What Is the Best Description to Explain the Difference Between Public and Private Keys for Accessing Cryptocurrency?

2025-04-17 09:29:23

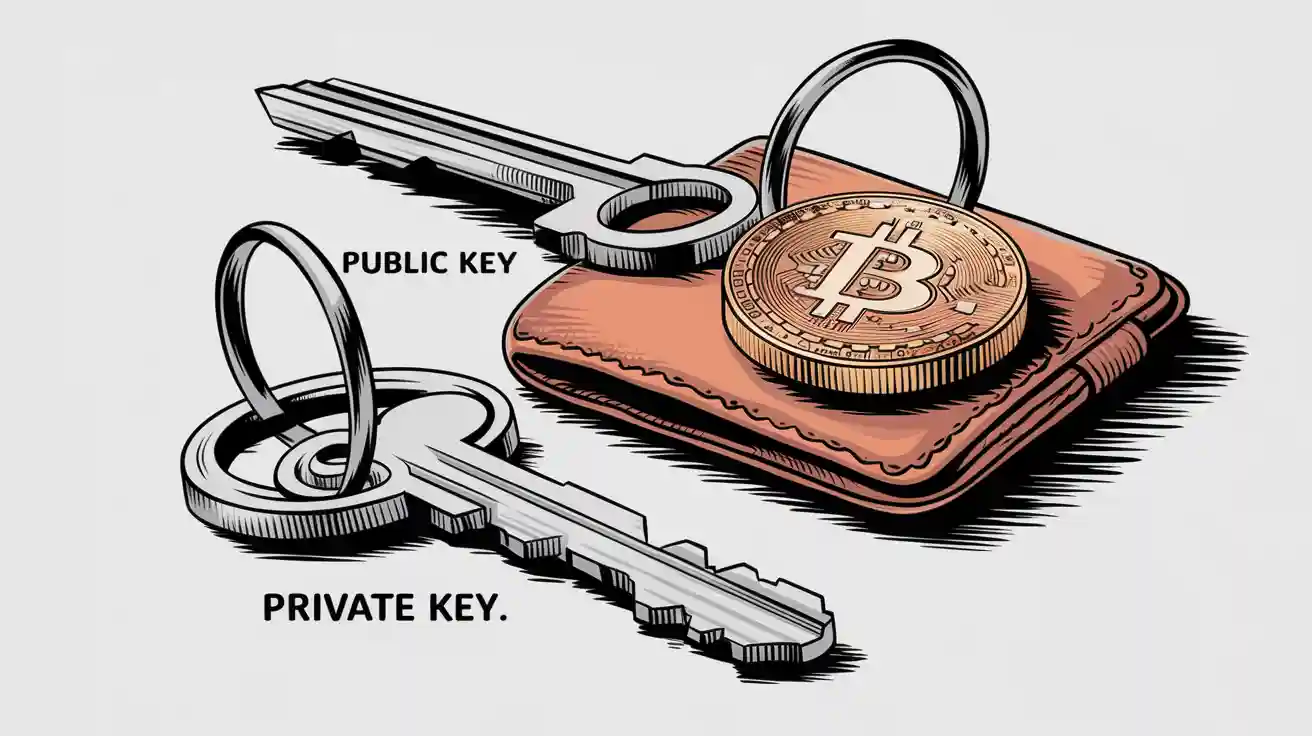

Public and private keys form the backbone of cryptocurrency security. A public key acts as an address for receiving funds, while a private key provides access to spend or transfer them. Mishandling these keys can lead to severe consequences. For instance:

- In 2024, private key compromises accounted for 43.8% of stolen cryptocurrency.

Moreover, over $2 billion was stolen in 2023 due to vulnerabilities in wallets and decentralized exchanges. Ethereum and other cryptocurrencies rely heavily on these keys to ensure safe transactions.

Key Takeaways

- Public keys are like addresses to get cryptocurrency. You can share them safely without risking security.

