What Will the 2024 Bitcoin Halving Mean for Cryptocurrency Markets?

2024-03-26 11:13:25

Key Points:

The Bitcoin Halving effectively reduces miner rewards, aiming to limit the supply of Bitcoin and potentially increase its value.

Historical patterns suggest halving events may lead to bullish market behaviors with price increases following past halvings.

The 2024 Halving is particularly noteworthy due to its potential for influencing Bitcoin's price, mining profitability, and overall market dynamics.

Introduction

The eagerly anticipated Bitcoin Halving event of 2024 is drawing closer, capturing the attention of cryptocurrency enthusiasts and investors worldwide. Scheduled to occur roughly every four years, this event significantly influences Bitcoin's landscape and the wider cryptocurrency market. Initially expected at the end of April, the date for the Bitcoin Halving has been adjusted, a shift attributed to the recent surge in Bitcoin's price. This price increase has not only attracted additional mining power but also accelerated the network's pace, resulting in the adjustment of the halving's expected date. The halving, a pivotal moment in the crypto world, reduces the reward for adding new data blocks to the Bitcoin network by 50%. It's a carefully programmed feature of the blockchain's code that aims to control the supply of Bitcoin and can lead to bull runs in its price.

This phenomenon is not new; similar patterns were observed in the run-up to the previous halving, indicating a repeating cycle of heightened anticipation and activity. The upcoming halving is set to decrease the block reward from 6.25 BTC to 3.125 BTC, underscoring its significance. Moreover, the rising Bitcoin prices encourage more mining activity as the rewards become increasingly lucrative, leading to a higher computational power or "hashrate" among miners. This dynamic, along with the halving itself, plays a crucial role in Bitcoin's market behavior. In this article, we'll explore the implications, significance, and viewpoints on the 2024 Bitcoin Halving, delving into what makes this event a focal point for the cryptocurrency community.

What is Bitcoin?

Bitcoin, introduced in 2009 by an enigmatic figure or group known as Satoshi Nakamoto, represents the dawn of decentralized digital currency and payment systems. As the inaugural cryptocurrency, Bitcoin introduced a novel approach to financial transactions, leveraging cryptography to secure and verify transactions. This groundbreaking technology relies on a distributed ledger called blockchain, ensuring that every transaction is transparently and securely recorded across multiple computers worldwide.

Central to Bitcoin's innovation is its decentralization. Unlike traditional currencies managed by central banks, Bitcoin operates on a peer-to-peer network. This network enables direct transactions between users without the need for intermediaries like banks or payment processors. Such a design not only enhances transaction efficiency but also democratizes financial interactions, granting users unprecedented control over their assets.

Bitcoin's utility extends beyond mere currency. It serves as an investment, a store of value akin to gold, and a medium for transferring value globally. Its flexibility allows it to be an avenue for exploring new technological frontiers, reflecting its nature as "internet money." Without any physical manifestation, Bitcoin exists solely in the digital realm, facilitating online transfers with ease and reducing the necessity for traditional financial gatekeepers. The cryptocurrency has witnessed widespread acceptance and legal recognition, usable in various transactions from travel bookings to charitable donations. Prominent companies like Microsoft and Expedia now accept Bitcoin, highlighting its growing mainstream appeal. As a testament to its versatility, Bitcoin functions as a medium of exchange, a unit of account, and a store of value—core properties of money. Despite the emergence of thousands of cryptocurrencies since Bitcoin's inception, it remains the most notable, leading the pack in terms of market capitalization and trading volume. Its success has not only captured public attention but also inspired the creation of numerous other digital currencies.

Bitcoin is designed for direct value exchange in the peer-to-peer network, emphasizing user empowerment and financial inclusivity. The Bitcoin network, characterized by its openness and public access, invites anyone with internet connectivity to participate. Moreover, its open-source nature ensures that its foundational code is accessible for scrutiny and enhancement by all. In essence, Bitcoin can be likened to the internet of money—a borderless, decentralized, and continuous digital space where individuals can freely transact. It embodies the principles of freedom, transparency, and innovation, making it a pivotal development in the evolution of digital finance.

In addition, users can purchase BTC tokens with fiat currency on secondary markets, like the FameEX exchange.

>> Click here to buy BTC directly <<

What is Bitcoin Halving?

