FameEX Weekly Market Trend | April 24, 2025

2025-04-24 11:37:29

1. Key Insights on Crypto Market Trends

From April 17 to 23, the BTC spot price swung from $83,870.28 to $94,633.56, a 12.83% range. The rise was mainly due to Trump’s pledge to “substantially reduce” U.S. tariffs on China, easing fears of a new trade war and global recession.

Over the past week, key remarks from the Federal Reserve (Fed) and the European Central Bank (ECB) include:

1) On April 17, Fed’s Harker said the current restrictive policy is essential to tame inflation and that maintaining the current policy may be the “right approach”, and a steady policy is a “positive choice”. Keeping inflation expectations anchored is key for the Fed. The Fed must respond slowly and correctly to policy needs, rather than making quick and mistaken rate changes. With inflation remaining high and job growth slowing, the Fed faces a “difficult trade-off”.

According to NY Fed President John Williams, the U.S. economic growth is expected to slow significantly this year, with GDP growth possibly falling below 1% and unemployment rising to 4.5%–5%. While the U.S. economy is in a “very good state”, housing data shows declining builder confidence.

2) On April 18, Fed’s Daly stated that there is no rush to act; there is room to gradually lower interest rates and further reduce the balance sheet. She is satisfied with the outlook for two rate cuts this year, but if inflation proves stickier, there may be fewer than two cuts.

The Philadelphia Fed appointed Anna Paulson, Research Director at the Chicago Fed, as its new president. The current president, Harker, will finish his term on June 30.

Williams suggested that long-term interest rates may remain at 3%. The monetary policy is in a good position, and there is currently no need for rapid rate adjustments.

3) On April 22, Fed’s Goolsbee indicated that long-term inflation expectations had not increased. The Fed must focus on developments throughout the year; tariff policy is just one factor. Tariffs may have limited impact on the macroeconomy.

Atlanta Fed Research: The broad size of the federal labor force may shrink by about 1.2 million.

4) On April 23, Fed’s Kashkari expressed that Fed policymakers are making the most reasonable decisions based on data—this is the essence of independence. Rising bond yields and a weakening dollar suggest a shift in global investor preferences, which could quickly reverse once trade uncertainty is resolved. Tariffs may lead to unanchored inflation expectations, and the absence of a trade deficit could make the U.S. a less attractive investment destination.

5) On April 23, the ECB warned that the U.S.’s push for crypto policy could pose risks of financial contagion.

ECB Governing Council Member Villeroy stated that the inflation risk stemming from trade tensions appears limited or may even trend downward.

Fed Chair Powell’s Speech in Chicago – High Uncertainty Requires Patience for Clarity

1) Interest Rate Outlook: Uncertainty remains high. The current policy stance is considered appropriate, and adjustments will be made only after clearer signals emerge.

2) Economic Outlook: The U.S. economy remains “resilient”. Strong imports in Q1 were a drag, and GDP growth may slow compared to last year.

3) Inflation Outlook: U.S. tariffs may have a more lasting impact and are expected to push inflation higher. March PCE is projected at 2.3% year-over-year, with core PCE at 2.6%.

4) Labor Market: Overall remains balanced. Reduced funding for research may significantly impact employment. Unemployment is expected to rise.

5) Tariff Impact: So far, tariff hikes have far exceeded expectations. Policy is still evolving, and the impact remains highly uncertain.

6) Cryptocurrency: Gradually becoming mainstream. A legal framework for stablecoins is needed. Bank regulations may be “partially eased”.

7) Independence: The Fed’s independence is legally mandated. It will not be influenced by political pressure.

8) Other Notes: Don’t expect the Fed to step in and rescue markets. If a dollar shortage arises, the Fed is prepared to provide liquidity to global central banks.

European Central Bank’s Latest Rate Decision & Highlights from Lagarde’s Press Conference

Rate Decision:

1) Rate Cut: As expected, the ECB cut rates by 25 basis points — the seventh cut in the past year — with unanimous agreement.

