A Comprehensive Guide to Profitable Crypto Trading Bot Strategies in 2024 - The Must-Know Tips for Best Crypto Trade Automation

2024-01-12 07:38:40Introduction to Crypto Trading Bots

In the ever-evolving world of cryptocurrencies now, trading bots have emerged as instrumental tools for traders. These automated software solutions enable both new and experienced traders to navigate the volatile crypto market with increased efficiency and effectiveness. As we explore this innovative technology, we will uncover how these bots operate, their underlying strategies, and their ability to capitalize on market opportunities, ultimately revolutionizing the approach to cryptocurrency trading.

What Are Crypto Trading Bots and How Do They Work?

Crypto trading bots are automated software programs that engage in cryptocurrency trading on behalf of their users. They are designed to make decisions based on predefined criteria or algorithms, executing trades with speed and precision that far surpasses human capabilities. The core purpose of these bots is to identify profitable trading opportunities automatically and act on them quickly, maximizing potential gains or minimizing losses in the fast-paced crypto markets.

Anatomy of a Crypto Trading Bot: The Strategy

At the heart of every crypto trading bot lies its strategy – the algorithm that dictates its trading actions. Common types of strategies employed by crypto trading bots include index rebalancing algorithmic, arbitrage, and DEX arbitrage. The most common one could be Arbitrage strategies which exploit price discrepancies across different exchanges, buying low on one and selling high on another. Algorithmic trading strategies, evolving continually, can be distilled into five core categories:

- Index Rebalancing Algorithmic Trading Strategies: Employed predominantly by algorithmic traders, this strategy leverages the periodic rebalancing of index funds in pension and retirement accounts. Traders anticipate these rebalancing acts, executing nanosecond trades to capitalize on new base prices and market values. This strategy, often inaccessible on retail platforms, is a staple in quantitative trading hedge funds.

- High Frequency Arbitrage Algorithmic Trading Strategies: Exploiting price disparities across different exchanges, this strategy is tailored for high-frequency traders. The rapidity of these price differences necessitates algorithmic intervention for effective exploitation.

- Mean-Reversion Algorithmic Trading Strategies: Based on the principle that prices revert to their historical mean, this strategy utilizes tools like moving averages and Bollinger Bands. These tools help identify deviations from the average, making the strategy viable for retail traders operating on various time frames, such as daily or hourly charts.

- Machine Learning AI Algorithmic Trading Strategies: This innovative approach employs machine learning and AI, enabling trading bots to self-optimize by learning from market dynamics. Unlike traditional strategies, these are not constrained by preset programming parameters.

- Trend-Following Momentum Algorithmic Trading Strategies: Widely adopted by diverse traders, this strategy rides market trends. The rationale is that trends, once formed, tend to persist. This tendency has been amplified in modern markets due to algorithmic trading, which rapidly aligns with emerging trends. Experienced traders often integrate indicators like moving averages to decode long-term trends and use algorithmic systems to automate trades based on specific market conditions.

These algorithmic trading strategies reflect the diverse tactics available to traders, from high-frequency operations to AI-driven approaches, each harnessing unique market dynamics.

How Bots Use Crypto Market Signals to Execute Trades?

Crypto trading bots utilize a range of market signals to execute trades. These signals can include price fluctuations, trading volume, and even news events that may impact the market. By analyzing these signals through complex algorithms, the bots can automatically make informed decisions about when to buy or sell a particular cryptocurrency. This process involves constant monitoring of the market and the ability to react instantaneously to changes, something that is nearly impossible for human traders to replicate with the same level of efficiency and accuracy.

