FameEX Weekly Market Trend | February 8, 2024

2024-02-08 21:14:11

1. Market Trend

From Feb. 5 to Feb. 7, the BTC price swung from $42,222.00 to $43,569.76, with a volatility of3.2%. The last analysis report indicated that the prolonged consolidation around the $43,000 mark, considering both fundamental and technical aspects, is inherently positive for the market sentiment. Moreover, from a higher timeframe perspective (1D), during the recent days of decline, the closing prices consistently remained above the MA10, MA20, and MA30 (with evident support), and the trend of these moving averages turning upwards became increasingly apparent. Therefore, the probability of BTC prices trending upwards is relatively high as the market transition approaches. Recently, BTC prices once again approached the psychological barrier of $43,000, reaching highs near $43,500 but quickly retracing to around $42,300 (a level highlighted for new entries). Unlike usual, the subsequent period of consolidation around $43,000 lasted just 10 hours, with rising trading volume.

This indirectly confirms the likelihood of a positive market transition mentioned earlier. On the 4-hour timeframe from 00:00 (UTC+8) on Feb. 5, a fierce battle around $43,000 ensued between bulls and bears. At this time, the MA60 (around $42,500) played a crucial support role, ensuring a positive technical outlook and successfully preventing a breakdown below $42,000 and subsequent downward price movement. This lays the groundwork for BTC to successfully break through $43,000 and reach a series of rallies targeting $44,000 and beyond. Therefore, the recommendation for this period remains to maintain a strategy of buying on dips, awaiting the market transition, and embracing the new upward trend.

Source: BTCUSDT | Binance Spot

Between Feb. 5 and Feb. 7, the price of ETH/BTC fluctuated within a range of 0.05325-0.05542, showing a 4.1% fluctuation. In the previous discussion, it was mentioned that if the ETH/BTC price stabilizes at 0.05400, it could be a good opportunity to initiate a position. In recent days, the price of ETH/BTC has reached our predetermined entry level. However, this entry only involves purchasing a small position. It is prudent to wait for BTC to signal a market transition before considering further action, particularly after ETH/BTC stabilizes above the next resistance level at 0.05650. Currently, we advise against adding any positions, as ETH’s upward momentum relies heavily on BTC's rise. Additionally, ETH itself hasn’t demonstrated significant strength in its upward movement, with trading volume and price gains falling somewhat short.

Based on overall analysis, currently, the majority of cryptocurrencies are closely following BTC’s trend. With continuous net inflows of funds into BTC and ongoing updates in technical analysis, a bullish bias has emerged in the direction of market transition. Therefore, amidst the current overall environment, the primary strategy remains to strategically position for buying on dips. However, it’s crucial for market participants to maintain a sense of caution. In the current prolonged consolidation phase, the safest approach is to await a clear direction in the overall market and then move in line with the trend.

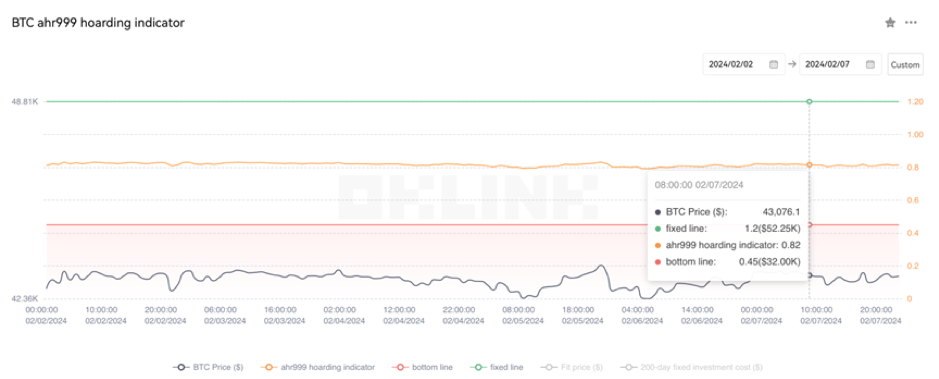

The Bitcoin Ahr999 index of 0.82 is between the buy-the-dip level ($32,000) and the DCA level ($52,250). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

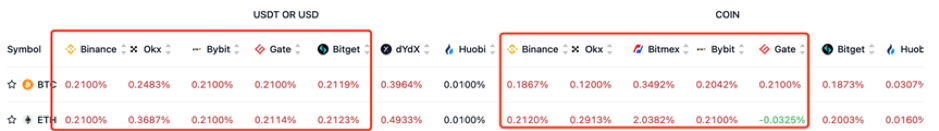

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

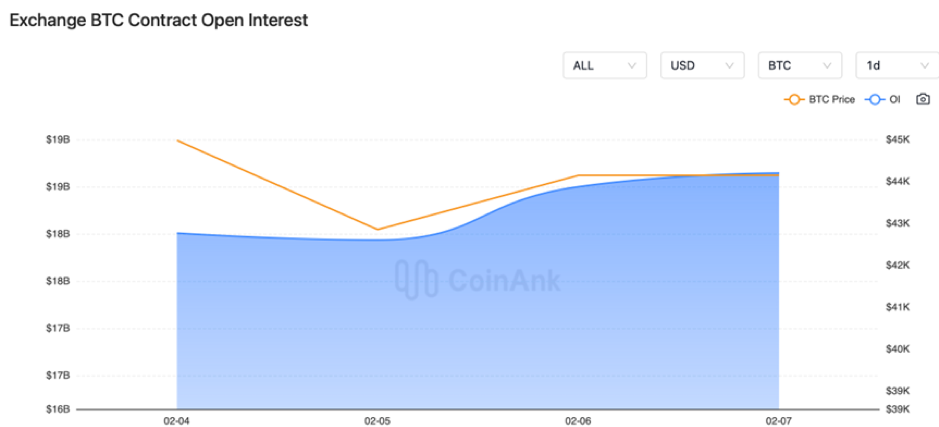

In recent days, both BTC and ETH contract open interest experienced a sharp rise from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On February 5, Donald Trump stated that CBDCs and AI are both very dangerous.

2) On February 5, data showed that the spot trading volume of digital assets in January hit a 19-month high.

3) On February 5, according to Grayscale CEO, developing a listed options market for spot Bitcoin ETFs is crucial.

4) On February 6, He Yi announced six measures to prevent information leakage of coins listed on Binance.

5) On February 6, based on KPMG, cryptocurrency investment in Singapore decreased by 86% compared to 2023.

6) On February 6, a New York judge ordered Ripple to share SEC-requested financial statements and court rules.

7) On February 7, the US Treasury Secretary called for crypto legislation on “non-securities” tokens.

8) On February 7, BlackRock’s spot Bitcoin ETF saw inflows rise to fifth place among all ETFs in 2024.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.