Powell has not declared victory over inflation. Housing inflation is a drag on the economy.

3. Economic Outlook: The overall economy remains strong, and the Fed is committed to maintaining this strength. Unemployment has risen slightly but remains low. There are no signs that the likelihood of a recession is increasing.

4. Market Reaction: During the announcement and Powell’s remarks, gold initially surged but then fell, briefly reaching a historic high of $2,600. U.S. stocks turned negative, erasing all gains following the rate decision. The dollar weakened but later rebounded strongly, while the U.S. 2-year Treasury yield fell 11 basis points before recovering.

5. Latest Expectations: According to CME data, there is a 63.6% chance the Fed will cut rates by 25 basis points in November and a 35.3% chance of a 50 basis point cut.

At Token2049 on September 18, Ethereum founder Vitalik delivered a keynote speech titled “What Excites Me About the Next Decade.” In his speech, Vitalik highlighted that Ethereum’s main goal for the next decade is to achieve mainstream adoption while maintaining open-source and decentralized values. He presented six key points to illustrate this vision: 1) wallet security, 1.5) decentralized social media user experience, 2) payments, 3) privacy tools, 4) zk-powered social media, and 5) Ethereum Layer 1 (Oribit SSF, Verkle Tree/stateless validation, addressing MEV issues, integrating Ethereum L1 ZK-SNARKs and light clients).

A new version of the phone, named Seeker, has generated nearly five times the revenue of Solana’s first crypto smartphone, Saga. Seeker is expected to launch in the summer of 2025. On September 18, the project announced that the second mobile device from the team behind Solana Mobile had received $70 million in pre-orders. So, what’s driving the demand? A new market. Solana Mobile General Manager Emmett Hollyer told DL News ahead of this week’s Token2049 conference in Singapore, “More than half of our orders come from Asia-Pacific countries, where we previously couldn’t sell phones.”

From September 19 to September 30, the primary focus should be on short-term selling opportunities. The ETH spot sell order at $4,700 is likely to be filled no earlier than next month, and we will provide additional sell order suggestions afterward. The buy order at $1,850 is recommended to remain in place.

For BTC, the spot sell orders at $72,500 and $77,500 have a better chance of being filled in the short term, while the sell order at $92,000 can be kept with patience. The buy order at $42,950 should also remain active without cancellation.

2. Blockchain Mastery & Trading Tips

This discussion will focus on mindset and emotional self-control, and will also touch on interpersonal relationships, habits, and skill development.

Those with an innate talent for trading are extremely rare—perhaps one in hundreds of thousands or even fewer. The vast majority of us are ordinary investors who must rely on learning, training, and scientific methods to expand our success in trading. However, this doesn’t mean that those with average ability can’t accumulate more wealth than highly talented traders like Jesse Livermore or Xu Xiang. Warren Buffett, for example, doesn’t possess extraordinary trading talent—he even lags behind his business partner, Charlie Munger—but through managing large funds and compounding returns year after year, he still became one of the world’s richest individuals.

In this light, not only in learning but also in trading, it’s essential to find the right methods and follow the principle of “starting easy and gradually progressing” to improve one’s overall capabilities. Avoid impatience and the constant desire to get rich overnight through luck. Money made through luck will eventually be lost through skill—it’s an inevitable rule. Every successful investor, even the most talented, went through years of accumulation before achieving fame. This process follows the natural law of “slow and steady wins the race”—trying to rush will only lead to failure.

In all fields, there’s a shared understanding among the strongest individuals: emotions should be used to influence others, not ourselves. Therefore, there is no need to feel regret or frustration over a few failed trades, nor to doubt oneself. No one can maintain a 100% win rate in trading. The key is to continuously improve one’s knowledge and overall strength.

Professional secondary market investors understand that loneliness is normal. The more time you spend perfecting a trading system that suits you, the better your grasp of market conditions will be, and the easier it will be to profit—that’s the power of focus. However, the key is to observe the entire cryptocurrency market, not just one specific token (except for index-like assets like Bitcoin and Ethereum). In today’s interconnected world, major events happening anywhere can quickly spread globally through mainstream media. For professional financial institutions, there are rapid connections between the economies, politics, wars, and price movements of major assets worldwide, including Bitcoin, other major cryptocurrencies, and their related ecosystem tokens. We must act as generals overseeing the big picture, not just soldiers focused on defeating the enemy in front of us. In other words, if you want to be one of the top crypto traders, you need to have at least the same level of information sensitivity, data collection and processing capabilities, mindset, and professional decision-making as the chief investment officer of Grayscale. Every trade we make is an outward reflection of our current understanding combined with our emotions.