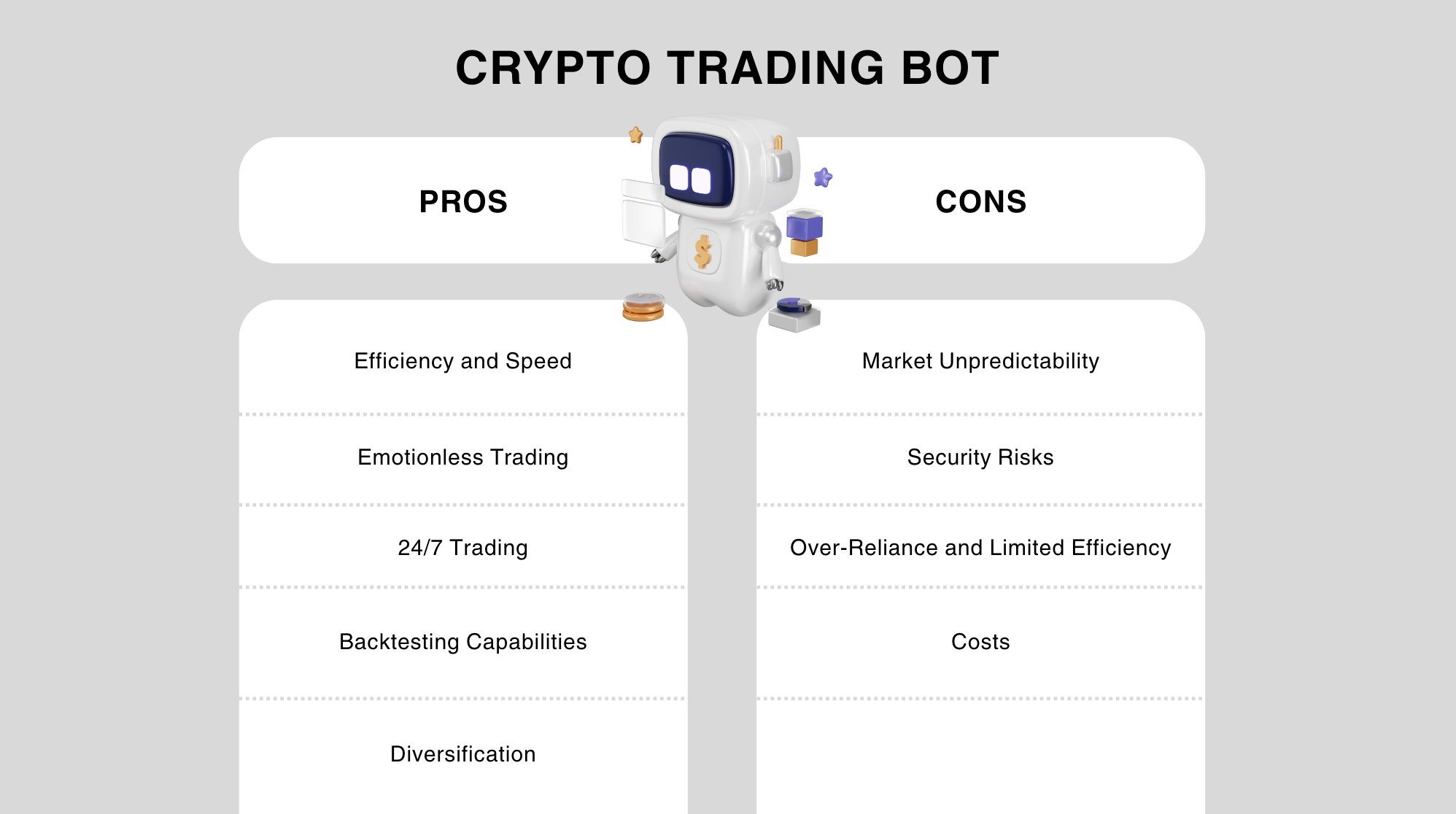

Pros and Cons of Using Crypto Trading Bots

Utilizing crypto trading bots comes with its own set of advantages and disadvantages. It's essential for traders to understand both sides of the coin to make informed decisions about integrating these tools into their trading strategies.

Top Advantages of Automating Your Crypto Trading Bot

We will list several advantages of using your automated crypto trading bot here and you will realize the benefits you can gain from it.

- Efficiency and Speed: Bots can process vast amounts of data and execute trades at a speed unattainable by humans. This rapid response to market changes can be crucial in volatile crypto markets.

- Emotionless Trading: Bots follow predefined rules without emotional influence, eliminating human biases and emotional reactions that often lead to impulsive decisions.

- 24/7 Trading: Cryptocurrency markets never close, and bots can operate round the clock, ensuring no profitable opportunity is missed due to human limitations like sleep or other commitments.

- Backtesting Capabilities: Most bots allow traders to test their strategies using historical data, enabling them to refine and optimize their approach without risking actual capital.

