FameEX Weekly Market Trend | July 17, 2023

2023-07-17 18:28:05

1. Market Trend

Between July 13 and July 16, the BTC price fluctuated between $29,900.00 and $31,804.20, with a volatility of 6.36%. Based on the 1-hour candle chart, in the early morning of July 14, BTC broke through the trading range it had maintained for over 20 days ($29,500-$31,500) with a surge, reaching a new high of $31,804 points. It then experienced a slight drop but remained above the $31,000 level. From a shorter timeframe (15 minutes, 30 minutes), the market chose $31,000 as the new support level, aiming to establish a new trajectory by breaking out of the current trading range. In the early morning of July 15, BTC dropped below $31,000, reaching a low of $29,900, indicating the failure to sustain the previous breakthrough. This expanded the trading range from $29,500 to $32,000, becoming the new range. Generally speaking, the market trend remains unchanged with no fundamental shifts. Therefore, the operational strategy remains consistent with the previous analysis reports, with swing trading and long-term value investments still considering the trading range as an important reference criterion.

Source: BTCUSDT | Binance Spot

Between July 13 and July 16, the price of ETH/BTC fluctuated within a range of 0.06148-0.06442, showing a 4.78% fluctuation. From the one-hour candlestick chart, ETH/BTC followed BTC’s upward movement and successfully broke through, maintaining a high level even when BTC declined below $30,000. This indicates a strong signal as ETH/BTC followed the rise but did not experience a significant retracement. The previous analysis report identified signs of strength in ETH based on candlestick patterns. However, It’s important to note the breakout pattern on the daily chart, specifically sustaining and stabilizing above the 7-day moving average (MA). Currently, the ETH trend has confirmed the viewpoints stated in the previous analysis report. As of the time of writing, ETH/BTC is consolidating at a high level (0.06383), suggesting a potential continuation of the upward movement. Traders should consider the recent high level and the possibility of retracement to the 7-day moving average as key points in their operational strategy.

Based on overall analysis, the market is currently more active compared to the previous days. BTC attempted to break through $32,000 but failed to stabilize and experienced a significant retracement. XRP, on the other hand, witnessed a doubling of its value (due to winning a lawsuit that lasted over three years) and led a group of coins previously defined as securities by the SEC to experience notable gains. However, the sustainability of such trends still depends on the support of BTC. Currently, BTC has expanded its range of oscillation, awaiting a breakout from this range before the overall market trend becomes clearer.

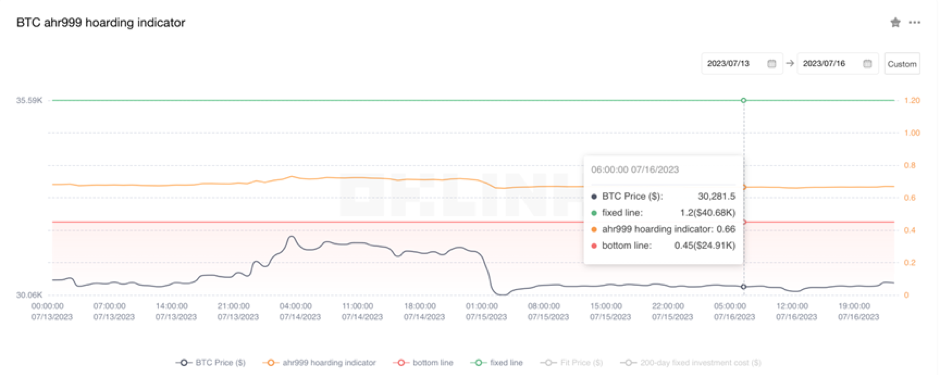

The Bitcoin Ahr999 index of 0.66 is above the buy-the-dip level ($24,910) but below the DCA level ($40,680). It is viable to purchase popular coins through DCA.

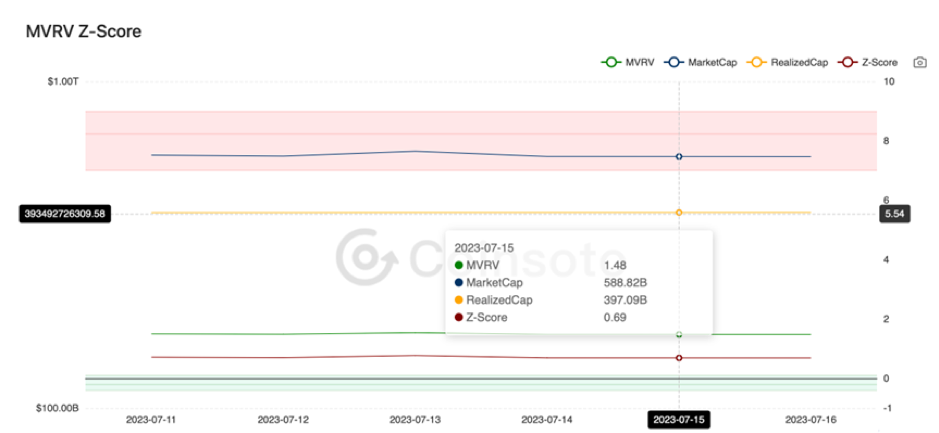

From the perspective of MVRV Z-Score, the value is 0.69. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.36-0.03).