2) Major Adjustment: The ECB dropped its previous assessment that policy was “significantly restrictive”, noting that several current factors may weigh on economic growth.

3) Forward Guidance: The ECB will continue a data-dependent, meeting-by-meeting approach, with no pre-commitment to a specific rate path.

4) Inflation Outlook: The disinflation process is broadly on track. Both headline and core inflation fell in March, in line with staff projections.

5) Economic Outlook: Despite ongoing global shocks, the eurozone has shown increased resilience. However, growth prospects have deteriorated due to escalating trade tensions.

President Lagarde’s Press Conference:

1) Tariffs: Tariffs will have adverse economic effects, though their net impact on inflation will become clearer over time.

2) Stimulus Measures: No discussion of stimulus took place. The ECB will adopt appropriate policy stances to meet its objectives.

3) Data Dependency: Now is the right time to rely on data. Trump’s 90-day tariff pause ends around July 9, at which point more information will be available.

4) Fed Relations: “I have great respect for Powell.” The ECB will continue acting based on dialogue and understanding of financial risks, independent of external influence.

5) Internal Debate: A few members favored skipping the rate cut weeks ago. No one supported a 50bps cut. All agreed on the 25bps cut.

6) Restrictiveness: Assessing the degree of policy restrictiveness is meaningless, as it largely depends on the gap between current and neutral rates.

7) Neutral Rate: The neutral rate is a theoretical concept that applies in a world free of shocks.

All in all, while Fed officials lean toward balance sheet reduction and holding off on rate cuts, short-term attention should stay on the implications of new U.S. tariff policies. ECB President Lagarde is satisfied with the decline in both headline and core inflation and hinted that further actions — such as another rate cut or a pause — could come after July 9.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

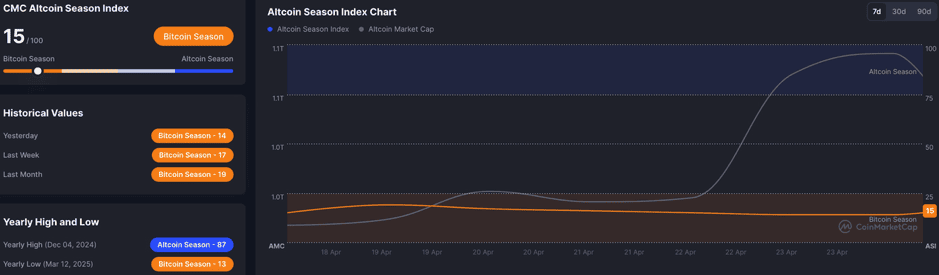

Altcoin Season Index: https://coinmarketcap.com/charts/

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

Fear & Greed Index, source: https://coinmarketcap.com/charts/

Over the past seven days, the total market value and trading volume of cryptocurrencies, market activity, and altcoin prices have continued to rebound significantly. ETF funds have continued to flow in, which has restored market confidence. The spot prices of major coins and altcoins with larger market capitalization have also started to rebound. The current fear and greed index is 53, which is in the median value area.

3. Perpetual Futures

The 7-day cumulative funding rates for BTC and ETH on the top 8 exchanges are 0.2265% and 0.7569%, respectively, indicating strong bullish sentiment across the market as of April 24. The bull market remains intact.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Over the past seven days, open interest in BTC and ETH futures has surged, indicating that most high-risk appetite market participants believe the market has now entered the second half of the bull run.

4. Global Economic and Crypto Sector Developments

Macroeconomy

1) On April 17, Bank of Japan Governor Kazuo Ueda indicated that Japan’s economy and inflation are largely in line with expectations, but growing uncertainties—such as the impact of global trade policies—must be closely monitored.

2) On April 17, the Bank of Canada held its interest rate steady at 2.75%, ending a streak of seven consecutive cuts.

3) On April 18, China’s Ministry of Foreign Affairs stated that the U.S. continues to play a numbers game with tariffs, which China will ignore. If the U.S. insists on materially harming China's interests, China will firmly retaliate.

4) On April 18, Japan’s core CPI for March rose 3.2% year-over-year, in line with expectations (3.20%) and up from the previous 3.00%.