- Diversification: Automated bots can manage multiple cryptocurrency trades simultaneously, spreading risk and increasing potential for returns through diversified portfolios.

Disadvantages of Using Automated Trading Bots in Crypto

Complex Setup and Maintenance: Setting up and maintaining a trading bot can be complex, especially for those without a technical background.

- Market Unpredictability: Despite their advanced algorithms, bots may not always predict or adapt to unexpected market events or trends.

- Security Risks: Bots require access to your cryptocurrency wallets and exchange accounts, posing a potential security risk if not properly managed or if the bot software is not secure.

- Over-Reliance and Limited Efficiency: Traders may become overly reliant on bots, neglecting to develop their own trading skills and understanding of the market. A trading bot's efficiency is constrained by the quality of its programming and the specific strategy it adheres to. Profit generation is not assured, particularly in volatile market conditions. Additionally, a strategy that is successful in one type of market may fail in different market circumstances.

- Costs: Some sophisticated bots come with a high price tag, either through a subscription model or a one-time purchase fee.

Automated Trading vs Manual Trading: What's Best for You?

When exploring the use of cryptocurrency trading bots, you'll find options ranging from free to paid services. These bots often have different pricing models, such as ongoing subscription fees or customized pricing plans. Choosing between automated and manual trading depends on several factors:

- Experience Level: Beginners may find automated trading more accessible, while experienced traders might prefer manual trading for greater control.

- Time Commitment: Those with limited time may benefit from the convenience of bots, while active traders might enjoy the hands-on approach of manual trading.

- Risk Tolerance: Automated trading can offer more consistent, rule-based trading, which might suit those with a lower risk tolerance. Manual trading allows for more flexible responses to market changes, appealing to those willing to take higher risks for potentially higher rewards.

- Personal Interest: Some traders enjoy the process and challenge of manual trading, while others prefer to automate the process and focus on strategy development and analysis.

Ultimately, the choice between automated and manual trading boils down to personal preference, trading goals, and lifestyle. Many traders use a combination of both, employing bots for certain strategies while keeping a hands-on approach for others.

Crypto Trading Bots and Cryptocurrency Exchanges

The synergy between crypto trading bots and cryptocurrency exchanges is a crucial aspect of the modern digital asset market. Exchanges play a pivotal role in the effectiveness of trading bots, as the features and functionalities they offer can significantly impact the performance of these automated systems. Key features that make an exchange bot-friendly include robust API connectivity, high liquidity, and support for various trading strategies.

・Robust API Connectivity: APIs (Application Programming Interfaces) are the lifelines that connect trading bots to cryptocurrency exchanges. A strong and reliable API allows for seamless communication between the bot and the exchange, enabling real-time data retrieval, order placement, and execution of trades. Exchanges with well-documented and stable APIs are highly sought after by bot developers, as they facilitate efficient and uninterrupted trading operations.

・High Liquidity: Liquidity refers to the ease with which an asset can be bought or sold in the market without causing a significant price movement. High liquidity is essential for the effective functioning of trading bots. It ensures that trades are executed quickly and at desired prices, minimizing slippage. Exchanges with high trading volumes typically provide better liquidity, making them more favorable for bot trading.

・Support for Various Trading Strategies: Different trading bots employ various strategies, such as arbitrage, market making, or trend following. An exchange that supports a wide range of trading pairs, provides detailed market data, and offers advanced order types is more conducive to a diverse array of trading strategies. This flexibility allows traders to implement their bots in the way they find most effective, catering to both conservative and aggressive trading styles.

Therefore, the interplay between crypto trading bots and cryptocurrency exchanges is vital. Exchanges that offer robust API connectivity, high liquidity, and support a multitude of trading strategies are more likely to attract and accommodate successful bot trading activities. As the crypto market continues to mature, the relationship between bots and exchanges is expected to become even more integral, driving innovation and efficiency in cryptocurrency trading.

Choosing the Right Crypto Trading Bot

Selecting the right trading bot can be a game-changer in the volatile crypto market. A well-chosen bot not only complements your trading strategy but also aligns with your goals and risk tolerance. Let’s explore the factors you should consider when choosing a crypto trading bot.

Factors to Consider When Selecting a Crypto Trading Bot

Trading Strategy Compatibility: Ensure that the bot supports the trading strategies you intend to use, such as arbitrage, trend following, or mean reversion. The bot should be adaptable to different market conditions and trading styles.

