FameEX Weekly Market Trend | May 22, 2023

2023-05-22 18:01:25

1. Market Trend

Between May 18 and May 21, the BTC price fluctuated between $26,361.20 and $27,500,00, with a volatility of 4.32%. According to the 1-hour candle chart, in the early morning on May 18, the price surpassed the $27,000 level, reaching a peak of $27,500. It has previously touched this level multiple times, resulting in intense speculation between longs and shorts. Subsequently, the price traded sideways above the $27,000 level. In the early morning of May 19, the bears gained the upper hand again, and the volume caused a drop below $27,000, reaching a low point near $26,300. Afterward, it consolidated and remained below $27,000, which had been identified as a significant resistance level in the past. As a result, both longs and shorts became cautious. Given the recent trend, it is advisable to wait patiently for a qualitative breakthrough (a rapid surge with high volume) and then select suitable investment opportunities.

Source: BTCUSDT | Binance Spot

Between May 18 and May 21, the price of ETH/BTC fluctuated within a range of 0.06638 to 0.06764, showing a 1.9% fluctuation. Looking at the 1-hour candle chart, after reaching the lowest point of 0.06638 at 08:00 am on May 18, there was a slight upward movement without a clear bullish trend. It is recommended to continue waiting for a suitable opportunity for trading.

Based on overall analysis, the market’s leading indicator, BTC, shows signs of indecision between the bulls and bears. Other popular coins also lack distinct independent trends. As such, the overall market trend is relatively weak. It is advisable to continue to exercise patience and wait for entry opportunities.

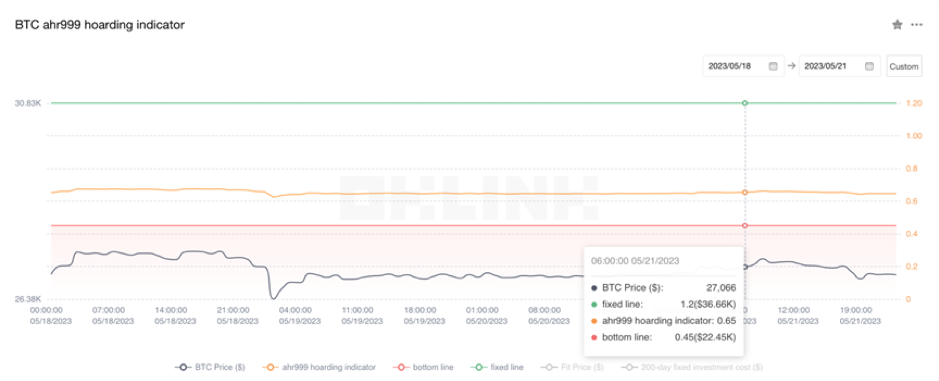

The Bitcoin Ahr999 index of 0.65 is above the buying-the-dip level ($22,450) but below the DCA level ($36,660). It is viable to purchase popular coins through DCA.

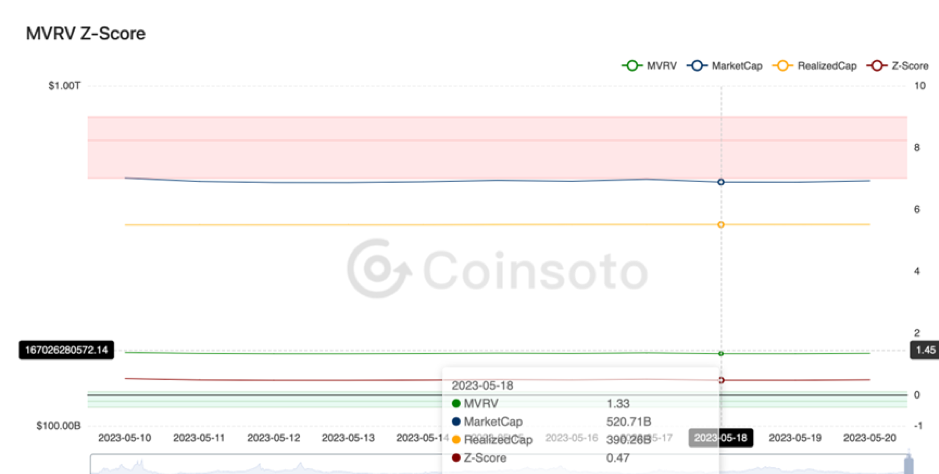

From the perspective of MVRV Z-Score, the value is 0.47. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.36-0.03).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges were positive, indicating that long leverages are relatively high.