The best hunters excel at waiting. The core idea of the world’s three greatest military books—"The Art of War," "The Book of Five Rings," and "On War"—is to secure victory before engaging in battle. If there isn’t a high-certainty profit opportunity you can control, place an order and wait patiently. When we turn a profession into a passion and make that passion a habit, we need to maintain a healthy body and get sufficient sleep to support the brain and body’s high daily demands. This is a form of energy management. A healthy body comes from fitness and other physical activities, which also foster a positive, sunny attitude and outlook. People are easily drawn to individuals with ideal physiques—not just because they’re pleasing to look at, but because their discipline is recognized. Disciplined individuals tend to value quality of life and work habits, leaving an impression of resilience, reliability, and the ability to handle setbacks, which makes them more likely to succeed in any field.

Each trading reflection should focus on improving knowledge and skills, rather than on the amount of profit. View gains and losses with detachment, and maintain a calm attitude. Money is merely a byproduct of enhanced skills and abilities. On a deeper level, if you can reflect on yourself in everything, be gentle in nature, and reduce complaints, you can “work with human nature, but live against it.” In doing so, you’ll be able to navigate life’s ups and downs independently. Those around you will feel uplifted, and this will not only help you succeed in trading or any other career, but also reduce the misfortunes in your life journey.

3. CMC 7D Statistics Indicators

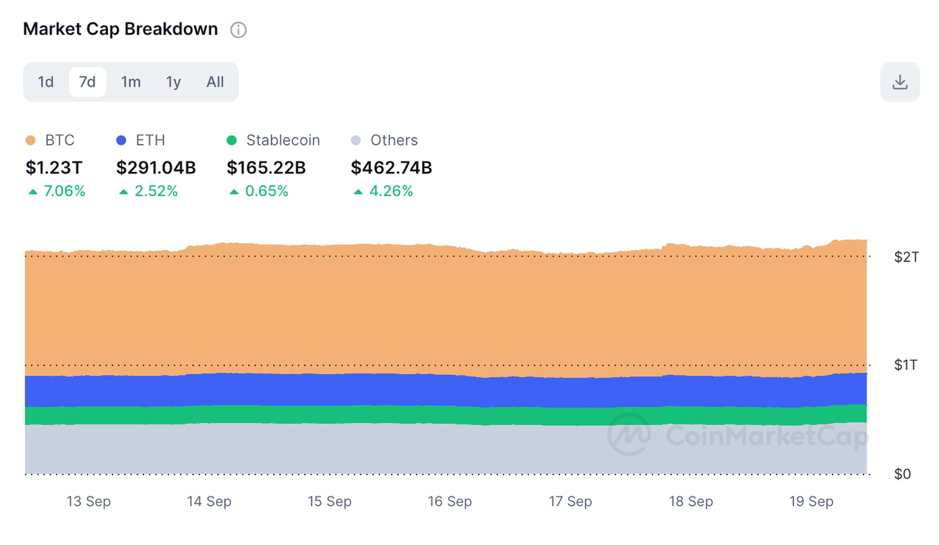

Overall market cap analysis, source: https://coinmarketcap.com/charts/

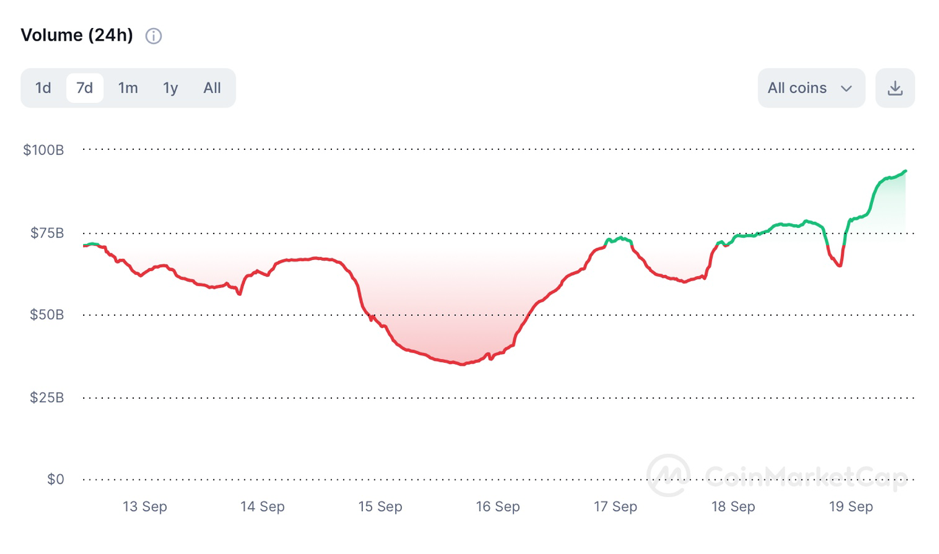

24h trading volume, source: https://coinmarketcap.com/charts/

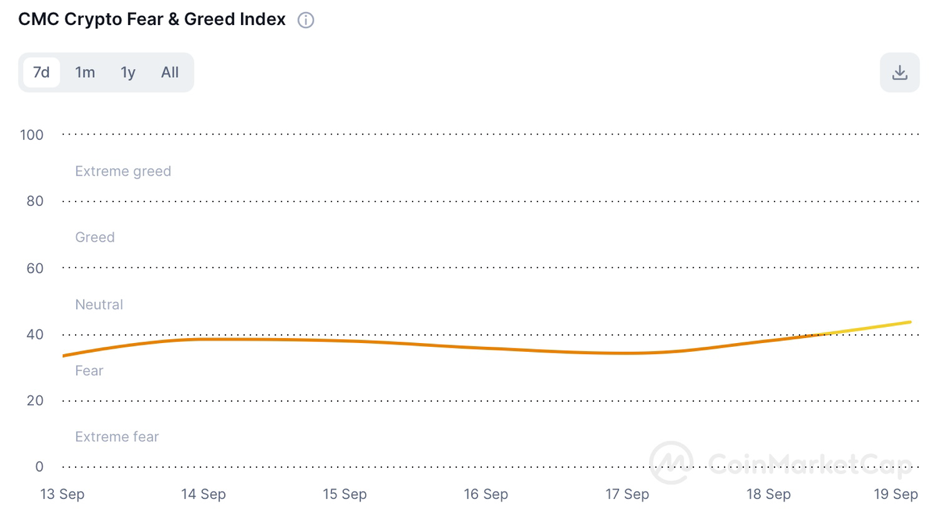

Fear & Greed Index, source: https://coinmarketcap.com/charts/

4. Perpetual Futures

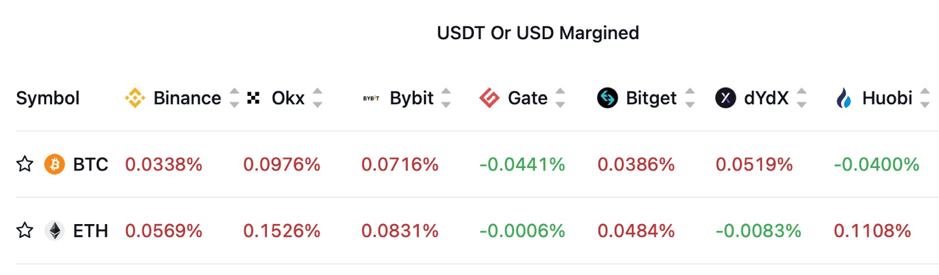

The 7-day cumulative funding rates for major mainstream coins on various exchanges are generally positive, clearly indicating a market-wide bullish sentiment driven by the Fed’s initiation of its current rate-cutting cycle.