- Goals and Objectives: Your trading goals – whether short-term profit, long-term investment, or simply learning – should dictate your choice of a trading bot. Some bots are designed for high-frequency trading, while others are better suited for long-term investment strategies.

- Free vs. Paid Options: While free bots can be a good starting point, they may lack advanced features and security measures. Paid bots, on the other hand, often come with more sophisticated strategies, better support, and more robust security protocols. At FameEX, we provide free grid trading bots that enable users to execute buy-low and sell-high strategies.

- Risk Management Features: The ability to control risk is crucial in volatile crypto markets. Look for bots that offer features like stop-loss orders, take-profit orders, and other risk management tools.

- Ease of Use and Support: Especially important for beginners, the user interface should be intuitive, and the bot should have good customer support for troubleshooting and guidance.

Integrating Artificial Intelligence in Crypto Trading

The integration of Artificial Intelligence (AI) in crypto trading bots represents a significant leap forward in trading technology. AI-based bots can analyze large datasets, recognize patterns, and make predictions with greater accuracy than traditional bots. This leads to enhanced profitability through more precise market trend analysis and improved decision-making processes. AI algorithms can adapt to changing market conditions, learning from new data to optimize trading strategies continually. The incorporation of machine learning and AI into crypto trading bots is rapidly becoming a standard for traders seeking an edge in the market.

What are the Best Crypto Trading Bots in 2024?

As of 2024, the crypto trading bot landscape has evolved, offering a variety of sophisticated options. Here are five notable bots, including:

1. 3Commas: As one of the top cryptocurrency trading bots in 2024, It provides a dynamic blend of manual and automated trading solutions. It allows users to manage assets across multiple major cryptocurrency exchanges through a single, advanced interface. The platform is particularly adept at adapting to various market conditions, including bear, bull, and sideways trends, thereby enhancing profit potential. Its features include beginner-friendly robot presets, sophisticated trading terminals for preemptive trade setup, diverse strategies like DCA, Grid, and Futures robots, as well as SmartTrade and Terminal functionalities for advanced trading precision. Furthermore, 3Commas integrates professional trade signals, allowing users to emulate the strategies of seasoned traders, making it an invaluable tool for both novice and experienced cryptocurrency traders.