2. Perpetual Futures

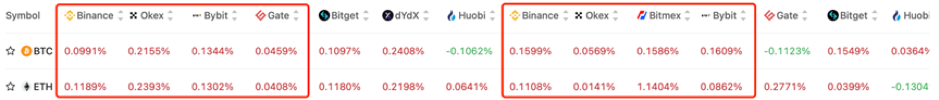

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

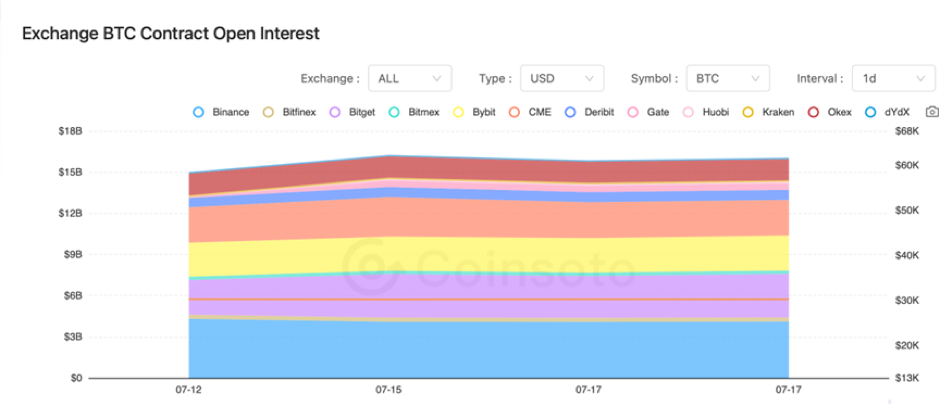

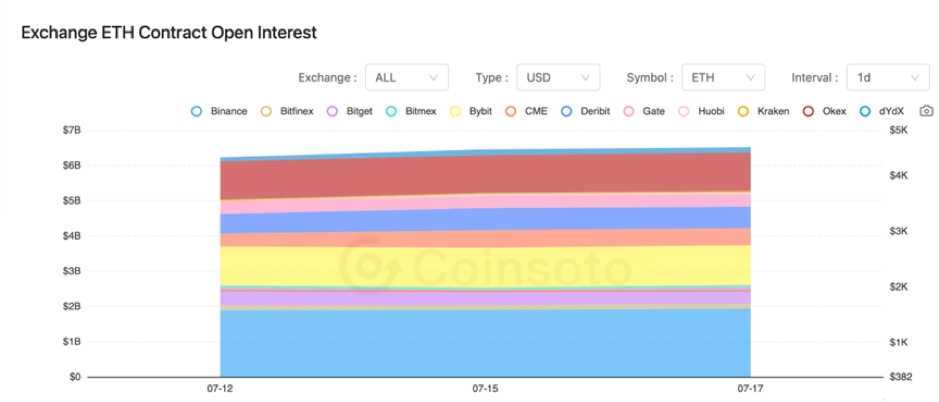

Between July 13 and July 16, the contract open interest of BTC and ETH almost remained unchanged from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On July 13, the FTX claimed the re-launch of the portal website (claims.ftx.com).

2) On July 13, Polygon proposed upgrading MATIC to POL.

3) On July 13, the first European spot Bitcoin ETF was expected to be publicly listed this month.

4) On July 14, a judge ruled that Ripple is not a security in partial, indicating that the SEC lawsuit against Ripple will proceed to trial.

5) On July 14, XRP’s market capitalization rose to fourth place in the cryptocurrency market rankings.

6) On July 14, it was reported that Indonesia is set to launch a cryptocurrency exchange this month.

7) On July 15, Ripple Labs CEO stated that the U.S. SEC has always been a bully.

8) On July 15, the SEC stated that approval for the listing application is not Coinbase’s “talisman”.

9) On July 16, the SEC formally accepted BlackRock’s application for reviewing and approving the spot Bitcoin ETF.

10) Over the past week, the circulating supply of USDC decreased by $100 million on July 16.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.