FameEX Weekly Market Trend | April 25, 2024

2024-04-25 19:27:45

1. BTC Market Trend

From April 22 to 24, the BTC price swung from $63,768.22 to $-67,215.9, a 5.41% range. On April 19, an Israeli airstrike targeted an air force base near Iran’s nuclear facilities, sparking concerns about potential conflict with Iran and causing a brief panic in the market. BTC spot prices dropped to $59,641.95 during this event. However, Iran’s response was not immediately clear, leading to a gradual return to a narrow range of fluctuations in the overall sentiment of the crypto market. The absence of a strong stance from Iran helped dissipate the uncertainty surrounding a potential Middle East conflict, bringing stability to daily candlestick levels in the bull market.

Taking the example of the Russia-Ukraine war that began on February 24, 2022, the outbreak of this war did not directly cause a significant drop in the BTC price within the bear market cycle (including the weekly candlestick on February 28). Subsequently, Russia vigorously developed the crypto industry to evade Western sanctions, and Ukraine continuously strengthened its policy support for the crypto industry to obtain more crypto aid funds. In the medium to long term, this is favorable for the development of the crypto industry globally.

Therefore, one can seize the opportunity of each 15% or more BTC price pullback within the bull market trend and engage in short-term bottom fishing swing trading. However, on April 24, President Biden proposed the highest capital gains tax in over a century for stocks and cryptocurrencies, potentially raising the highest marginal tax rate for long-term capital gains and qualified dividends to 44.6%. While the likelihood of this proposal passing amidst the current economic climate in the United States seems low, its approval would bring significant short-term bearish sentiments. In such a scenario, both the US stock market and the crypto market are likely to witness rapid declines, given the US’s historical dominance in the global economy.

Additionally, the “EU Anti-Money Laundering Directive” has just passed its final vote, formally requiring due diligence investigations on crypto companies, which is medium-term bearish news. This could dampen the upward trajectory from April 25 to 28, unless there’s substantial positive news in macroeconomics or the crypto industry to counteract the impact of Biden's proposal and the Directive. Given the recent performance of major asset classes worldwide, the likelihood of a significant BTC surge during this period is limited.

In summary, the current bull market in cryptocurrencies is likely not yet over. Profiting during this bullish phase through short-term spot and long-only futures trading is relatively straightforward. However, profiting from shorting futures during the bull market requires significant negative events like black swans, along with a deeper understanding of the crypto market and spending more time monitoring it daily.

The Bitcoin Ahr999 index of 1.2 is over the DCA level ($62,390). In the short term, chasing higher prices for buying may not be advisable. It’s more prudent to set lower price limit orders for spot BTC purchases for medium-term trading. There’s also a possibility of a significant and rapid price drop in BTC in the near term.

2. Perpetual Futures

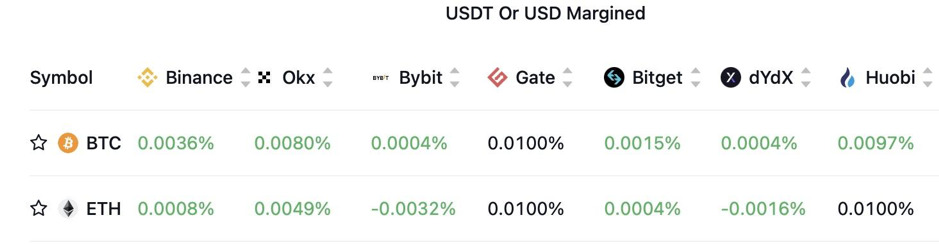

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are negative, indicating that short leverages are relatively high.

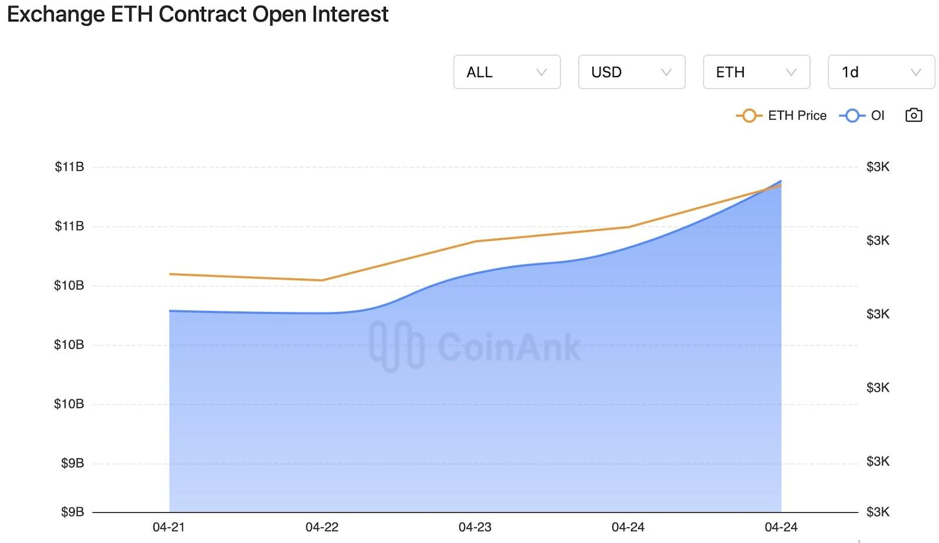

In the recent period, both BTC and ETH contract open interest have experienced a slow rise, with ETH showing a relatively more pronounced trend.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On April 22, Bitcoin’s stock-to-flow ratio surpassed that of gold.

2) On April 22, the Russian Foreign Minister expressed concerns about significant strategic risks that could lead to an increase in nuclear threat levels.

3) On April 22, significant unlocks are expected for tokens like YGG, ID, and AGIX, with YGG unlocking over $15 million.

4) On April 22, CouponBirds reported that over 80% of American parents who hold or plan to invest in cryptocurrency intend to do so for their children’s future.

5) On April 23, Watcher.Guru stated on the X platform that 72% of local users in the UAE have invested in Bitcoin.

6) On April 23, the total supply of USD stablecoins reached $165 billion, hitting its highest level in nearly two years.

7) On April 24, the BNY Mellon IBIT accounted for 24% of the total global ETF inflows.

8) On April 24, recent reports from Iranian media suggested that Iran has been in contact with the United States seeking negotiations to restore compliance with the Iran nuclear deal.

9) On April 24, Schnabel, a European Central Bank (ECB) board member, mentioned that if new forecasts and data confirm a return to 2% consumer price growth, the ECB could consider cutting interest rates.

10) On April 24, President Biden proposed the highest capital gains tax in over 100 years for stocks and cryptocurrencies, with the highest marginal tax rate for long-term capital gains and qualified dividends rising to 44.6%.

11) On April 24, the U.S. SEC sought public opinion on a revised version of BlackRock’s proposed Ethereum ETF and postponed the decision on whether to approve Grayscale’s Ethereum Trust conversion to an ETF.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.