- Private keys are needed to use and control cryptocurrency. Keep them secret to stop others from stealing access.

- Storing private keys in cold wallets is the safest way. Never share them and always make a backup.

Understanding Public and Private Keys

What Is a Public Key?

A public key is a cryptographic code that serves as an address for receiving funds in a bitcoin wallet or other cryptocurrency wallets. It is derived from a private key using mathematical algorithms, ensuring a secure one-way relationship. Public keys are openly shared and allow users to receive cryptocurrency or verify digital signatures.

Public key encryption plays a vital role in modern cryptography. It enables secure communication by allowing users to encrypt messages that only the intended recipient can decrypt with their private key. For example:

- Public keys facilitate authentication by verifying the sender's identity.

- They rely on hard mathematical problems, such as factoring large primes, which underpin the security of the system.

- Public key encryption ensures confidentiality by allowing users to share their public keys openly while keeping their private keys secret.

Public-key cryptography, introduced by Martin Hellman and Whitfield Diffie in 1976, revolutionized digital security. It allows two parties to communicate securely over an insecure channel without sharing a secret key. This system relies on one-way functions, making it easy to compute in one direction but difficult to reverse.

What Is a Private Key?

A private key is a secret code that grants access to funds stored in a bitcoin wallet. It is essential for signing transactions and proving ownership of cryptocurrency. Unlike public keys, private keys must remain confidential to prevent unauthorized access.

The operational mechanism of private keys is based on asymmetric cryptography, which uses a pair of keys (public and private) for secure communication and authentication. Private keys are used in:

| Aspect | Description |

|---|---|

| Asymmetric Cryptography | Utilizes a pair of keys (public and private) for secure communication and authentication. |

| Use in SSL/TLS | Protects online interactions by encrypting data between the browser and server. |

| Digital Signatures | Enables authentication and validation of documents and communications. |

| Secure Storage Methods | Includes encryption, hardware solutions (TPM, HSM), and air-gapped devices for enhanced security. |

If a private key is lost, access to the associated cryptocurrency is permanently lost. This highlights the importance of securely managing private keys.

Why Public and Private Keys Are Essential for Cryptocurrency

Public and private keys are the foundation of cryptocurrency security. Public keys allow users to receive funds and verify signatures, while private keys enable signing transactions and proving ownership. This relationship is secured by cryptographic algorithms, ensuring that the private key cannot be derived from the public key.

The security of cryptocurrency transactions relies heavily on proper management of private keys. Key points include:

- A private key must remain confidential to prevent unauthorized access to funds.

- Losing a private key results in permanent loss of access to the associated cryptocurrency.

- Public keys can be shared openly, ensuring secure communication and authentication.

What Is the Best Description to Explain the Difference Between Public and Private Keys for Accessing Cryptocurrency?

The best way to describe the difference between public and private keys is through their roles and functionalities. A public key acts as a receiving address, similar to a bank account number, while a private key functions like a PIN, granting access to funds.

| Feature | Public Key | Private Key |

|---|---|---|

| Generation | Derived from a private key | User-generated like a password |

| Sharing | Can be shared with anyone | Must be kept secret |

| Function | Used to receive cryptocurrency | Used to sign transactions and send cryptocurrency |

| Analogy | Similar to a bank account number | Similar to a bank PIN number |

| Security | Safe to share; losing it is not critical | Must never be shared; losing it results in loss of assets |

| Retrieval | Can be retrieved from the blockchain | Cannot be retrieved if lost |

This distinction ensures that only the holder of the private key can authorize the spending of funds, maintaining the integrity and security of the cryptocurrency system.

How Public and Private Keys Work Together

The Relationship Between Public and Private Keys

Public and private keys form a cryptographic pair that works together to secure cryptocurrency transactions. This private-public key pair ensures that only the rightful owner can access and control their funds. The private key generates the corresponding public key through a mathematical process. While the public key can be shared openly, the private key must remain confidential.

