FameEX Weekly Market Trend | February 10, 2025

2025-02-10 11:56:30

1. BTC Market Trend

From February 6 to February 9, the BTC spot price swung from $94,570.71 to $99,960.87, a 5.7% range.

In the past four days, the Federal Reserve (Fed) and the European Central Bank (ECB) have made the following important statements:

1) On February 6, Fed Barkin indicated that the Q1 inflation rate would drop significantly due to base effects, while reiterating his inclination to continue rate cuts this year.

2) On February 7, Fed Kashkari stated that the rise in the U.S. 10-year Treasury yield is not concerning. The most important data today is the 4% unemployment rate. The current labor market remains strong, and businesses are optimistic. On U.S. tariff policy: “We need to wait and see.” If good inflation data emerges and the labor market remains strong, he would support further rate cuts.

Goolsbee said that the fiscal policy uncertainty might reduce the number of rate cuts.

Waller indicated that stablecoins are like synthetic dollars. If they can make payments faster and cheaper, he supports them. Stablecoins will strengthen the dollar’s role as a reserve currency.

Lorgan suggested that the 2025 options boil down to “resume rate cuts as soon as possible” or “maintain rates for quite a long time”.

3) On February 9, Fed Goolsbee stated that full employment appears to be within reach. Based on recent observations, he expressed optimism that tariffs are unlikely to become a significant trade barrier. Rates may remain unchanged temporarily, as the neutral rate balance has declined.

4) On February 6, ECB Executive Cipollone stated that there’s room for further rate cuts, and inflation is nearly on target.

5) On February 7, ECB Governing Council Member Vujčić indicated that U.S. tariffs would not immediately trigger a 50-basis point rate cut. Market bets on three rate cuts are “not unreasonable”.

The Fed released its semi-annual monetary policy report, stating that it continues to significantly reduce holdings of the U.S. Treasury and agency securities in a predictable manner. Since June 2024, the Fed has reduced securities holdings by $297 billion, with a cumulative reduction of approximately $2 trillion since the balance sheet reduction began. The Federal Open Market Committee (FOMC) indicated its intention to maintain securities holdings at a level consistent with the efficient implementation of monetary policy under an ample reserves regime. To ensure a smooth transition, the FOMC slowed the pace of securities reductions in June 2024, planning to stop reducing holdings once reserve balances slightly exceed the level considered sufficient for ample reserves.

From February 10 to February 12, keep monitoring ETH spot trading opportunities. The sell order at $5,125, along with the buy orders at $2,040 and $1,730, should remain active. For the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source:https://coinmarketcap.com/charts/

