FameEX Weekly Market Trend | December 9, 2024

2024-12-09 09:39:50

1. BTC Market Trend

From December 5 to December 8, the BTC spot price swung from $91,210.8 to $103,793.34, a 13.8% range.

The key recent statements from the Federal Reserve (Fed) and the European Central Bank (ECB) over the past four days are as follows:

1) On December 5, according to the Federal Reserve Beige Book, economic activity in most regions of the United States has slightly increased recently.

Chairman Jerome Powell indicated that the Fed should adopt a more cautious approach without substantially altering expectations for rate cuts. He saw no possibility of a “shadow Fed chairman” during the Trump era. The Fed can remain cautious in identifying a neutral interest rate. Bitcoin’s competitor is gold, not the U.S. dollar. Due to his position, Powell is not permitted to hold Bitcoin.

Mousalem suggested that a pause in rate cuts might occur at the December meeting or later.

Barkin indicated that inflation and employment are moving in the right direction but still face risks.

2) On December 6, Fed Goolsbee indicated that the addition of 227,000 jobs is significant, but we need to examine the averages. A gradual pace of rate cuts seems appropriate.

Bowman was reluctant to oppose rate cut policies easily, favoring cautious and incremental rate reductions.

3) On December 7, Fed Daly advocated a gradual approach to interest rates as the Fed reaches an “approximately appropriate” policy level. Harker stated that the Fed is “at or near” the point of slowing the pace of rate cuts.

4) On December 5, Christine Lagarde (ECB) expected weak economic growth in the Eurozone and intended to continue lowering interest rates.

Vujcic preferred small rate hikes in uncertain conditions.

Nagel supported a gradual and cautious approach to rate cuts.

On December 6, Bitcoin Magazine CEO David Bailey stated that the opposition between Bitcoin and other cryptocurrencies is a false narrative. He argued that if the SEC reforms existing regulations and positions tokens as “Equity 2.0”, cryptocurrencies will naturally synergize with Bitcoin as “Gold 2.0”. This shift could unlock trillions of dollars in market value, push Bitcoin’s market cap to unprecedented heights, and ultimately establish a truly decentralized financial system based on Bitcoin.

Donald Trump announced the appointment of Silicon Valley investor David O. Sacks as the White House Director of AI and Cryptocurrency. On Truth Social, Trump posted: “I am pleased to announce that David O. Sacks will serve as the ‘White House AI and Cryptocurrency Director’. In this critical role, David will guide policies in AI and cryptocurrency, two fields crucial to America’s future competitiveness. He will work to make the U.S. the clear global leader in these domains, protect online free speech from Big Tech’s bias and censorship, and establish a legal framework for the cryptocurrency industry to thrive in America. David will also chair the Presidential Technology Advisory Board. With his knowledge, business experience, wisdom, and pragmatism, David will make America great again in these critical technologies. Congratulations, David!”

According to Rootdata, the cryptocurrency projects funded by Sacks’ venture capital firm, Craft Ventures, include dYdX, Lightning Labs, River Financial, Kresus, Set Protocol, FOLD, Harbor, Handshake, Voltage, Galoy, Lumina, Rare Bits, and others.

Syrian Crisis: ① The Syrian opposition claimed to have taken control of Damascus and overthrown Assad’s regime. ② Assad has left Damascus, and his whereabouts are unknown. The Syrian military stated that his rule had ended, with reports of a plane departing Damascus possibly crashing. ③ Syria’s Prime Minister is negotiating a transfer of power with rebel forces in Damascus. ④ Russia’s Foreign Ministry announced that President Assad had resigned. ⑤ Trump commented that Assad fled Syria after losing Russian support, while the Ukrainian intelligence claimed Russian forces were withdrawing from their bases in Syria. Syrian opposition fighters have stormed the Iranian Embassy in Syria, and Iran’s Foreign Ministry stated that Syria's future should not be disrupted or interfered with by external forces. U.S. Defense Department officials affirmed that the U.S. would maintain its presence in eastern Syria.

From December 9 to December 11, continue monitoring trading opportunities for ETH spot orders. Focus on sell orders placed at $8,510, $7,840, and $5,040, as well as buy-the-dip orders at $2,040 and $1,730. For the BTC spot, maintain sell orders at $169,400, along with buy-the-dip orders at $73,970, $59,935, and $45,900. Additionally, it is still recommended that exposure to altcoins in the spot market be increased.