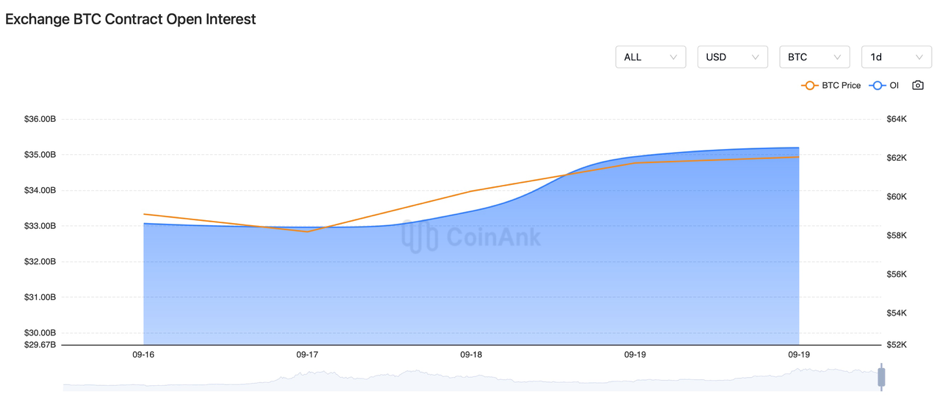

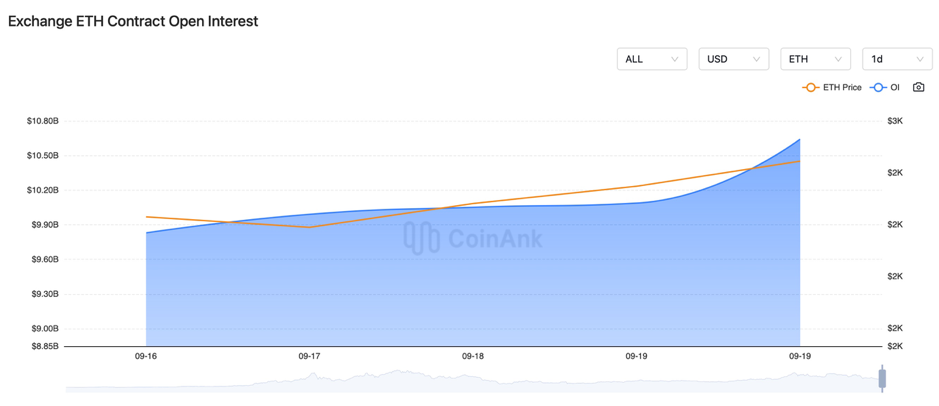

In the past three days, both the BTC and ETH contract open interest has slightly risen, suggesting that a long position strategy should be the primary focus.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

5. Industry Roundup

1) On September 16, Vitalik Buterin stated that the crypto industry is in the early stages of lowering L2 costs, ZK-SNARKs, and account abstraction. He also mentioned that solo stakers could be critical for Ethereum’s long-term security. The documentary Vitalik: An Ethereum Story will premiere globally on September 18.

2) On September 16, Russian President Putin signed a decree to increase the number of military personnel to 2.39 million, including 1.5 million military staff.

3) On September 16, the Russian Central Bank raised the benchmark interest rate to 19%, contrary to market expectations of maintaining it at 18%. European diplomats have proposed new measures to extend sanctions on the Russian Central Bank’s assets.

4) On September 16, an Indian court banned the police from freezing entire bank accounts in cryptocurrency fraud investigations.

5) On September 16, there were reports of another possible assassination attempt on former President Trump, with an assailant armed with an AK rifle within 500 meters. Following the incident, Trump’s election odds rose by 1%, though he still trails behind Kamala Harris.

6) On September 16, X (formerly Twitter) obtained money transmission licenses in 37 U.S. states.

7) On September 16, the founder of CryptoQuant noted that the crypto industry is in crisis, with altcoins performing poorly and no significant inflows of capital this year.

8) On September 16, Trump expressed that while the crypto industry is in its infancy, it has great potential. He emphasized the importance of establishing a legal framework for crypto in the U.S. and said that without him in office, crypto startups in the country would face severe challenges.

9) On September 17, Bitcoin mining company Cathedra Bitcoin shifted from mining to increasing its Bitcoin holdings.

10) On September 17, DBS Bank announced the launch of crypto options and structured notes for institutional clients.

11) On September 17, Mark Zuckerberg banned Russian state media from using Facebook and Instagram.

12) On September 17, the U.S. House Financial Services Committee Chair expressed confidence that the crypto market structure bill would be passed by the end of the year.

13) On September 17, the Qatar Financial Centre launched a digital asset lab.

14) On September 17, the Reserve Bank of Australia said it would prioritize wholesale central bank digital currency (CBDC) over retail versions.

15) On September 17, pharmaceutical distributor Cencora reportedly paid $75 million in Bitcoin as ransom to hackers in March.

16) On September 17, the U.S. SEC charged NanoBit and CoinW6 for allegedly promoting crypto “relationship investment schemes” on social media.

17) On September 18, JPMorgan, UBS, and others joined the Bank for International Settlements’ blockchain-based cross-border payment reform initiative.

18) On September 18, Vitalik Buterin stated that the crypto industry is no longer in its early stages, reflecting that Ethereum’s ICO was undervalued and that community-driven operations offer valuable lessons to the broader crypto sector.

19) On September 18, USDC stablecoin integrated with Brazil and Mexico’s real-time payment systems to enhance cross-border payment efficiency.

20) On September 18, World Liberty Financial’s whitepaper listed Donald Trump as the “chief crypto advocate.”

21) On September 18, the number of Bitcoin deposit addresses on centralized exchanges dropped to its lowest in years, indicating reduced sell pressure.

22) On September 18, DeFi lending platform Rari Capital reached a settlement with the SEC, while the U.S. CFTC Chair stated that the Kalshi prediction market investigation would continue.

23) On September 18, analysts reported that UNI tokens had been fully unlocked, with around 258.3 million tokens (25.83% of the total supply) now in circulation.

24) On September 18, major token unlocks for ARB, ID, APE, and LISTA, collectively releasing more than $80 million in value this week.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.