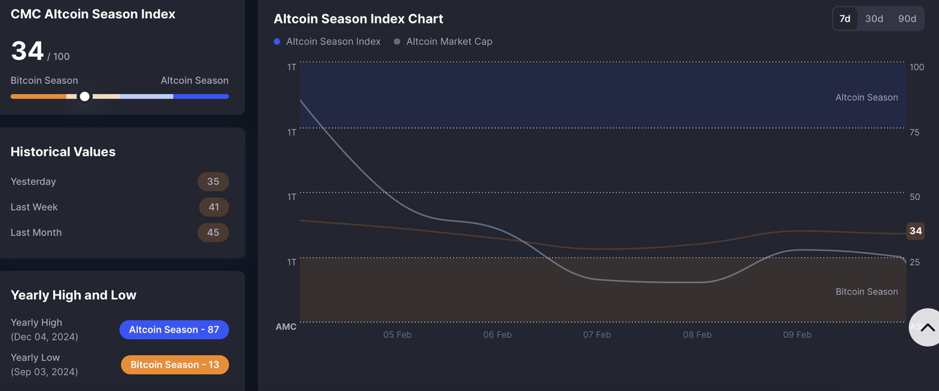

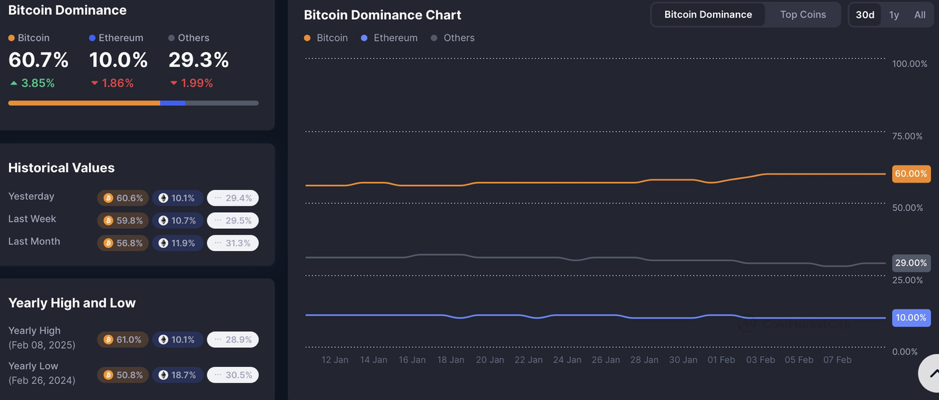

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

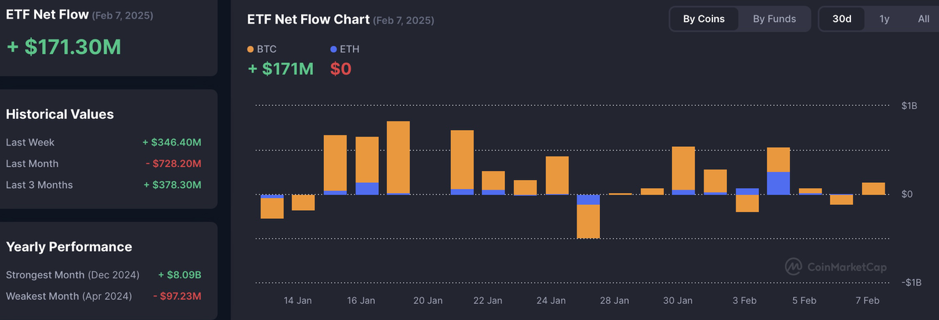

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index:https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

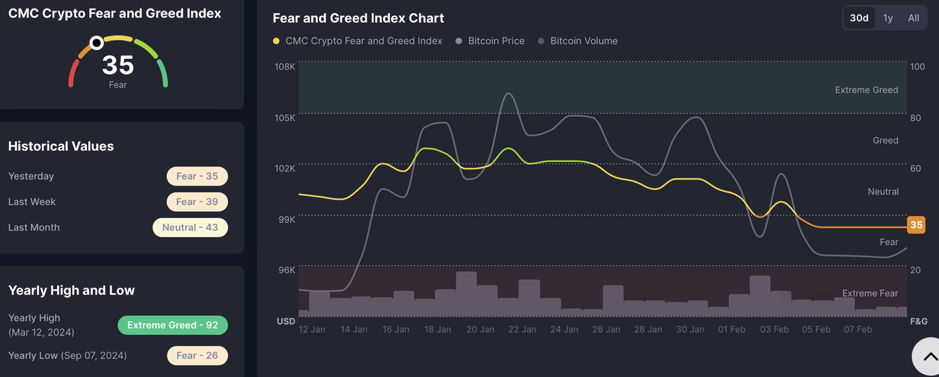

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

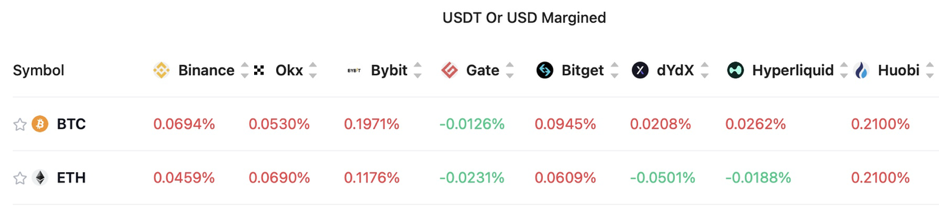

The 7-day cumulative funding rates for major exchanges’ mainstream cryptocurrencies are generally positive, indicating that long leverage is currently higher.

