FameEX Weekly Market Trend | November 28, 2024

2024-11-28 10:10:35

1. BTC Market Trend

From November 25 to November 27, the BTC spot price swung from $90,644.2 to $98,673.05, an 8.86% range.

The key recent statements from the Federal Reserve (Fed) and the European Central Bank (ECB) over the past three days are as follows:

1) On November 26, Fed’s Kashkari said that it is a reasonable consideration to cut interest rates in December.

“Hawkish” Minneapolis Fed President Kashkari stated that a rate cut in December is a reasonable consideration.

“Dovish” Chicago Fed President Goolsbee believed that the Fed is expected to continue cutting interest rates, moving toward a neutral rate stance.

2) On November 27, according to Federal Reserve Minutes, officials inclined toward gradual rate cuts in the future. Some officials mentioned that high inflation and a weak labor market were reasons for either pausing easing or accelerating easing. They are also considering reducing the overnight reverse repo rate by 5 basis points to align with the lower bound of the federal funds rate.

3) On November 27, Fed’s Goolsbee indicated that as interest rates approach R*, it would be reasonable for the FOMC to slow the pace of rate cuts.

4) On November 25, ECB Governing Council Member Kazaks indicated that interest rates must continue to fall, and another rate cut must happen in December.

Chief Economist Lane said that the monetary policy should not remain restrictive for too long. Restrictive policies may not be needed by 2025.

Governing Council Member Villeroy indicated that the 2% inflation target might be reached earlier than expected in 2025, and inflation’s decline would enable the ECB to lower rates.

Governing Council Member Nagel stated that further rate cuts may occur in the coming months, with the inflation target expected to be reached by mid-2025.

Governing Council Member Centeno indicated that the inflation has met the target, but the economy faces challenges. The neutral rate could be around 2% or lower.

5) On November 26, ECB Governing Council Member Mahroof was open to the speed of rate cuts, confident that the 2% inflation target can be achieved by 2025.

Nagel said that the ECB cannot cut rates too quickly.

Chief Economist Lane emphasized that a flexible, incremental approach ensures sensitivity to the evolving economic conditions.

6) On November 27, ECB Vice President Guindos stated new forecasts would be released in December, but current developments suggest that economic growth remains fragile.

According to Governing Council Member Villeroy, Trump’s economic policies may have a limited impact on European inflation, but market rates could be affected.

Governing Council Member Centeno indicated that there are growing risks to European economic activity, and U.S. tariffs are not good news.

Governing Council Member Rehn said that if data and forecasts support it, a rate cut could happen in December.

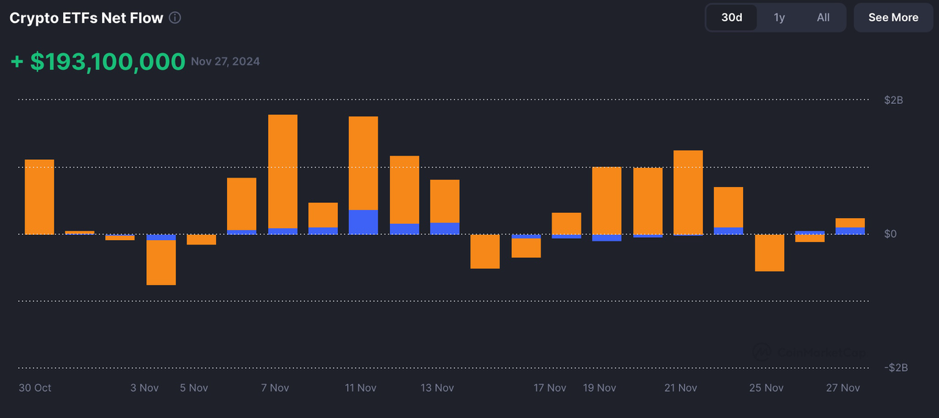

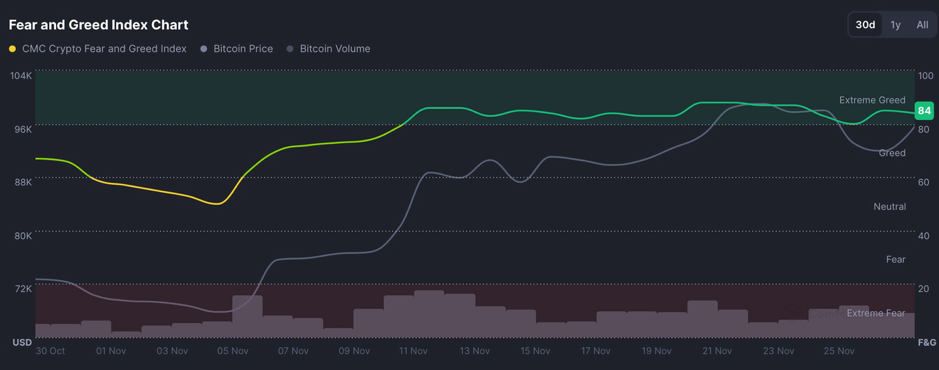

Bitfinex released a report stating that Bitcoin’s near-historic climb to the $100,000 mark is driven by unprecedented inflows from Bitcoin ETFs and strong institutional demand. Despite encountering some profit-taking resistance at its latest all-time high, Bitcoin showed resilience, holding steady near $96,000 over the weekend and regaining some upward momentum during early Monday trading.

