FameEX Weekly Market Trend | June 19, 2023

2023-06-19 10:29:10

1. Market Trend

Between June 15 and June 18, the BTC price fluctuated between $24,800.00 and $26,839.99, with a volatility of 8.13%. According to the 1-hour candle chart, at 4:00 am on June 15, BTC chose to break through with increased volume, falling below the multi-day support level of $25,000 and reaching a low of $24,800 (the Federal Reserve (Fed) announced a pause in interest rate hikes, marking the first pause after ten consecutive hikes since March last year). Subsequently, the BTC price fluctuated around $25,000. The market had already priced in the news of the interest rate pause, as seen in the preceding market conditions such as multiple tests of the $25,000 support level and an extended period of trading in a tight range just above $25,000. As a result, when the interest rate pause was officially announced, it triggered a final wave of panic selling, leading to a breach of the support level and resulting in investors holding blood-stained chips. Starting at midnight on June 16, the 1-hour and 4-hour candlestick charts steadily followed the 7-day moving average upward, without falling below that moving average position. The daily chart reestablished itself above the 7-day moving average, and the weekly chart successfully tested and continued to climb above the 25-day moving average. Currently, it appears that the market may recover from here, and it may be a good time to enter the market with a small position and establish long positions. However, if it falls below 25,000 points again, it is advisable to exit with a stop-loss (please bear in mind that this is an individual opinion and does not constitute investment advice).

Source: BTCUSDT | Binance Spot

Between June 15 and June 18, the price of ETH/BTC fluctuated within a range of 0.06446 to 0.06604, showing a 2.37% fluctuation. Looking at the hourly candlestick chart, The ETH/BTC trend has remained weak, hitting new lows during the rebound of BTC. Currently, the price is still at a position after the sharp drop caused by the announcement of the Fed’s halt in interest rate hikes. There are no signs of a rebound, and it is being suppressed by various moving averages. It is recommended to observe the price movement after breaking above the 7-day moving average. Therefore, it is advisable to primarily adopt a wait-and-see approach.

Based on overall analysis, the recent bearish market news has mostly been incorporated and digested by the market. The market trend is gradually becoming clear. Currently, the market is largely driven by bullish momentum, displaying notable strength. This makes it an opportune moment to cautiously consider entering the market.

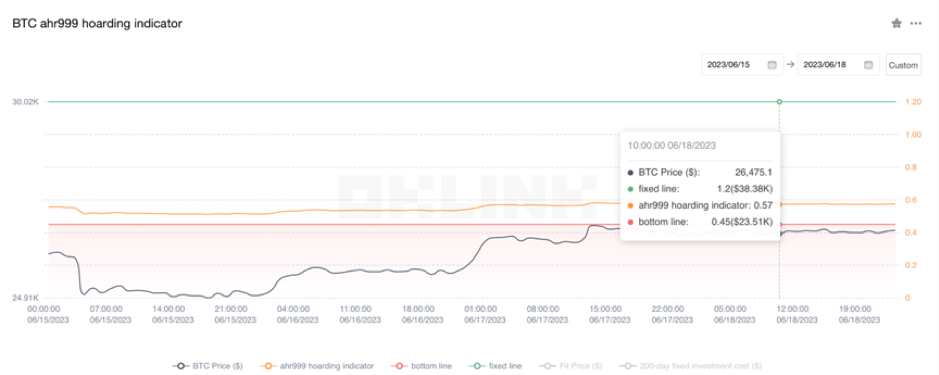

The Bitcoin Ahr999 index of 0.57 is above the buying-the-dip level ($23,510) but below the DCA level ($38,380). It is viable to purchase popular coins through DCA.