The relationship between these keys is one-directional. A public key can be derived from a private key, but the reverse is computationally infeasible. This design ensures the security of the system. For example, when a user creates a crypto wallet, they generate a key pair. The public key serves as an address for receiving cryptocurrency, while the private key acts as a digital signature for authorizing transactions.

This relationship is fundamental to blockchain technology. It enables users to maintain ownership of their assets without relying on intermediaries. By combining transparency with security, public and private keys empower individuals to manage their cryptocurrency independently.

How They Secure Cryptocurrency Transactions

Public and private keys play a critical role in securing cryptocurrency transactions. The public key allows anyone to send funds to a wallet, while the private key ensures that only the wallet owner can access and spend those funds. This dual-key system prevents unauthorized access and ensures the integrity of the blockchain.

When a user initiates a transaction, they sign it with their private key. This signature proves ownership and authorizes the transfer of funds. The network then uses the corresponding public key to verify the signature. If the signature matches, the transaction is validated and added to the blockchain.

This process ensures secure transactions by combining cryptographic algorithms with decentralized verification. It eliminates the need for trust between parties, as the system itself guarantees the authenticity of each transaction. For instance:

- A private key acts like a password, granting access to funds.

- A public key functions as a receiving address, enabling secure communication.

- Together, they create a robust framework for managing digital assets.

Example of Using Public and Private Keys in a Transaction

The process of using public and private keys in a cryptocurrency transaction can be broken down into several steps. This example illustrates how these keys work together to ensure security and transparency:

| Step | Description |

|---|---|

| 1 | A user generates a private-public key pair when creating a crypto wallet. |

| 2 | The public key is shared as a public address for receiving cryptocurrency. |

| 3 | The sender authorizes a transaction using their private key. |

| 4 | The network validates the transaction using the corresponding public key. |

| 5 | Once validated, the transaction is recorded on the blockchain. |

For instance, imagine Alice wants to send Bitcoin to Bob. Bob shares his public key with Alice, who uses it as the destination address. Alice signs the transaction with her private key, proving she owns the funds. The network verifies the signature using Alice's public key and confirms the transaction. This process ensures that only Alice can authorize the transfer, maintaining the security of the system.

By combining public and private keys, cryptocurrency transactions achieve a high level of security and efficiency. This system protects users' assets while enabling seamless transfers across the blockchain.

Key Differences Between Public and Private Keys

Sharing and Accessibility

Public and private keys differ significantly in how they are shared and accessed. A public key is designed for sharing. It acts as an address that others can use to send cryptocurrency. Sharing a public key does not compromise security, as it cannot be used to access funds. In contrast, a private key must remain confidential. It serves as the sole means of accessing and managing cryptocurrency funds.

Mishandling private keys can lead to severe consequences. For example:

- Investigators may fail to trace crypto assets if private keys are mismanaged.

- Mishandling private keys during seizures can result in lost or stolen funds.

- Operational vulnerabilities arise when agencies lack expertise in managing private keys.

These risks highlight the critical importance of securely managing private keys while freely sharing public keys for transactions.

Security and Confidentiality

The security of cryptocurrency relies on the confidentiality of private keys. A private key functions like a digital signature, proving ownership and authorizing transactions. If exposed, it grants unauthorized access to funds. Public keys, however, are inherently secure to share. They enable users to receive funds and verify transactions without revealing sensitive information.

Legal challenges and operational delays often occur when private keys are mishandled. For instance, procedural errors in securing private keys can lead to dismissed cases or returned assets. This underscores the need for robust security measures to protect private keys from unauthorized access.

Simplifying the Concept with Analogies

Analogies can make the concept of public and private keys easier to understand. One effective analogy involves colors. Imagine Alice and Bob agree on a public color, such as yellow. They each have a private color—Alice has red, and Bob has cyan. They mix their private colors with the public color and exchange the results. This process creates a shared secret color that outsiders cannot deduce.