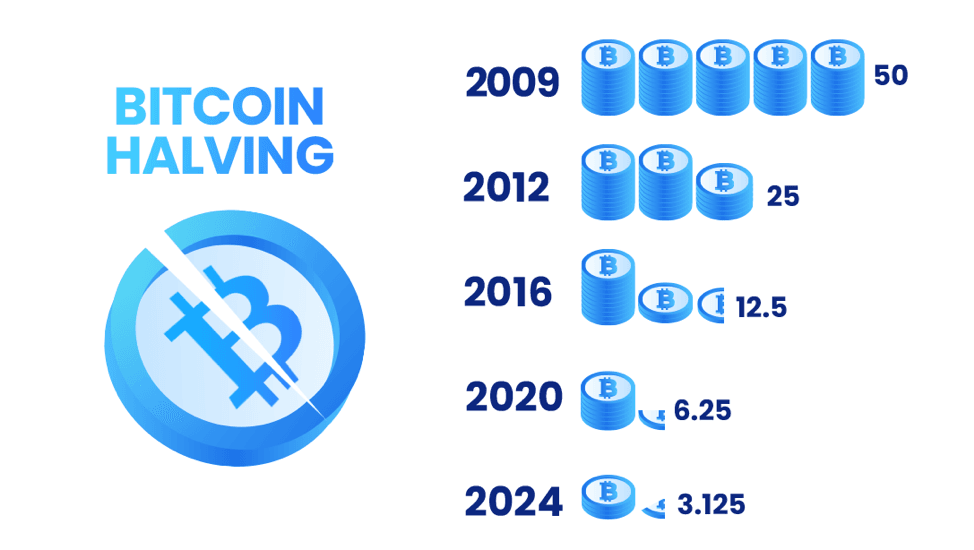

The Bitcoin network undergoes a significant event approximately every four years, known as the Bitcoin Halving. This event halves the reward that miners receive for processing transactions, thereby reducing the rate at which new bitcoins are created and enter the market. Initially, miners were rewarded with 50 bitcoins per block, but this amount decreases with each halving. Past halving events have taken place on:

November 28, 2012, reducing the reward to 25 bitcoins

July 9, 2016, further reducing it to 12.5 bitcoins

May 11, 2020, bringing it down to 6.25 bitcoins

Bitcoin Halving, Source: Plus+500

The next halving is anticipated in April 2024, when the reward will decrease to 3.125 bitcoins. This process is critical for controlling the supply of bitcoins and is expected to continue until around the year 2140, at which point the total number of bitcoins will approach the 21 million coin limit set by the network's creators. After reaching this limit, miners will no longer receive new bitcoins as rewards. Instead, their compensation will come from transaction fees paid by network users, ensuring that miners have a continued incentive to maintain and secure the blockchain network.

The Next Bitcoin Halving: When Will It Happen in 2024?

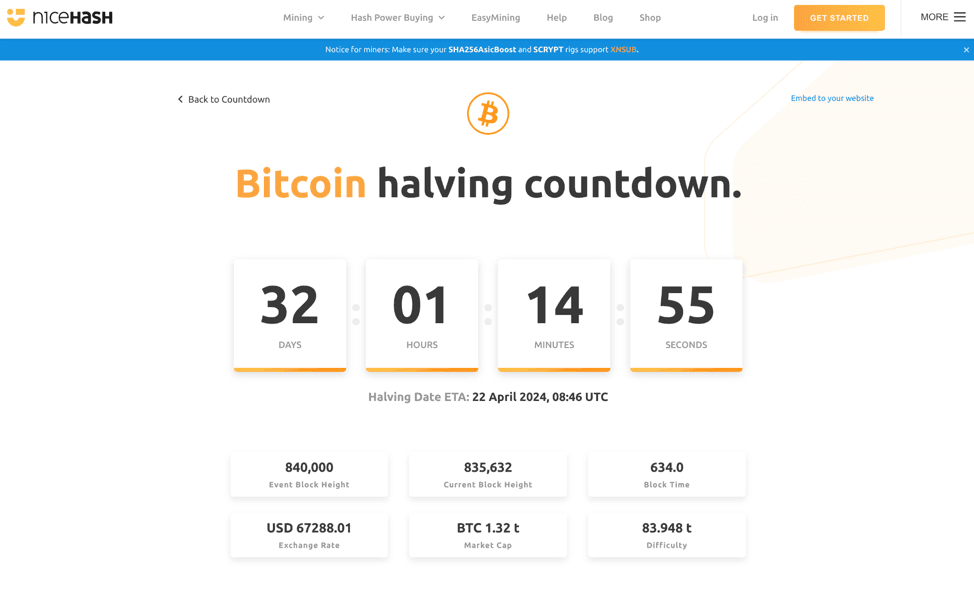

Predicting the precise date of the next Bitcoin halving is a challenge, given its dependence on the blockchain's block height. Traditionally, a halving event occurs every 210,000 blocks, pointing to April 2024 for the next occurrence, when the block height is expected to reach 840,000.