Since its recent low of $66,880 before the U.S. presidential election, Bitcoin has risen by 47% and has seen an astonishing 130% increase year-to-date, opening new possibilities. The performance of Bitcoin compared to traditional assets is undeniable: its market capitalization has now surpassed Saudi Aramco, becoming the world’s seventh-largest asset, with a valuation at its peak exceeding $1.9 trillion. Although Bitcoin’s surge is impressive, it has not been without profit-taking from long-term holders. Despite some increased pressure, the current level of resistance remains manageable compared to historical peaks in March 2021 and March 2024.

These trends suggest that market momentum has temporarily stalled, but the overall market may absorb selling pressure and continue upward in the medium term. The overall cryptocurrency market (excluding Bitcoin and Ethereum, referred to as the Total3 index) has also reached a new cycle high. Investor sentiment has surged, pushing the Total3 index up by 23.2% from its low to high last week, marking the largest increase since April 2021. Large-cap altcoins, such as Solana (SOL), have reached new all-time highs, breaking through key resistance levels, including the April 2022 peak.

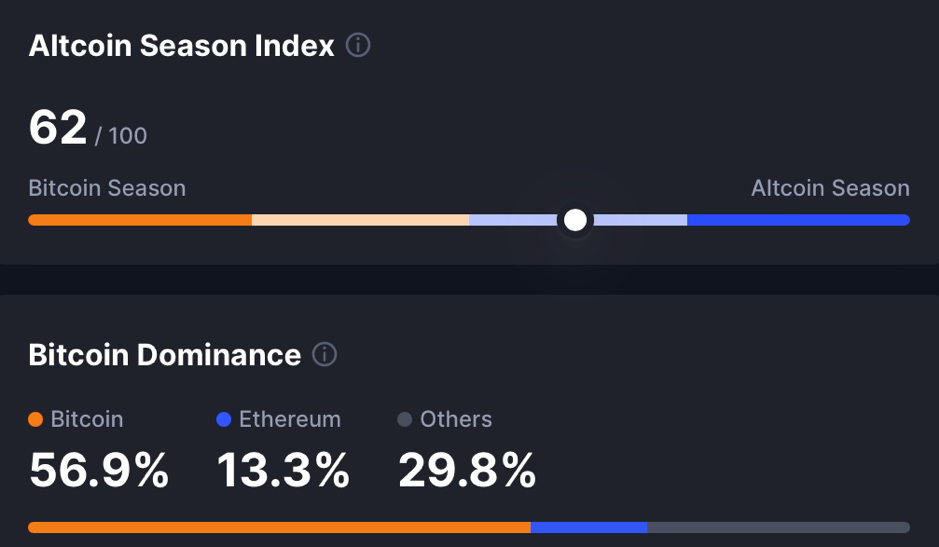

The market capitalization of altcoins is now approaching the $984 billion high from May 2021, indicating that speculative funds are shifting from Bitcoin to altcoins. Historically, this type of fund rotation often signals the arrival of “altcoin season”, where altcoins outperform Bitcoin. In fact, the annualized financing rate for large-cap altcoins has surpassed the 45% threshold, signaling an increase in speculative activity. As retail investor participation grows, short-term volatility is expected to rise, further fueling the momentum of altcoins. However, these conditions also warrant caution, as extreme financing rates often foreshadow significant market corrections.

From November 28 to December 1, continue monitoring trading opportunities for ETH spot orders. Focus on sell orders placed at $8,510, $7,840, and $5,040, as well as buy-the-dip orders at $2,040 and $1,730. For the BTC spot, maintain sell orders at $169,400, $102,980, and $96,820, along with buy-the-dip orders at $73,970, $59,935, and $45,900. Additionally, congratulations to the users who placed sell orders for Bitcoin at $96,820, securing their profits once again! It is still recommended to increase exposure to altcoins in the spot market.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

