FameEX Weekly Market Trend | June 12, 2023

2023-06-12 09:22:10

1. Market Trend

Between June 8 and June 11, the BTC price fluctuated between $25,358 and $26,810, with a volatility of 5.72%. According to the 1-hour candle chart, after BTC recovered from the negative news related to SEC regulation, the price of BTC remained sideways near $26,500 from June 8 to June 9. During this period, trading volume was low and the market atmosphere was relatively quiet, with a strong bearish sentiment. On June 10 at noon, BTC broke downwards to its lowest point at $25,358 and then oscillated back up above $26,000. BTC price has recently approached the important level of $25,000 three times, but each time it has experienced swift upward movements followed by consolidation. The $25,000 level has shown strong support, but the overall trend remains bearish, with three instances of breaking below this level. The stability of the $25,000 level remains uncertain. If it breaks below this level, there is a high probability that the price will reach the next significant support area around $23,500. It is recommended to exercise caution and wait for favorable opportunities, keeping an eye on the SEC’s execution results regarding the securitization of multiple currencies and the outcomes for Binance & Coinbase. Wait for the right moment to enter the market.

Source: BTCUSDT | Binance Spot

Between June 8 and June 11, the price of ETH/BTC fluctuated within a range of 0.06716 to 0.06999, showing a 4.21% fluctuation. Looking at the hourly candlestick chart, the trend of ETH/BTC followed BTC without establishing an independent market movement. When the BTC price broke below $26,500, ETH/BTC experienced a significant volume-driven decline, indicating a potential for further downward movement. On the daily chart, it has also fallen below the 7-day and 25-day moving averages, indicating a downward channel. Hodlers of ETH/BTC should closely monitor the price action around the next support level near 0.06699, while off-exchange users are advised to observe more and take fewer actions, waiting for the market situation to become clear before considering entry opportunities.

Based on overall analysis, the market has recently been inundated with regulatory events, leading to a waterfall-like decline in many altcoins. The market leader BTC has been continuously testing the key support level at $25,000, with a strong bearish sentiment. Hodlers should pay close attention to the fluctuations of BTC around the $25,000 level. It is advisable for investors to observe more and take fewer actions, waiting for opportune moments to enter the market.

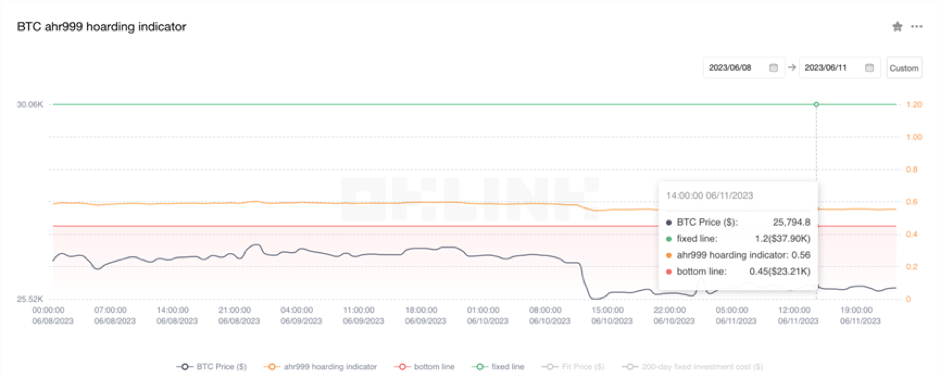

The Bitcoin Ahr999 index of 0.56 is above the buying-the-dip level ($23,210) but below the DCA level ($37,900). It is viable to purchase popular coins through DCA.

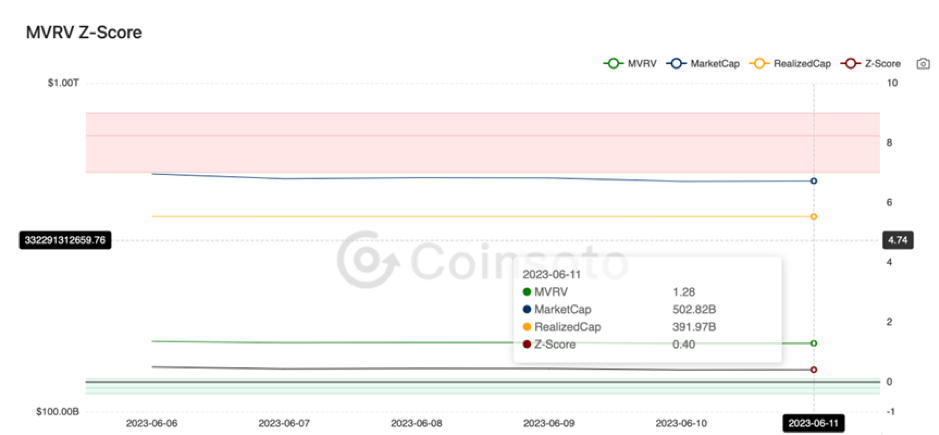

From the perspective of MVRV Z-Score, the value is 0.40. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.47-0.11).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