Source: 3Commas site

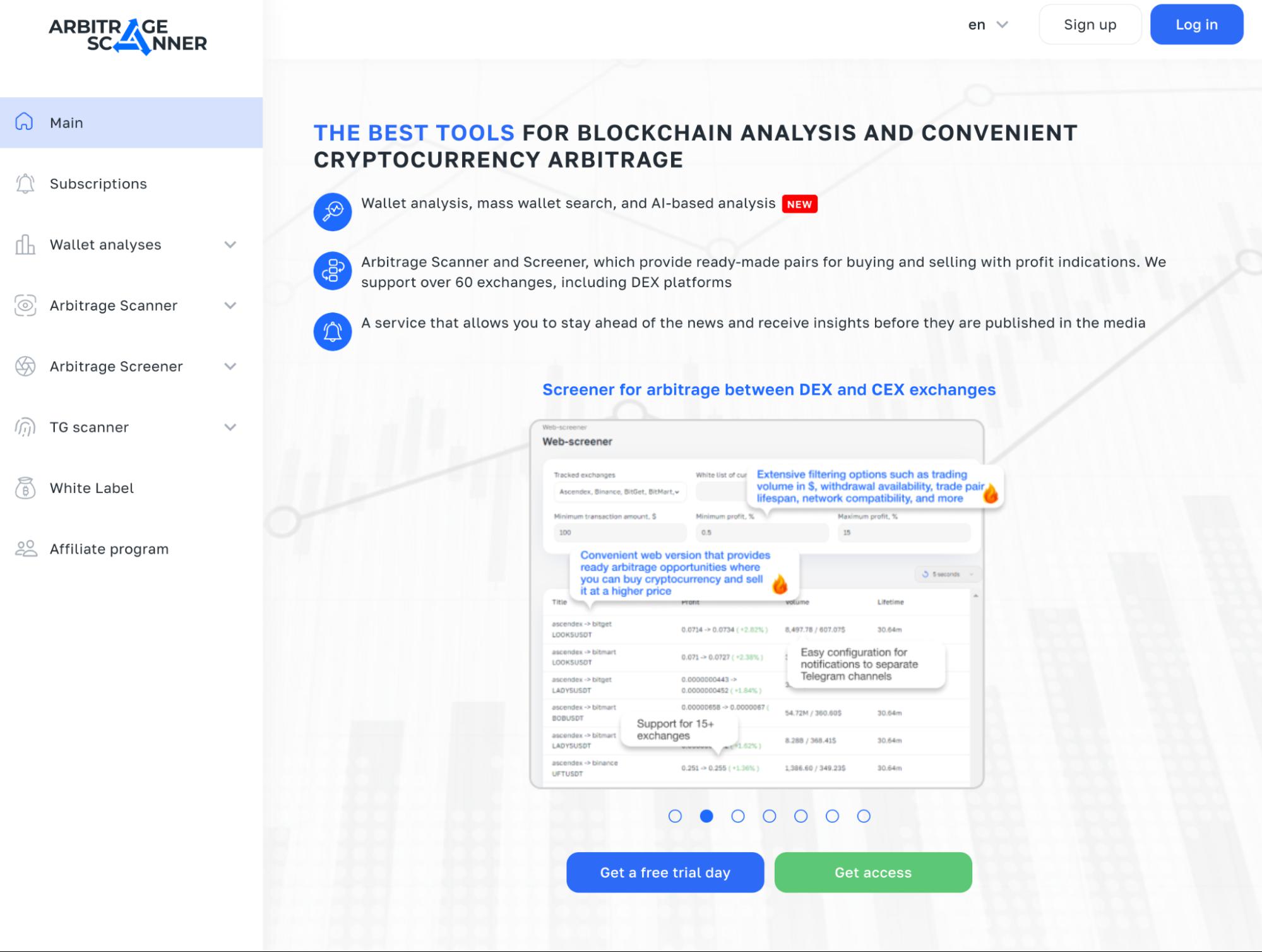

2. ArbitrageScanner.io: ArbitrageScanner.io emerges as a top-tier crypto trading bot in 2024, enabling traders to exploit price discrepancies across over 75 global exchanges from DEX to CEX without pre-holding tokens. Its standout feature is the 24/7 notification system alerting users to these price variances. The platform prioritizes security, operating independently from users' funds and without requiring API or wallet connections. Additionally, it offers comprehensive training, practical examples, and access to an exclusive community for shared insights. Particularly notable is its Expert Program, which provides personalized robot customization and dedicated mentorship, ensuring a secure, informed, and profitable trading experience. However, this bot costs $60 USD for basic usage and can go up to $399 with mentor help.

Source: https://arbitragescanner.io/

・Altrady: In 2024, a cutting-edge crypto trading bot emerges as a market leader, offering integration with over 17 major cryptocurrency exchanges, including several big exchanges. This platform provides advanced features surpassing traditional exchange capabilities, with a diverse range of trading robots like GRID Robots, Signal Bot for Spot and Futures, and TradingView Webhook. It enables users to maximize profits through sophisticated Take Profit Targets and Advanced Stop Loss Settings. Additionally, it offers automated position sizing based on desired risk percentages and a clear risk/reward ratio display. The bot's automation tools enhance profitability by streamlining trading processes and minimizing human error, offering smart trading and advanced robots for a more efficient, accurate, and profitable trading experience.

Source: https://www.altrady.com/

・Kryll: Kryll emerges as one of the leading cryptocurrency trading bots in 2024, blending automated software with AI to simplify trading for both beginners and experts. Its standout features include the Crypto Generator, enabling easy script creation without coding knowledge, and a marketplace for sharing trading strategies. Additionally, its advanced trading terminal allows for precise trade management, including stop-losses and multiple take-profits, complemented by a strategy editor for crafting automated trading algorithms. This makes Kryll an ideal platform for streamlined and effective cryptocurrency trading. No need to subscribe, just pay while using it.

Source: https://www.kryll.io/

・FameEX: Known for its user-friendly interface and robust security measures, FameEX provides a grid trading bot for all traders to arbitrage profits by setting up individual grids. When the price reaches a specified grid range, the bot automatically buys or sells, embodying the 'buy low, sell high' philosophy. This approach allows users to save time and enjoy the freedom to engage in other activities. Additionally, the grid trading section includes an AI-recommended tool that helps traders set up parameters based on their ability and desired price range. This tool offers suggestions tailored to the user's preferences. Furthermore, this grid trading bot is completely free for everyone to use.