5) On April 19, U.S. initial jobless claims for the week ending April 12 recorded 215,000, the lowest since the week of February 8, 2025.

6) On April 20, a top U.S. economist stated that the Fed has overcut rates, and the probability of the U.S. entering stagflation is now 65%.

7) On April 20, the IMF World Economic Outlook reported that global inflation is projected to reach 4.3% in 2025 and 3.6% in 2026, with inflation expectations for developed economies significantly revised upward.

8) On April 21, U.S. President Trump announced plans to “significantly reduce” high tariffs on China. Treasury Secretary Besant said high tariffs are unsustainable, expecting the trade war between the world’s two largest economies to “de-escalate”.

9) On April 22, Trump made a 180° shift in tone, stating he has no plans to fire Fed Chair Powell, blaming the media for stirring confusion. He added that now is the perfect time for the Fed to cut rates and hopes Powell acts early or on time, not too late.

10) On April 23, the White House announced it has received 18 trade agreement proposals and will hold trade team meetings with 34 countries this week. Trump emphasized maintaining the U.S. dollar’s global reserve currency status.

11) On April 23, this Thursday, the U.S. will release its weekly jobless claims data and the Fed will publish its Beige Book on current economic conditions.

Cryptocurrency Industry Updates:

1) On April 17, a warning indicated that scammers are hijacking abandoned DeFi project websites to trick users into signing malicious transactions.

2) On April 18, Richard Kim, founder of the crypto project Zero Edge, was arrested for gambling away investor funds.

3) On April 18, a crypto exchange CEO stated they are working with multiple countries to help develop crypto regulatory frameworks and assist in building strategic reserves.

4) On April 19, as trading volume declined, Ethereum transaction fees dropped to their lowest level in five years.

5) On April 20, an analyst stated that historical data shows Bitcoin often follows gold’s lead within 150 days after gold hits a new high.

6) On April 20, Tether’s CEO said that Tether now has over 450 million users, growing by more than 30 million per quarter.

7) On April 21, it was reported that Cantor would partner with SoftBank and Tether to launch a $3 billion crypto joint venture focused on Bitcoin investment.

8) On April 21, Trump Media & Technology Group planned to launch a series of ETFs under the Truth.Fi brand this year, covering digital assets.

9) On April 22, Coinbase confirmed it is considering applying for a U.S. federal banking license.

10) On April 22, the BTC/Nasdaq ratio reached 4.96, nearing historic highs.

11) On April 23, Bernstein indicated that the macro environment is favorable for Bitcoin, with five key catalysts ahead for the “digital gold.”

12) On April 23, it was opined that the U.S. government’s budget-neutral path could unleash up to $874 billion in structural BTC demand.

Regulation & Crypto Policy:

1) On April 17, North Carolina advanced HB 92, a bill that would allow the state treasurer to invest in digital assets.

2) On April 18, Slovenia announced plans to tax personal cryptocurrency profits at a rate of 25% starting in 2026.

3) On April 20, Arizona’s cryptocurrency reserve bill passed in the House Committee and entered the third reading stage.

4) On April 22, U.S. lawmakers proposed a tax bill targeting cryptocurrency tax avoidance through Puerto Rico.

5) On April 23, U.S. President Trump stated that the cryptocurrency industry urgently needs clear regulatory policies, while SEC Chairman Atkins emphasized that the primary task is to establish a solid foundation for digital assets.

Other News:

1) On April 18, OpenAI launched the Flex processing mode: API costs were halved, but at the expense of response speed and stability.

2) On April 18, ByteSeed open-sourced UI-TARS-1.5: a multimodal intelligent agent built on a vision-language model.

5. Market Outlook

From April 24 to April 30, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively. It is recommended to place a sell order for the ETH spot at $5,125 and set buy orders for bottom-fishing at $1,240.

Risk Reminder: The cryptocurrency market is highly volatile, and investors are advised to control their positions and implement stop-loss strategies. The above content is for reference only and does not constitute specific investment advice from this exchange.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.