This analogy illustrates how public and private keys work together. The public key (yellow) is shared openly, while the private key (red or cyan) remains secret. Together, they create a secure system for communication and transactions.

Best Practices for Managing Private Keys

Why Keeping Private Keys Secure Is Crucial

Private keys are the gateway to cryptocurrency ownership. They grant access to funds stored in a crypto wallet and authorize transactions. If a private key falls into the wrong hands, the consequences can be devastating. Unauthorized users can transfer funds, leaving the rightful owner with no recourse.

Losing a private key is equally problematic. Without it, users cannot access their cryptocurrency. This loss is permanent, as no recovery mechanism exists. For this reason, understanding how to keep your private key safe is essential. Security breaches often occur due to negligence or lack of awareness. By prioritizing private key security, users can protect their digital assets from theft and loss.

Tips for Safely Storing Private Keys

Storing private keys securely requires careful planning. Different storage methods offer varying levels of security. Cold wallets, such as hardware wallets, provide the highest level of protection. These devices store private keys offline, shielding them from online threats. Paper wallets also offer strong security by keeping private keys on physical paper. However, they are prone to physical damage or loss.

Hot wallets, including web and mobile wallets, are convenient for daily transactions. However, they are more vulnerable to cyberattacks. Centralized exchanges provide ease of use but come with risks. Users do not control their private keys, making them reliant on the exchange's security measures.

| Wallet Type | Security Level | Pros | Cons |

|---|---|---|---|

| Centralized Exchanges | Moderate | Convenient for trading and accessing funds quickly. | Susceptible to hacks. Users do not control their private keys. |

| Hot Wallet (Web/Mobile) | Low to Moderate | Accessible and easy to use. Suitable for small amounts of cryptocurrency. | Vulnerable to malware and cyberattacks. |

| Cold Wallet (Hardware) | High | Offline storage. Protects against online threats. | Expensive and less convenient for quick transactions. |

| Paper Wallet | High | No digital footprint. Extremely secure. | Easy to damage or lose. Difficult for beginners to use. |

Common Mistakes to Avoid with Private Keys

Many users make errors that compromise private key security. Sharing private keys is a common mistake. Unlike public keys, private keys must remain confidential. Writing down private keys on unsecured devices or storing them in cloud services increases the risk of theft.

Failing to back up private keys is another frequent error. Without a backup, recovering access to a crypto wallet becomes impossible if the original private key is lost. Neglecting to use multi-factor authentication (MFA) also exposes users to unnecessary risks. MFA adds an extra layer of security, making unauthorized access more difficult.

| Best Practice | Description |

|---|---|

| Multi-Factor Authentication (MFA) | Enhances security by requiring two forms of verification before granting access. |

| Conducting Periodic Audits | Regular reviews to identify vulnerabilities and ensure compliance with security policies. |

| Investing in Employee Training | Training programs to reduce risks from social engineering and insider threats. |

| Establishing a Proactive Incident Response Plan | Plans to effectively respond to and mitigate data breaches when they occur. |

By avoiding these mistakes and adopting best practices, users can significantly reduce the risk of losing their cryptocurrency.

Public and private keys serve distinct purposes in cryptocurrency. Public keys act as addresses for receiving funds, while private keys grant access to manage them. Keeping private keys secure is essential to prevent unauthorized access or permanent loss of assets. Adopting best practices, such as using cold wallets and avoiding key sharing, ensures robust protection for digital holdings.

FAQ

What happens if someone loses their private key?

Losing a private key results in permanent loss of access to the associated cryptocurrency. No recovery mechanism exists, so users must securely store and back up their private keys.

Can a public key reveal a private key?

No, a public key cannot reveal a private key. Cryptographic algorithms ensure that deriving a private key from a public key is computationally infeasible, maintaining the system's security.

Is it safe to share a public key?

Yes, sharing a public key is safe. It functions as a receiving address for cryptocurrency and does not grant access to funds or sensitive information.