Source: https://www.fameex.com/en-US/grid/btc-usdt

Each of these bots has its unique strengths and caters to different aspects of crypto trading, from AI-powered analysis to user-friendly interfaces for beginners. When choosing a bot, it's essential to consider your specific needs, trading style, budget, and the level of support you require.

What are Profitable Trading Bot Strategies?

Utilizing effective strategies is key to profitability in the rapidly changing world of cryptocurrency trading. Trading bots, with their speed and precision, can execute these strategies more efficiently than manual trading. Below are some of the most profitable trading bot strategies being used in the market today.

Day Trading with Crypto Bots for Profitability

Day trading involves entering and exiting positions within the same trading day. Crypto bots excel in this strategy by exploiting small price movements in the market. They can analyze market trends and execute multiple trades quickly, capitalizing on short-term volatility. Day trading bots can be programmed to adhere to specific indicators and signals, ensuring disciplined trading without emotional interference.

Arbitrage Trading: Algorithmic Strategy for Crypto Bots

Arbitrage trading in the crypto world involves buying a cryptocurrency on one exchange where the price is low and simultaneously selling it on another exchange where the price is higher. This strategy benefits from the price discrepancies across different exchanges. Crypto bots are ideal for arbitrage as they can execute these trades almost instantaneously, which is crucial since arbitrage opportunities can be fleeting.

Grid Bot Trading: A Profitable Crypto Trading Strategy

Grid trading involves placing a series of buy and sell orders at predefined intervals around a set price. This creates a grid of orders that captures profit from natural market fluctuations. Crypto bots can automate this process, constantly adjusting the grid as the market moves and ensuring that trades are executed at optimal points. This strategy works best in a ranging market, where the price fluctuates within a certain range.

Buy and Sell Strategies in Automated Crypto Trading

Automated buy and sell strategies involve programming bots to execute trades based on specific market indicators or signals. For example, a bot might be set to buy a cryptocurrency when its price drops to a certain level and sell when it reaches a predetermined higher price. This strategy requires thorough market analysis to set the right parameters, which can be continuously adjusted based on market conditions.

Effective Use of Trading Signals in Your Bot Strategy

Trading signals are triggers for action, either to buy or sell, based on a set of criteria. These can be based on technical analysis, statistical analysis, or even news-based events. Bots can be programmed to act on these signals, allowing traders to leverage a variety of analytical methods and data points. The effective use of trading signals in bot strategies can significantly increase the chances of profitable trades, as bots can respond faster to changing market conditions than humans.

Each of these strategies has its own set of risks and rewards, and the best strategy for a trader will depend on their risk tolerance, market knowledge, and investment goals. By understanding and correctly implementing these strategies, traders can greatly enhance their chances of success in the volatile world of crypto trading.

Setting up Your Automated Crypto Trading Bot

Setting up an automated crypto trading bot is a critical process that requires careful planning and understanding. It involves selecting the right bot, configuring it according to your trading strategy, and continuously monitoring its performance. Here's a guide to help you through each step of setting up your crypto trading bot.

How to Set Up Your Trading Bot on Crypto Exchange?

You might need to choose a Compatible Crypto Exchange. Before paying or using the bot, you might need to ensure the exchange you choose is compatible with your trading bot. Check for API support, as you will need to connect your bot to the exchange via an API.