2. CMC 7D Statistics Indicators

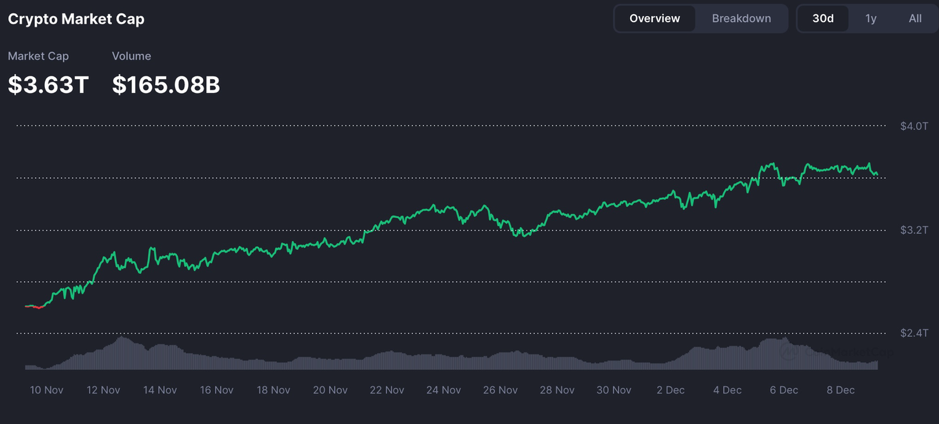

Overall market cap and volume, source: https://coinmarketcap.com/charts/

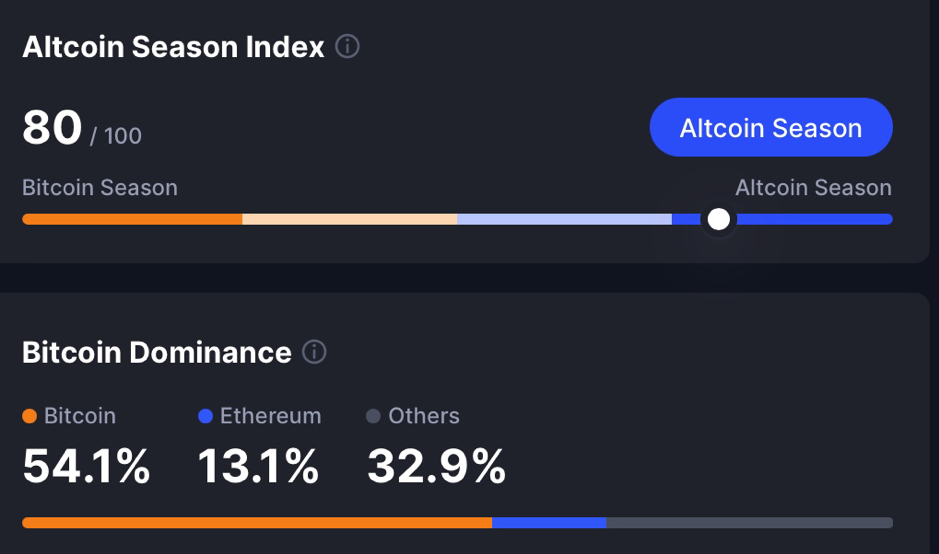

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

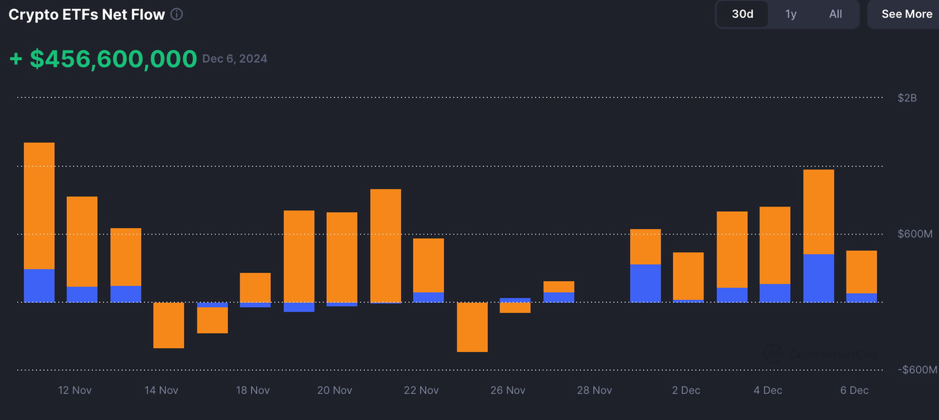

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

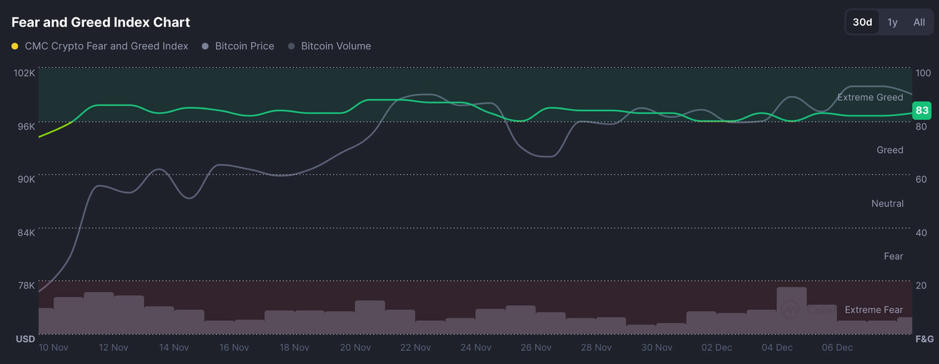

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

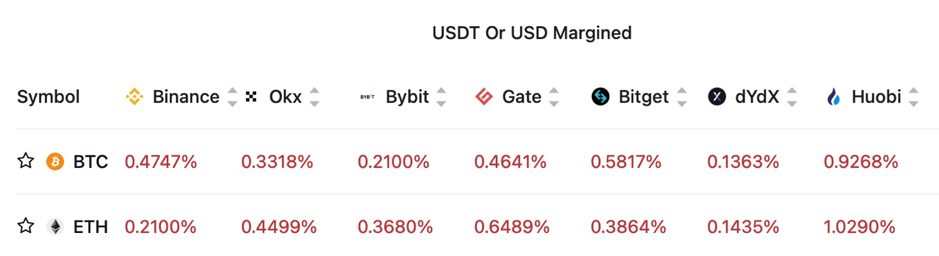