For an extended period, April 28, 2024, had been marked by investors as the anticipated date for the halving. However, recent updates suggest a possible change in schedule. Referencing a countdown by Nicehash reports that the halving is now likely to happen around April 22, 2024. This adjustment is largely due to an uptick in mining activity, propelled by the recent surge in Bitcoin's price, which has hastened the network's operations.

Bitcoin Halving countdown, Source: Nicehash

Such a shift is consistent with historical precedents, as previous halvings have also occurred sooner than initially expected. Nonetheless, the specific date—whether it be April 22, April 28, or another—does not detract from the halving's critical role. The process is essential for halving the miners' rewards, thereby reducing the rate at which new Bitcoins are generated and ensuring the total supply does not surpass 21 million tokens. Currently as written this article, 19 million Bitcoins have been mined and are in circulation.

Moreover, the importance of Bitcoin halvings transcends the mechanics of supply reduction. The introduction of BTC exchange-traded funds (ETFs) and other market innovations also contribute to the crypto market's momentum. Yet, the halving event itself remains a pivotal moment for the cryptocurrency sector, capable of significantly affecting future price movements.

What's the Purpose of Bitcoin Halving?

The concept of Bitcoin Halving emerges from the innovative framework established by Bitcoin's enigmatic creator or creators, known as Satoshi Nakamoto—a pseudonym that may represent either an individual or a group. Nakamoto vanished approximately a year after releasing the Bitcoin software, leaving behind a veil of mystery regarding their identity and intentions. Hence, direct explanations from Nakamoto about the choice of Bitcoin's monetary policy are scarce. Nonetheless, an examination of Nakamoto's early communications provides insight into their rationale.

Nakamoto's initial discussions, particularly around the time of the Bitcoin white paper's release, reveal a contemplative approach to the digital currency's monetary policy. This policy, essentially a schedule dictating how miners are rewarded with new Bitcoin for verifying transactions, was crafted with careful consideration of its long-term economic implications. Nakamoto pondered whether their approach might lead to deflation, characterized by an increase in the purchasing power of Bitcoin, or inflation, indicated by a rise in the cost of goods and services purchasable with Bitcoin.

One of the few explanations Nakamoto offered regarding their choice of the distribution formula for the new Bitcoin was its simplicity and fairness. "Coins have to get initially distributed somehow, and a constant rate seems like the best formula," Nakamoto stated. This brief comment suggests a preference for a straightforward and predictable method of introducing new Bitcoin into circulation, which eventually led to the implementation of the halving events.

These halving events, occurring approximately every four years, are a fundamental aspect of Bitcoin's design, intended to control the supply of new Bitcoin and mimic the scarcity and value preservation seen in precious metals. While Nakamoto's exact motives and the full extent of their foresight remain topics of speculation, their communications hint at a deliberate strategy aimed at fostering a stable yet flexible monetary system for the digital age.

What Are the Impacts of Bitcoin Halving?

Bitcoin halving are pivotal moment within the cryptocurrency ecosystem, designed to reduce the reward for mining new blocks by half, thereby slowing the rate at which new Bitcoins are created. This deliberate mechanism aims to mimic the scarcity-driven value preservation seen in precious metals like gold. By examining how Bitcoin halving influences inflation rates, affects demand and price fluctuations, impacts the profitability and operations of mining, and shifts the cryptocurrency's role as an investment vehicle, we can gain insights into the broader implications of this unique feature of Bitcoin's design. The halving process not only serves as a countermeasure against inflation within the digital currency realm but also plays a significant role in shaping investor behavior, mining strategies, and the overall market dynamics of Bitcoin.

・Impact on Mining Operations

Halving directly affects miners by slashing their rewards for verifying transactions and creating new blocks. This reduction can diminish profitability for miners unless there's a compensatory rise in Bitcoin's price. Large mining operations, such as Marathon Digital Holdings, may expand their capacity in anticipation of halving to maintain competitiveness and profitability. Smaller miners, however, face greater challenges due to decreased rewards and the increasing costs of mining equipment and energy.

・Inflation Control through Bitcoin Halving

Bitcoin halving is a mechanism designed to counter inflation within the Bitcoin ecosystem by reducing the reward for mining new blocks, thereby ensuring the cryptocurrency remains scarce. This scarcity aims to prevent the devaluation of Bitcoin, unlike fiat currencies, where inflation reduces purchasing power over time. However, this mechanism offers limited protection against the inflation of fiat currencies, to which Bitcoin often needs to be converted for widespread economic use. While market value gains from Bitcoin may offer inflation protection for investors, they do not safeguard the currency's purchasing power when used for transactions.