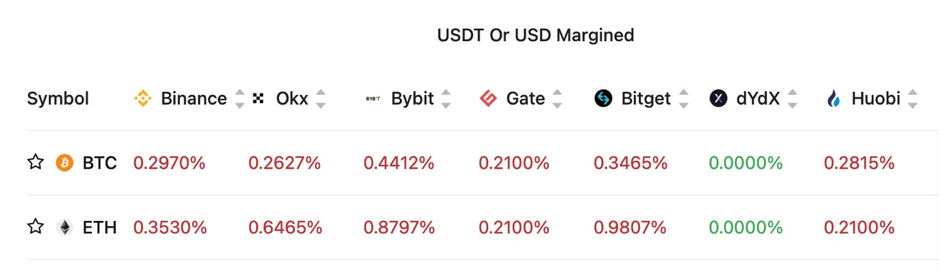

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

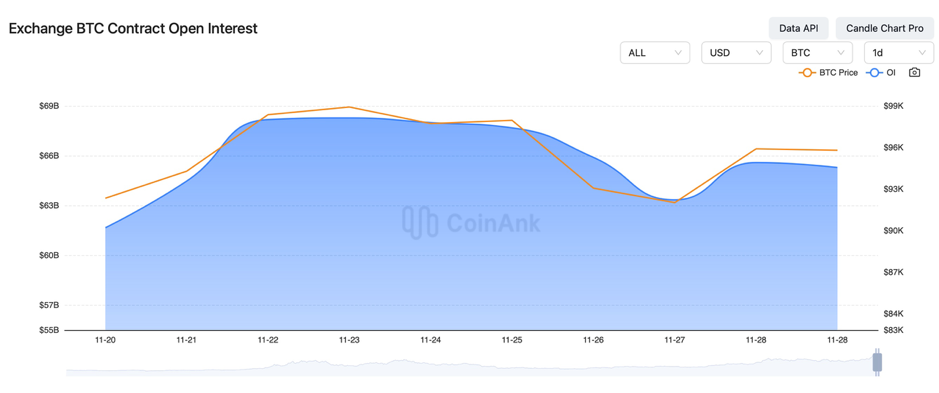

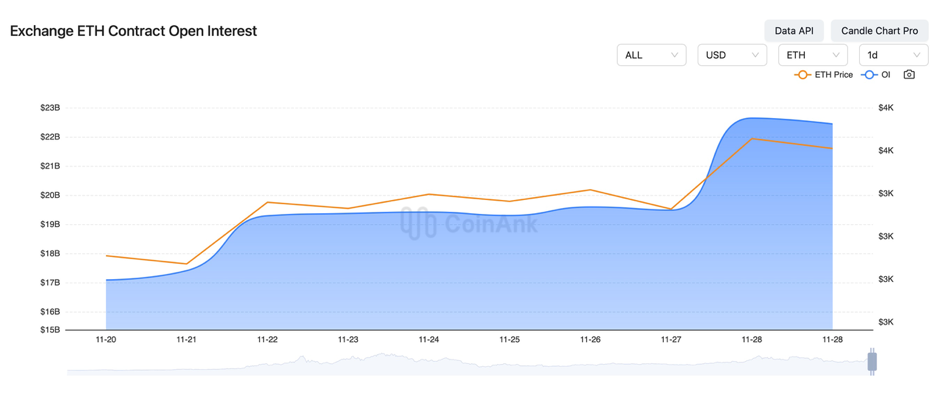

In the past three days, the Bitcoin contract open interest has gradually decreased, while the Ethereum contract open interest has remained relatively stable.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On November 25, it was said that the Chicago Board Options Exchange (CBOE) would launch Bitcoin-related index options products.

2) On November 25, Trump said the U.S. would impose a 25% tariff on goods from Mexico and Canada.

3) On November 25, it was reported that the UK financial regulatory agency plans to establish a cryptocurrency regulatory framework by 2026.

4) On November 25, Trump family’s crypto project WLFI received a $30 million investment from Justin Sun.

5) On November 25. Morocco might officially lift the 2017 cryptocurrency ban and re-legalize crypto.

6) On November 25, reports suggested that the missing OneCoin “Crypto Queen” Ruja Ignatova may be hiding in Russia.

7) On November 26, the Trump administration planned to grant the U.S. CFTC more power to reshape digital asset regulation.

8) On November 26, the Bank of Canada Deputy Governor indicated that if overall economic development aligns with our predictions, further interest rate cuts are reasonable. Decisions will be gradually implemented.

9) On November 26, Bank of England’s Dhingra stated that the UK is no longer an inflation “outlier” among developed economies, and is now facing deflation risks.

10) On November 26, Bank of England Chief Economist Pill said the impact of the budget on the consumer price index should not be overstated; there are no significant vacancies in the UK labor market.

11) On November 26, Bank of England Deputy Governor Lambarde indicated that the UK has made good progress in reducing inflation, but it’s too early to declare victory. U.S. tariffs pose a risk to UK economic growth.

12) On November 26, the U.S. October Core PCE Price Index MoM was 0.3%, in line with expectations, while YoY was 2.8%, slightly above the previous value of 2.7%.

13) On November 27, U.S. Initial Jobless Claims for the week ending November 23 were 213,000, below the forecast of 216,000; the previous week’s number was revised to 215,000.

14) On November 27, the EU initiated an excessive deficit procedure against France, Italy, and six other member states.

15) On November 27, Liu Liange, former Chairman of the Bank of China, was sentenced to death with a two-year reprieve for bribery of 121 million yuan and illegal lending of 3.32 billion yuan.

16) On November 27, The China Securities Regulatory Commission (CSRC) published 8 financial industry standards, including the “Blockchain General Infrastructure Communication Guidelines for Regional Equity Markets”.

17) On November 27, it was reported that Japan would release the October unemployment rate and November Tokyo CPI this Friday.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.