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

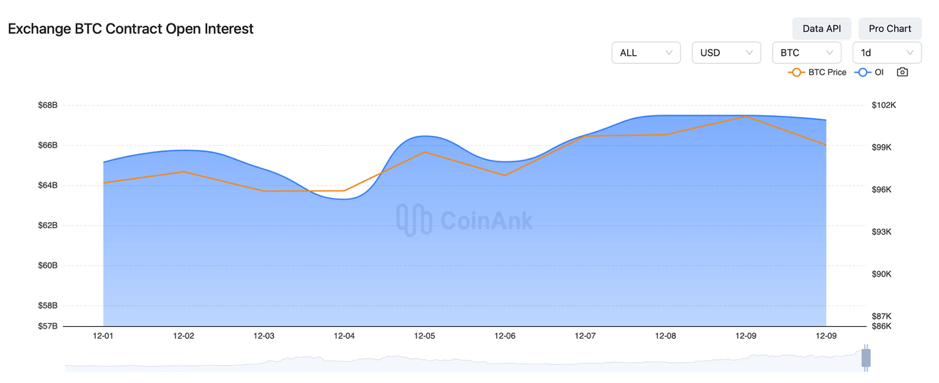

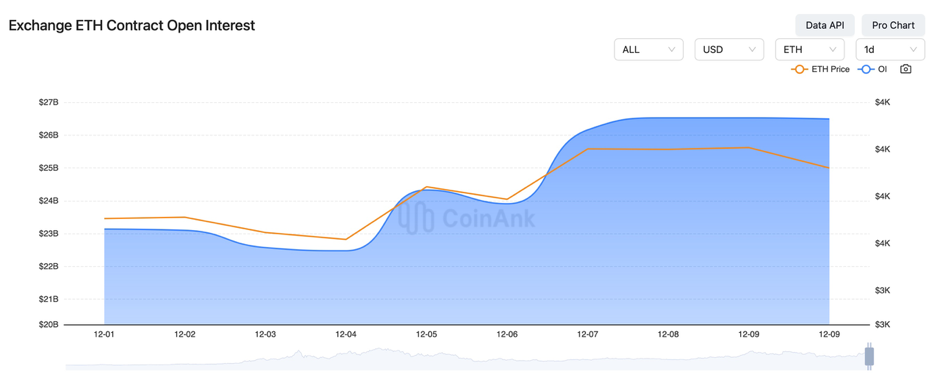

In the past four days, the open interest in BTC and ETH contracts has increasingly risen.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On December 5, U.S. initial jobless claims for the week ending November 30 reached 224,000, exceeding the expected 215,000. The previous figure was revised from 213,000 to 215,000.

