FameEX Weekly Market Trend | October 16, 2023

2023-10-16 18:36:10

1. Market Trend

From Oct. 12 to Oct. 15, the BTC price fluctuated between $26,585.51 and $27,130.00, with a volatility of 2.04%. The prior report mentioned that conservative investors should engage in the market when Bitcoin breaks through and stabilizes above the 99-day MA on a daily basis. Otherwise, it is recommended to primarily adopt a wait-and-see approach. Recently, Bitcoin found solid support at $26,500 despite bearish resistance at $27,000. Even at $27,000, pullbacks stay above $26,500, indicating a strong bullish trend, as seen in recent months. To gauge market sentiment, watch trading volume, pullback size, and speed when BTC hits $27,000, which helps identify entry points. Conservative investors use the 99-day MA as a signal, while the more aggressive can react based on overall market response. The 1-hour, 4-hour, and 1-day MAs are all rising, indicating an early bullish trend. In higher timeframes, the weekly chart retraced to the 25-day MA and is now steadily moving upwards. Shorts can gradually build positions and wait, while bullish traders can enter the market progressively based on this analysis.

Source: BTCUSDT | Binance Spot

Between Oct. 12 and Oct. 15, the price of ETH/BTC fluctuated within a range of 0.05699-0.05810, showing a 1.94% fluctuation. ETH/BTC, after rebounding to 0.05860 a few days ago, has sharply turned down once again. It has now broken to new lows, displaying a typical bearish alignment within multiple timeframes. Investors should steer clear of this cryptocurrency, as technical analysis and various indicators are currently showing ineffective signals for this trading pair.

Based on overall analysis, the current market is showing signs of recovery, with a continuous inflow of funds leading to increased trading volume and activity. This is primarily due to BTC appearing to have successfully established a bottom at its current level. The resilience of the bulls is evident, which is boosting investor confidence. The next crucial step for Bitcoin is to break through the significant psychological barrier of 28,000 points and maintain stability at that level. If this occurs, the future market outlook will become clearer. Apart from BTC, numerous coins in the market have experienced declines of over 80-90%. Among these, there are high-quality projects and meme-based coins like BCH, LTC, PEPE, and others. They all have the potential to experience significant rebounds. Whether they are popular coins or altcoins, once BTC reaches its target level, investors can consider entering and allocating funds to these coins as appropriate (provided that BTC reaches the specified target level).

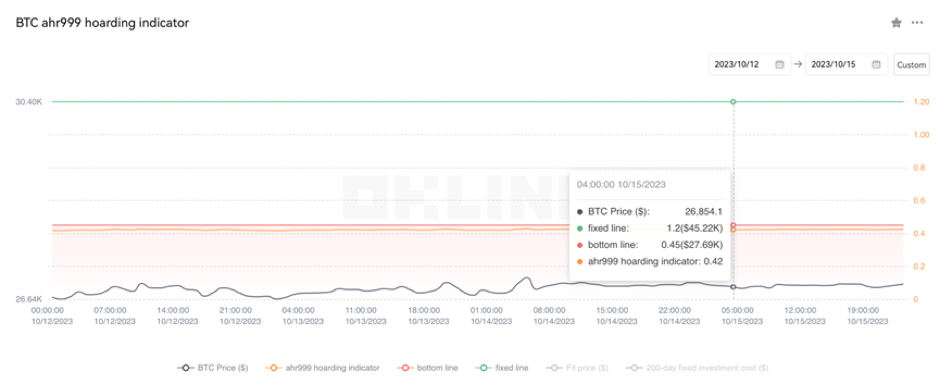

The Bitcoin Ahr999 index of 0.42 is below the buy-the-dip level ($27,690). Therefore, it is advised to purchase popular coins at the current level for spot trading.