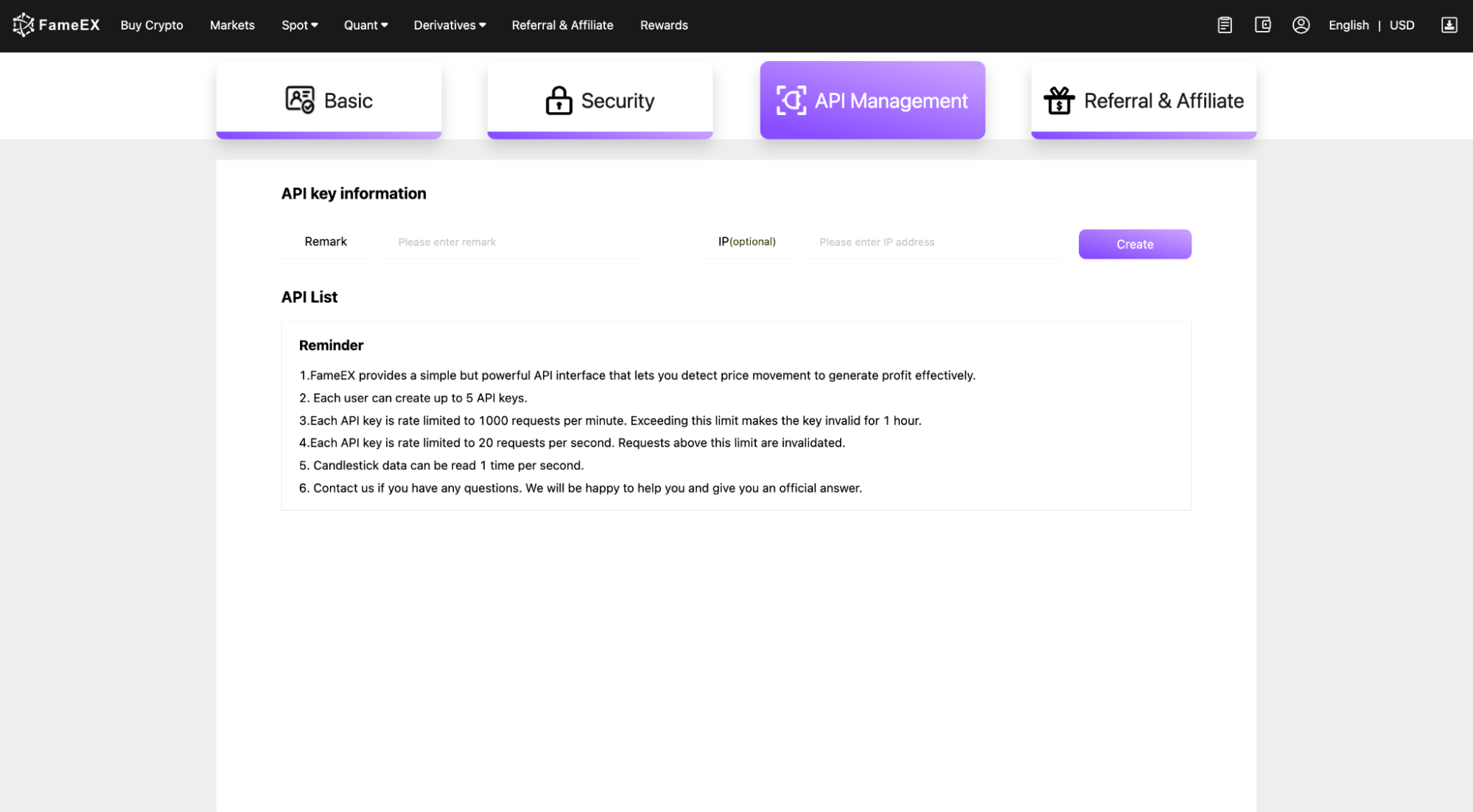

Step1. Generate API Keys: In your exchange account, usually go to the profile under ‘API Management’ and generate API keys. These keys will allow your bot to access your account and execute trades. Ensure you set the necessary permissions for these keys and never share your secret key.

Step2. Connect the Bot to the Exchange: Enter your API keys into your trading bot platform. This step varies depending on the bot's interface, but typically, you will find an option to 'Add Exchange' or 'Connect to Exchange' in the settings.

Step3. Configure Security Settings: Implement security measures like two-factor authentication (2FA) on both your exchange and bot accounts to protect against unauthorized access.

Understanding Your Bot's Platform and Its Features

It’s important to explore the Interface on different trading bot platforms. Familiarize yourself with the bot’s dashboard, where you can access features like setting up strategies, backtesting, and viewing trade history. Understand the different features your bot offers, such as stop-loss orders, take-profit orders, backtesting tools, and strategy templates. Also, you might need to know how to customize your options. Look into how you can customize the bot. This might include creating your own trading strategies, adjusting existing ones, or setting up specific parameters for trades.