・Demand and Price Fluctuations

The reduction in the supply of new Bitcoins due to halving events typically leads to an increase in demand, as observed in the price surges following previous halvings. This pattern suggests that halvings can significantly influence Bitcoin's market value, though the exact impact on price remains speculative, with historical precedents indicating both immediate and delayed reactions in the market.

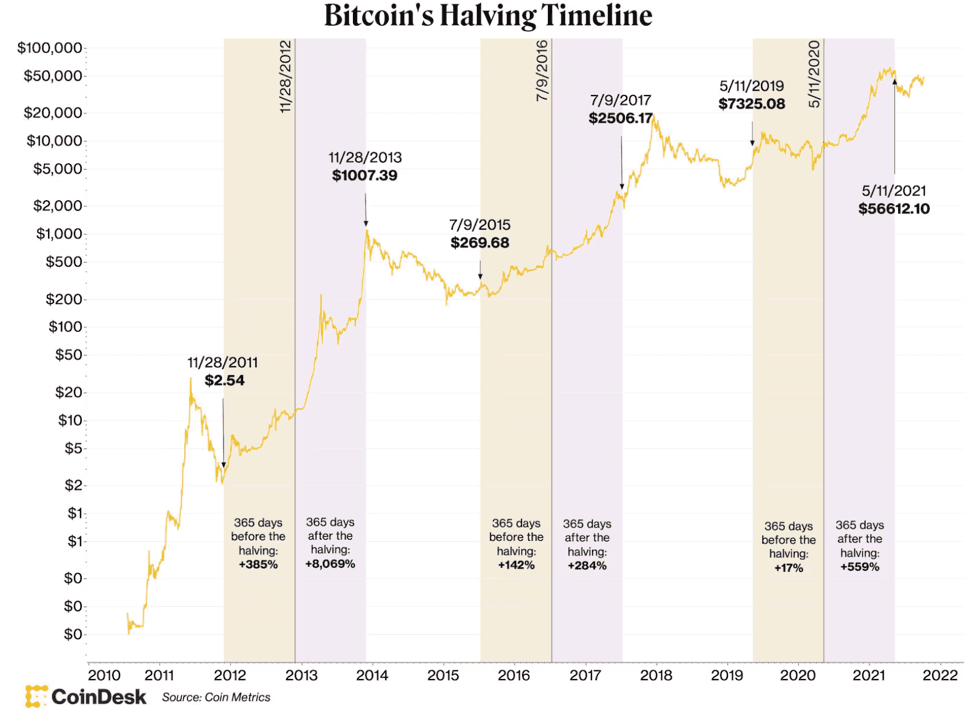

Previous Bitcoin Halving Timeline and Price Relation, source: Coindesk

・Bitcoin Investment

Originally envisioned as a decentralized payment system, Bitcoin has also become a popular investment vehicle. Investors are drawn to the potential for significant returns, especially around halving events that reduce the supply of new coins. This speculative aspect of Bitcoin investing hinges on the expectation of price increases following halvings, despite the inherent unpredictability of market responses.

Bitcoin has undergone several halvings since its inception, with each event closely watched by the community and investors alike. These halvings have been marked by speculative anticipation and varying market responses, demonstrating the unique economic model introduced by Satoshi Nakamoto. The price movements following these events have ranged from immediate spikes to gradual increases over the following year, highlighting the complex interplay between supply reduction and market dynamics. Bitcoin halving affects various aspects of the cryptocurrency world, from inflation control to mining profitability and investment dynamics. While its impact on demand and price is closely observed and speculated upon, the true outcomes of these events unfold over time, influenced by a myriad of factors within the broader economic and technological landscape.

Could the 2024 Bitcoin Halving Spark a Bull Market?

Bitcoin Halving events, historically linked to bull markets, have consistently marked significant moments in the cryptocurrency's journey. Let's explore the impact of these events over time and ponder the potential aftermath of the 2024 halving.

The inaugural Bitcoin Halving took place on November 28, 2012, cutting the block reward from 50 BTC to 25 BTC. At this juncture, Bitcoin's price hovered around $12.35. What followed was a remarkable surge in value, culminating in a peak of $1,242 in November 2013—a more than 100-fold increase from its pre-halving price. The second halving event, on July 9, 2016, further reduced the block reward to 12.5 BTC. Bitcoin's price at that time was approximately $650. Subsequently, the cryptocurrency embarked on a gradual ascent, reaching a then all-time high of $19,106 in December 2017. The most recent halving occurred on May 11, 2020, with the reward diminishing to 6.25 BTC. Around this event, Bitcoin was priced at about $8,500. Despite an initial dip, it soon embarked on an upward trend, achieving an all-time high of almost $64,000 in April 2021.