2. Perpetual Futures

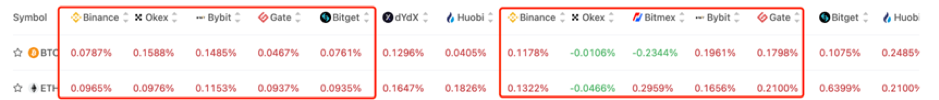

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

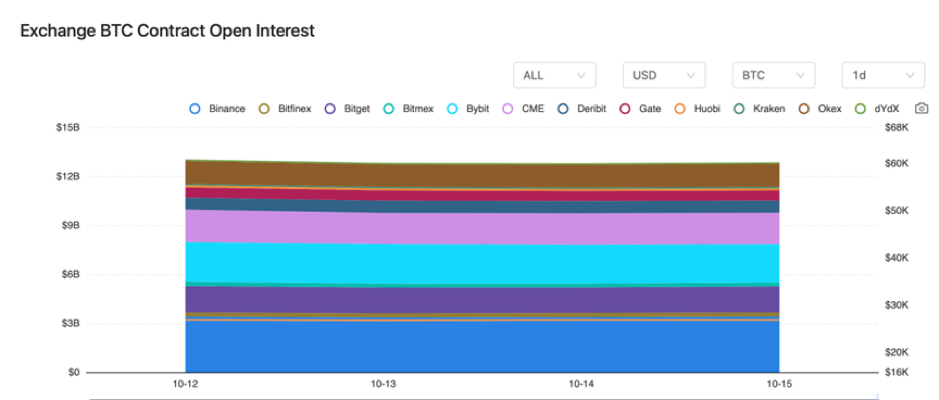

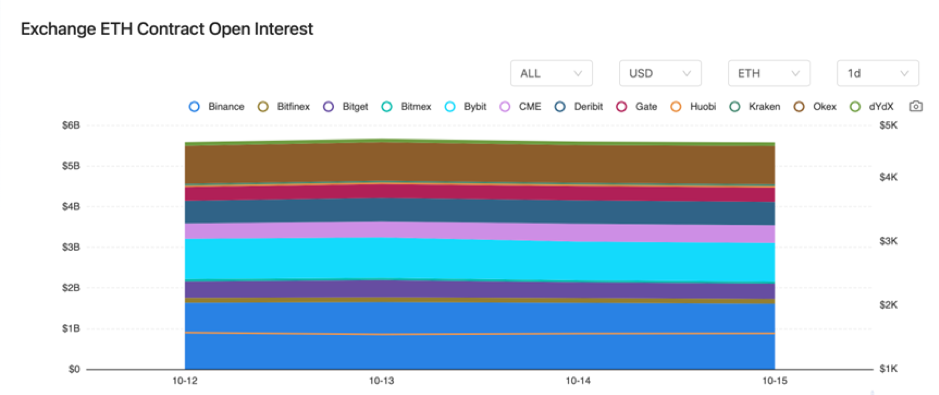

There were rarely any changes in the BTC and ETH contract interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On October 12, Talos integrated with Coinbase International Exchange to provide perpetual futures trading.

2) On October 12, the UK’s FCA was in the process of developing a blueprint for tokenizing funds.

3) On October 13, according to 21.co, the tokenized asset market cap could reach $10 trillion by the 2030s.

4) On October 13, the former Alameda CEO stated that Zhao Changpeng’s tweet had “triggered” FTX’s crash.

5) On October 14, Bloomberg analysts estimated a 90% chance of approval for a spot Bitcoin ETF before January 10, 2024.

6) On October 14, Reuters reported that the SEC did not plan to appeal the decision on Grayscale.

7) On October 14, the New York Times stated that U.S. authorities were keeping tabs on Bitcoin miners with ties to China.

8) On October 15, MetaMask was re-added to the Apple App Store.

9) On October 15, the founder of SkyBridge Capital suggested that the Fed system might be heading for a collapse, potentially driving Bitcoin's market cap to $15 trillion.

10) On October 15, most economists believed that the Fed had completed its last interest rate hike.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.