Setting Up Your Bot Trading Strategy

To effectively utilize a trading bot, begin by selecting a strategy that resonates with your trading objectives and risk tolerance. This could range from day trading to swing trading or even arbitrage. Once the strategy is chosen, proceed to configure the strategy settings in the bot. This involves inputting various parameters, such as defining entry and exit points, setting stop losses, and selecting the assets you wish to trade. An essential step in this process is to backtest your strategy using historical data. This allows you to gauge how your strategy would have fared in past market conditions, offering insight into its potential effectiveness for future trades.

Monitoring Your Trading Bot's Performance

Setting up and managing a crypto trading bot is a multifaceted process that demands a blend of technical acumen, strategic foresight, and continual supervision. One critical aspect involves regularly monitoring your bot's performance. Most bots come equipped with a dashboard, allowing you to observe its activities and outcomes closely. It's important to be ready to adjust your strategies if the bot isn't performing as expected or if there are shifts in market conditions. Despite the automation in trading, staying informed about the crypto market is essential, as external factors can significantly influence trading performance. Alongside these considerations, securing your investments is paramount. This includes routinely reviewing and updating security measures to safeguard your investments, ensuring that your bot software is up-to-date, and maintaining robust security on your exchange account. With the right approach and a commitment to continuous learning, your automated trading bot can evolve into an invaluable asset in your cryptocurrency trading toolkit.

Conclusion: 2024 Crypto Trends: How Trading Bots are Responding

As we venture further into 2024, it's evident that the landscape of cryptocurrency trading is continually evolving, marked by increasing complexity and volatility. Trading bots, in this context, have risen to the challenge, becoming indispensable tools for traders navigating these dynamic waters. They offer a blend of efficiency, speed, and precision, allowing traders to capitalize on opportunities that would be impossible to seize manually.

This year's trends indicate a significant shift towards more sophisticated, AI-driven trading bots, with the emergence of tools like ChatGPT, Grok, and Bard. These are capable of analyzing vast datasets and adapting to market changes in real time. The emphasis on automation has not only streamlined trading processes but also opened doors to innovative strategies like arbitrage, grid trading, and algorithmic day trading. Moreover, the integration of trading bots with crypto exchanges has become more seamless, with exchanges enhancing API connectivity and supporting a diverse range of trading strategies.

However, as much as these bots represent a leap in trading technology, they also underscore the importance of human oversight. The need for strategic planning, continuous monitoring, and adapting to market shifts remains integral. Traders must balance reliance on these automated systems with their understanding of the market and risk management. 2024 is shaping up to be a year where trading bots not only respond to current crypto trends but also actively shape them. They are not just tools but partners in a trader's journey, offering new possibilities and enabling traders to navigate the crypto markets with greater confidence and success. As the crypto world continues to evolve, so too will these bots, adapting and innovating in ways we can only begin to imagine.

FAQ About Crypto Bot Trading Strategies

Q: What is crypto trading bot?

A: A crypto trading bot is an automated software program that executes cryptocurrency trades on behalf of a user, based on predefined criteria and algorithms. These bots analyze market data, interpret signals, and make buy or sell decisions faster and more efficiently than a human trader could.

Q: What are the best crypto trading bots for beginners?

A: For beginners, bots like 3Commas, Kryll, and FameEX are recommended. These platforms are user-friendly, offer easy setup, and provide educational resources to help novices understand automated trading. They also offer pre-configured strategies, which are helpful for those new to trading.

Q: What are the best crypto trading bot strategies for beginners to consider?

A: Beginners should consider simple, low-risk strategies like 'buy and hold', simple moving average (SMA) crossover strategies, or fixed-time interval rebalancing. These strategies are straightforward to implement and can provide a gentle introduction to crypto trading dynamics.

Q: Are crypto trading bots profitable?

A: Crypto trading bots can be profitable, but their success depends on various factors, including the effectiveness of the chosen strategy, market conditions, and the bot’s execution capabilities. While they offer the potential for profit, they also carry risks, and profitability is not guaranteed.

Q: What is the best strategy for a crypto bot?

A: The best strategy for a crypto bot depends on individual trading goals, risk tolerance, and market knowledge. Popular strategies include trend following, arbitrage, and market making. Each strategy has its strengths and is best chosen based on a trader's specific objectives and market understanding.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.