2) On December 5, Bank of England Governor Andrew Bailey stated that four rate cuts are most likely next year, with inflation declining faster than expected.

3) On December 5, Russian President Vladimir Putin declared that no one can ban Bitcoin, as everyone is striving to reduce costs and enhance reliability.

4) On December 5, the total market capitalization of altcoins surged 78.16% in the past month, rising from $870 billion to $1.55 trillion.

5) On December 5, Musk’s xAI completed a new round of funding, raising $6 billion and reaching a valuation exceeding $40 billion.

6) On December 5, it was reported that Florida is expected to launch a strategic Bitcoin reserve in Q1 2025.

7) On December 6, the annualized premium on two-month Bitcoin futures hit 20%, the highest in eight months.

8) On December 6, Changpeng Zhao stated that Satoshi Nakamoto’s permanent retirement is the best part of Bitcoin’s design.

9) On December 6, the Financial Times issued a public apology for its negative coverage of cryptocurrencies since 2014.

10) On December 6, Vancouver, Canada, planned to incorporate Bitcoin into municipal finances, aiming to become a Bitcoin-friendly city.

11) On December 6, the UN’s Committee on Enforced Disappearances (CED) discovered approximately 20,000 bodies in a hangar at Bogotá International Airport, Colombia, with investigations ongoing.

12) On December 6, Bitcoin surpassed the $100,000 milestone, with its market capitalization reaching $2 trillion.

13) On December 7, U.S. nonfarm payrolls for November exceeded expectations, while the unemployment rate rose slightly to 4.2%. Markets increased bets on Fed rate cuts. U.S. one-year inflation expectations rose to 2.9%, the highest in six months.

14) On December 7, the U.S. retail investor icon “Roaring Kitty” posted his first tweet in three months, sparking a surge in meme stocks.

15) On December 7, the U.S. November unemployment rate stood at 4.2%, as expected, up from 4.1%. Canada added 50,500 jobs in November, exceeding the forecast of 25,000 and the previous 14,500.

16) On December 7, the Eurozone’s Q3 GDP growth rate was revised to 0.9% year-on-year, meeting the forecast of 0.90% and matching the previous value of 0.90%. The final seasonally adjusted quarterly employment growth rate for Q3 was 0.2%, also in line with expectations of 0.2% and the prior value of 0.20%.

17) On December 7, Bank of England MPC member Silvana Tenreyro suggested further policy easing is needed.

18) On December 7, China’s November foreign exchange reserves increased to $3.2659 trillion, beating the $3.23 trillion estimate and the previous $3.261 trillion.

19) On December 8, South Korea’s National Assembly failed to pass President Yoon Suk-yeol’s impeachment motion. The opposition plans to resubmit it next Wednesday. The ruling party leader stated Yoon had agreed to step down early. The prosecutor’s office announced the arrest of former defense minister Kim Yong-hyun.

20) On December 8, Elon Musk’s net worth surpassed $360 billion.

21) On December 8, Syrian Central Bank Governor Issam Hazma reported a planned theft of the bank earlier that morning. He assured that the bank’s funds belong to Syria, not any individual, and that security, now managed by opposition forces, has been restored.

22) On December 8, Donald Trump stated he has no plans to replace Federal Reserve Chairman Jerome Powell. He mentioned plans to impose additional tariffs but was uncertain whether American families would bear higher costs. He also refused to commit to the U.S. staying in NATO unless Europe pays its share of the expenses.

23) On December 8, next Monday, China will release November CPI and M2 money supply data. Next Thursday, the U.S. will report November CPI data, and the Bank of Canada will announce its rate decision. South Korea’s opposition party plans to reattempt President Yoon’s impeachment.

24) On December 8, next Thursday, the Eurozone will announce deposit facility and main refinancing rates as of December 12.

25) On December 8, China’s Xiangcai Securities was embroiled in a ¥30 billion fraud scandal, with shocking chat records exposed.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.