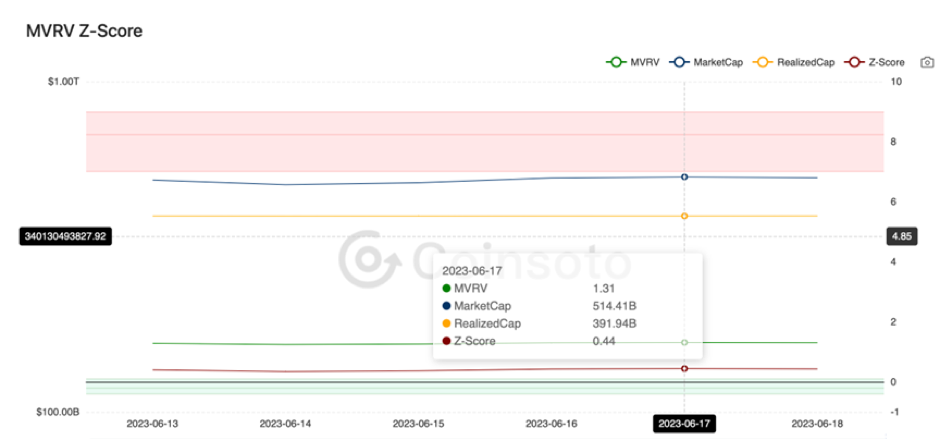

From the perspective of MVRV Z-Score, the value is 0.44. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.33-0.03).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

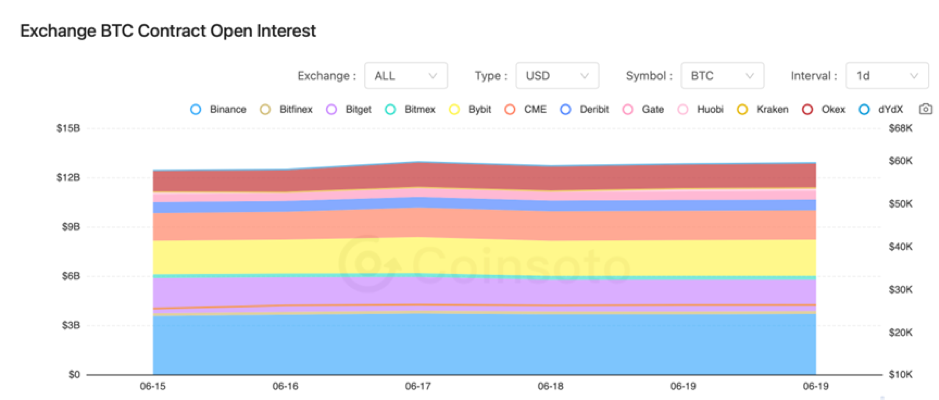

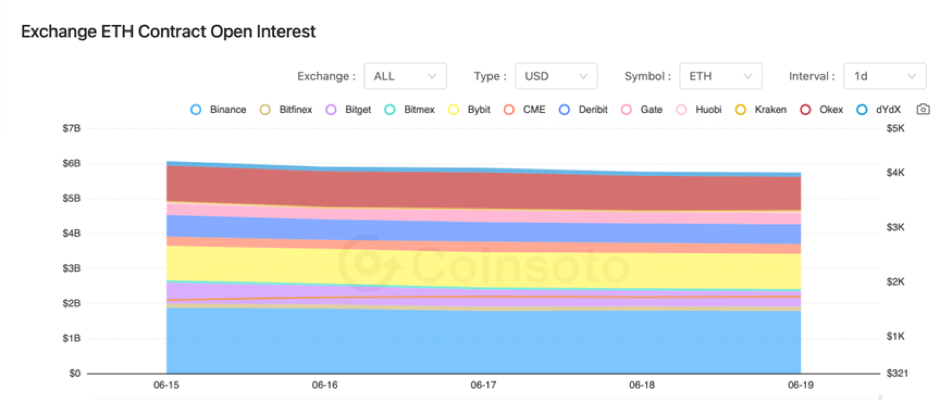

Between June 15 and June 18, the contract open interest of BTC slightly increased, while ETH experienced a minor decline.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On June 15, the media reported that if CRV drops to $0.371, CRV worth over $100 million will face liquidation risk.

2) On June 15, Tether CTO stated that they are ready to redeem any amount of funds.

3) On June 15, the founder of CRV repaid 1.35 million USDT to AAVE to avoid liquidation risk.

4) On June 16, Coinbase announced a 4% reward for USDC.

5) On June 16, Binance was being investigated in France and accused of money laundering.

6) On June 17, the second round of testing for Hong Kong’s digital yuan cross-border payments was drawing to a close.

7) On June 17, LINK tokens worth $96.4 million were unlocked and transferred to Binance.

8) On June 17, Binance reached an agreement with the U.S. SEC to transfer all US customer funds and wallet keys back to the United States.

9) On June 18, the number of active accounts on Arbitrum exceeded 7 million.

10) On June 18, Paul Chan Mo-po, the Secretary for Commerce and Economic Development of Hong Kong, announced that over the past year, more than 150 WEB3-related companies have settled in Cyberport.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.