US Bitcoin ETFs Are Set to Surpass Satoshi Nakamoto’s BTC Holdings in the Near Future

2024-08-14 09:29:10Bitcoin exchange traded funds (ETFs) in the United States are on track to surpass the estimated Bitcoin holdings of Satoshi Nakamoto, the pseudonymous creator of the cryptocurrency.

Source: www.fool.com

These ETFs have been adding approximately 37,510 BTC to their collective holdings each month. Currently, the total Bitcoin held by these ETFs stands at around 909,700 BTC, valued at approximately $55.1 billion based on the current price of about $60,500 per BTC.

Bloomberg ETF Analyst Eric Balchunas highlighted this trend on August 13, showcasing a chart that reveals the rapid accumulation of Bitcoin by these funds. The ETFs are approaching Nakamoto's estimated stash of 1.1 million BTC, a significant portion of which was mined in the early days of Bitcoin and has remained untouched since Nakamoto's disappearance over 13 years ago. Nakamoto's holdings are a topic of considerable interest and speculation. The precise amount is difficult to determine due to Nakamoto's use of multiple wallets and the fact that the Bitcoin was mined using a fresh wallet for each block. Estimates suggest that Nakamoto's stash could be as low as 600,000 BTC, distributed across up to 20,000 different wallets.

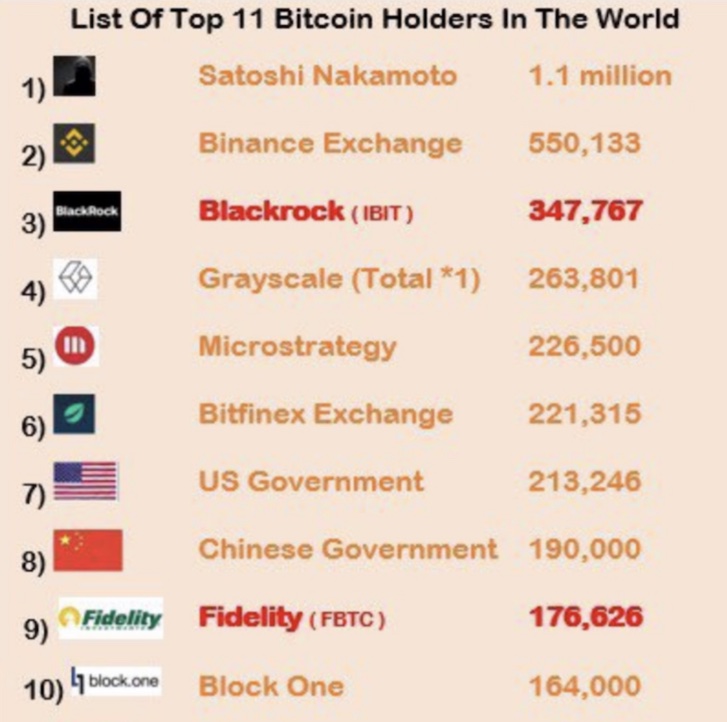

List of Top 11 BTC Holders, Source: Eric Balchunas

However, the exact number remains elusive, as Nakamoto has not moved any of this Bitcoin since vanishing from the public eye. At the current rate of accumulation, the Bitcoin ETFs could surpass Nakamoto's holdings by January 2025, marking one year since the launch of the first Bitcoin ETFs. Balchunas has speculated that the ETFs might exceed Nakamoto’s Bitcoin holdings even earlier, potentially as soon as October 2024. He notes that BlackRock’s ETF is already a leading player in the space and is on track to become the largest holder of Bitcoin among the ETFs by late next year, with a strong likelihood of maintaining that position for an extended period.

Since the beginning of the year, the 11 Bitcoin ETFs have experienced combined net inflows totaling $17.35 billion. This figure includes $19.49 billion in net outflows from Grayscale’s flagship ETF, which has seen a reduction in its Bitcoin holdings. BlackRock's iShares Bitcoin Trust ETF (IBIT) has seen the largest share of inflows, accumulating $20.33 billion in Bitcoin as of August 12. This is followed by Fidelity's Wise Origin Bitcoin Fund (FBTC), which has attracted $9.72 billion in inflows, according to data from Farside Investors.

The rapid growth in ETF holdings reflects increasing institutional interest and investment in Bitcoin, further cementing the role of these financial products in the broader cryptocurrency ecosystem. As the ETFs continue to grow and attract more investment, they are set to become major players in the Bitcoin market, potentially surpassing even the enigmatic Nakamoto in terms of Bitcoin holdings.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.