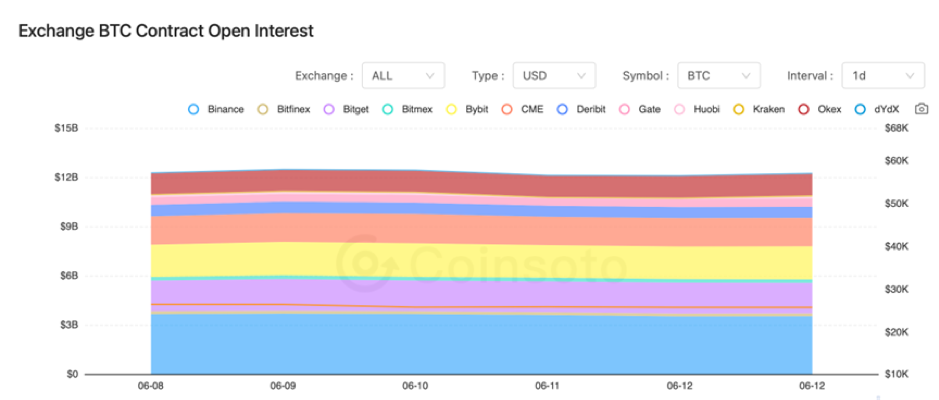

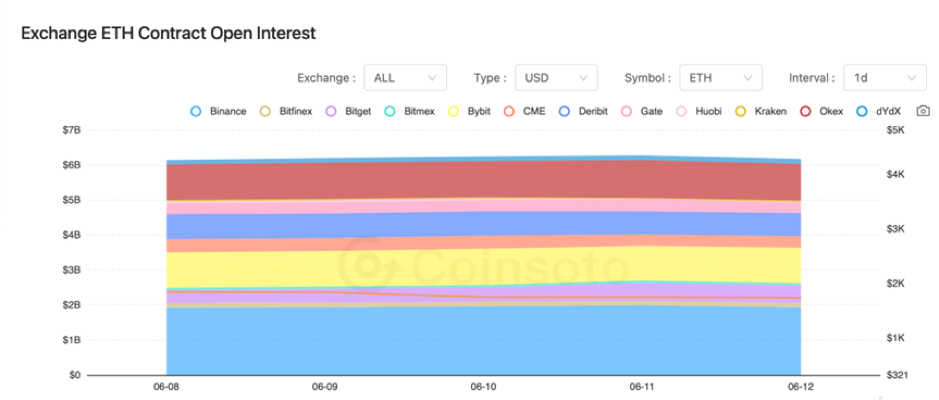

The contract open interest of BTC and ETH from major exchanges basically remains unchanged between June 8 and June 11.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On June 8, CZ confirmed he had received the subpoena from the US District Court. However, personal appearance is not necessary, no need for FUD (fear, uncertainty, and doubt).

2) On June 8, Taiko Labs raised $22 million in two rounds of seed financing.

3) On June 8, the Commonwealth Bank of Australia prepared to restrict users from making payments to cryptocurrency exchanges.

4) On June 9, Solana Foundation stated that SOL is not a security.

5) On June 9, Protocol Labs stated that FIL is not a security.

6) On June 9, the Chairman of the U.S. SEC stated that the majority of cryptocurrencies meet the investment contract test, and most crypto intermediaries must also comply with securities laws.

7) On June 10, Grayscale filed a request with the U.S. SEC to withdraw the application for the Filecoin Trust product.

8) On June 10, Uniswap’s gas usage increased by 388% since April.

9) On June 10, the Securities and Futures Commission of Hong Kong started reviewing virtual asset licenses and received applications from two platforms holding voluntary licenses.

10) On June 11, Solana Foundation disagreed with the U.S. SEC’s classification of SOL as a security.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.