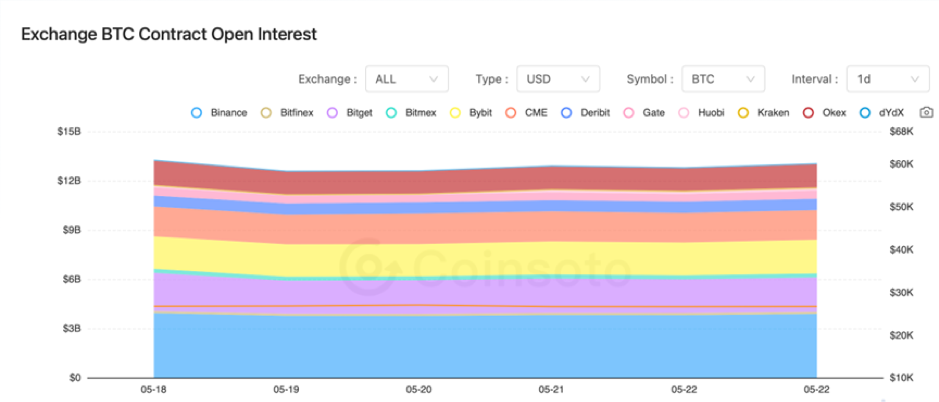

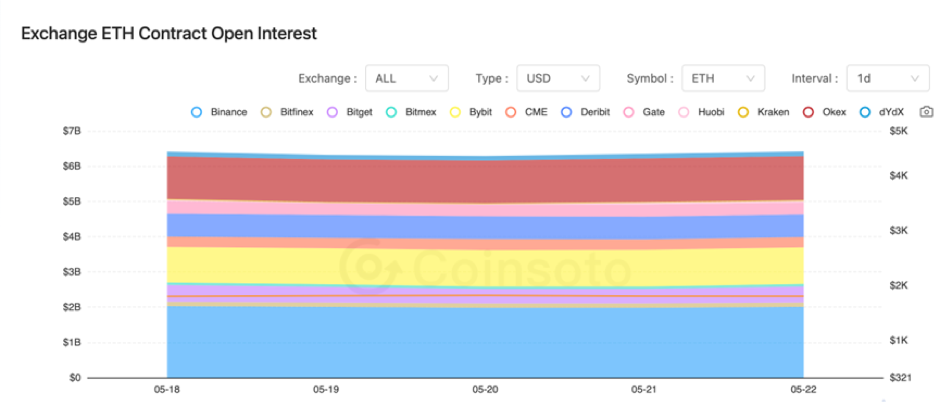

In general, the contract open interest of BTC experienced a brief and marginal decrease between May 18 and May 19, but subsequently returned to its previous level. The ETH contract open interest showed no significant changes.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On May 18, since the Shanghai upgrade, the net increase in ETH staking amount exceeded one million coins.

2) On May 18, Ripple announced the launch of a CBDC platform.

3) On May 18, Pakistan declared its intention to ban online services related to cryptocurrencies.

4) On May 19, the Chairman of the U.S. CFTC stated that BTC and ETH are commodities and strongly opposed the SEC’s enforcement regulation.

5) On May 19, FTX leadership sought to recover approximately $244 million from internal personnel and executives at Embed.

6) On May 19, the Bank of England revealed its plan to reject Revolut’s banking license application.

7) On May 20, the total inscription volume of the Ordinals protocol exceeded eight million coins.

8) On May 20, the market capitalization of USDC fell below the $30 billion mark.

9) On May 21, Binance announced the suspension of TORN deposits until further notice.

10) On May 21, Arbitrum gained widespread adoption of derivative protocols such as GMX.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.