These events underscore a trend where the reduction in Bitcoin's new supply, alongside growing public awareness, seemingly catalyzes increased demand and a rise in price. Although historical performance doesn't guarantee future outcomes, the pattern has led many investors to anticipate a potential bull run in the wake of the upcoming 2024 Bitcoin Halving.

Why Does Bitcoin Halving Matter for Investors and the Cryptocurrency Market?

Bitcoin halving is a pivotal event in the cryptocurrency world, distinguished by its profound effect on Bitcoin's ecosystem and its wider implications on the financial landscape. This process is significant for several reasons, each contributing to the overarching interest and investment in Bitcoin.

At the heart of Bitcoin halving is its fundamental role in managing the cryptocurrency's supply, setting it apart from traditional financial practices. Unlike central banks, which can increase money supply at will, bitcoin halving systematically reduces the influx of new bitcoins into circulation. This mechanism ensures a controlled supply of Bitcoin, drawing a sharp distinction from conventional financial systems.

The halving event typically triggers increased volatility in Bitcoin's value, largely due to the decreased supply of available Bitcoin. This scarcity potentially elevates the value of remaining Bitcoins, making them more appealing to investors. It suggests that a consistent or growing demand against a dwindling supply could, theoretically, propel the price of Bitcoin upwards over time.

Historical trends have shown that past halvings have acted as long-term bullish signals for Bitcoin's price. Despite the economic incentives for mining diminishing, leading to a potential decrease in the number of miners, the interest and investment in Bitcoin do not wane. This enduring interest underscores Bitcoin's value proposition and its nickname as "digital gold." Therefore, Bitcoin halving matters because it directly influences the supply and, potentially, the value of Bitcoin. It underscores the cryptocurrency's unique economic model, contrasts sharply with traditional fiat currency practices, and captivates the market and investors alike. Each halving event not only affects the immediate economic landscape of Bitcoin mining but also reinforces Bitcoin's long-term value and appeal.

Conclusion

The Bitcoin Halving of 2024 represents a watershed moment for cryptocurrency especially in the bull market recently, embodying both its innovative economic model and its potential to impact the broader financial landscape significantly. This event, by halving the reward for mining Bitcoin, directly influences the supply dynamics of the cryptocurrency, potentially catalyzing a bull market similar to past cycles. It underscores the intricate balance between scarcity and demand that defines Bitcoin's value proposition. Investors and market watchers are keenly anticipating the effects of this halving, not just for its immediate impact on Bitcoin's price and mining community but also for its long-term implications on cryptocurrency adoption and the digital economy. This anticipation reflects a growing recognition of cryptocurrency as a pivotal component of modern financial systems.

FAQ

Q: When Does the Next Bitcoin Halving Occur?

A: The next Bitcoin halving is anticipated to occur in April 2024, with predictions pointing to a specific date around April 22, 2024. This event marks a significant milestone in the cryptocurrency's calendar, where the reward for mining new blocks is halved from the current 6.25 BTC to 3.125 BTC. The halving process is a programmed feature of the Bitcoin network designed to occur every 210,000 blocks, roughly every four years, as part of its deflationary economic model to control the supply of new bitcoins entering circulation.

Q: What Is the Historical Background of Bitcoin?

A: Bitcoin, created in 2008 by Satoshi Nakamoto, is the first decentralized cryptocurrency, launching with a white paper and the genesis block in January 2009. Aimed at enabling a peer-to-peer electronic cash system without a central authority, it introduced halving events to control inflation by cutting miner rewards, thus limiting the new bitcoin supply. Halvings in 2012, 2016, and 2020 have notably impacted its economy and value.

Q: What Are the Price Projections for Bitcoin Following the 2024 Halving?

A: While it's challenging to predict the exact price movements of Bitcoin following the 2024 halving due to the cryptocurrency's volatile nature and sensitivity to a wide range of external factors, historical patterns suggest a potential for bullish market behaviors post-halving. Past halvings in 2012, 2016, and 2020 have been followed by significant increases in Bitcoin's price, attributed to the reduced rate of new bitcoins entering circulation, increasing demand, and heightened investor interest. The anticipation surrounding the halving event often leads to speculative trading, contributing to increased volatility and price surges. However, it's important to note that while historical trends can provide insight, they do not guarantee future outcomes, and investors should approach with caution, considering the myriad of factors that can influence market dynamics.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.