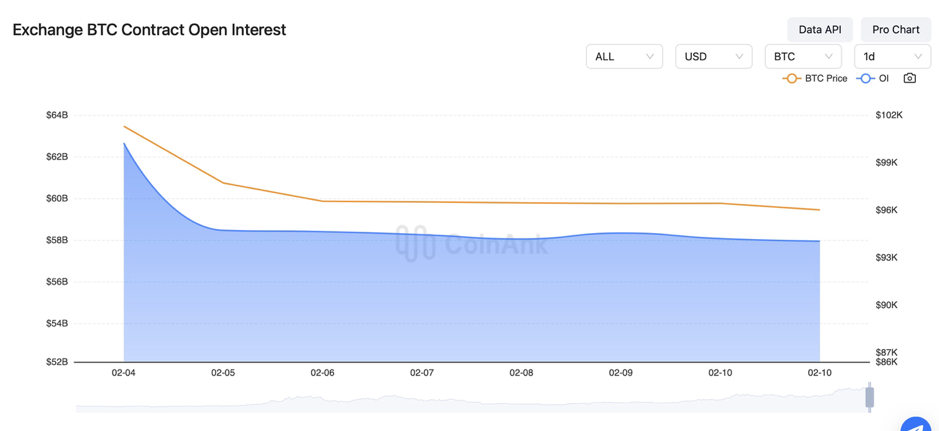

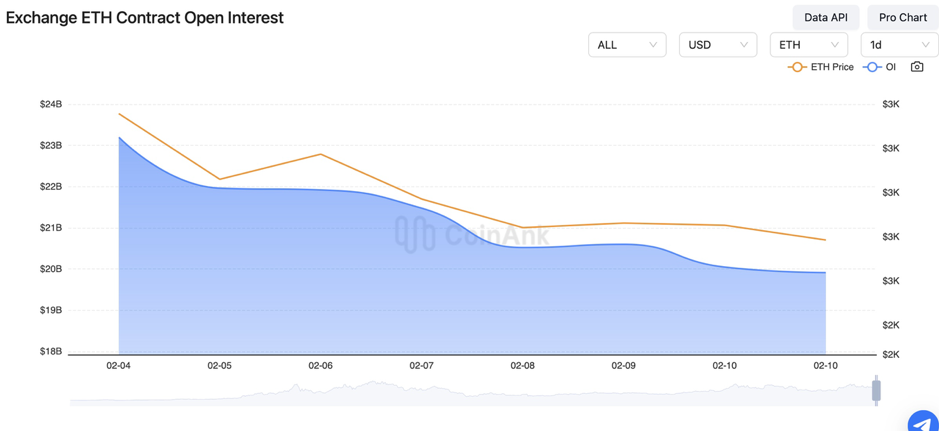

In the past three days, the BTC contract open interest has remained unchanged, while the ETH contract open interest has gradually dropped.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On February 6, Trump Media Group filed trademarks for “Truth.Fi Bitcoin Plus ETF” and related services, aiming to expand financial services.

2) On February 6, Canada banned crypto funds from enjoying reduced margin benefits, increasing the cost of leveraged trading.

3) On February 6, U.S. initial jobless claims for the week ending February 1 recorded 219,000 (forecast: 213,000; previous: revised to 208,000).

4) On February 6, Bank of England Deputy Governor Bailey indicated that further rate cuts are expected; Deputy Governor Ramsden stated that gold reserves have declined by about 2% since late 2024.

5) On February 6, the Bank of England cut interest rates by 25 basis points to 4.5%, as expected, marking the third cut in the current cycle.

6) On February 7, Bank of Japan Policy Board Member Naoki Tamura indicated that interest rates must be raised to around 1% by the second half of FY2025, but not necessarily on a semi-annual basis.

7) On February 7, U.S. February one-year inflation expectations stood at 4.3% (forecast: 3.30%; previous: 3.30%).

8) On February 7, U.S. January unemployment rate fell to 4.0% (forecast: 4.1%), the lowest since May last year; non-farm payrolls increased by 143,000, below the forecast of 170,000, marking a new low since October.

9) On February 7, Canada added 76,000 jobs in January (forecast: 25,000; previous: revised to 91,000).

10) On February 7, Warning: Beware of fake DeepSeek schemes, with over 2,000 phishing traps targeting virtual asset purchases.

11) On February 8, the Dominican Republic President announced a preliminary reserve estimate of 100 million tons of rare earth minerals.

12) On February 8, according to news, the U.S. FDIC is reassessing crypto regulations, removing previous warnings.

13) On February 8, the Czech President signed a new law exempting Bitcoin held for more than three years from capital gains tax.

14) On February 8, a Brazilian lawmaker proposed a bill allowing funds to invest in cryptocurrencies.

15) On February 8, the Bank of England cut interest rates by 25 basis points to 4.5%; two members voted for a 50-point cut.

16) On February 8, a New Mexico Senator proposed a strategic Bitcoin reserve bill, allocating 5% of public funds.

17) On February 9, the U.S. FDIC released 175 crypto-related bank regulatory documents.

18) On February 9, market reports indicated a U.S. sovereign wealth fund launch within 90 days, with Sacks’ crypto plan expected in 170 days.

19) On February 9, U.S. January non-farm payrolls rose by 143,000, the lowest since October, with a 4.0% unemployment rate, both below expectations.

20) On February 9, China and Thailand issued a joint statement to establish a cooperation mechanism to combat online gambling and fraud.

21) On February 9, the People’s Bank of China increased gold reserves for the third consecutive month; January gold reserves stood at 73.45 million ounces, while foreign exchange reserves reached $3.209 trillion (forecast: $3.2 trillion; previous: $3.202 trillion).

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.